Brookfield Reconsiders US Manufacturing Due To Tariffs

Table of Contents

Brookfield Asset Management, a global giant with significant investments in US manufacturing, finds itself navigating a turbulent economic landscape. The current climate, marked by escalating trade tensions and fluctuating global markets, has led to a critical juncture: Brookfield Reconsiders US Manufacturing Due to Tariffs. This article will examine the profound impact of tariffs on Brookfield's manufacturing strategy in the US and explore the potential consequences for the company, the US economy, and global trade.

<h2>The Impact of Tariffs on Brookfield's US Operations</h2>

The imposition of tariffs on various imported goods has significantly increased the cost of production for numerous US-based manufacturers, and Brookfield is no exception. Specific tariffs impacting Brookfield's manufacturing sectors likely include those on steel, aluminum, and potentially other raw materials and components crucial to their production processes. These tariffs translate directly into increased costs across the board.

The increased costs associated with tariffs are multifaceted:

- Increased costs of imported components: Many manufacturing processes rely on globally sourced components. Tariffs on these inputs directly increase the cost of production, squeezing profit margins.

- Reduced competitiveness in the global market: Higher production costs make US-manufactured goods less competitive against those produced in countries without similar tariffs. This can lead to a loss of market share, both domestically and internationally.

- Potential loss of market share: Facing higher prices, consumers may opt for cheaper alternatives from overseas competitors, further eroding Brookfield's market position.

While precise data on Brookfield's internal cost increases related to tariffs may not be publicly available, analysts suggest that tariff-related cost increases across the manufacturing sector are substantial and widely reported. (Source needed: Insert citation to a relevant industry report or news article).

<h2>Brookfield's Potential Strategies in Response to Tariffs</h2>

Faced with these challenges, Brookfield has several strategic options to consider:

- Relocation of manufacturing facilities (nearshoring, friendshoring): Moving production to countries with lower tariffs or more favorable trade agreements—a process known as nearshoring (moving to nearby countries) or friendshoring (moving to countries with strong political alliances) – could mitigate tariff impacts.

- Restructuring supply chains to utilize domestic suppliers: Sourcing more components and raw materials domestically could reduce reliance on tariff-affected imports. This, however, might lead to higher costs if domestic suppliers are less efficient or charge higher prices.

- Investing in automation and technology to improve efficiency and reduce costs: Automation can reduce labor costs and improve productivity, potentially offsetting some tariff-related expenses.

- Lobbying for tariff reductions or exemptions: Brookfield could engage in lobbying efforts to persuade governments to reduce or eliminate tariffs on specific goods relevant to its operations.

Each strategy has its pros and cons: Relocating manufacturing involves significant capital investment and potential disruptions. Restructuring supply chains requires careful planning and may lead to increased costs initially. Automation is a long-term investment requiring considerable upfront costs. Lobbying efforts are not guaranteed to be successful.

<h2>Economic and Political Implications of Brookfield's Decision</h2>

Brookfield's decision will have significant implications. If Brookfield decides to shift a substantial portion of its manufacturing overseas, it could result in job losses in the US, impacting the local economy and potentially triggering negative political repercussions. The potential for negative publicity and strained trade relations is also a factor.

The ripple effect would impact other businesses within Brookfield's supply chain. Suppliers of raw materials, parts, and services would be affected, leading to potential economic hardship in affected communities. Experts predict that such decisions by multinational corporations could further exacerbate existing economic inequalities. (Source needed: Insert citation to an expert opinion or analysis).

<h2>The Future of Brookfield's US Manufacturing Presence</h2>

The long-term impact of tariffs on Brookfield's US operations remains uncertain. A phased approach, gradually shifting production or diversifying sourcing strategies, might be a more pragmatic approach. Brookfield might focus on innovation and technological advancements to improve efficiency and competitiveness despite the tariffs. Government support, in the form of tax incentives or subsidies, could influence Brookfield's decision to maintain or expand its US manufacturing presence.

<h2>The Uncertainty of US Manufacturing for Brookfield and Beyond</h2>

In conclusion, Brookfield's reconsideration of its US manufacturing operations highlights the significant impact of tariffs on multinational corporations' investment strategies. The potential economic and political consequences of Brookfield's decision—be it relocation, supply chain restructuring, or other responses—are far-reaching. The situation underscores the broader uncertainty surrounding US manufacturing in the face of ongoing trade tensions. This situation extends beyond Brookfield, impacting many businesses and underscoring the need for comprehensive trade policies that foster growth and stability.

Stay updated on Brookfield's response to tariffs and their impact on US manufacturing. Follow our future articles for further analysis of Brookfield’s strategies and the broader implications for the industry.

