Navigating Market Volatility: Learning From Professional And Individual Investor Behavior

Table of Contents

Professional Investor Strategies During Market Volatility

Professional investors employ sophisticated strategies to mitigate risk and capitalize on opportunities during periods of market volatility. Their approach differs significantly from that of individual investors, largely due to resources, experience, and a different risk tolerance.

Risk Management Techniques

Professional investors utilize a range of sophisticated risk management techniques to protect their portfolios. This goes beyond simply diversifying; it involves proactive measures to limit potential losses.

- Diversification across asset classes: Professionals spread investments across various asset classes (stocks, bonds, real estate, commodities) to reduce the impact of poor performance in any single area. This is fundamental to mitigating risk and managing volatility.

- Hedging strategies using derivatives: They employ derivatives like options and futures contracts to hedge against potential losses in specific investments or market segments. This involves strategically offsetting risk.

- Stress testing portfolios: Professionals routinely stress-test their portfolios under various adverse market scenarios to assess vulnerability and identify potential weaknesses. This allows for proactive adjustments.

- Utilizing quantitative models: Sophisticated quantitative models are used to analyze market data, predict trends, and inform investment decisions, aiming to minimize exposure to downside risk. This involves deep data analysis and predictive modeling. This is often done through advanced algorithms and statistical modeling. The goal is to identify undervalued assets during periods of market distress.

Long-Term Investment Horizon

A key differentiator is the long-term investment horizon adopted by professionals. They focus on the long-term growth potential of their investments, resisting the urge to react to short-term market fluctuations.

- Strategic asset allocation: Professionals define a strategic asset allocation based on long-term goals and risk tolerance, rarely deviating from it except for well-justified reasons.

- Disciplined rebalancing: They regularly rebalance their portfolios to maintain their target asset allocation, buying low and selling high over the long term.

- Avoiding emotional trading: Professionals maintain emotional detachment from short-term market movements. They understand that market volatility is inherent and that panicking often leads to poor investment decisions. This involves a disciplined approach that transcends emotional responses.

Adaptability and Market Research

Professional investors constantly monitor market conditions and adjust their strategies accordingly. They leverage a combination of fundamental and technical analysis to inform their decisions.

- Fundamental analysis of company financials: They delve deep into the financial health of companies, evaluating their profitability, growth potential, and competitive landscape. This is crucial to identifying long-term value.

- Technical analysis of market trends: Technical analysis uses charts and other data to identify trends, support levels, and resistance levels in the market, helping them anticipate shifts in momentum.

- Macroeconomic forecasting: They keep abreast of global economic trends, geopolitical events, and other macroeconomic factors that can influence market performance. Understanding these factors helps to manage and anticipate risk.

- Adapting investment strategies based on market conditions: Professional investors are agile and adapt their strategies as market conditions change. They are not static in their approach.

Individual Investor Behavior During Market Volatility

Individual investors, often lacking the resources and experience of professionals, frequently make emotional decisions during periods of market volatility, leading to suboptimal outcomes.

Common Mistakes During Volatility

Several behavioral biases commonly impact individual investors' decisions during market volatility.

- Panic selling during market downturns: Fear often drives individuals to sell their assets at the worst possible time, locking in losses. This is a classic example of emotional decision-making.

- Chasing hot tips and trends: The desire for quick profits can lead individuals to chase speculative investments without proper due diligence, increasing their exposure to risk. This is particularly prevalent during periods of market excitement.

- Overreacting to news and rumors: Individual investors may overreact to news headlines and market rumors, making impulsive investment decisions without proper evaluation.

- Ignoring long-term financial goals: Focusing on short-term gains often overshadows long-term financial goals. This lack of a clear plan undermines sound investment strategy.

Improving Individual Investor Behavior

Individual investors can significantly improve their approach to market volatility by adopting a more disciplined and informed strategy.

- Developing a long-term investment plan: Creating a well-defined investment plan that aligns with your financial goals and risk tolerance is essential. This provides a roadmap to navigate volatility.

- Diversifying investments across asset classes: Diversification is crucial in mitigating risk and reducing the impact of market fluctuations on your portfolio. This requires careful consideration and balance.

- Utilizing dollar-cost averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions, mitigating the risk of timing the market. This reduces the impact of market volatility.

- Seeking professional financial advice: Consulting with a qualified financial advisor can provide valuable guidance and support in managing your investments during periods of market uncertainty.

The Role of Financial Education

Financial literacy plays a pivotal role in navigating market volatility effectively. Understanding basic investment principles, risk management, and behavioral finance is crucial.

