Can Palantir Hit A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Current Market Position and Growth Trajectory

Analyzing Palantir's potential requires a close look at its current financial health and market standing. While Palantir has demonstrated impressive revenue growth, profitability remains a key area of focus for investors. Examining key financial metrics like revenue, operating margins, and net income reveals a company striving for consistent profitability amidst significant investments in research and development.

- Key financial metrics and their trends: Review Palantir's quarterly and annual reports to track revenue growth, profit margins, and operating expenses. Analyze trends to identify patterns and project future performance.

- Market share comparisons with competitors: Palantir competes with other big data analytics companies like Databricks, Snowflake, and Amazon Web Services. Assessing its market share in both government and commercial sectors provides context for its growth potential. A competitive landscape analysis is crucial.

- Projected revenue growth for the next decade: Based on historical growth rates and industry forecasts, projecting Palantir's revenue over the next decade is vital to assessing the trillion-dollar valuation possibility. Conservative and optimistic scenarios should be considered.

- Risks and challenges to growth: Factors like increased competition, economic downturns, and potential shifts in government spending could significantly impact Palantir's growth. Identifying and assessing these risks is paramount.

Key Factors Contributing to (or Hindering) a Trillion-Dollar Valuation

Several key factors will determine whether Palantir can achieve this ambitious goal. These factors need to be analyzed carefully to understand their potential impact.

Innovation and Technological Leadership

Palantir's continued success hinges on its ability to innovate and maintain a technological edge in the rapidly evolving big data analytics market. Its investment in research and development is crucial to this.

- Specific examples of Palantir's innovations: Analyzing past innovations and assessing the pipeline of future technologies will illuminate Palantir's capacity for technological leadership. This includes advancements in artificial intelligence (AI), machine learning (ML), and data visualization.

Government Contracts and Expansion into Commercial Markets

Government contracts have historically been a major revenue source for Palantir. However, diversifying into the commercial market is critical for sustained, exponential growth.

- Analysis of government spending trends: Understanding the future trajectory of government spending on data analytics is crucial. Any decrease could significantly affect Palantir's revenue.

- Expansion into commercial sectors: Palantir's success in penetrating commercial markets will significantly impact its valuation potential. Analyzing its progress and strategies in this area is essential.

Competition and Market Saturation

The big data analytics market is highly competitive. Understanding the competitive landscape and the potential for market saturation is crucial for a realistic valuation assessment.

- Profiles of key competitors and their strengths/weaknesses: Analyzing competitors like Databricks, Snowflake, and AWS is crucial to understanding Palantir's competitive position. Identifying their strengths and weaknesses offers a clear view of the challenges ahead.

Economic and Geopolitical Factors

Global economic conditions and geopolitical events can significantly impact Palantir's growth prospects. These external factors must be considered.

- Potential risks from economic downturns or geopolitical instability: Recessions and geopolitical instability can severely impact government and commercial spending on data analytics, directly affecting Palantir's revenue streams.

Valuation Analysis and Financial Modeling

To assess the feasibility of a trillion-dollar valuation, we need robust financial modeling. This involves using various valuation methods and projecting Palantir's future financial performance.

- Key assumptions underlying the financial model: Assumptions about revenue growth, profit margins, and capital expenditures are vital for creating a realistic model. Transparency in these assumptions is crucial.

- Sensitivity analysis showing the impact of different growth rates: Testing the model's sensitivity to varying growth rates helps understand the impact of different scenarios on the final valuation.

