Broadcom's VMware Acquisition: AT&T Exposes A Staggering 1050% Price Hike

Table of Contents

The VMware-Broadcom Merger: A Consolidation of Power

The merger of Broadcom and VMware, finalized in 2023, represents a significant consolidation of power in the technology industry. Broadcom, known primarily for its semiconductor components, is aggressively expanding its portfolio into enterprise software. VMware, a leading provider of virtualization and cloud infrastructure solutions, became a highly desirable target due to its vast customer base and critical role in many enterprise IT infrastructures.

This acquisition signals Broadcom's ambition to become a major player in the enterprise software market, potentially creating significant synergies and market dominance. However, the deal has also attracted considerable antitrust scrutiny and regulatory review, raising concerns about potential monopolistic practices and reduced competition.

- Broadcom's expansion beyond its core semiconductor business: This strategic move diversifies Broadcom's revenue streams and positions it as a key player in the increasingly important enterprise software sector.

- VMware's position as a leading virtualization and cloud infrastructure provider: VMware's vSphere, vSAN, and NSX products are critical components for many businesses, making this acquisition particularly impactful.

- Potential synergies and market dominance resulting from the merger: The combined entity holds a substantial market share, potentially leading to increased pricing power and reduced competitive pressure.

- Antitrust concerns and regulatory scrutiny surrounding the deal: Regulators in various jurisdictions are carefully examining the potential anti-competitive effects of this merger.

AT&T's 1050% Price Hike: A Case Study in Post-Merger Exploitation?

AT&T's announcement of a 1050% price increase for certain VMware services has shocked many of its enterprise clients. This drastic price hike, following closely on the heels of the Broadcom acquisition, has raised serious questions about the potential for post-merger exploitation. While AT&T has yet to provide a comprehensive justification for this significant increase, concerns are mounting regarding the impact on business operations and budgets.

- Specific VMware products affected by the price hike: The exact VMware products and licensing impacted by the price increase vary, but the scale of the increase itself is the primary concern.

- Impact on AT&T's enterprise clients: Many businesses are facing substantial budget overruns as a result of the price increase, forcing them to reconsider their IT strategies.

- Comparison with pricing from other providers: The price hike stands out significantly when compared to pricing from competing cloud infrastructure providers, raising concerns about potential market manipulation.

- Potential legal challenges and customer backlash: AT&T is likely to face legal challenges and significant customer backlash due to the magnitude of the price increase.

The Broader Implications for Enterprise Software Pricing

AT&T's 1050% price hike is not just an isolated incident; it represents a potential turning point in enterprise software pricing. This dramatic increase raises serious concerns about whether similar price hikes will follow other large mergers and acquisitions in the tech sector. It's possible this could set a precedent for less competition and reduced innovation in the enterprise software space.

- Increased costs for businesses relying on VMware solutions: The price hike directly impacts the bottom line for many businesses dependent on VMware's virtualization and cloud solutions.

- Potential for reduced competition and innovation: The reduced competitive landscape following the merger could stifle innovation and lead to a less dynamic market for enterprise software.

- The impact on cloud computing and virtualization strategies: Businesses may be forced to reconsider their cloud strategies and explore alternative solutions in response to the price increase.

- Strategies for businesses to mitigate potential price increases: Proactive contract negotiation, exploring alternative solutions, and careful budgeting are essential strategies to mitigate future price shocks.

