BigBear.ai (BBAI) Retains Buy Rating: Defense Sector Investment Implications

Table of Contents

Understanding the Buy Rating for BBAI Stock

The recent buy rating for BBAI stock comes from [Name of Analyst Firm or Rating Agency], a reputable source within the financial industry. Their assessment is based on a comprehensive analysis of BigBear.ai's financial performance and future prospects. The rationale behind this positive assessment rests on several key factors. [Name of Analyst Firm or Rating Agency] highlights BigBear.ai's strong revenue growth, improved profit margins, and strategic initiatives aligning with the increasing demand for advanced AI and analytics solutions within the defense sector. The analyst(s) have set a target price of [Target Price] for BBAI stock, implying a significant upside potential for investors.

- Key financial metrics supporting the buy rating: Revenue growth exceeding [Percentage] year-over-year, improved EBITDA margins, and a strong backlog of contracts.

- Positive industry trends benefiting BigBear.ai: Increased government spending on defense technology, growing adoption of AI and machine learning in defense applications, and a heightened focus on data analytics for improved operational efficiency.

- Assessment of the company's competitive landscape: BigBear.ai's unique technological offerings and strong partnerships provide a competitive edge within the market.

BigBear.ai's Position in the Defense Sector

BigBear.ai provides critical data analytics and AI-powered solutions to the defense industry, focusing on areas such as intelligence analysis, cybersecurity, and logistical optimization. The defense technology sector is experiencing rapid growth driven by technological advancements and geopolitical uncertainties. BigBear.ai has capitalized on these trends, establishing itself as a key player. The company's competitive advantages lie in its proprietary algorithms, deep expertise in data science, and strong relationships with key government agencies.

- Key contracts and partnerships with defense agencies: BigBear.ai has secured contracts with [mention specific agencies or examples if public], showcasing its credibility and market presence.

- Innovative technologies offered by BigBear.ai: The company's AI-powered solutions offer enhanced capabilities in areas such as predictive maintenance, risk assessment, and situational awareness.

- Market share and growth potential within specific defense niches: BigBear.ai is poised for significant growth, particularly in [mention specific niche areas, e.g., cyber security, intelligence analysis].

Investment Risks and Considerations for BBAI

While the buy rating for BBAI stock is positive, it's crucial to acknowledge potential risks. Investing in any stock, particularly within the defense sector, carries inherent uncertainties. Geopolitical instability, changes in government spending priorities, and intense competition from established players are all factors that could negatively impact BigBear.ai's performance.

- Geopolitical risks impacting the defense sector: International conflicts and shifting geopolitical alliances can influence government spending on defense technologies.

- Competition from other defense technology companies: BigBear.ai faces competition from larger, more established companies in the defense technology market.

- Economic factors that could affect government spending on defense: Budgetary constraints or shifts in national priorities could impact the demand for BigBear.ai's services.

Alternative Investment Strategies in the Defense Sector

Diversification is key to a successful investment strategy. While BigBear.ai presents an interesting opportunity, investors should consider alternative options within the defense sector to mitigate risk.

- Other publicly traded defense companies: [Mention a few examples of other publicly traded defense companies and briefly compare them to BBAI].

- Potential ETFs focused on the defense sector: Investing in defense-focused ETFs provides broader exposure to the sector and reduces reliance on a single company.

- Highlight the importance of diversification in investment portfolios: A diversified portfolio reduces the overall risk of investment losses.

BigBear.ai (BBAI) and Your Investment Strategy

In conclusion, the retained buy rating for BigBear.ai (BBAI) stock signals a positive outlook, driven by strong financial performance and the company's strategic positioning within the growing defense technology sector. However, it’s essential to weigh the potential benefits against the inherent risks before making any investment decisions. Thorough due diligence, including a comprehensive analysis of the company's financials, competitive landscape, and industry trends, is crucial. Consider BigBear.ai (BBAI) as a potential addition to your defense sector investment portfolio, but always conduct thorough due diligence before investing. Informed decision-making regarding BBAI stock and the defense industry as a whole is paramount to successful investing.

Featured Posts

-

Can Apple Revitalize Siri With Large Language Models

May 21, 2025

Can Apple Revitalize Siri With Large Language Models

May 21, 2025 -

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025

Honest Review Young Playwrights Watercolor Themed Play

May 21, 2025 -

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 21, 2025

Dimotiko Odeio Rodoy Synaylia Kathigiton Stin Dimokratiki

May 21, 2025 -

Superalimentos Por Que Este Supera Al Arandano En La Lucha Contra Enfermedades Cronicas

May 21, 2025

Superalimentos Por Que Este Supera Al Arandano En La Lucha Contra Enfermedades Cronicas

May 21, 2025 -

The Touching Reason Behind Peppa Pigs Baby Sisters Name

May 21, 2025

The Touching Reason Behind Peppa Pigs Baby Sisters Name

May 21, 2025

Latest Posts

-

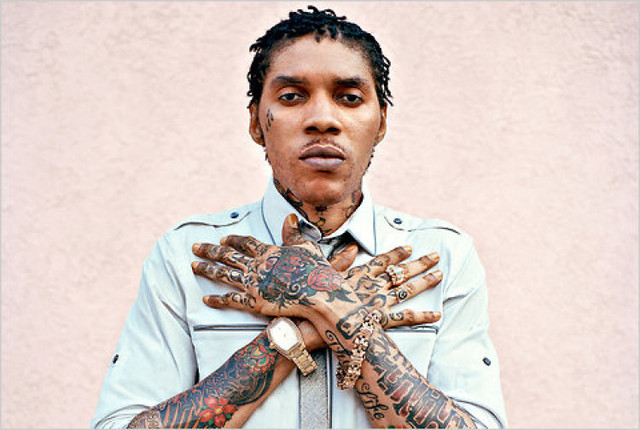

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025

The Unforgettable Vybz Kartel Brooklyn Concerts Sell Out

May 22, 2025 -

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025

Vybz Kartels New York Shows Sold Out Success In Brooklyn

May 22, 2025 -

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025

Brooklyn Roars For Vybz Kartel Sold Out Shows A Testament To His Enduring Popularity

May 22, 2025 -

Vybz Kartel Electrifies Brooklyn Sold Out Concerts Captivate Fans

May 22, 2025

Vybz Kartel Electrifies Brooklyn Sold Out Concerts Captivate Fans

May 22, 2025 -

The Role Of Kartel In Shaping Rum Culture Analysis From Stabroek News

May 22, 2025

The Role Of Kartel In Shaping Rum Culture Analysis From Stabroek News

May 22, 2025