Broadcom's VMware Acquisition: A 1050% Price Spike For AT&T

Table of Contents

Understanding the Broadcom-VMware Merger and its Market Impact

Broadcom's Strategic Acquisition of VMware

Broadcom, a semiconductor giant, made a bold move by acquiring VMware, a leading provider of virtualization and cloud infrastructure solutions. This acquisition reflects Broadcom's strategic ambition to expand significantly into the lucrative enterprise software market and solidify its position as a dominant player in the tech industry.

- Previous Acquisitions: Broadcom has a history of strategic acquisitions, including CA Technologies and Symantec, demonstrating its capacity for integrating large-scale software companies.

- Market Position: This merger positions Broadcom to compete more directly with other major players in the enterprise software market like Microsoft and Oracle.

- Deal Value: The $61 billion deal marked one of the largest tech acquisitions in history, highlighting the immense value placed on VMware's technology and market share.

VMware's Role in the Enterprise Software Market

VMware is a cornerstone of enterprise IT infrastructure, providing virtualization, cloud computing, and security solutions to businesses worldwide. Its products are critical for modern data centers and cloud operations.

- Key Products & Services: VMware's portfolio includes vSphere (server virtualization), vSAN (storage virtualization), NSX (network virtualization), and vRealize (automation and operations management).

- Customer Base & Market Share: VMware boasts a vast and diverse customer base, ranging from small businesses to large multinational corporations, making it a significant player in the enterprise software market.

Initial Market Reactions to the Merger

The announcement of the Broadcom-VMware merger sent shockwaves through the market. While VMware's stock price initially surged, reflecting investor optimism about the deal, Broadcom's stock experienced more moderate fluctuations. The overall market reaction signaled a significant shift in the tech landscape.

Deconstructing AT&T's 1050% VMware Stock Price Surge

AT&T's VMware Holdings and Investment Strategy

AT&T's significant investment in VMware proved unexpectedly lucrative. The precise size of AT&T's VMware holdings before the acquisition isn't publicly available in granular detail. However, we know that their investment represented a substantial portion of their portfolio.

- Acquisition Timeline: Determining the exact dates AT&T purchased its VMware shares requires further financial disclosure analysis.

- Public Statements: While AT&T might not have explicitly publicized the extent of their VMware investment, the magnitude of their profit suggests a considerable stake.

The Valuation Increase

The 1050% price increase translates to a massive financial windfall for AT&T. While the precise figures remain undisclosed without full financial transparency from AT&T, the sheer percentage represents an extraordinary return on investment.

- Profit Calculation: Determining the exact profit requires knowing the initial investment cost and the number of shares held.

- Purchase vs. Sale Price: The dramatic difference between AT&T's presumed acquisition price and the sale price per share following the Broadcom acquisition is the source of this massive return.

Potential Reasons for the Dramatic Price Spike

Several factors contributed to AT&T's extraordinary gains.

- Market Speculation: Anticipation of a significant premium offered by Broadcom fuelled market speculation, driving up VMware's share price.

- Broadcom's Reputation: Broadcom's history of successful acquisitions and strong financial performance instilled confidence in investors.

- Future Growth Projections: Investors likely anticipated significant synergies between Broadcom and VMware, leading to future growth and enhanced profitability.

- Synergies: The combined strengths of Broadcom's hardware and VMware's software were seen as a recipe for success in the enterprise market.

- Investor Sentiment: The overwhelmingly positive investor sentiment following the acquisition announcement further contributed to the price surge.

Implications and Future Outlook for Broadcom, VMware, and AT&T

Broadcom's Integration Challenges and Future Strategy

Integrating VMware into Broadcom's operations will present significant challenges.

- Regulatory Hurdles: The merger may face scrutiny from antitrust regulators, potentially leading to delays or conditions.

- Integration Complexity: Combining two such large and complex organizations requires careful planning and execution.

- Future Product Roadmap: Broadcom will need to develop a clear roadmap for VMware's future products and services.

VMware's Transformation under Broadcom's Ownership

VMware's operations may undergo significant changes under Broadcom's ownership, impacting its employees, customers, and partners.

