Musk's X Debt Sale: New Financials Reveal A Transforming Company

Table of Contents

The Details of the X Debt Sale

The Amount and Terms

The exact figures surrounding X's debt sale remain partially undisclosed, shrouded in the typical secrecy surrounding such large-scale financial transactions. However, reports suggest a substantial amount was raised, potentially in the billions of dollars. The terms of the debt, including interest rates, maturity dates, and lender identities, are crucial factors in understanding the long-term financial health of X Corp. The interest rates likely reflect the perceived risk associated with lending to X, a company undergoing significant restructuring and facing economic headwinds.

- Specific figures: While precise figures are unavailable publicly, analysts suggest the debt sale involved billions of dollars.

- Notable investors/lenders: Information regarding specific lenders is limited, suggesting a mix of traditional banks and potentially private equity firms.

- Interest rates: The interest rates are likely higher than those offered to more stable companies, reflecting the inherent risk involved in lending to a company undergoing such a drastic transformation.

- Debt servicing impact: The substantial interest payments associated with this debt will significantly impact X's future profitability, placing pressure on the company to generate sufficient revenue to meet its obligations.

The Purpose of the Debt

The rationale behind X's significant debt undertaking remains a subject of much speculation. While official statements remain vague, several factors likely contributed to the decision. It's highly probable that the funds are earmarked for several key areas: paying down existing debt, financing ambitious new product development, covering operational expenses, and potentially even facilitating further acquisitions.

- Official statements: While limited official statements directly address the debt's purpose, Musk's public statements about X's future direction hint at potential uses for the funds.

- Current/future projects: The debt could fund the development of X's payment processing system, expansion into new markets (especially within the advertising sector), and investment in artificial intelligence, aligning with Musk's expressed long-term vision.

- Strategic implications: This debt financing demonstrates a willingness to take on significant risk to fuel aggressive growth and achieve ambitious goals, a strategy typical of Musk’s leadership style.

Impact on X's Financial Performance

Revenue and Profitability

Analyzing X's most recent financial reports is crucial to understanding the impact of the debt sale. Initial reports suggest challenges in profitability, compounded by the increased debt burden. Maintaining positive revenue growth and controlling operational costs are critical for X to successfully manage its debt obligations.

- Key financial metrics: Revenue figures, operating expenses, profit margins, and subscriber numbers are all vital indicators of X's financial performance. Year-over-year comparisons are essential to gauge the trend.

- Year-over-year comparisons: Comparing financial data from before and after the debt sale will highlight the true impact of this financial strategy.

- Impact of debt on operating costs: Servicing the debt adds substantial operating costs, placing further pressure on profitability.

- Future profitability: Future profitability depends heavily on X's ability to generate increased revenue and control expenses while handling its debt obligations effectively.

Debt-to-Equity Ratio and Financial Health

The debt sale undeniably increases X's debt-to-equity ratio, a key metric indicating financial health. A higher ratio implies increased financial risk. Careful analysis of this ratio, compared to industry benchmarks, offers insights into the long-term financial sustainability of X.

- Debt-to-equity ratio analysis: Comparing the ratio before and after the debt sale offers a clear picture of the impact on X's financial risk.

- Industry benchmarks: Comparing X's debt-to-equity ratio with similar tech companies provides a valuable benchmark for assessing its risk profile.

- Expert opinions: Analyzing the opinions of financial analysts and experts offers a broader perspective on X's long-term financial prospects.

Musk's Vision and X's Transformation

Strategic Goals

Musk's vision for X extends far beyond its current iteration as a social media platform. The debt financing appears aligned with his broader goals, which could involve significant technological advancements, integrating diverse services, and potentially disrupting existing markets. This debt sale is a crucial step towards achieving his ambitious vision.

- Musk's publicly stated goals: Musk's public statements concerning the future of X provide clues to his overall strategy.

- Capital allocation strategy: The raised capital likely supports investments in artificial intelligence, development of its payment system, and expansion into new markets.

Long-Term Implications

The long-term implications of this debt sale are multifaceted and uncertain. While it fuels ambitious projects, it also introduces substantial financial risk. X's success hinges on its ability to generate sufficient revenue to meet its debt obligations and realize its strategic goals.

