BOE Rate Cut Odds Diminish: Pound Gains Momentum Following Inflation Report

Table of Contents

Inflation Report Fuels Pound Sterling Strength

The recently released UK inflation report revealed figures that significantly deviated from market expectations. This unexpected data played a crucial role in altering the perception of the need for a BOE rate cut. The report highlighted a more persistent inflationary pressure than previously anticipated.

- Specific inflation numbers: The Consumer Price Index (CPI) reached X%, exceeding forecasts of Y%. The Retail Price Index (RPI) also showed a similar upward trend.

- Comparison to previous months and forecasts: This represents a Z% increase compared to last month and a significant divergence from the predicted rate of W%.

- Impact on consumer spending and business confidence: The higher-than-expected inflation figures are likely to dampen consumer spending and negatively impact business confidence as rising prices erode purchasing power.

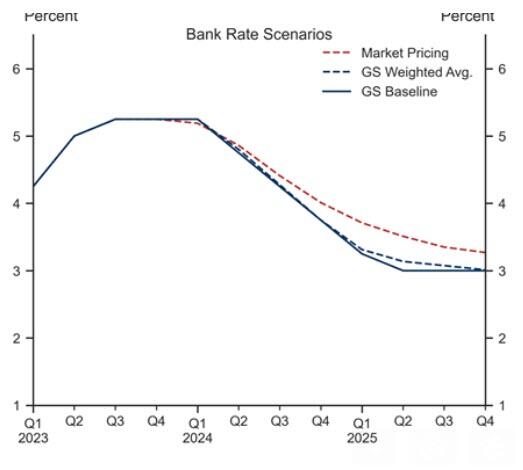

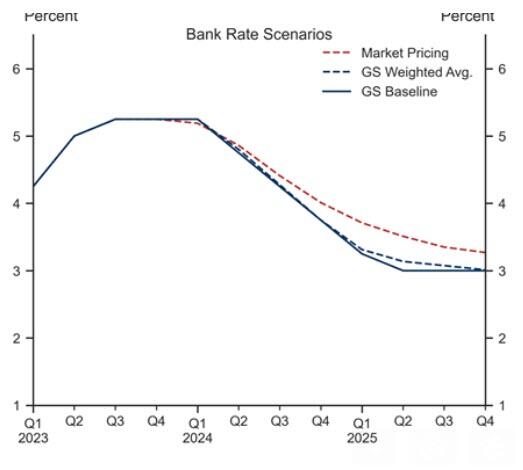

Diminishing Probability of a BOE Rate Cut

The unexpectedly high inflation figures significantly reduce the probability of a BOE rate cut. The BOE's primary mandate is to maintain price stability, and the latest data suggests that this objective is still far from being achieved. Market speculation, which previously favored a rate cut, has now shifted towards expectations of either a maintained rate or even a potential increase.

- Changes in interest rate futures contracts: Interest rate futures contracts, which reflect market expectations, have shown a sharp upward revision since the report's release, indicating a decreased likelihood of a rate cut.

- Analyst predictions and their rationale: Many analysts have revised their predictions, citing the persistent inflationary pressures as the primary reason for their changed outlook on BOE policy.

- Potential economic consequences of maintaining or raising rates: Maintaining or increasing interest rates could potentially curb inflation but might also slow economic growth, increasing unemployment.

Pound Sterling Exchange Rate Fluctuations

The pound sterling has experienced a noticeable strengthening against major currencies following the inflation report. This positive movement is directly linked to the diminished expectations of a BOE rate cut. A rate cut is generally considered negative for a currency's value, as it often signals a weakening economy.

- GBP/USD exchange rate changes: The GBP/USD exchange rate has seen an increase of approximately X% since the report was released.

- GBP/EUR exchange rate changes: Similarly, the GBP/EUR exchange rate has appreciated by Y%, reflecting the positive market sentiment towards the pound.

- Impact on UK exports and imports: A stronger pound makes UK exports more expensive for international buyers and imports cheaper, potentially impacting the UK's trade balance.

Impact on UK Businesses and Consumers

The implications of higher interest rates and a stronger pound are multifaceted, impacting both UK businesses and consumers. Higher interest rates directly translate to increased borrowing costs for businesses, potentially hindering investment and expansion plans. Consumers will also face higher mortgage rates and reduced affordability for housing.

- Impact on mortgage rates and home affordability: Rising interest rates will lead to increased mortgage payments, making homeownership less accessible for many.

- Effects on business investment and expansion: Increased borrowing costs could discourage businesses from undertaking significant investments or expansion projects.

- Changes in consumer confidence and spending habits: Higher prices and reduced affordability could lead to a decrease in consumer confidence and a shift in spending habits.

Conclusion: Understanding the Implications of Reduced BOE Rate Cut Odds

The latest UK inflation report has significantly altered the outlook on BOE monetary policy. The unexpectedly high inflation figures have diminished the odds of a BOE rate cut, leading to a strengthening of the pound sterling. This development carries substantial implications for UK businesses and consumers, impacting borrowing costs, investment decisions, and spending habits. The persistent inflationary pressures highlight the challenges faced by the BOE in balancing price stability with economic growth. To effectively navigate these complex economic shifts, it is crucial to monitor BOE rate cut probabilities and stay updated on pound sterling exchange rates. Learn more about BOE interest rate policy and its potential impact on your financial well-being by regularly checking for updates on BOE rate cuts and pound sterling forecasts. Understanding the intricacies of BOE rate cut decisions is paramount for informed decision-making in today's dynamic market.

Featured Posts

-

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025

Indian Wells 2024 Draper Secures Historic Masters 1000 Victory

May 24, 2025 -

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025 -

A Look At Nicki Chapmans Country Escape In Chiswick

May 24, 2025

A Look At Nicki Chapmans Country Escape In Chiswick

May 24, 2025 -

Analysis Le Pens Support Following Sundays National Rally Demonstration In France

May 24, 2025

Analysis Le Pens Support Following Sundays National Rally Demonstration In France

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Nav Analysis And Investment Implications

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Nav Analysis And Investment Implications

May 24, 2025

Latest Posts

-

Understanding The Mythology Of Dc Legends Of Tomorrow

May 24, 2025

Understanding The Mythology Of Dc Legends Of Tomorrow

May 24, 2025 -

Free Movies And Celebrity Appearances The Usa Film Festival In Dallas

May 24, 2025

Free Movies And Celebrity Appearances The Usa Film Festival In Dallas

May 24, 2025 -

Dc Legends Of Tomorrow A Review Of The Series Best And Worst Episodes

May 24, 2025

Dc Legends Of Tomorrow A Review Of The Series Best And Worst Episodes

May 24, 2025 -

Usa Film Festival Brings Free Films And Celebrities To Dallas

May 24, 2025

Usa Film Festival Brings Free Films And Celebrities To Dallas

May 24, 2025 -

Dc Legends Of Tomorrow Character Profiles And Abilities

May 24, 2025

Dc Legends Of Tomorrow Character Profiles And Abilities

May 24, 2025