Bitcoin's Rise: Impact Of Trump's Initiatives On Market Sentiment

Table of Contents

Deregulation and Bitcoin's Appeal

Trump's administration, despite some mixed signals, generally adopted a less stringent approach towards financial market regulation. This relative deregulation created a more welcoming environment for Bitcoin, reducing investor apprehension concerning potential government crackdowns. The impact of this on Bitcoin's price was significant.

Reduced Regulatory Uncertainty

- Decreased regulatory uncertainty led to increased institutional investment. Large financial institutions, previously hesitant due to regulatory ambiguity, felt more comfortable entering the Bitcoin market. This influx of capital significantly boosted Bitcoin's price.

- Less fear of government bans fueled higher Bitcoin adoption rates. The perception of a less hostile regulatory environment encouraged greater adoption among individual investors and businesses. This increased demand further propelled Bitcoin's price upwards.

- The perception of a more laissez-faire approach boosted market confidence. A less interventionist regulatory stance contributed to a general increase in market confidence, leading to greater investment in Bitcoin and other cryptocurrencies.

Impact on Traditional Markets

Trump's economic policies, including significant tax cuts, profoundly impacted traditional markets. These shifts, coupled with uncertainty surrounding trade wars, often drove investors towards alternative assets like Bitcoin, seeking diversification and potential higher returns. This flight to alternative assets strengthened Bitcoin's position.

- Tax cuts spurred economic growth, but also increased inflation, making Bitcoin an attractive hedge. Some investors saw Bitcoin as a hedge against inflation, driven by the expansive fiscal policies of the Trump administration.

- Trade disputes created volatility in traditional markets, pushing investment towards Bitcoin’s perceived safety. The uncertainty generated by trade wars led investors to seek refuge in the perceived stability and decentralized nature of Bitcoin.

- Investors sought refuge in Bitcoin's decentralized nature, away from political instability. The perceived independence of Bitcoin from traditional financial systems and government control made it an attractive safe haven during times of political and economic uncertainty.

The Role of Economic Nationalism and Bitcoin's Decentralized Nature

Trump's emphasis on economic nationalism presented a fascinating contrast to Bitcoin's decentralized and borderless nature. This paradox inadvertently made Bitcoin appealing to investors seeking to circumvent national economic policies or protect their assets from political risks. The relationship between Bitcoin's price and Trump's policies is therefore complex.

Nationalistic Policies and Bitcoin's Global Appeal

- Concerns over protectionist trade policies drove investment into Bitcoin's globally accessible network. Investors sought assets that were less susceptible to nationalistic trade barriers, making Bitcoin an attractive option.

- Uncertainty surrounding national currencies strengthened Bitcoin's position as an alternative store of value. Fears about currency devaluation or instability in traditional fiat currencies increased the demand for Bitcoin as a more stable alternative.

- Bitcoin's decentralized structure offered a shield against potential currency devaluations. Its independence from government control and central banks made it an attractive hedge against potential currency crises.

Increased Global Uncertainty and Bitcoin's Safe Haven Status

The global political uncertainty associated with the Trump administration contributed significantly to Bitcoin’s adoption as a safe-haven asset. Investors viewed Bitcoin as a hedge against geopolitical risk, economic instability, and potential currency fluctuations. The correlation between Bitcoin's price and Trump's policies is clear in this context.

- Geopolitical tensions increased demand for Bitcoin as a store of value outside traditional financial systems. Bitcoin's decentralized nature made it appealing as a store of value independent of government or institutional influence.

- Market volatility fueled by Trump's policies encouraged a flight to safer assets, including Bitcoin. Uncertainty in traditional markets often resulted in a shift towards Bitcoin, pushing its price upwards.

- Bitcoin's price often moved inversely to the uncertainty in traditional markets. As traditional markets experienced volatility, investment often flowed into Bitcoin, creating an inverse correlation.

The Influence of Media and Public Perception

Any public statement from Trump regarding cryptocurrency, even indirectly, could significantly impact media coverage and, consequently, Bitcoin's price. This highlights the potent influence of political figures on market sentiment and the relationship between Bitcoin's price and Trump's policies.

