Bitcoin's Surge: US-China Trade Talks Fuel Crypto Rally

Table of Contents

The Impact of US-China Trade Uncertainty on Bitcoin

The volatile nature of US-China trade relations has created a climate of uncertainty that significantly impacts global markets. This uncertainty is a major driver behind the current Bitcoin surge.

Safe Haven Asset Narrative

Many investors view Bitcoin as a safe haven asset, similar to gold, during times of economic and geopolitical instability.

- Increased uncertainty in traditional markets, fueled by trade war anxieties, pushes investors towards alternative assets like Bitcoin. The unpredictability of stock and bond markets makes them less appealing during times of heightened risk.

- Bitcoin's decentralized nature makes it less susceptible to government intervention compared to fiat currencies. This perceived independence from geopolitical pressures is a key attraction for investors seeking to hedge against risks associated with trade disputes.

- Historically, we've seen a correlation between major geopolitical events and Bitcoin price movements. Periods of global uncertainty often lead to increased demand for Bitcoin, as investors seek to preserve capital and diversify their portfolios.

Flight to Safety Capital Flows

Trade war anxieties often trigger a "flight to safety," where capital flows away from traditional markets (stocks, bonds) seeking refuge in assets perceived as safer. Bitcoin frequently benefits from this phenomenon.

- Investors diversify their portfolios to mitigate risks associated with trade tensions. Bitcoin, with its inherent volatility, offers a way to potentially offset losses in more traditional assets.

- Previous instances of geopolitical instability, such as the 2018-2019 trade war escalations, saw similar increases in Bitcoin prices as investors sought safer alternatives to traditional investment vehicles.

- Data from various cryptocurrency exchanges show a clear increase in capital flows into crypto markets during periods of heightened trade uncertainty, directly supporting the argument that trade wars are a significant driver of Bitcoin price increases.

The Role of Regulatory Developments in the Bitcoin Surge

Regulatory clarity and developments, both positive and negative, significantly influence investor sentiment and consequently the price of Bitcoin.

Positive Regulatory Signals

Positive regulatory developments, even outside the US and China, can bolster investor confidence and contribute to a Bitcoin surge.

- New regulations providing clarity and legitimacy to the crypto market help reduce uncertainty and attract institutional investors. A clearer regulatory landscape reduces risk for large-scale investors.

- Positive statements from government officials or regulatory bodies regarding cryptocurrency can significantly impact market sentiment, leading to price increases. Words of support from influential figures can dramatically increase confidence.

- This positive regulatory sentiment contributes to investor confidence and drives price increases as more investors see Bitcoin as a less risky investment option.

Contrast with Negative Regulatory News

Conversely, negative regulatory news in other sectors can indirectly benefit Bitcoin. When traditional markets face regulatory crackdowns, investors may seek less-regulated assets.

- Negative regulatory news in traditional financial markets, such as increased banking regulations or stricter controls on investment products, can push investors towards alternative assets like Bitcoin.

- This negative news drives investors towards assets perceived as less regulated, like Bitcoin, fostering a "flight to freedom" alongside the "flight to safety" phenomenon.

Technical Factors Contributing to the Bitcoin Rally

Beyond geopolitical and regulatory influences, technical factors also contribute to Bitcoin's price movements.

Increased Trading Volume and Market Liquidity

A significant increase in Bitcoin trading volume and market liquidity is a key indicator of the current rally.

- Data from major cryptocurrency exchanges reveals a considerable spike in trading volume, demonstrating increased market activity.

- Increased liquidity makes it easier for large investors to enter and exit the market without significantly impacting the price, fostering a more stable, yet volatile environment.

Technical Indicators and Chart Analysis

While a deep dive into technical analysis is beyond the scope of this article, some technical indicators support the upward trend in Bitcoin's price.

- Certain significant chart patterns, such as sustained breakouts above key resistance levels, are indicative of a strong upward trend.

- Positive momentum indicators suggest sustained bullish sentiment within the Bitcoin market.

Conclusion

The recent Bitcoin surge is a multifaceted phenomenon influenced by several interacting factors. The ongoing US-China trade talks and the resulting uncertainty have played a crucial role, driving investors towards Bitcoin as a safe haven asset and fueling a significant crypto rally. Positive regulatory developments, coupled with technical factors such as increased trading volume, have further accelerated this price increase. Understanding the interplay of these elements is crucial for navigating the volatile cryptocurrency market. Stay informed about future developments in US-China trade relations and global regulatory landscapes to make informed decisions regarding your Bitcoin investments. Learn more about the factors driving the current Bitcoin surge and stay ahead of the curve in this dynamic market.