Featured Posts

-

Stronger Than Anticipated Macau Gaming Revenue Before Golden Week Holiday

May 02, 2025

Stronger Than Anticipated Macau Gaming Revenue Before Golden Week Holiday

May 02, 2025 -

Ukraine Receives Strong Backing From Switzerland Presidential Statement

May 02, 2025

Ukraine Receives Strong Backing From Switzerland Presidential Statement

May 02, 2025 -

Bbc Two Hd Tv Guide Newsround Listings And Schedule

May 02, 2025

Bbc Two Hd Tv Guide Newsround Listings And Schedule

May 02, 2025 -

Investing In Xrp What You Need To Know Before You Buy

May 02, 2025

Investing In Xrp What You Need To Know Before You Buy

May 02, 2025 -

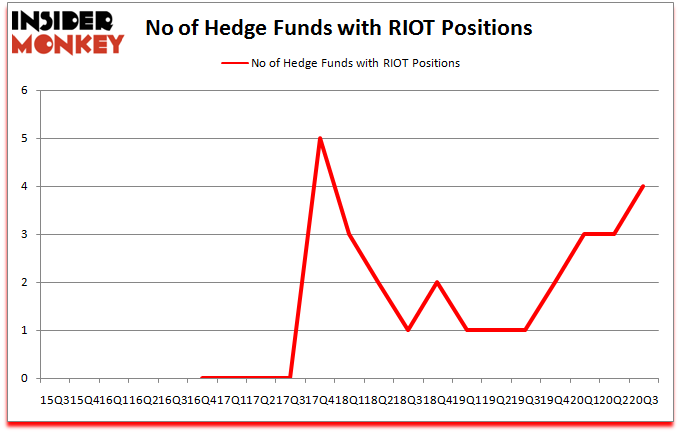

Is Riot Platforms Stock Riot A Good Investment Comparing Riot And Coin

May 02, 2025

Is Riot Platforms Stock Riot A Good Investment Comparing Riot And Coin

May 02, 2025

Latest Posts

-

North Carolina Supreme Court Gop Candidate Challenges Recent Rulings

May 02, 2025

North Carolina Supreme Court Gop Candidate Challenges Recent Rulings

May 02, 2025 -

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025

Understanding The Gop Candidates Appeal In The North Carolina Supreme Court Race

May 02, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 02, 2025 -

Gop Candidates Nc Supreme Court Appeal What It Means

May 02, 2025

Gop Candidates Nc Supreme Court Appeal What It Means

May 02, 2025 -

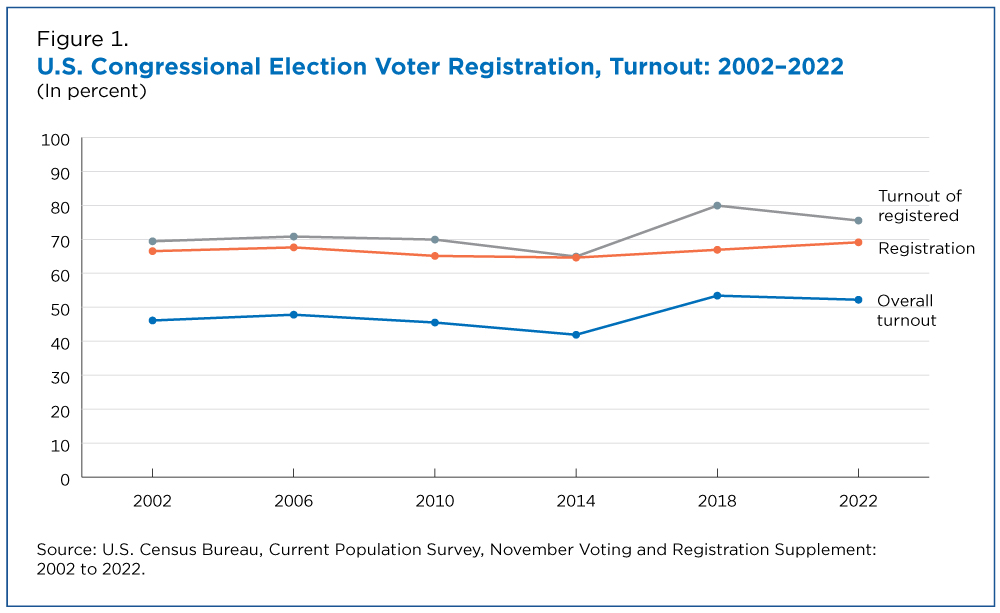

Examining Recent Elections Turnout Trends In Florida And Wisconsin

May 02, 2025

Examining Recent Elections Turnout Trends In Florida And Wisconsin

May 02, 2025