BlackRock ETF: A Billionaire Bet Poised For Massive Growth In 2025?

Table of Contents

BlackRock, a global leader in investment management, offers a vast array of ETFs providing investors with diversified exposure to various asset classes. ETFs, essentially baskets of securities trading on exchanges like stocks, offer a convenient and cost-effective way to invest in diversified portfolios. This article will explore the reasons why BlackRock ETFs are positioned for significant growth in 2025, attracting even the shrewdest billionaire investors.

BlackRock's Dominance in the ETF Market

BlackRock's dominance in the ETF market is undeniable. They boast a staggering market share, significantly outpacing their competitors. This leadership position isn't accidental; it's a result of years of strategic growth, innovation, and a strong brand reputation.

- Market Capitalization: BlackRock's ETF offerings represent a massive market capitalization, dwarfing many of its competitors. (Note: Specific figures would require up-to-date market data).

- Number of ETFs: BlackRock manages hundreds of ETFs, covering a broad spectrum of asset classes, sectors, and investment strategies. This wide selection caters to diverse investor needs and risk tolerances.

- Comparison to Competitors: Compared to rivals like Vanguard and State Street Global Advisors, BlackRock consistently maintains a leading position in terms of assets under management (AUM) and market share within the ETF landscape.

BlackRock's success is fueled by several key factors: its established brand recognition, its diverse range of products catering to various investment styles (including sustainable investing and thematic ETFs), and continuous technological advancements in portfolio management and trading.

Analyzing the Potential for Massive Growth in 2025

The future looks bright for the ETF market, and BlackRock is well-positioned to capitalize on this growth. Several factors suggest a significant expansion of BlackRock ETF assets under management by 2025.

- Projected ETF Market Growth: Industry analysts predict substantial growth in the overall ETF market in the coming years. (Note: Include relevant statistics from reputable sources).

- High-Growth Sectors: Specific BlackRock ETFs focusing on technology, sustainable investing, and emerging markets are expected to experience particularly strong growth. The increasing adoption of ESG (environmental, social, and governance) investing is likely to further boost demand for BlackRock's sustainable ETFs.

- Regulatory Changes: Favorable regulatory changes or a stable regulatory environment could further propel ETF adoption and, consequently, BlackRock's market share.

However, a balanced perspective is crucial. Potential risks include market volatility, geopolitical uncertainty, and shifts in investor sentiment. While the outlook is positive, investment in BlackRock ETFs, like any investment, carries inherent risks.

Billionaire Investment Strategies and BlackRock ETFs

The investment choices of prominent billionaires often serve as a benchmark for market trends. Many high-net-worth individuals are incorporating BlackRock ETFs into their diversified portfolios. Why?

- Diversification: BlackRock ETFs allow for easy diversification across various asset classes and geographies, mitigating risk.

- Low Fees: Compared to actively managed funds, BlackRock ETFs generally offer lower expense ratios, enhancing returns.

- Accessibility: ETFs are easily accessible through most brokerage accounts, making them a convenient investment option for both individual and institutional investors.

(Note: Ideally, this section would include specific examples of billionaires known to hold BlackRock ETFs and the types of ETFs they favor. However, this information is often private). The correlation between billionaire investment in specific BlackRock ETFs and subsequent ETF performance should be analyzed cautiously, as past performance is not indicative of future results.

Investing in BlackRock ETFs: A Practical Guide

Investing in BlackRock ETFs is relatively straightforward. However, a well-defined strategy is crucial.

- Opening a Brokerage Account: Begin by opening an online brokerage account with a reputable firm.

- Choosing ETFs: Carefully research different BlackRock ETFs to find those aligning with your investment goals and risk tolerance. Consider factors such as expense ratios, historical performance, and asset allocation.

- Diversification: Diversify your portfolio by investing in a range of BlackRock ETFs across different sectors and asset classes.

- Risk Management: Assess your risk tolerance and adjust your investment strategy accordingly.

Disclaimer: Investing in ETFs involves inherent risks, including the potential loss of principal. Consult with a qualified financial advisor before making any investment decisions.

Conclusion: BlackRock ETF: A Smart Investment for the Future?

BlackRock's dominance in the ETF market, combined with predicted market trends and the growing interest from billionaire investors, strongly suggests a promising future for BlackRock ETFs. Their accessibility, diversification benefits, and generally low expense ratios make them an attractive option for both individual and institutional investors. Learn more about BlackRock ETFs today and consider incorporating them into a well-diversified investment portfolio. Invest in BlackRock ETFs to potentially capitalize on their projected growth in the ever-evolving financial landscape. The long-term potential of BlackRock ETFs in a dynamic global market presents a compelling investment opportunity for those with a long-term perspective.

Featured Posts

-

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 09, 2025

Elon Musks Space X Stake Surges Now Worth 43 B More Than Tesla Holdings

May 09, 2025 -

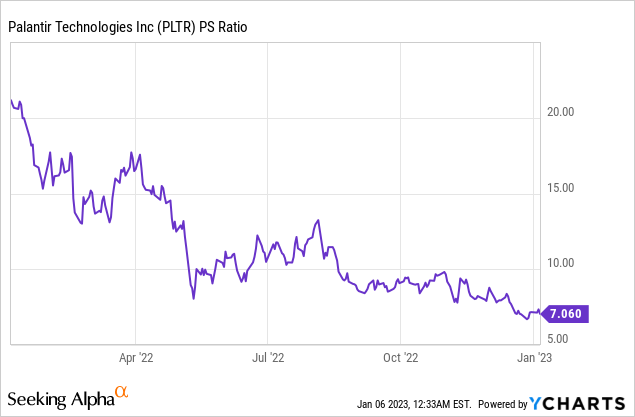

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 09, 2025

Can Palantir Hit A Trillion Dollar Valuation By 2030

May 09, 2025 -

Uy Scuti Release Date Teased By Young Thug

May 09, 2025

Uy Scuti Release Date Teased By Young Thug

May 09, 2025 -

Is Daycare Right For Your Child A Balanced Look At The Challenges

May 09, 2025

Is Daycare Right For Your Child A Balanced Look At The Challenges

May 09, 2025 -

Racial Hate Crime Womans Unprovoked Attack Leaves Man Dead

May 09, 2025

Racial Hate Crime Womans Unprovoked Attack Leaves Man Dead

May 09, 2025