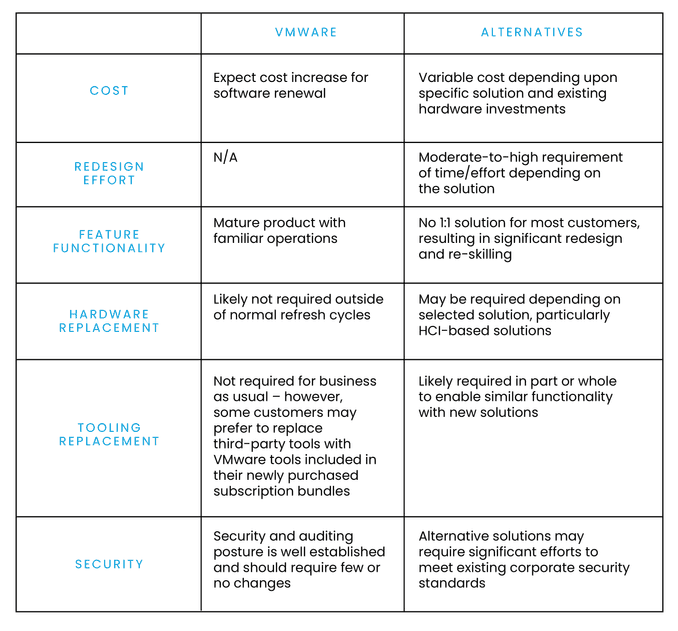

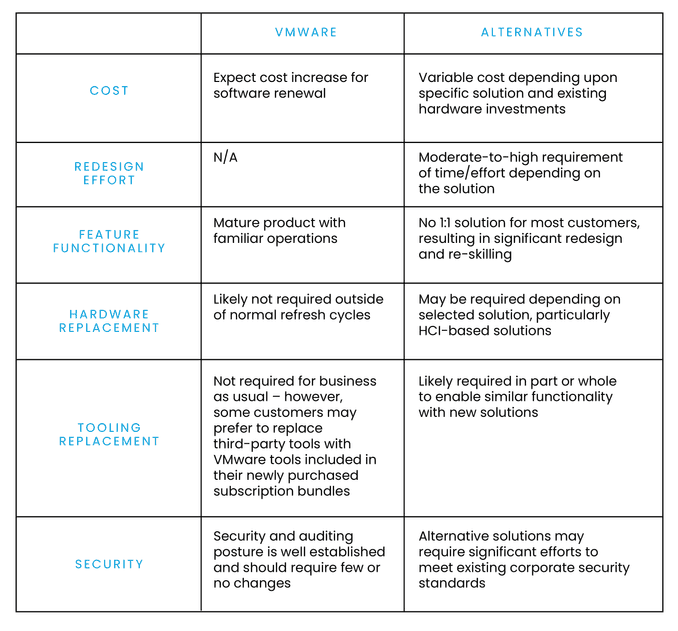

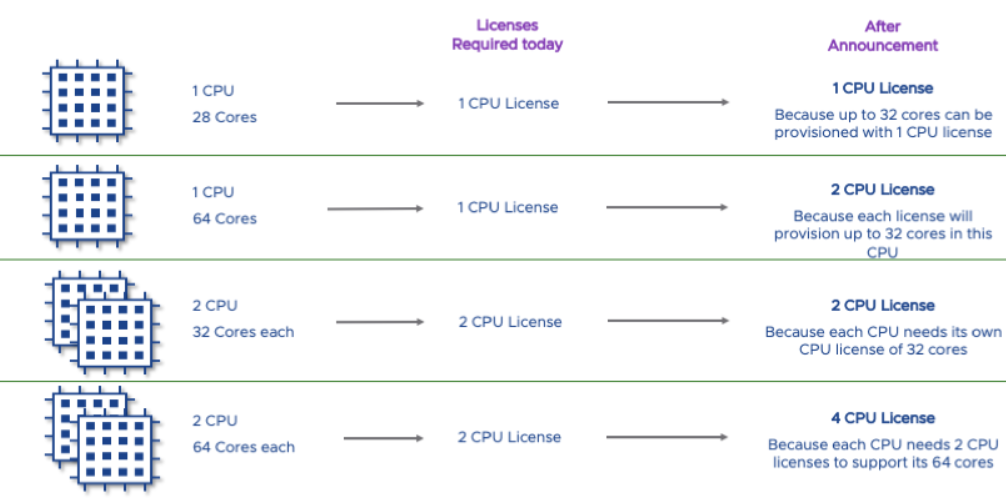

- Potential Impacts: Changes could include shifts in product development, pricing strategies, and customer support.

AT&T's Investment Strategy Moving Forward

This event could significantly influence AT&T's future investment strategy.

Conclusion: The Broadcom-VMware Acquisition: A Case Study in Market Volatility

Broadcom's VMware acquisition serves as a striking example of the volatility and potential for both immense gains and significant losses in the tech industry's mergers and acquisitions landscape. AT&T's 1050% price increase underscores the unpredictable nature of the market and the importance of careful investment analysis. This case study highlights the significant impact that major mergers and acquisitions can have on investors and the overall market. To stay ahead of the curve, stay informed about major mergers and acquisitions in the tech industry and consider further research into the effects of this acquisition on other investors. Understanding the dynamics of Broadcom's VMware acquisition and similar events is crucial for making informed investment decisions.

