BOE Should Temper Future QE With Smaller-Scale Interventions: Greene's Proposal

Table of Contents

The Risks Associated with Large-Scale QE

Large-scale QE programs, while effective in stimulating economies in the short-term, carry considerable risks. The sheer scale of these interventions can lead to unintended consequences, undermining the long-term stability of financial markets and the broader economy.

Inflationary Pressures

Large injections of liquidity into the financial system through QE can fuel inflationary pressures. This occurs through several channels:

- Asset Bubbles: QE can inflate asset prices (e.g., stocks, bonds, real estate), creating bubbles that are prone to bursting, causing significant economic disruption.

- Increased Consumer Spending: Increased money supply can lead to higher consumer spending, pushing up demand and contributing to inflation if supply cannot keep pace.

- Erosion of Price Stability: Sustained inflation erodes the purchasing power of consumers and can destabilize the economy, making future economic planning difficult.

For instance, some economists argue that previous rounds of QE contributed to rising inflation in certain sectors. Careful monitoring of inflation metrics is crucial to avoid these negative consequences.

Market Distortion

Substantial QE interventions can distort financial markets, leading to unintended consequences:

- Suppressed Bond Yields: The BOE's purchases of government bonds can artificially suppress yields, potentially hindering the effectiveness of interest rate adjustments as a monetary policy tool.

- Inflated Equity Valuations: QE can inflate equity valuations, creating a disconnect between asset prices and underlying economic fundamentals.

- Misallocation of Capital: Distorted market signals can lead to misallocation of capital, hindering efficient resource allocation and long-term economic growth. Examples from past QE programs illustrate how these distortions can unfold.

Reduced Effectiveness Over Time

The effectiveness of QE diminishes with repeated large-scale interventions. This is due to:

- Market Saturation: Repeated large-scale purchases can lead to market saturation, reducing the impact of further injections of liquidity.

- Need for Alternative Tools: The diminishing returns of QE highlight the need for the BOE to explore and utilize alternative monetary policy tools to achieve its objectives.

Greene's Proposal for Smaller-Scale Interventions

Greene's proposal offers a compelling alternative: smaller-scale, targeted QE interventions. This approach aims to address the shortcomings of large-scale programs while retaining the benefits of monetary stimulus.

Targeted QE

Greene suggests focusing QE on specific sectors or needs, rather than broad-based injections of liquidity:

- Supporting Specific Industries: Targeted QE could support struggling industries or sectors vital to the economy, such as renewable energy or infrastructure development.

- Addressing Specific Economic Needs: Smaller-scale interventions could be used to address temporary economic shocks or regional imbalances more effectively.

- Reduced Inflation Risk: By directing liquidity to specific areas, the risk of broad-based inflation is significantly reduced.

Increased Flexibility and Responsiveness

Smaller-scale interventions allow the BOE to react more swiftly to changing economic conditions:

- Adaptability to Economic Shocks: The BOE can adjust its monetary policy more rapidly in response to unexpected economic events.

- Agility in Policy Implementation: Smaller programs are easier to implement and adjust, making monetary policy more agile.

Enhanced Transparency and Accountability

Smaller, more focused QE programs can improve transparency and accountability:

- Easier Public Understanding: The impact and purpose of smaller interventions are simpler to explain to the public.

- Increased Public Trust: Greater transparency can lead to increased public trust in the BOE's monetary policy decisions.

Alternative Monetary Policy Tools

While smaller-scale QE offers advantages, it shouldn't be the sole tool in the BOE's arsenal. Alternative tools can complement this approach:

Interest Rate Adjustments

Adjusting interest rates remains a fundamental tool for managing inflation and economic growth:

- Advantages: Interest rate adjustments directly affect borrowing costs, influencing investment and consumer spending.

- Limitations: Interest rate changes can take time to fully impact the economy.

Forward Guidance

Clear communication and forward guidance play a crucial role in managing market expectations:

- Managing Market Expectations: Open communication about future monetary policy can help stabilize financial markets and reduce uncertainty.

- Importance of Clear Communication: Consistent and transparent communication from the BOE is vital to building public confidence.