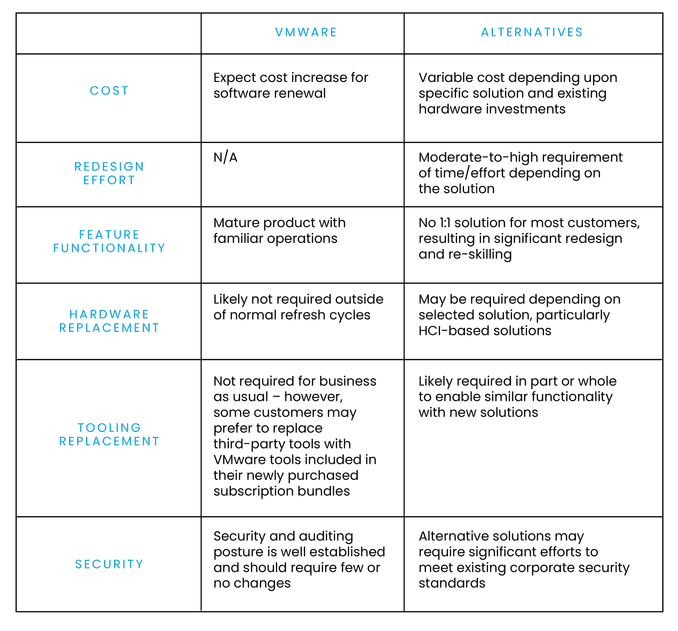

Alternatives and Mitigation Strategies for Businesses

Businesses facing exorbitant price increases for VMware services are not without options. Several alternatives and mitigation strategies exist to help mitigate the impact of this merger's consequences:

- Open-source virtualization solutions: Open-source alternatives like Proxmox VE and oVirt offer cost-effective virtualization options that can replace VMware products.

- Competing cloud infrastructure providers: Businesses can explore migrating to other cloud providers, such as AWS, Azure, or Google Cloud, which may offer more competitive pricing.

- Negotiating contracts and leveraging market power: Companies with significant negotiating power can attempt to renegotiate contracts with AT&T or other VMware providers to secure more favorable pricing.

- Long-term planning and budget adjustments: Proactive long-term planning and careful budget adjustments are crucial to absorb unexpected price increases and maintain financial stability.

Conclusion

The Broadcom acquisition of VMware, coupled with AT&T's shocking 1050% price hike, serves as a critical wake-up call for businesses relying on VMware products. This situation highlights the potential for significantly increased costs following mergers and acquisitions within the enterprise software market. Businesses must proactively assess their VMware dependence, explore alternative solutions, and aggressively negotiate contracts to avoid being caught off guard by future price increases. Understanding the implications of this merger and strategizing accordingly is crucial for navigating the changing landscape of enterprise software pricing. Stay informed about developments regarding the Broadcom VMware acquisition and its impact on your business. Don't wait for another price shock; take action to secure your business's future today.

Featured Posts

-

Del Toro Extends Giro D Italia Lead Stage 17 Victory Vine And Plapp Withdraw

May 30, 2025

Del Toro Extends Giro D Italia Lead Stage 17 Victory Vine And Plapp Withdraw

May 30, 2025 -

Ftc Appeals Activision Blizzard Merger Ruling Microsoft Deal Uncertain

May 30, 2025

Ftc Appeals Activision Blizzard Merger Ruling Microsoft Deal Uncertain

May 30, 2025 -

Pulsating Space Object Observations Challenge Existing Astronomical Models

May 30, 2025

Pulsating Space Object Observations Challenge Existing Astronomical Models

May 30, 2025 -

Alexander Gustafssons Assessment Jon Jones And The Aspinall Threat

May 30, 2025

Alexander Gustafssons Assessment Jon Jones And The Aspinall Threat

May 30, 2025 -

Guia De Programacion De Television Del Sabado 10 5 This Is Incorrect As The Keyword Is In Greek And This Is In Spanish

May 30, 2025

Guia De Programacion De Television Del Sabado 10 5 This Is Incorrect As The Keyword Is In Greek And This Is In Spanish

May 30, 2025

Latest Posts

-

Rebuilding After The Inferno The Texas Panhandles Post Wildfire Recovery

May 31, 2025

Rebuilding After The Inferno The Texas Panhandles Post Wildfire Recovery

May 31, 2025 -

Out Of Control Wildfires In Eastern Manitoba A Look At The Ongoing Emergency Response

May 31, 2025

Out Of Control Wildfires In Eastern Manitoba A Look At The Ongoing Emergency Response

May 31, 2025 -

Deadly Wildfires Continue To Threaten Eastern Manitoba Update On Firefighting Efforts

May 31, 2025

Deadly Wildfires Continue To Threaten Eastern Manitoba Update On Firefighting Efforts

May 31, 2025 -

One Year After The Texas Panhandle Wildfire Assessing The Damage And Progress

May 31, 2025

One Year After The Texas Panhandle Wildfire Assessing The Damage And Progress

May 31, 2025 -

Respiratory Health Concerns Rise As Canadian Wildfires Affect Minnesota Air

May 31, 2025

Respiratory Health Concerns Rise As Canadian Wildfires Affect Minnesota Air

May 31, 2025