Buying The Dip: Is This AI Quantum Computing Stock Worth It?

Table of Contents

Understanding the AI Quantum Computing Market

The potential of AI quantum computing is nothing short of revolutionary. It promises to solve problems currently intractable for even the most powerful classical computers, impacting diverse industries like pharmaceuticals (drug discovery), materials science (new material design), finance (risk modeling), and cybersecurity (cryptography). Market projections point towards explosive growth, with estimates suggesting a [Insert Market Size Projection and Source Here] market by [Insert Year Here].

However, the AI quantum computing landscape is still nascent. Key players like IBM, Google, and Rigetti Computing are locked in a fierce competition, vying for market dominance and technological leadership. This competition, while driving innovation, also creates uncertainty.

- High growth potential, but also high risk: The potential rewards are enormous, but so are the potential losses.

- Technological advancements driving market expansion: Breakthroughs in qubit technology and error correction are crucial for market growth.

- Government investments and regulations influencing the market: Government funding and regulations will shape the industry's trajectory.

- Examples of successful (and failed) AI quantum computing ventures: Analyzing past successes and failures provides valuable insights into the risks and opportunities. [Cite relevant examples here].

Analyzing [Stock Name] Performance and Financials

[Insert Stock Name Here] is an [describe the company - e.g., emerging player/established leader] in the AI quantum computing sector, focusing on [mention company's specific area of focus, e.g., developing quantum algorithms, building quantum hardware]. Its recent performance has been [describe recent performance - e.g., volatile, showing signs of recovery, experiencing a significant dip]. Let's examine the numbers:

- Current stock price and market capitalization: [Insert Current Stock Price and Market Cap]

- Recent financial reports and earnings calls: [Summarize key findings from recent financial reports and earnings calls, highlighting positive and negative aspects].

- Analysis of the company's financial health and stability: [Analyze key financial indicators like revenue growth, profitability, debt levels, and cash flow]. Compare these to industry benchmarks.

- Comparison with competitors' financial performance: [Compare [Stock Name]'s financial performance to that of its main competitors. Highlight areas of strength and weakness].

Evaluating the Risk vs. Reward of Buying the Dip

Investing in [Insert Stock Name Here] during a dip presents both significant risks and potential rewards.

- Market volatility and potential for further price drops: The AI quantum computing market is notoriously volatile, and further price drops are possible.

- Technological risks and the possibility of the company failing to deliver on its promises: The company's technology might not meet expectations, or competitors might surpass it.

- Competitive landscape and potential for disruption: The highly competitive nature of the industry poses a significant risk.

- Potential for substantial returns if the company succeeds: If [Insert Stock Name Here] successfully develops and commercializes its technology, the potential returns could be substantial.

Diversification is key. Don't put all your eggs in one basket. Consider your overall investment portfolio and risk tolerance before committing any significant capital.

Alternative Investment Strategies in the AI Quantum Computing Sector

Investing in individual AI quantum computing stocks is not the only option. Consider diversifying your portfolio by investing in:

-

Exchange-Traded Funds (ETFs): Some ETFs offer exposure to the broader technology sector, including AI quantum computing companies.

-

Other AI quantum computing stocks: Research other promising companies in the field to spread your risk.

-

Examples of alternative AI quantum computing investments: [List examples of ETFs or other relevant stocks].

-

Comparison of risk profiles and potential returns of different investment options: [Compare the risk/reward profiles of different investment options].

-

Considerations for building a diversified portfolio: A diversified portfolio reduces overall risk.

Conclusion: Making Informed Decisions About AI Quantum Computing Stocks

Investing in AI quantum computing stocks, particularly during a dip, requires careful consideration of both the potential rewards and the significant risks involved. [Insert Stock Name Here] presents a [describe the investment opportunity - e.g., high-risk, high-reward, potentially lucrative] opportunity, but thorough due diligence is crucial. Analyzing financial statements, understanding the competitive landscape, and assessing the company's technological progress are essential steps. Remember to consider your risk tolerance and diversify your investment portfolio. Before making any investment decisions, focus on researching AI quantum computing stocks, evaluating AI quantum computing investments carefully, and understanding AI quantum computing market trends. Only then can you make an informed decision that aligns with your financial goals.

Featured Posts

-

Fing A Look At David Walliams New Fantasy Film Greenlit By Stan

May 21, 2025

Fing A Look At David Walliams New Fantasy Film Greenlit By Stan

May 21, 2025 -

The Love Monster And Emotional Development In Children

May 21, 2025

The Love Monster And Emotional Development In Children

May 21, 2025 -

Big Bear Ai Bbai Retains Buy Rating Defense Sector Investment Implications

May 21, 2025

Big Bear Ai Bbai Retains Buy Rating Defense Sector Investment Implications

May 21, 2025 -

Kamerbrief Certificaten Abn Amro Programma Details En Verkoopmogelijkheden

May 21, 2025

Kamerbrief Certificaten Abn Amro Programma Details En Verkoopmogelijkheden

May 21, 2025 -

Discussion Autour De Les Grands Fusains De Boulemane D Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025

Discussion Autour De Les Grands Fusains De Boulemane D Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025

Latest Posts

-

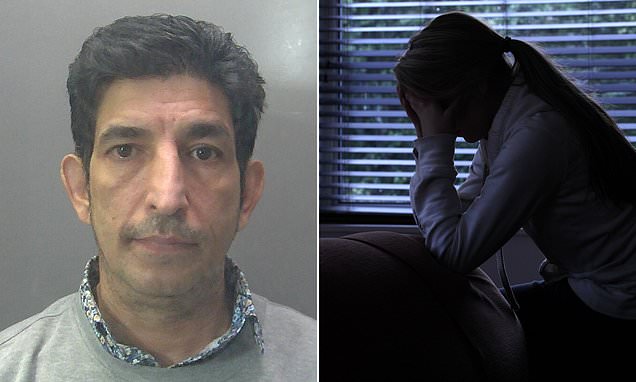

Appeal Pending Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 22, 2025

Appeal Pending Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025 -

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks Sentence Appeal

May 22, 2025 -

Were They Underestimated Tigers Triumph Over Rockies 8 6

May 22, 2025

Were They Underestimated Tigers Triumph Over Rockies 8 6

May 22, 2025