Investing In XRP: What You Need To Know Before You Buy

Table of Contents

Understanding XRP and Ripple

What is XRP?

XRP is a cryptocurrency designed to facilitate fast and low-cost international money transfers within the Ripple network. Unlike Bitcoin, which relies on a proof-of-work consensus mechanism, XRP uses a unique consensus algorithm, enabling significantly faster transaction speeds and lower fees. This makes it attractive for cross-border payments where speed and efficiency are paramount.

- Cross-border Payments: XRP facilitates near-instantaneous transfers across borders, bypassing traditional banking systems and their associated delays and high costs.

- Technological Advantages: Ripple's technology leverages a distributed ledger, providing transparency and security. Its speed and scalability are key advantages over other cryptocurrencies.

- Differences from Other Cryptocurrencies: XRP distinguishes itself from Bitcoin and Ethereum through its specific focus on institutional payments and its relationship with the Ripple company. It isn't purely decentralized in the same way as some other cryptocurrencies. The XRP cryptocurrency is managed by Ripple Labs.

Ripple's Business Model and Partnerships

Ripple's success is intrinsically linked to the adoption of its technology by financial institutions. The company focuses on providing its RippleNet solution to banks and payment providers, enabling them to conduct seamless cross-border transactions using XRP. The more institutions adopt RippleNet, the greater the demand for XRP, potentially driving its price upward.

- Key Partnerships: Ripple has secured partnerships with numerous major banks and financial institutions globally, demonstrating growing institutional acceptance of its technology and XRP. These partnerships play a significant role in shaping market sentiment and XRP's price.

- Institutional Adoption of XRP: The increasing adoption of XRP by large financial players adds credibility and legitimacy to the cryptocurrency, potentially reducing its risk profile for some investors.

- Ripple's Impact on XRP Price: The success of Ripple's business directly impacts XRP's value. Increased adoption and positive news from Ripple often correlate with price appreciation.

Risks Associated with Investing in XRP

Regulatory Uncertainty

Ripple faces ongoing legal battles, most notably a lawsuit filed by the Securities and Exchange Commission (SEC) in the United States. The outcome of this litigation significantly impacts XRP's price and its future prospects. Regulatory uncertainty in the cryptocurrency market is a considerable risk for investors.

- SEC Lawsuit on XRP: The SEC alleges that XRP is an unregistered security, which could have significant legal and financial implications for Ripple and XRP holders.

- Regulatory Uncertainty in Crypto: The evolving regulatory landscape for cryptocurrencies globally presents a complex and unpredictable environment for investors. Laws and regulations can change rapidly, creating significant risks.

- XRP Regulatory Risk: The potential for future regulatory actions against XRP adds to the inherent uncertainty of investing in this cryptocurrency.

Market Volatility

The cryptocurrency market is notoriously volatile, and XRP is no exception. Its price can fluctuate dramatically in short periods due to various factors. This inherent volatility presents a significant risk for investors.

- XRP Price Volatility: XRP's price is subject to rapid and substantial changes driven by market sentiment, news events, and overall crypto market trends.

- Crypto Market Volatility: The cryptocurrency market as a whole is susceptible to significant price swings, influenced by macroeconomic factors, technological advancements, and regulatory developments.

- Investing in Volatile Assets: Investing in volatile assets like XRP requires a high-risk tolerance and a long-term perspective.

Security Risks

Like all cryptocurrencies, XRP is subject to security risks, including exchange hacks and scams. Protecting your XRP investment requires careful consideration of storage and trading practices.

- XRP Security: Securing your XRP holdings is paramount. Choose reputable exchanges and employ robust security measures.

- Secure XRP Wallets: Use secure wallets, preferably hardware wallets for larger holdings, to protect your XRP from theft or loss.

- Cryptocurrency Security Risks: The risks of hacking, phishing scams, and other security breaches are real and must be taken seriously.

How to Invest in XRP

Choosing an Exchange

Selecting a reputable cryptocurrency exchange is the first step in buying XRP. Consider factors such as security features, transaction fees, user-friendliness, and regulatory compliance.

- Buying XRP: Research and select a reputable exchange that meets your needs and security requirements before purchasing XRP.

- XRP Exchanges: Many cryptocurrency exchanges offer XRP trading pairs. Compare fees, security measures, and user reviews before choosing an exchange.

- Best Exchanges for XRP: Look for exchanges with a strong track record of security and a user-friendly interface.

Storage Options

Once you've purchased XRP, you need to store it securely. Options include software wallets and hardware wallets, with hardware wallets offering greater security for larger holdings.

- XRP Storage: Secure storage is crucial to protect your XRP from theft or loss.

- Secure XRP Wallets: Research different wallet options, considering factors such as security, ease of use, and compatibility with your chosen exchange.

- Cold Storage for XRP: For significant XRP holdings, cold storage (hardware wallets) is recommended for enhanced security.

