CAAT Pension Plan Seeks Increased Canadian Private Investment

Table of Contents

The Growing Need for Diversification in the CAAT Pension Plan

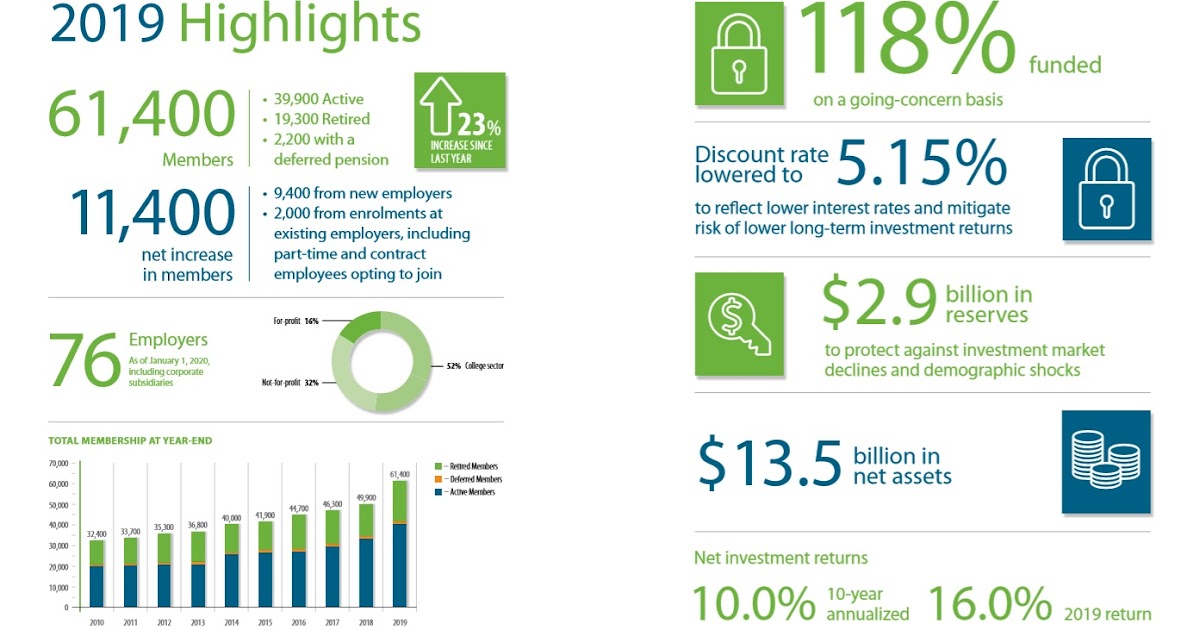

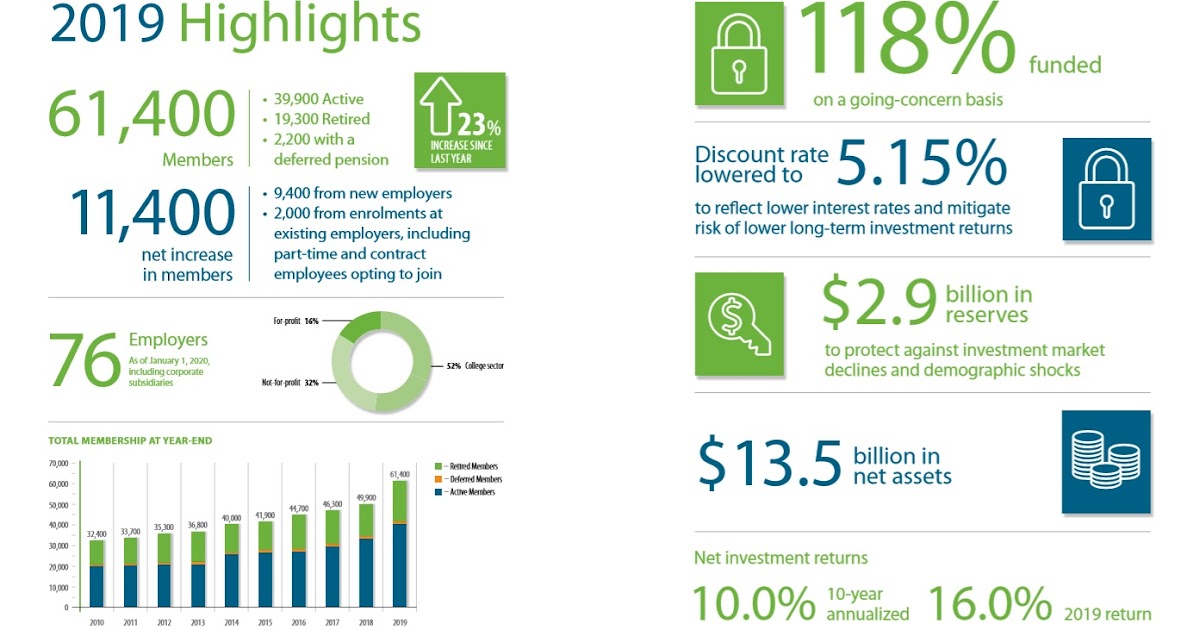

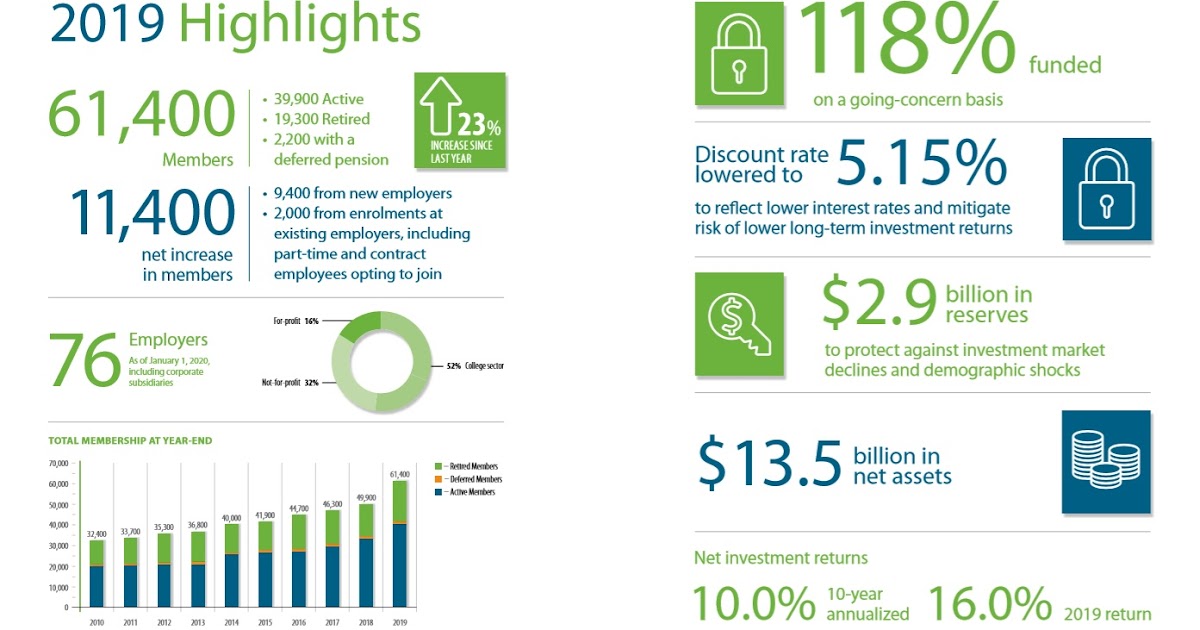

The CAAT Pension Plan, responsible for the retirement security of thousands of Canadians, recognizes the importance of a robust and diversified investment strategy. Over-reliance on traditional investment avenues presents significant risks in today's market.

Reducing Reliance on Traditional Investments

Traditional investments like government bonds and publicly traded stocks, while offering some stability, are subject to market volatility and interest rate fluctuations. Diversification into private investment markets offers a powerful counterbalance to these risks.

- Market Volatility: Public markets are susceptible to sudden and unpredictable shifts, impacting returns.

- Interest Rate Fluctuations: Changes in interest rates directly impact the value of fixed-income investments like government bonds.

- Benefits of Diversification: Spreading investments across different asset classes reduces overall portfolio risk.

- Private Investment Mitigation: Private investments, such as Canadian private equity and real estate, often exhibit less correlation with public markets, offering a natural hedge against market downturns.

