Berkshire Hathaway's Stake Boosts Japan Trading House Stock Prices

Table of Contents

The Magnitude of Berkshire Hathaway's Investment

Berkshire Hathaway's investment in five prominent Japanese trading houses – Itochu, Mitsubishi, Mitsui, Sumitomo, and Marubeni – represents a significant commitment to the Japanese market. The sheer scale of the investment underscores Berkshire Hathaway's confidence in the long-term growth potential of these companies and the Japanese economy as a whole. This Berkshire Hathaway Japan investment is a landmark event, showcasing a strategic shift in the global investment landscape.

-

Specific Investment Figures: While the exact figures haven't been publicly disclosed for each individual company in their entirety, it's known that Berkshire Hathaway acquired significant stakes in all five. Reports suggest investments in the billions of dollars across these companies.

-

Percentage Ownership: The percentage stakes acquired vary slightly between the trading houses, with each representing a substantial minority position, allowing Berkshire Hathaway significant influence but not outright control. Further details on the precise percentages are expected to be revealed in future filings.

-

Comparison to Other Major Investments: This investment is considerable even in the context of Berkshire Hathaway's vast portfolio. While Apple remains a significant holding, this Japanese foray represents a notable diversification and a substantial commitment to a specific geographic market. The scale of this Berkshire Hathaway Japan investment signals a potential shift in investment strategy.

-

Analysis of the Total Investment Value: The total investment value across all five companies is substantial and represents one of Berkshire Hathaway's largest investments in a single country outside the United States. This highlights the significant potential Berkshire Hathaway sees within the Japanese market.