Trump's Statements and Bitcoin's Media Coverage

- Positive or negative media coverage amplified the impact of Trump's policies on Bitcoin prices. Media attention, often influenced by Trump's statements or actions, significantly impacted market sentiment and Bitcoin's price volatility.

- Increased public awareness about Bitcoin, driven by news cycles, directly correlated with price fluctuations. News coverage, often amplified by political events, played a substantial role in driving Bitcoin adoption and price changes.

- The interplay between political news and financial news significantly impacted Bitcoin's volatility. The convergence of political and financial news cycles created a highly volatile environment for Bitcoin pricing.

Conclusion

Trump's economic initiatives, while multifaceted, demonstrably influenced Bitcoin's rise. The combination of deregulation, economic nationalism, global uncertainty, and media attention created a complex environment where Bitcoin thrived as a hedge against traditional market volatility and a potential store of value outside national control. Understanding the correlation between Bitcoin's price and Trump's policies offers valuable insights into the interplay between political decisions and the cryptocurrency market. To stay ahead in the dynamic world of cryptocurrency, continue monitoring the effects of political climates on Bitcoin's price and market sentiment. Further research into the impact of future political decisions on Bitcoin’s price is essential for informed investing. Keep up-to-date on the latest news about Bitcoin's price and Trump's policies to make well-informed investment decisions.