Targeting Higher Returns

Canadian private investment presents a compelling opportunity for higher returns compared to traditional investments. The potential for long-term capital appreciation in sectors like private equity and real estate is substantial.

- Potential Return Rates: Private equity and real estate investments have historically demonstrated superior returns compared to publicly traded stocks and bonds over the long term.

- Comparison to Traditional Investments: While risk is inherent in all investments, the risk-adjusted return potential of private investment is often viewed favorably.

- Long-Term Growth Potential: Canadian private investment offers opportunities for substantial long-term capital growth, aligning with the CAAT Pension Plan's long-term liability horizon.

Attracting Canadian Private Investment: Opportunities and Challenges

Attracting Canadian private investment requires a proactive approach that addresses both opportunities and challenges within the regulatory landscape.

Incentivizing Private Investment

The CAAT Pension Plan is implementing various strategies to attract Canadian private investment, including initiatives that streamline processes and offer attractive investment terms.

- Tax Benefits: Exploring potential tax advantages for investors to incentivize participation.

- Streamlined Processes: Simplifying the investment process to make it more efficient and appealing to potential investors.

- Investor Relations: Proactive communication and engagement with prospective Canadian investors to showcase the opportunities.

- Transparency and Due Diligence: Providing clear and transparent information to potential investors to build trust and confidence.

Navigating Regulatory Hurdles

The Canadian pension investment landscape is subject to various regulations. The CAAT Pension Plan is committed to navigating these complexities to ensure compliance and attract responsible private investment.

- Regulatory Compliance: Strict adherence to all relevant Canadian regulatory requirements for pension investments.

- Risk Management: Implementing robust risk management frameworks to mitigate potential challenges and ensure responsible investment practices.

- Transparency and Reporting: Maintaining transparent reporting mechanisms to provide investors with regular updates and performance information.

The Benefits of Increased Canadian Private Investment for the CAAT Pension Plan and Canada

Increased Canadian private investment in the CAAT Pension Plan offers significant benefits, both for the plan’s members and the broader Canadian economy.

Strengthening the Canadian Economy

Investing in Canadian private companies stimulates economic growth through job creation, innovation, and diversification.

- Job Creation: Private investments often lead to the creation of new jobs and increased employment opportunities across various sectors.

- Innovation and Growth: Supporting Canadian businesses fosters innovation and strengthens the competitiveness of the Canadian economy on a global scale.

- Economic Diversification: Investing in diverse private sectors helps diversify the Canadian economy, reducing reliance on specific industries.

Ensuring Long-Term Pension Security

A more diversified investment portfolio, bolstered by increased Canadian private investment, translates to enhanced long-term security for CAAT pensioners.

- Portfolio Stability: Diversification reduces the impact of market fluctuations on pension payouts.

- Increased Investment Returns: Higher potential returns from private investments contribute to the long-term financial health of the plan.

- Secure Pension Payouts: A robust and well-managed investment portfolio safeguards the future pension payments for CAAT members.

Conclusion

The CAAT Pension Plan’s proactive pursuit of increased Canadian private investment is a strategic move designed to enhance portfolio diversification, target higher returns, and strengthen the long-term financial security of its members. This initiative offers significant benefits for both the CAAT Pension Plan and the Canadian economy as a whole, stimulating economic growth and creating a more robust and resilient investment landscape. The CAAT Pension Plan invites Canadian private investors to explore the numerous opportunities available and contribute to a secure financial future for its members and the continued growth of the Canadian economy. Learn more about investing in the CAAT Pension Plan by visiting [website address].

Featured Posts

-

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025 -

Jackson Chourios Two Home Runs Fuel Brewers 8 2 Win Vs Reds

Apr 23, 2025

Jackson Chourios Two Home Runs Fuel Brewers 8 2 Win Vs Reds

Apr 23, 2025 -

Ai For Wildlife Conservation A Balancing Act

Apr 23, 2025

Ai For Wildlife Conservation A Balancing Act

Apr 23, 2025 -

How Ai Is Reshaping Wildlife Conservation A Double Edged Sword

Apr 23, 2025

How Ai Is Reshaping Wildlife Conservation A Double Edged Sword

Apr 23, 2025 -

Cincinnati Reds Drop Third Straight 1 0 Match

Apr 23, 2025

Cincinnati Reds Drop Third Straight 1 0 Match

Apr 23, 2025