BofA On Stock Market Valuations: Why Investors Shouldn't Worry

Table of Contents

BofA's Bullish Stance on Stock Market Valuations

Bank of America maintains a surprisingly bullish stance on current stock market valuations. Their analysis suggests that while valuations might appear high on the surface, a deeper dive reveals a more nuanced picture, justifying current market prices. Their positive outlook is supported by several key metrics:

- Price-to-Earnings (P/E) Ratios: BofA's analysts point to forward P/E ratios, which consider projected future earnings, rather than just past performance. These forward-looking metrics paint a more optimistic picture than trailing P/E ratios alone.

- Sector-Specific Analysis: The report highlights specific sectors, such as technology and healthcare, which BofA believes are currently undervalued, offering potentially attractive investment opportunities. They emphasize the growth potential within these sectors, counterbalancing concerns about overall market valuation.

- Dividend Yields: BofA also considers dividend yields as a crucial factor in their valuation assessment. They highlight companies with strong dividend payouts as potentially resilient investments in a volatile market. This provides a layer of stability for investors seeking income alongside capital appreciation.

- Data and Charts: BofA's report utilizes extensive data and clear charts to illustrate their findings, making the analysis readily accessible and transparent. This data-driven approach strengthens the credibility of their bullish assessment.

Addressing Concerns About High Inflation and Interest Rates

The elephant in the room is the impact of high inflation and rising interest rates on stock valuations. Many investors fear that these factors will stifle corporate earnings and lead to a market downturn. However, BofA counters these concerns with several key arguments:

- Priced-In Expectations: BofA argues that the market has already largely priced in the expected impact of inflation and interest rate hikes. Current valuations, therefore, already reflect these risks to a significant extent.

- Manageable Inflation: While acknowledging inflation's impact, BofA suggests that the current inflationary pressures may be more manageable than widely feared. They cite potential factors like easing supply chain disruptions and moderating demand.

- Strategic Portfolio Management: BofA recommends diversification as a crucial strategy for navigating this challenging environment. They suggest spreading investments across various sectors and asset classes to mitigate risk. A long-term investment horizon is also key, advising investors to avoid impulsive reactions to short-term market fluctuations.

- Economic Forecasts: The BofA report incorporates detailed economic forecasts, supporting their assertions about the manageable nature of inflationary pressures and interest rate increases. This rigorous approach provides a solid foundation for their conclusions.

The Role of Corporate Earnings in Justifying Current Valuations

BofA's bullish stance is significantly bolstered by strong corporate earnings and positive future earnings projections. They present compelling evidence supporting their view that robust earnings growth justifies current market prices, despite concerns over valuations:

- Robust Earnings Growth: The report cites specific examples of companies demonstrating impressive earnings growth, showcasing the resilience of the corporate sector.

- Positive Earnings Projections: BofA's analysts project continued earnings growth across various sectors, reinforcing their optimistic outlook. These projections are carefully considered and supported by detailed analysis.

- Earnings Justification: The combination of strong current earnings and positive future projections directly supports their argument that current market prices are not necessarily overvalued. They effectively bridge the gap between valuation concerns and positive financial performance.

Long-Term Investment Strategies and BofA's Recommendations

Based on their thorough valuation analysis, BofA offers several key recommendations for investors:

- Sector Allocation: They advise investors to consider strategic sector allocation, focusing on sectors with strong growth potential, as identified in their report.

- Stock Picking: BofA suggests a careful approach to stock picking, prioritizing companies with strong fundamentals and resilient business models.

- Long-Term Perspective: Above all, BofA strongly emphasizes the importance of maintaining a long-term investment horizon. They caution against reacting to short-term market fluctuations, advocating for patience and a disciplined approach.

- Reiterating the Message: BofA consistently reiterates that the current market valuations, while perhaps appearing high at first glance, are not necessarily a cause for alarm when considering the overall economic landscape and corporate performance.

Conclusion

In conclusion, BofA's assessment of stock market valuations offers a reassuring counterpoint to prevailing anxieties. Their positive outlook is supported by their analysis of forward-looking P/E ratios, sector-specific assessments, strong corporate earnings, and positive future projections. They effectively address concerns about inflation and rising interest rates, suggesting these factors are largely priced in or are manageable. By emphasizing long-term investment strategies and diversification, BofA provides a valuable framework for investors navigating current market conditions. Don't let concerns about BofA stock market valuations deter you from a sound investment strategy; consider their analysis and maintain a long-term perspective. Learn more about BofA's analysis of stock market valuations and make informed decisions by visiting [link to BofA research].

Featured Posts

-

The Untapped Value Of Middle Managers Benefits For Companies And Employees

Apr 24, 2025

The Untapped Value Of Middle Managers Benefits For Companies And Employees

Apr 24, 2025 -

Bof A On Stock Market Valuations Why Investors Shouldnt Worry

Apr 24, 2025

Bof A On Stock Market Valuations Why Investors Shouldnt Worry

Apr 24, 2025 -

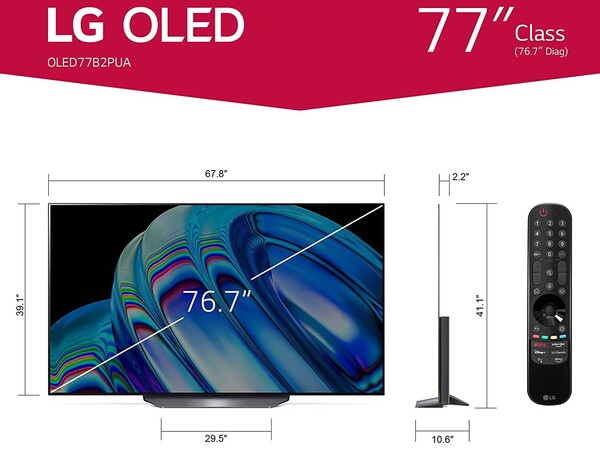

Living With A 77 Inch Lg C3 Oled My Honest Review

Apr 24, 2025

Living With A 77 Inch Lg C3 Oled My Honest Review

Apr 24, 2025 -

How Elite Universities Are Responding To Funding Threats From The Trump Administration

Apr 24, 2025

How Elite Universities Are Responding To Funding Threats From The Trump Administration

Apr 24, 2025 -

Dow Jones S And P 500 And Nasdaq Stock Market Analysis For April 23rd

Apr 24, 2025

Dow Jones S And P 500 And Nasdaq Stock Market Analysis For April 23rd

Apr 24, 2025