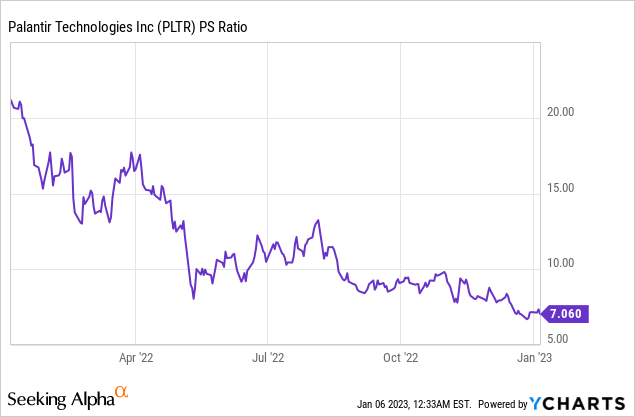

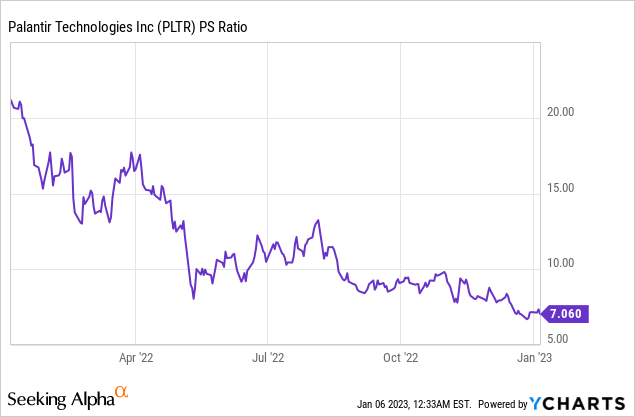

- Comparison of Palantir's valuation to comparable companies: Comparing Palantir's valuation multiples (e.g., Price-to-Sales ratio) to those of similar companies in the data analytics space provides valuable context.

Conclusion: The Likelihood of Palantir Reaching a Trillion-Dollar Valuation by 2030

Reaching a trillion-dollar valuation by 2030 presents a significant challenge for Palantir. While the company possesses strong technological capabilities and a foothold in lucrative markets, several factors could hinder its progress. Sustained high revenue growth, increased profitability, successful expansion into the commercial sector, and navigating the competitive landscape are all crucial. Geopolitical and economic stability will also play a role. A balanced perspective suggests that while a trillion-dollar valuation is possible, it’s far from guaranteed. The path to achieving such a milestone requires continued innovation, strategic execution, and favorable market conditions. Further research into Palantir's financial performance, technological advancements, and competitive landscape is essential to forming a well-informed opinion on its future valuation and its trillion-dollar potential. Continue following Palantir's progress to stay informed about its journey towards this ambitious goal.

Featured Posts

-

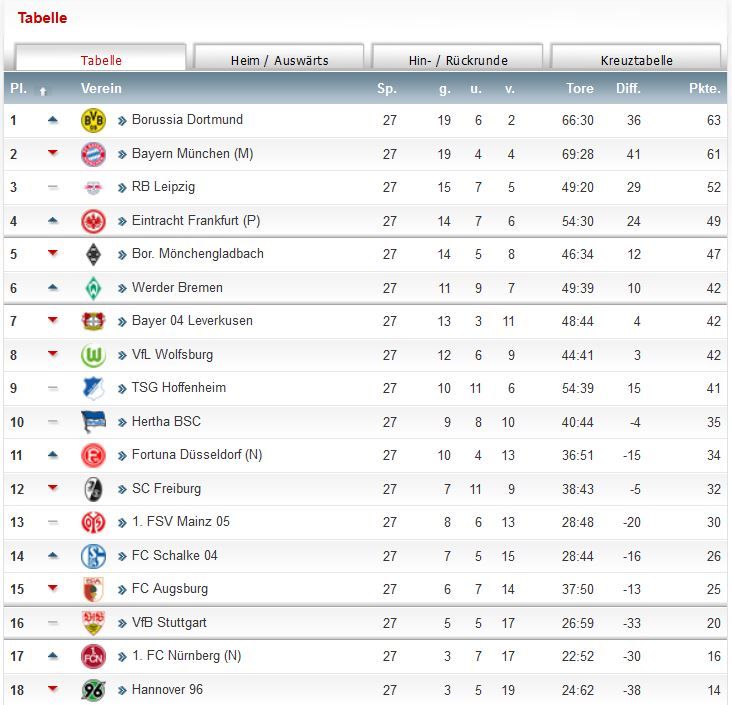

Bundesliga Spieltag 27 Koeln Neuer Tabellenfuehrer

May 09, 2025

Bundesliga Spieltag 27 Koeln Neuer Tabellenfuehrer

May 09, 2025 -

West Bengal Madhyamik Exam Result 2025 Merit List And Analysis

May 09, 2025

West Bengal Madhyamik Exam Result 2025 Merit List And Analysis

May 09, 2025 -

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025

Sudden Shift White House Withdraws Nomination Chooses Maha Influencer For Surgeon General

May 09, 2025 -

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Netiketa Istorija

May 09, 2025

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Netiketa Istorija

May 09, 2025 -

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025

U S Fed Holds Rates Amid Inflation And Unemployment Concerns

May 09, 2025