Chip Tester UTAC: A Chinese Buyout Firm's Strategic Decision

Table of Contents

UTAC's Technological Significance in Semiconductor Testing

UTAC holds a pivotal position in the semiconductor testing market, specializing in providing advanced semiconductor test equipment for a wide range of chips. Its expertise is crucial in today's complex technological landscape.

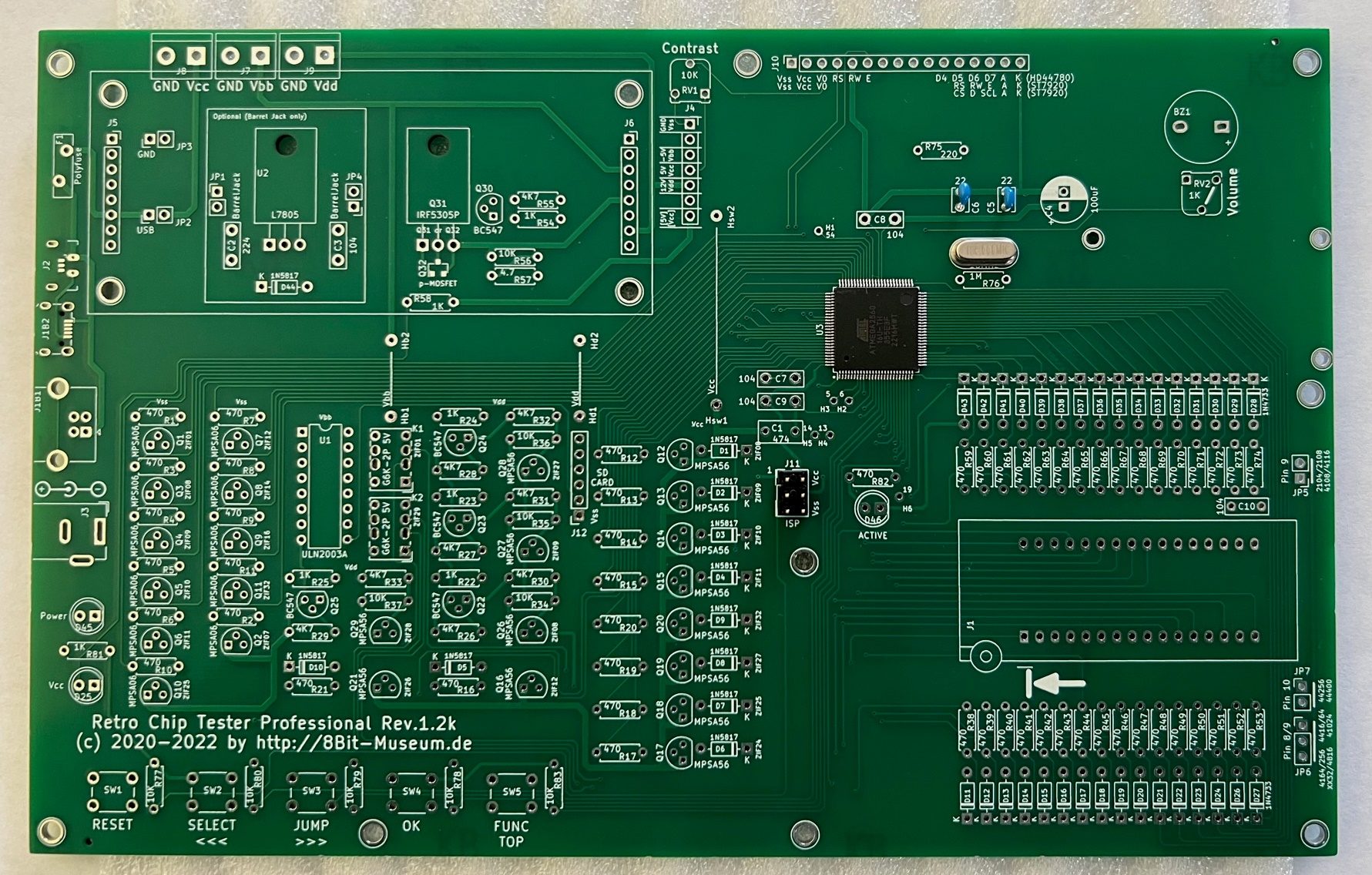