Featured Posts

-

Strong Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025

Strong Interest In 65 Hudsons Bay Company Leases

Apr 24, 2025 -

Chat Gpt Maker Open Ai Investigated By The Ftc

Apr 24, 2025

Chat Gpt Maker Open Ai Investigated By The Ftc

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025 -

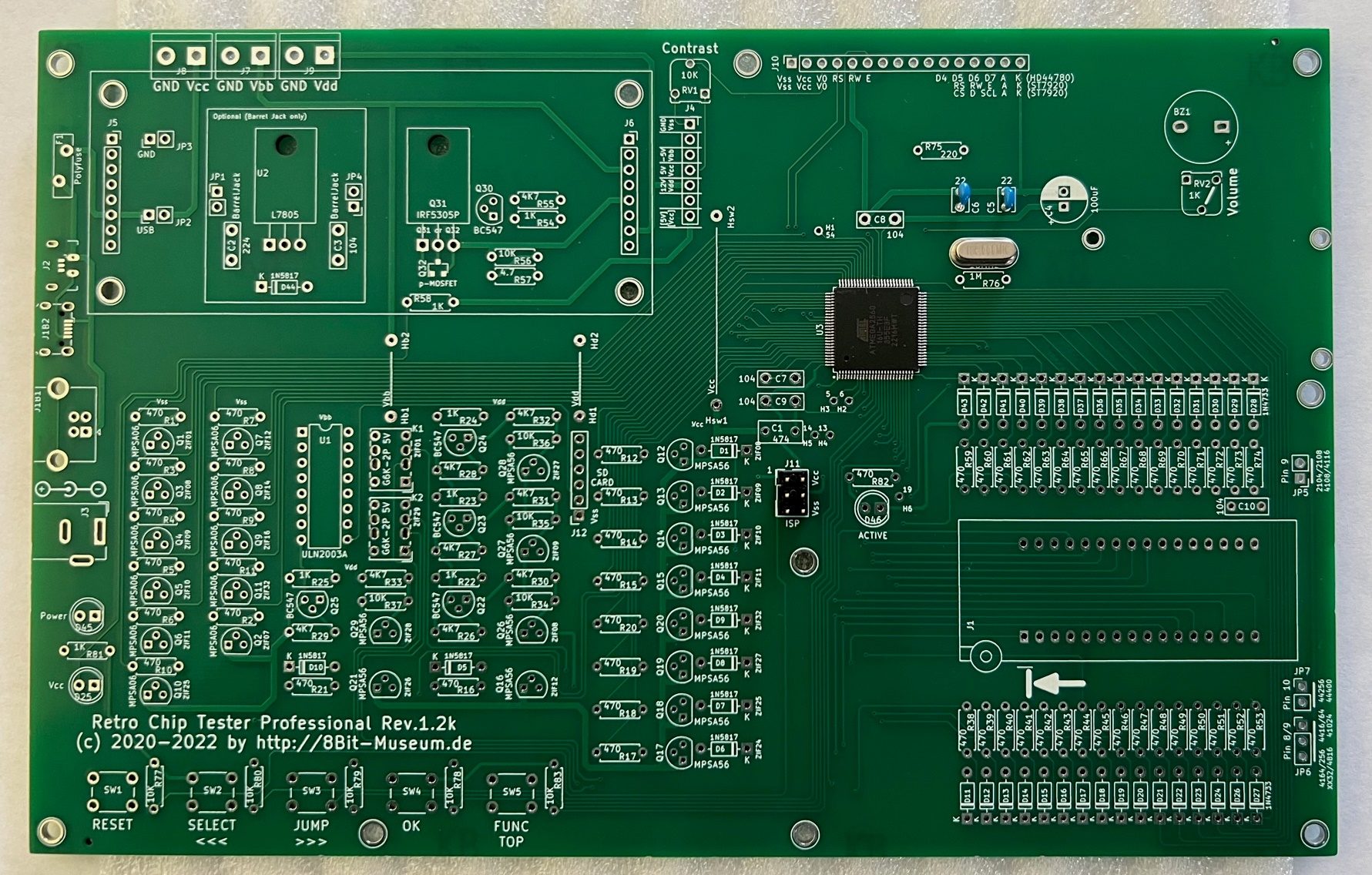

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025 -

Warriors Hield And Payton Crucial Bench Production In Victory Over Blazers

Apr 24, 2025

Warriors Hield And Payton Crucial Bench Production In Victory Over Blazers

Apr 24, 2025

Latest Posts

-

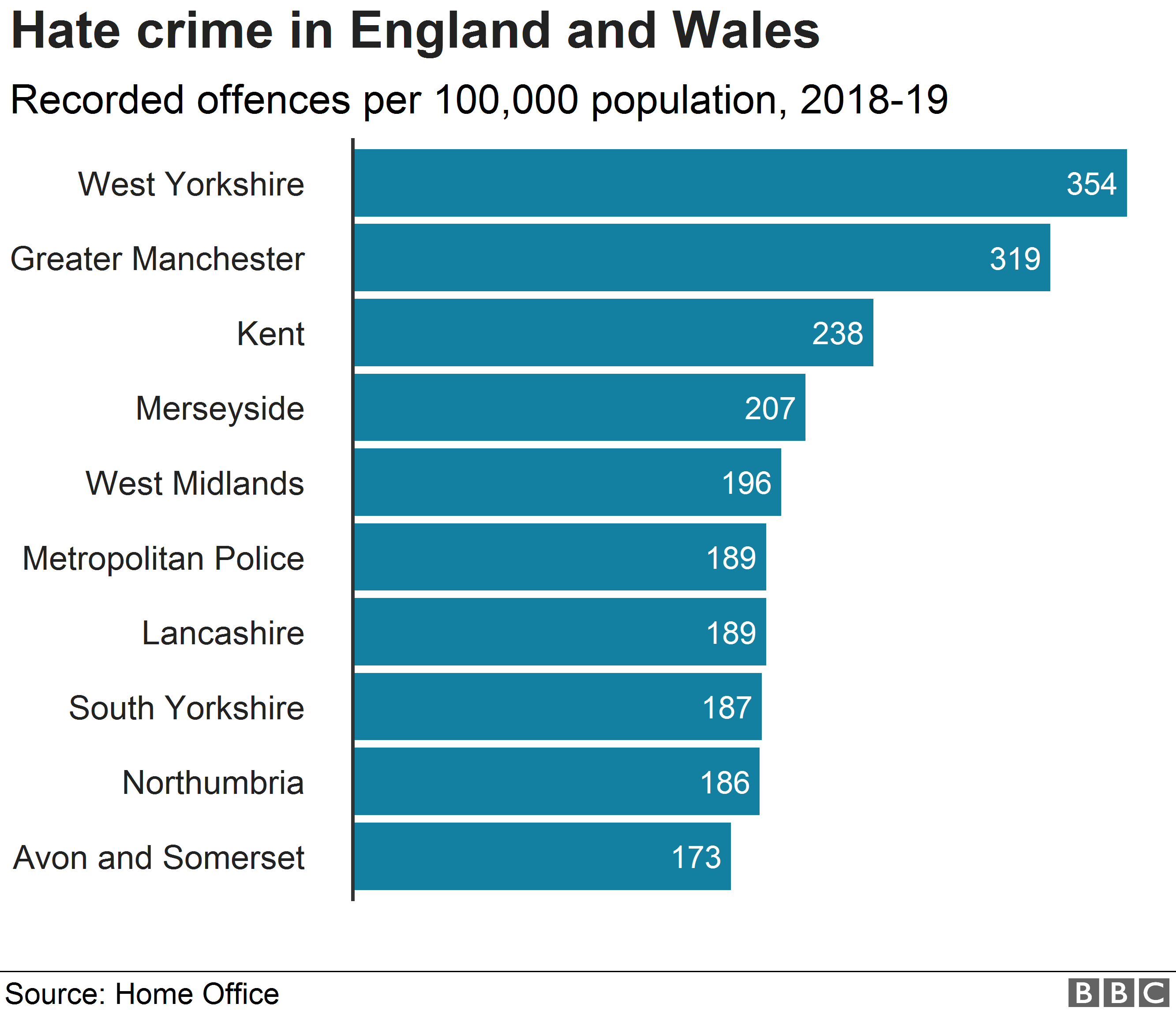

Community Mourns Family Devastated By Senseless Racist Killing

May 10, 2025

Community Mourns Family Devastated By Senseless Racist Killing