Conclusion: The Case for Tempering Future QE

The risks associated with large-scale QE, including inflationary pressures, market distortions, and diminishing returns, necessitate a shift towards a more targeted and flexible approach. Greene's proposal for smaller-scale interventions offers a compelling solution, promoting greater flexibility, responsiveness, and transparency. By combining smaller-scale QE with other monetary policy tools like interest rate adjustments and effective forward guidance, the BOE can foster a more stable and sustainable economic environment. Understand the implications of smaller-scale interventions and join the conversation on the future of BOE's QE strategy. [Link to relevant resources]

Featured Posts

-

The Biotech Industry Under Trumps Fda A Positive Outlook

Apr 23, 2025

The Biotech Industry Under Trumps Fda A Positive Outlook

Apr 23, 2025 -

Istanbul Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025

Istanbul Iftar Sahur Vakitleri 3 Mart 2024 Pazartesi

Apr 23, 2025 -

Another 1 0 Defeat Reds Tie All Time Mlb Record For Consecutive Losses

Apr 23, 2025

Another 1 0 Defeat Reds Tie All Time Mlb Record For Consecutive Losses

Apr 23, 2025 -

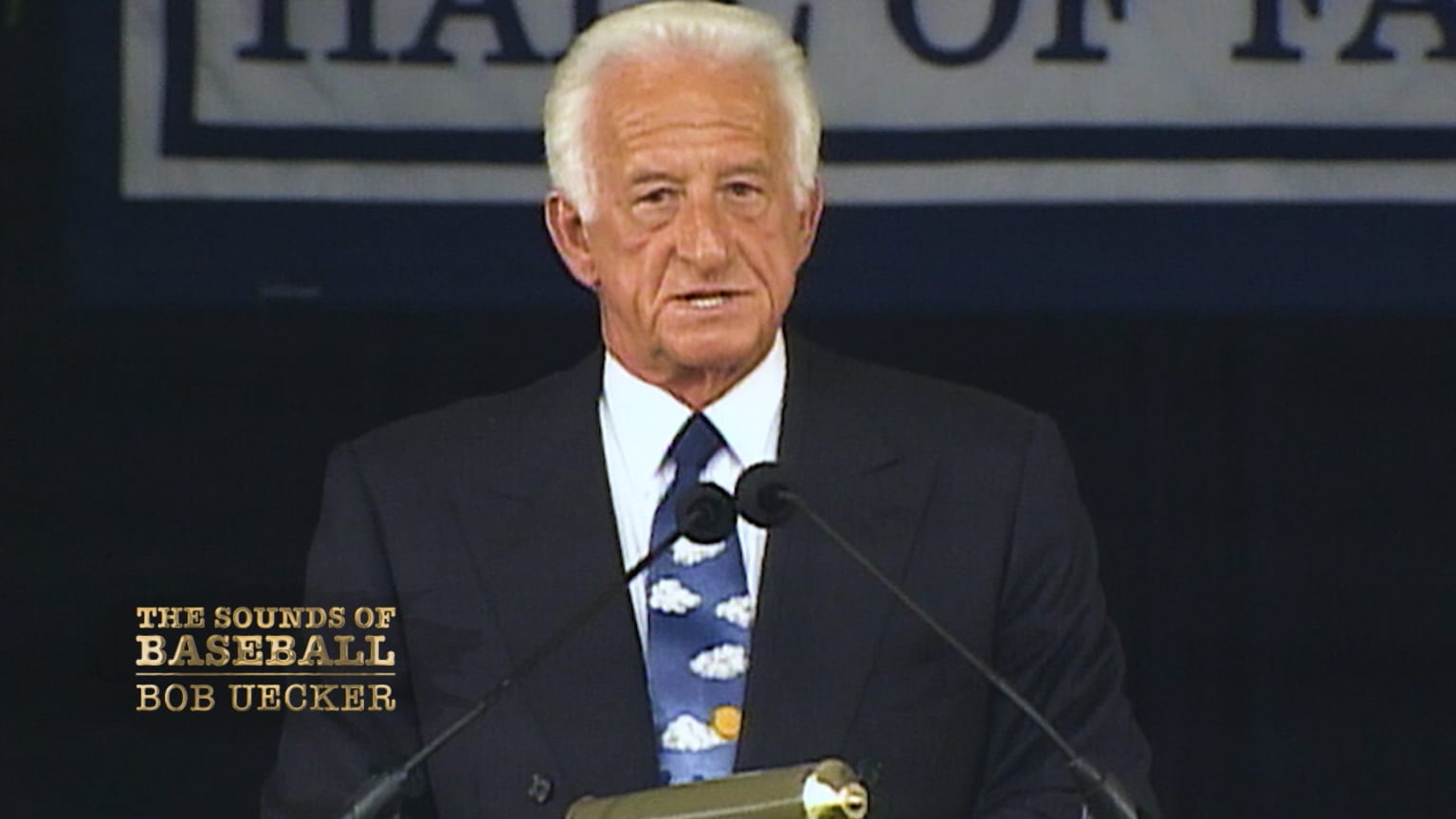

Cory Provus Emotional Tribute To His Mentor Bob Uecker

Apr 23, 2025

Cory Provus Emotional Tribute To His Mentor Bob Uecker

Apr 23, 2025 -

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025

Royals Crush Brewers 11 1 In Home Opener

Apr 23, 2025