Buffett's Succession At Berkshire Hathaway: What Happens To Apple Investment?

Table of Contents

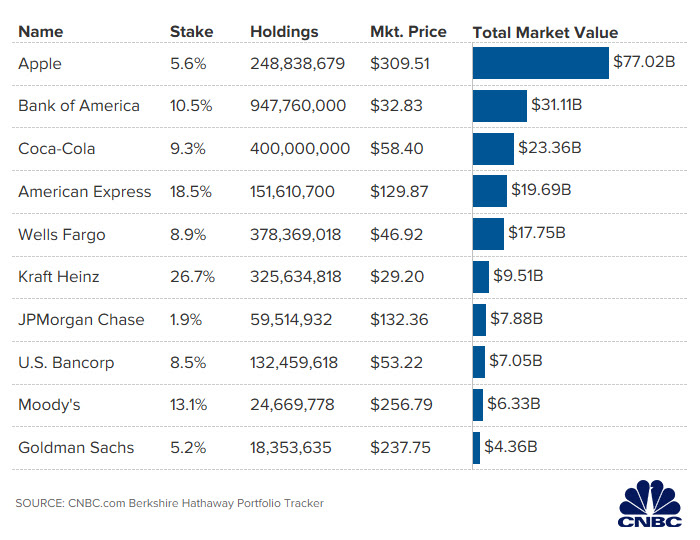

The Significance of Berkshire Hathaway's Apple Stake

Berkshire Hathaway's Apple holdings are monumental, representing a significant portion of its overall investment portfolio. This investment has played a crucial role in Berkshire's recent strong financial performance, making the future of this stake a key focus for investors and analysts alike. Apple's consistent growth and profitability have significantly benefited Berkshire, solidifying its position as a cornerstone investment.

- Percentage of Berkshire's portfolio held in Apple: Currently, Apple represents a substantial portion of Berkshire's portfolio, exceeding 40% in recent years, making it the largest holding by a considerable margin.

- Historical returns from the Apple investment: Berkshire Hathaway's Apple investment has yielded significant returns over the years, contributing substantially to the company's overall growth and shareholder value.

- Impact of Apple stock performance on Berkshire's overall valuation: The performance of Apple's stock directly influences Berkshire Hathaway's overall valuation. Positive Apple performance translates to higher Berkshire share prices and vice-versa.

Potential Scenarios for Apple Investment After Buffett's Succession

Several scenarios could unfold regarding Berkshire Hathaway's Apple investment following Buffett's succession. Understanding these possibilities is crucial for assessing the potential risks and rewards.

Maintaining the Status Quo

One possibility is that Berkshire's successors maintain the current investment strategy, retaining the substantial Apple holdings. This approach would require a deep understanding of and faith in Apple's continued growth and market dominance.

- Potential successors and their investment philosophies: Greg Abel and Ajit Jain, the leading candidates for succession, have different backgrounds and investment philosophies that could influence their decision-making.

- Likelihood of this scenario: The likelihood of this scenario depends largely on the chosen successor's assessment of Apple's long-term prospects and their alignment with Buffett's investment principles.

Partial Divestment

Another scenario involves a partial divestment, where Berkshire sells a portion of its Apple shares. This could be driven by various factors, including diversification needs or a shift in market conditions.

- Reasons for potential divestment: Diversification to mitigate risk, changing market dynamics, and the need to fund other investment opportunities are all potential drivers.

- Impact of a partial divestment on Berkshire's financial position: A partial divestment could generate significant cash flow for Berkshire while still maintaining a considerable stake in Apple.

Complete Divestment

The most extreme scenario is a complete divestment, where Berkshire sells all its Apple stock. This would be a dramatic move, likely triggered by unforeseen circumstances or a significant change in the successors' investment strategy.

- Circumstances that would lead to such a decision: A sharp downturn in Apple's performance, a significant shift in the technology landscape, or a fundamentally different investment philosophy from the successors could lead to this drastic step.