Impact on Japanese Trading House Stock Prices

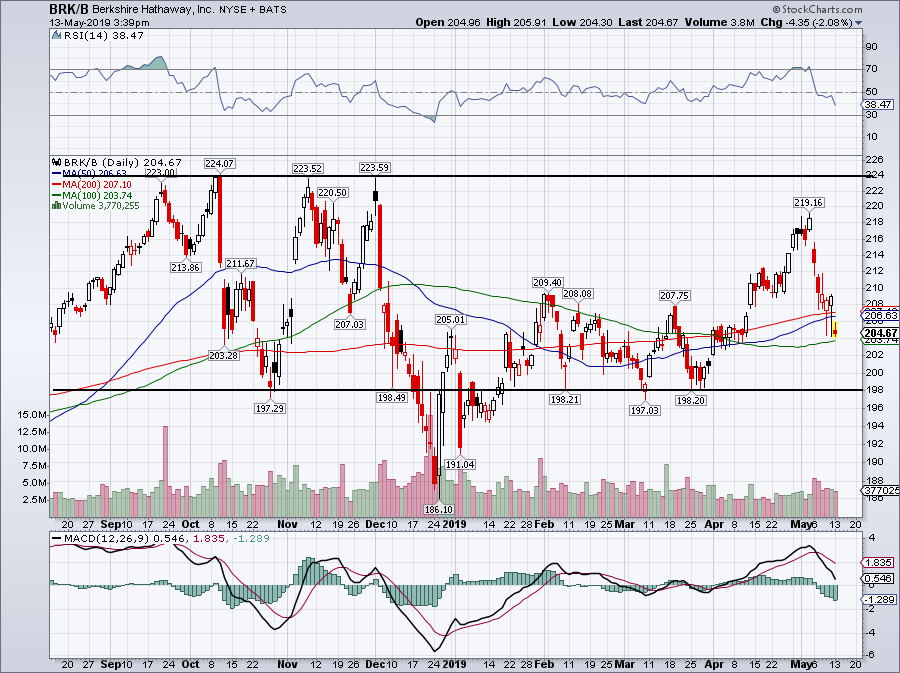

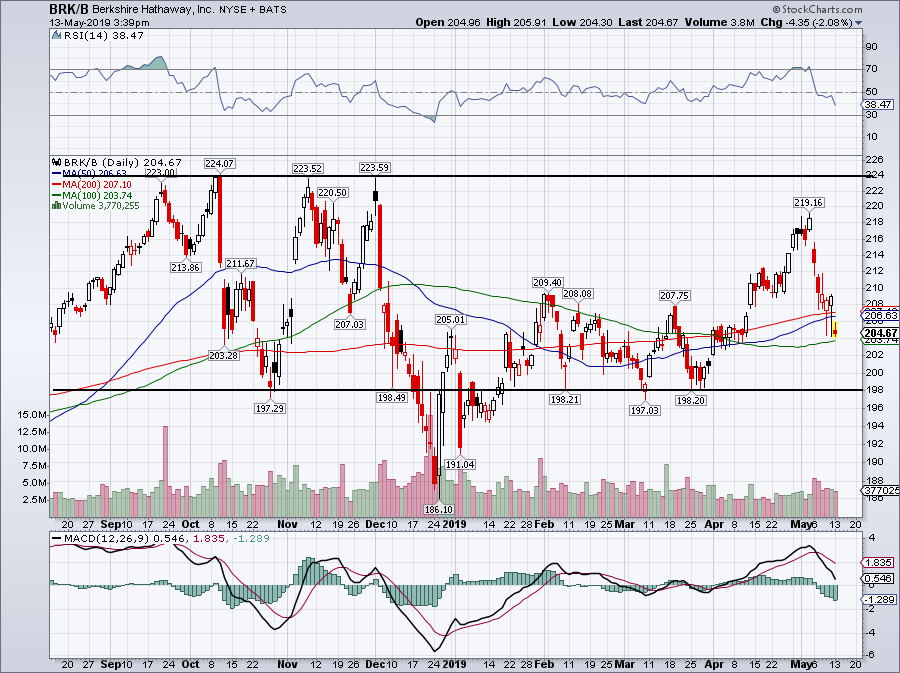

The immediate impact of Berkshire Hathaway's investment was a significant surge in the stock prices of all five trading houses. This demonstrates the powerful influence of Warren Buffett's investment decisions and the market's confidence in his judgment. The long-term implications, however, are still unfolding.

-

Percentage Increase in Stock Prices: Each company experienced a double-digit percentage increase in its share price immediately following the announcement, showcasing the positive market reaction to the news.

-

Trading Volume Changes: Trading volume increased dramatically in the days following the announcement, indicating heightened investor interest and activity. This is typical of a significant investment like this Berkshire Hathaway Japan investment.

-

Analyst Comments and Predictions: Analysts generally viewed the investment positively, predicting further growth for these companies and a strengthening of investor confidence in the Japanese market. The positive analyst comments further solidified the market's bullish sentiment following the announcement.

-

Comparison to Market Indices: The stock price increases of these five companies significantly outperformed broader Japanese market indices in the short term, highlighting the specific impact of the Berkshire Hathaway investment.

Reasons Behind Berkshire Hathaway's Investment in Japanese Trading Houses

Berkshire Hathaway's strategic move into the Japanese market is multifaceted. The decision likely reflects a combination of factors, focusing on the long-term potential of these companies and the broader Japanese economy.

-

Analysis of the Trading Houses' Business Models and Profitability: These trading houses are diversified conglomerates with substantial global reach and robust business models, offering long-term stability and growth potential.

-

Assessment of the Japanese Market's Growth Potential: Japan's economy, while facing demographic challenges, boasts significant strengths in technology, manufacturing, and global trade. This represents an appealing long-term growth market.

-

Discussion of the Diversification Benefits for Berkshire Hathaway: The investment diversifies Berkshire Hathaway's portfolio geographically and sectorally, reducing risk and offering exposure to a different economic landscape.

-

Potential for Future Collaborations and Synergies: The investment could open doors for future collaborations between Berkshire Hathaway and these trading houses, leveraging synergies and expanding market reach.

Implications for the Global Market

Berkshire Hathaway's investment carries significant implications for the global market, influencing investor sentiment towards Japan and potentially sparking increased foreign investment in the country.

-

Increased Foreign Investment in Japan: This move is likely to attract further foreign investment into Japan, boosting confidence in the country's economic prospects. This has already begun to gain traction following the announcement of the Berkshire Hathaway Japan investment.

-

Strengthening of the Yen: The investment could contribute to a strengthening of the Japanese Yen, reflecting increased demand for Japanese assets. This effect will be analyzed as time progresses.

-

Implications for Other Asian Markets: The positive impact on the Japanese market could have ripple effects across other Asian economies, boosting investor sentiment in the region.

-

Increased Interest in Japanese Stocks by International Investors: The investment could stimulate further interest in Japanese stocks among international investors, leading to increased capital flows into the Japanese market.

Conclusion

Berkshire Hathaway's substantial investment in Japanese trading houses represents a significant event with far-reaching implications. The immediate impact on stock prices is clear, but the long-term effects on the Japanese economy and global markets remain to be seen. This bold move underscores the attractiveness of Japanese companies and the growing strategic importance of the Japanese market. Further analysis of this Berkshire Hathaway Japan investment will be crucial for understanding the evolving landscape of global finance. Stay informed on future developments in this dynamic sector by following our updates on Berkshire Hathaway's Japanese investments and other significant market trends.

Featured Posts

-

Wall Street Predicts 110 Growth The Billionaire Backed Black Rock Etf

May 08, 2025

Wall Street Predicts 110 Growth The Billionaire Backed Black Rock Etf

May 08, 2025 -

The Importance Of Trustworthy Crypto News Sources

May 08, 2025

The Importance Of Trustworthy Crypto News Sources

May 08, 2025 -

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025

Andor First Look A 31 Year Old Star Wars Tease Finally Revealed

May 08, 2025 -

The Long Walk Trailer Breakdown And Analysis Of Stephen Kings Upcoming Film

May 08, 2025

The Long Walk Trailer Breakdown And Analysis Of Stephen Kings Upcoming Film

May 08, 2025 -

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025

Why Dogecoin Shiba Inu And Sui Are Soaring This Week A Market Analysis

May 08, 2025