May 10, 2025 -

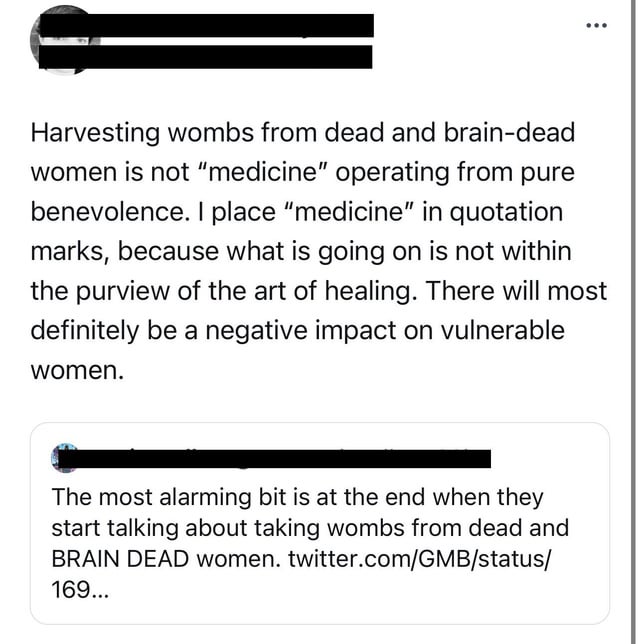

Live Womb Transplants A Discussion On Expanding Reproductive Options For Transgender Individuals

May 10, 2025

Live Womb Transplants A Discussion On Expanding Reproductive Options For Transgender Individuals

May 10, 2025 -

Is Us Government Funding Transgender Animal Research A Detailed Look

May 10, 2025

Is Us Government Funding Transgender Animal Research A Detailed Look

May 10, 2025 -

Broken Family The Devastating Impact Of A Racist Hate Crime

May 10, 2025

Broken Family The Devastating Impact Of A Racist Hate Crime

May 10, 2025 -

Transgender Women And Pregnancy Exploring The Potential Of Uterine Transplantation

May 10, 2025

Transgender Women And Pregnancy Exploring The Potential Of Uterine Transplantation

May 10, 2025