Featured Posts

-

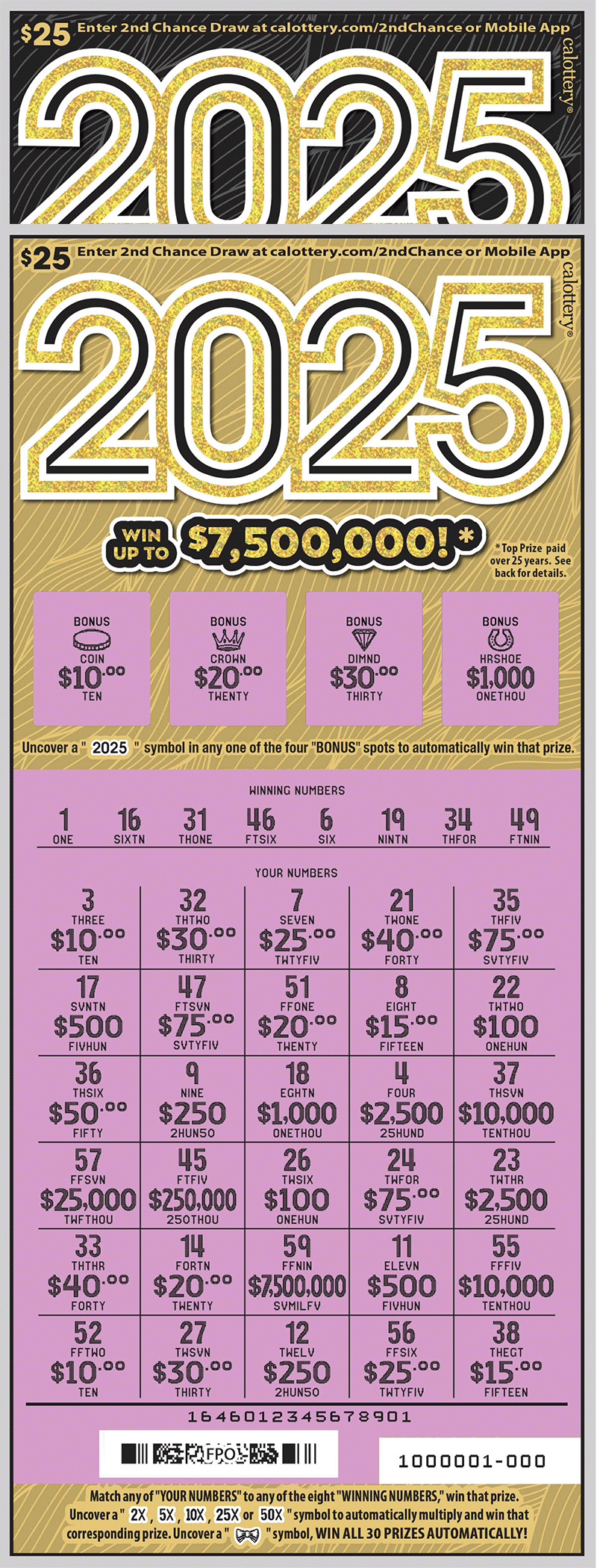

April 16 2025 Lottery Results

May 08, 2025

April 16 2025 Lottery Results

May 08, 2025 -

A New Challenger To Saving Private Ryans War Film Throne

May 08, 2025

A New Challenger To Saving Private Ryans War Film Throne

May 08, 2025 -

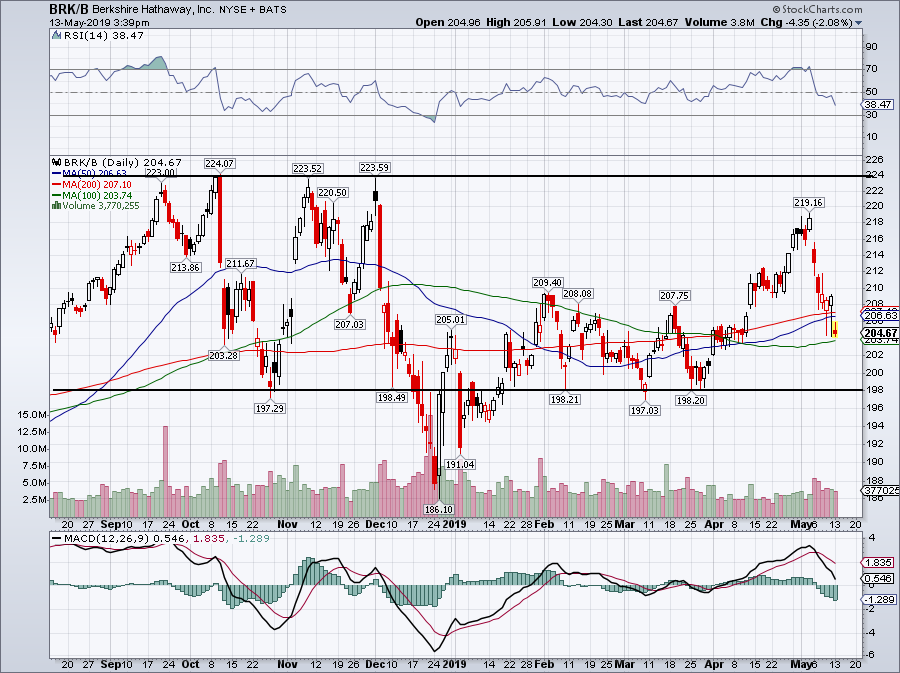

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025

Berkshire Hathaways Stake Boosts Japan Trading House Stock Prices

May 08, 2025 -

Liga De Quito Vs Flamengo Analisis Del Partido De La Libertadores Grupo C Fecha 3

May 08, 2025

Liga De Quito Vs Flamengo Analisis Del Partido De La Libertadores Grupo C Fecha 3

May 08, 2025 -

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025

Informe Sobre La Situacion Del Club Atletico Central Cordoba Perspectivas Desde El Gigante De Arroyito

May 08, 2025