- Online courses and workshops: Numerous online resources offer courses and workshops on investment strategies and financial planning.

- Financial planning books and articles: Reading books and articles on personal finance can significantly improve your understanding of investment strategies.

- Consulting with a financial advisor: A financial advisor can provide personalized guidance tailored to your specific circumstances and financial goals. This personalized guidance is invaluable during periods of uncertainty.

Conclusion

Navigating market volatility successfully requires a disciplined, long-term approach that prioritizes risk management and emotional control. Professional investors utilize sophisticated strategies and maintain a long-term perspective, while individual investors often fall prey to emotional biases. By understanding the strategies employed by professionals and avoiding common individual investor pitfalls, you can improve your ability to navigate market volatility effectively. Start learning more about effective strategies for navigating market volatility today!

Featured Posts

-

Trump And Zelensky Meet Ahead Of Popes Funeral First Encounter Since Oval Office Dispute

Apr 28, 2025

Trump And Zelensky Meet Ahead Of Popes Funeral First Encounter Since Oval Office Dispute

Apr 28, 2025 -

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025

Post Roe America How Otc Birth Control Impacts Womens Health

Apr 28, 2025 -

Post Oval Office Confrontation Trump And Zelensky Meet At Popes Funeral

Apr 28, 2025

Post Oval Office Confrontation Trump And Zelensky Meet At Popes Funeral

Apr 28, 2025 -

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

Apr 28, 2025

Over The Counter Birth Control Redefining Reproductive Healthcare Post Roe

Apr 28, 2025 -

Federal Job Loss Challenges Faced By Workers Seeking State And Local Employment

Apr 28, 2025

Federal Job Loss Challenges Faced By Workers Seeking State And Local Employment

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

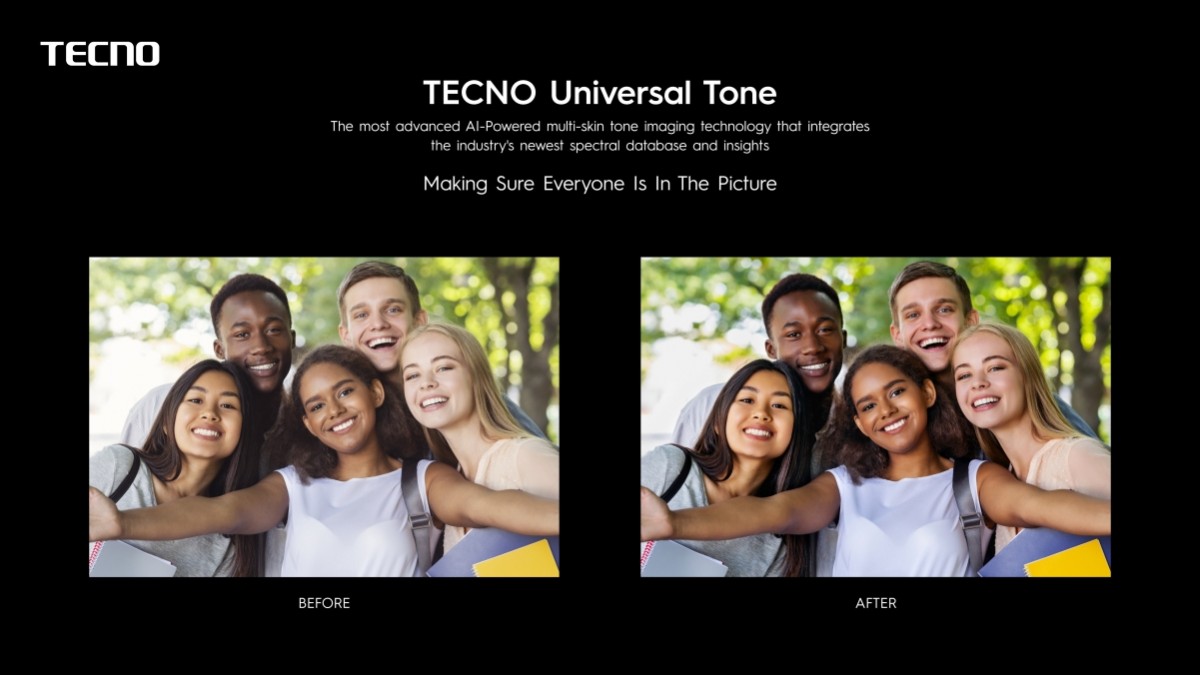

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025