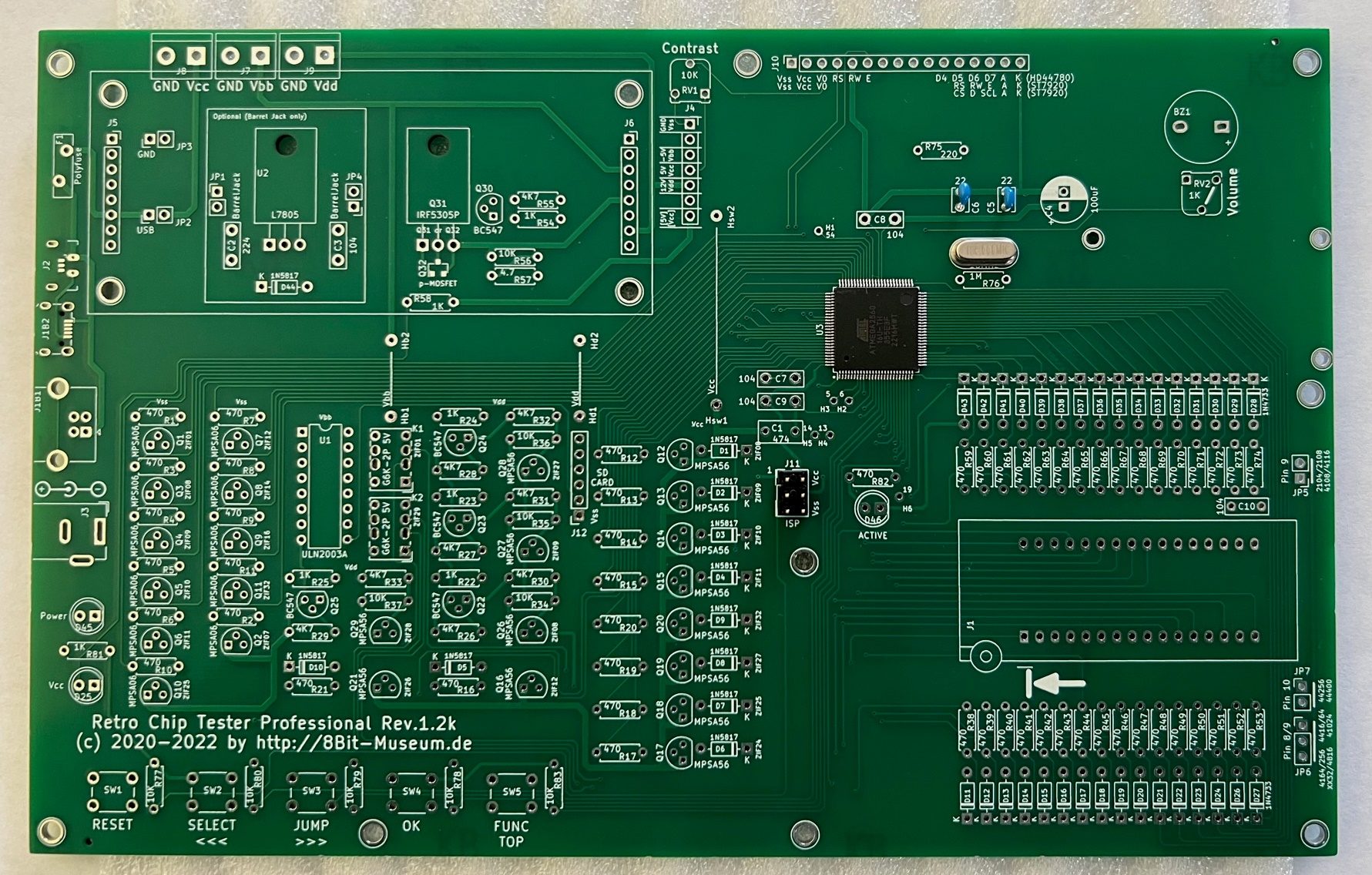

Advanced Testing Capabilities

UTAC boasts cutting-edge capabilities in advanced semiconductor test equipment, enabling high-throughput testing and automated test equipment solutions. Their specialization includes:

- Proprietary algorithms for faster fault detection: UTAC's unique algorithms significantly reduce testing time and improve accuracy, a critical advantage in high-volume manufacturing.