- Consequences for both Berkshire and Apple: A complete divestment would significantly impact both Berkshire's financial position and Apple's stock price, potentially causing significant market volatility.

The Role of Berkshire Hathaway's Successors

The investment decisions of Greg Abel and Ajit Jain, the frontrunners to succeed Buffett, will be paramount in shaping the future of Berkshire's Apple investment. Their distinct approaches to investment could significantly affect Apple's stock price and the broader market.

- Key differences in their investment philosophies: Abel's focus on operational efficiency and Jain's expertise in insurance underwriting suggest potentially differing investment approaches.

- Potential implications of each successor's approach for Apple's stock price: Each successor's decisions could create market uncertainty, leading to temporary fluctuations in Apple's stock price.

- Analysis of their past investment decisions: Examining their past investment choices provides valuable insights into their potential handling of Berkshire's Apple holdings.

Impact on Investors and the Market

The outcome of Buffett's Berkshire Hathaway succession concerning the Apple investment will significantly impact investors and the broader market. Understanding the potential implications is crucial for informed decision-making.

- Potential volatility in Apple's stock price: Uncertainty surrounding the future of Berkshire's Apple stake could lead to significant volatility in Apple's stock price.

- Impact on investor confidence in Berkshire Hathaway: The succession plan's execution and the subsequent investment decisions will shape investor confidence in Berkshire Hathaway.

- Wider market implications of Berkshire's investment decisions: Berkshire's actions will ripple through the market, influencing investor sentiment and potentially triggering broader market movements.

Conclusion

The future of Berkshire Hathaway's Apple investment post-Buffett's succession remains uncertain, with several potential scenarios, from maintaining the status quo to a complete divestment. The actions of Greg Abel or Ajit Jain will be crucial in determining this future. The significant role of the successors in shaping the investment strategy cannot be overstated. Monitoring the situation closely is essential. Stay informed about Buffett's Berkshire Hathaway succession Apple investment developments to make informed investment decisions. Further research and analysis are crucial for understanding the future of this significant investment.

Featured Posts

-

G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025

G 7s Consideration Of Reduced Tariffs For Chinese Products

May 24, 2025 -

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025

Berkshire Hathaways Apple Holdings The Impact Of Ceo Transition

May 24, 2025 -

Ihanet Edildiginde Intikami Geciktirmeyen Burclar

May 24, 2025

Ihanet Edildiginde Intikami Geciktirmeyen Burclar

May 24, 2025 -

Repression Des Dissidents Chinois En France Les Methodes Employees

May 24, 2025

Repression Des Dissidents Chinois En France Les Methodes Employees

May 24, 2025 -

Alix Earles Dwts Debut A Gen Z Influencers Smart Marketing Strategy

May 24, 2025

Alix Earles Dwts Debut A Gen Z Influencers Smart Marketing Strategy

May 24, 2025

Latest Posts

-

Walt Frazier Shows Off Championship Rings To Dylan Dreyer On Today

May 24, 2025

Walt Frazier Shows Off Championship Rings To Dylan Dreyer On Today

May 24, 2025 -

Understanding Dylan Dreyer And Brian Ficheras Relationship

May 24, 2025

Understanding Dylan Dreyer And Brian Ficheras Relationship

May 24, 2025 -

Al Roker And Today Show Co Host In Public Dispute Following Private Conversation

May 24, 2025

Al Roker And Today Show Co Host In Public Dispute Following Private Conversation

May 24, 2025 -

Inside Dylan Dreyer And Brian Ficheras Lasting Relationship

May 24, 2025

Inside Dylan Dreyer And Brian Ficheras Lasting Relationship

May 24, 2025 -

Al Roker Today Show Co Host Clash Over Off The Record Comments

May 24, 2025

Al Roker Today Show Co Host Clash Over Off The Record Comments

May 24, 2025