Diversification and Risk Management

Diversification and risk management are crucial aspects of responsible investing. Never invest more than you can afford to lose, and diversify your portfolio to mitigate risk.

- Risk Management in XRP Investing: Only invest an amount you can comfortably afford to lose, considering the inherent volatility of XRP.

- Diversifying Crypto Portfolio: Don't put all your eggs in one basket. Diversify your investment across different cryptocurrencies and asset classes.

- Responsible XRP Investment: Conduct thorough research, understand the risks involved, and invest responsibly.

Conclusion

Investing in XRP presents both significant opportunities and considerable risks. The potential for high returns is balanced by the volatility of the cryptocurrency market and regulatory uncertainties. Understanding XRP's role within the Ripple network, its technological advantages, and the risks associated with its investment is essential. Before you begin investing in XRP, carefully weigh the risks and rewards based on your individual financial situation and risk tolerance. Learn more about responsible investing in XRP and make informed decisions.

Featured Posts

-

L Escalation Nucleare Di Medvedev Cause Ed Effetti Sulla Russofobia Europea

May 02, 2025

L Escalation Nucleare Di Medvedev Cause Ed Effetti Sulla Russofobia Europea

May 02, 2025 -

Sony Play Station Christmas Voucher Glitch Users Receive Free Credit Compensation

May 02, 2025

Sony Play Station Christmas Voucher Glitch Users Receive Free Credit Compensation

May 02, 2025 -

Kendal Pitch Tragedy Manchester Uniteds Tribute To Poppy Atkinson

May 02, 2025

Kendal Pitch Tragedy Manchester Uniteds Tribute To Poppy Atkinson

May 02, 2025 -

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 02, 2025

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 02, 2025 -

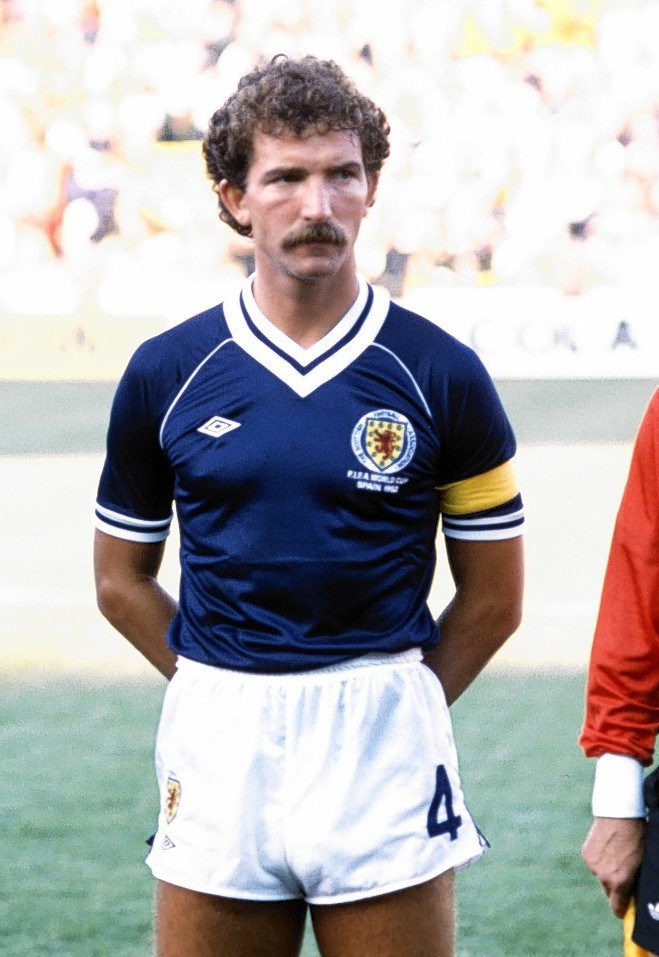

The Special Quality Graeme Souness Sees In Lewis Skelly His Attitude

May 02, 2025

The Special Quality Graeme Souness Sees In Lewis Skelly His Attitude

May 02, 2025

Latest Posts

-

Sleet And Snow Expected In Tulsa City Crews Pre Treat Roads

May 03, 2025

Sleet And Snow Expected In Tulsa City Crews Pre Treat Roads

May 03, 2025 -

Nws Forecaster In Tulsa Details Approaching Near Blizzard Conditions

May 03, 2025

Nws Forecaster In Tulsa Details Approaching Near Blizzard Conditions

May 03, 2025 -

Tulsa Facing Near Blizzard Conditions Nws Forecast

May 03, 2025

Tulsa Facing Near Blizzard Conditions Nws Forecast

May 03, 2025 -

Impact Of Saturdays Storm Report Damage To Help The Tulsa National Weather Service

May 03, 2025

Impact Of Saturdays Storm Report Damage To Help The Tulsa National Weather Service

May 03, 2025 -

Tulsa Winter Weather A Numerical Look Back

May 03, 2025

Tulsa Winter Weather A Numerical Look Back

May 03, 2025