- Future scenarios: Analyzing various possible scenarios, including potential success and challenges, helps to assess the overall risk profile.

- Competitive landscape: The competitive landscape of the tech industry, particularly in social media and financial technology, is extremely dynamic. X needs to maintain a strong competitive edge.

- Future valuation: The long-term impact of the debt sale on X's future valuation is difficult to predict but depends greatly on its success in achieving its strategic goals and maintaining financial stability.

Conclusion

Musk's X debt sale represents a significant gamble with substantial implications for the company's future. The massive debt injection, while providing necessary capital for ambitious expansion plans, also increases X's financial risk. The success of this strategy depends heavily on X's ability to generate substantial revenue growth to offset the substantial interest payments and realize the ambitious goals outlined by Musk. Careful monitoring of X's financial performance and strategic execution will be crucial in evaluating the long-term impact of this bold financial maneuver.

Call to Action: Stay informed about the ongoing transformation of X by following our updates on Musk's X and its financial performance. Continue to monitor the evolving financial landscape of X Corp and its impact on the tech industry. Learn more about the intricacies of Musk's X debt sale and its implications for the future of the company.

Featured Posts

-

Driving The Florida Keys From Key Largo To Key West

Apr 28, 2025

Driving The Florida Keys From Key Largo To Key West

Apr 28, 2025 -

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 28, 2025

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 28, 2025 -

Real Time Economic Analysis The Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Real Time Economic Analysis The Impact Of A Canadian Travel Boycott On The Us