Featured Posts

-

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025

Extreme V Mware Price Increase At And T Details Broadcoms 1050 Hike

Apr 28, 2025 -

Us And Iran Fail To Reach Agreement In Latest Nuclear Negotiations

Apr 28, 2025

Us And Iran Fail To Reach Agreement In Latest Nuclear Negotiations

Apr 28, 2025 -

Navigating Market Volatility Learning From Professional And Individual Investor Behavior

Apr 28, 2025

Navigating Market Volatility Learning From Professional And Individual Investor Behavior

Apr 28, 2025 -

Trump And Zelensky Meet Ahead Of Popes Funeral First Encounter Since Oval Office Dispute

Apr 28, 2025

Trump And Zelensky Meet Ahead Of Popes Funeral First Encounter Since Oval Office Dispute

Apr 28, 2025 -

Top Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025

Top Chefs Fishermans Stew Wins Over Eva Longoria

Apr 28, 2025

Latest Posts

-

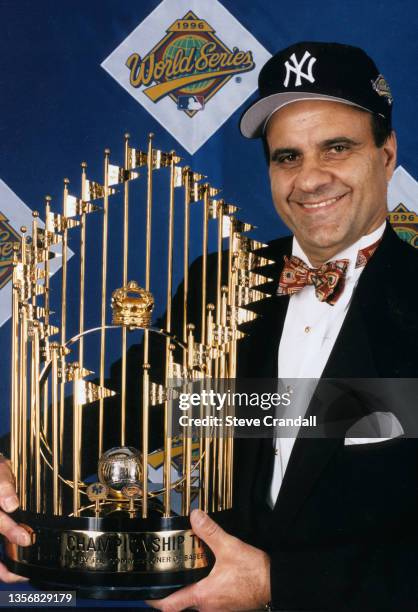

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

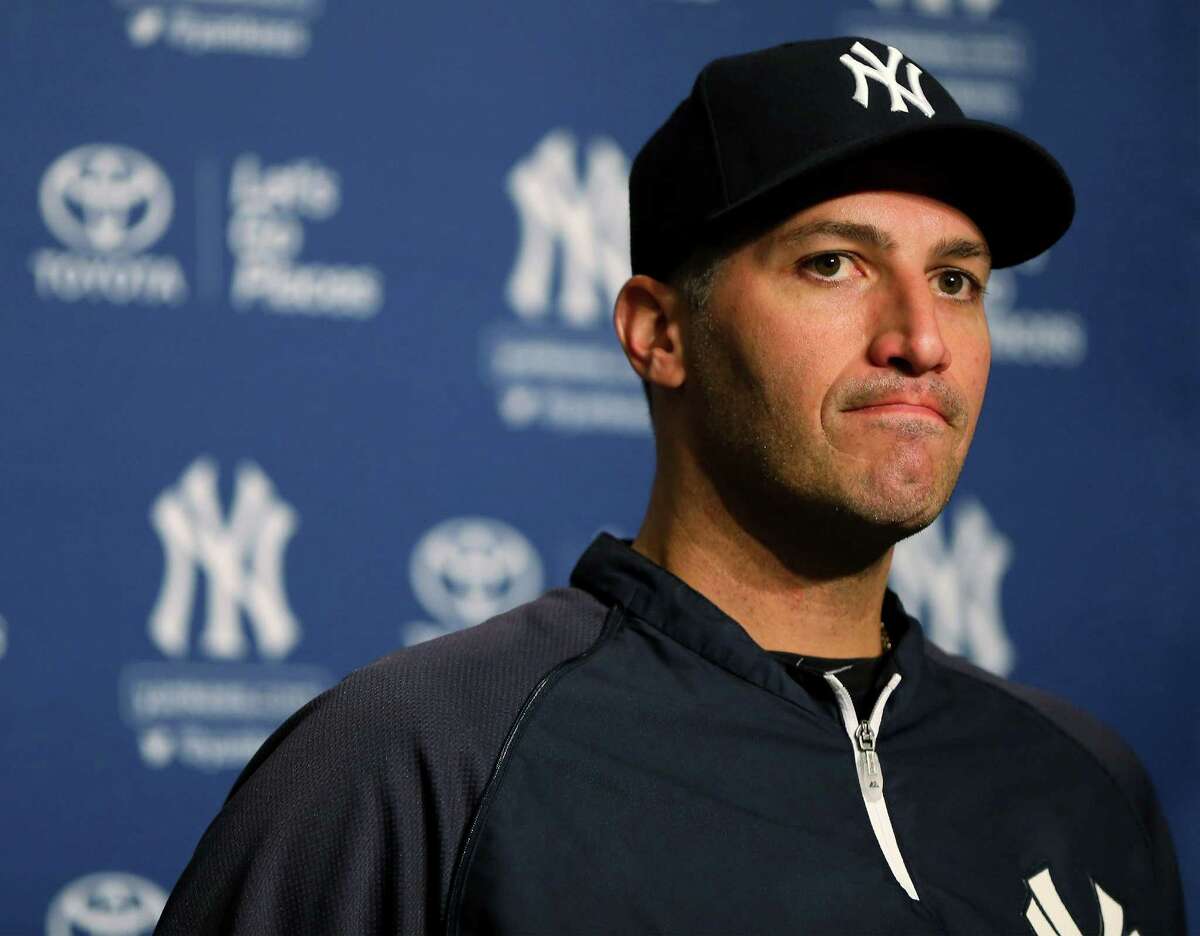

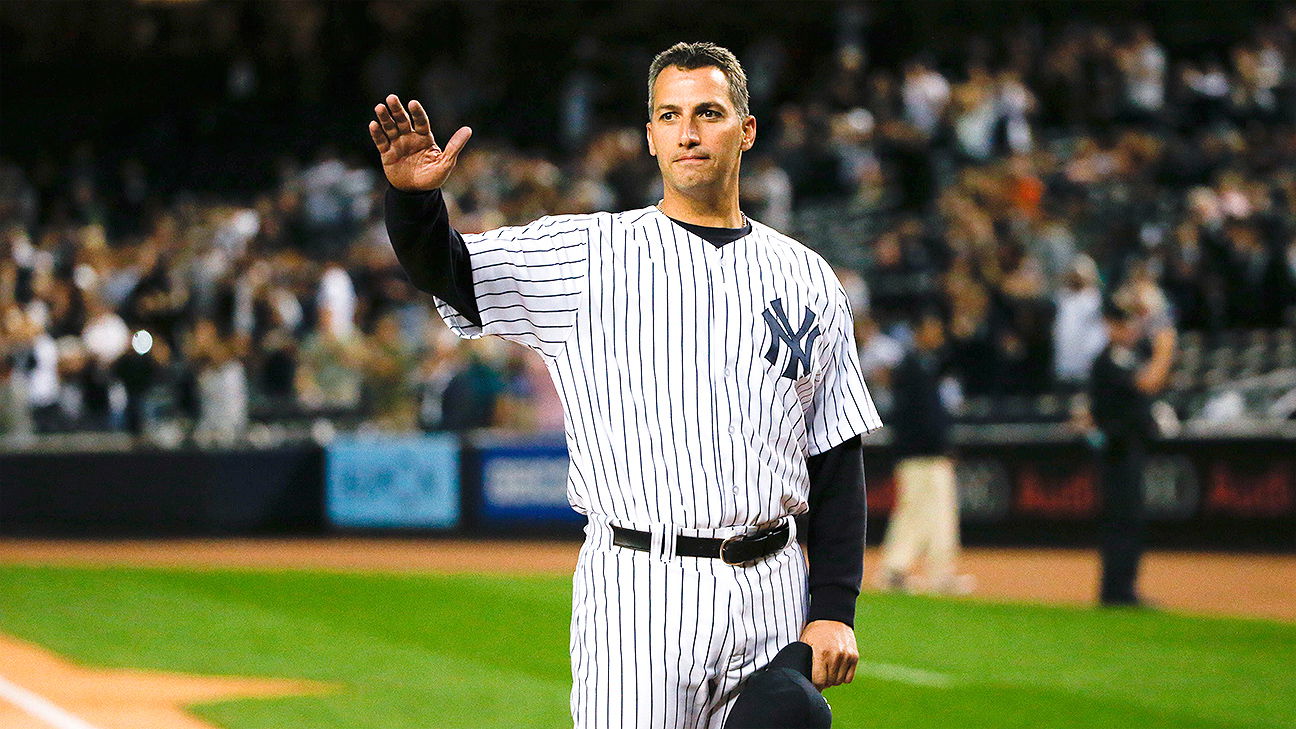

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025

Andy Pettittes Gem Recalling The 2000 Yankees Victory Over The Twins

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025

Early Bats And Rodons Pitching Secure Yankees Victory

Apr 28, 2025 -

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025

Yankees Rally Past Astros Rodon Leads The Charge

Apr 28, 2025