Apr 28, 2025 -

Boston Red Sox Doubleheader Coras Game 1 Lineup Changes

Apr 28, 2025

Boston Red Sox Doubleheader Coras Game 1 Lineup Changes

Apr 28, 2025 -

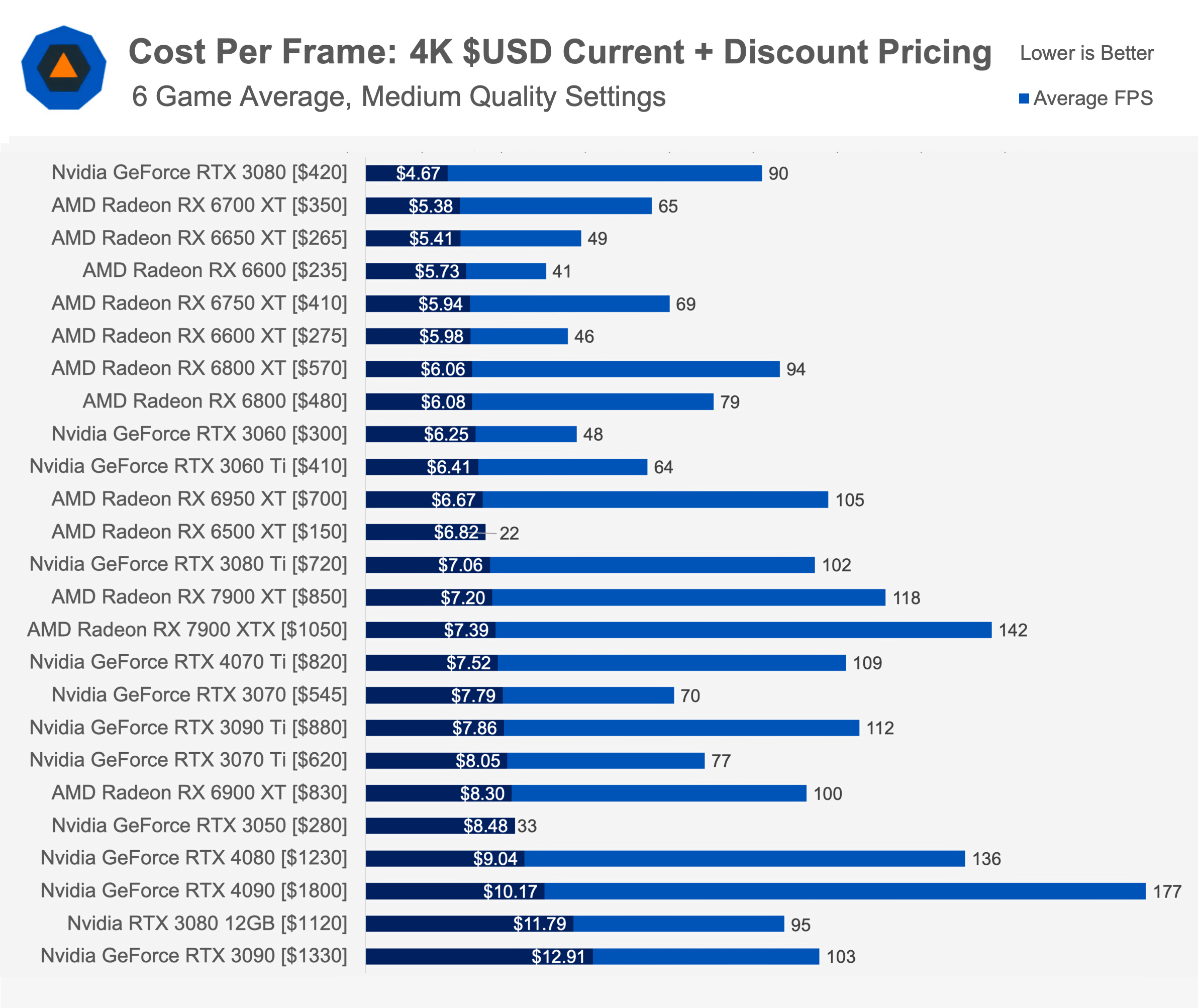

The Current State Of Gpu Pricing

Apr 28, 2025

The Current State Of Gpu Pricing

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

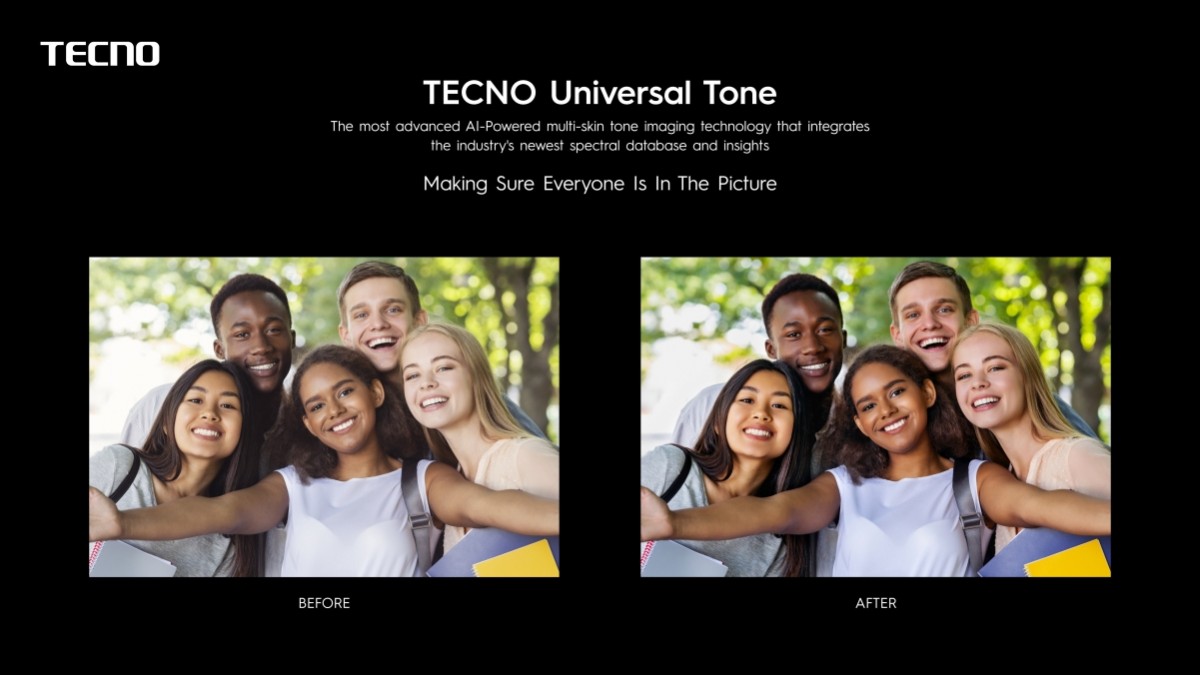

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025