- Expertise in testing cutting-edge 5nm and 3nm chips: This capability positions UTAC at the forefront of testing the most advanced chips currently available, a technology highly sought after globally.

- Advanced package testing: UTAC possesses expertise in testing various package types, catering to the evolving needs of the semiconductor industry.

- Development of AI-powered test solutions: UTAC is actively involved in leveraging Artificial Intelligence to improve the efficiency and effectiveness of chip testing.

Market Position and Client Base

UTAC's market leadership is undeniable. Their global market share is substantial, built on a strong foundation of key clients and strategic partnerships within the semiconductor industry.

- Significant partnerships with major chip manufacturers: UTAC works closely with many of the world's leading chip manufacturers, ensuring its technology remains at the cutting edge.

- Strong presence in the automotive and consumer electronics sectors: These crucial sectors rely heavily on robust chip testing, making UTAC's position even more strategically significant.

- Extensive global distribution network: UTAC's reach extends across multiple continents ensuring its services are readily available to clients worldwide.

Strategic Implications for the Chinese Buyout Firm

The acquisition of UTAC provides the Chinese firm with several key strategic advantages, significantly boosting their position in the global semiconductor arena.

Access to Advanced Technology

This acquisition represents a significant technology acquisition for the Chinese firm, offering access to crucial semiconductor technology and potentially bridging a significant technological gap.

- Acquisition of key patents related to semiconductor testing: UTAC's intellectual property (IP) portfolio is a valuable asset, giving the Chinese firm a considerable technological edge.

- Access to skilled engineers and expertise in chip testing: The acquisition brings a wealth of experienced engineers and technicians, bolstering the Chinese firm's capabilities.

- Improved semiconductor manufacturing efficiency: UTAC's expertise can significantly improve the efficiency and yield of semiconductor manufacturing processes.

Expansion of Market Reach and Influence

UTAC's established global market presence translates into immediate market expansion for the Chinese firm.

- Increased market share in key regions: UTAC's existing client base provides immediate access to major markets worldwide.

- Access to new supply chains and partnerships: The acquisition opens doors to new suppliers and collaborations, strengthening the Chinese firm's position.

- Enhanced brand reputation and market credibility: Association with a reputable company like UTAC enhances the buyer’s overall image and credibility.

Geopolitical Ramifications

The acquisition carries significant geopolitical implications, impacting the ongoing competition in the semiconductor industry.

- Increased technological capabilities for China: The acquisition significantly enhances China’s technological capabilities in the critical area of semiconductor testing.

- Potential shift in global semiconductor market dynamics: This acquisition could trigger further consolidation and competition within the industry, potentially altering the global balance of power.

- Implications for US-China technological rivalry: The acquisition is likely to exacerbate the already tense relationship between the US and China in the semiconductor sector.

Conclusion: The Future of Chip Tester UTAC and Chinese Strategic Investment

The acquisition of UTAC by a Chinese firm marks a pivotal moment in the global semiconductor industry. The strategic importance of this buyout cannot be overstated. It provides the acquiring firm with immediate access to advanced technologies, expands its market reach significantly, and carries substantial geopolitical implications. This acquisition is a clear signal of China's commitment to becoming a global leader in semiconductor technology. The future of UTAC, and indeed the future of the global semiconductor industry, will be profoundly shaped by this strategic move. To stay abreast of the evolving landscape of Chinese investment in semiconductor technology and the implications for strategic acquisitions in the chip testing sector, further research into industry analysis reports and news from reliable sources is recommended. Understanding the future of UTAC is key to understanding the future of chip testing and manufacturing.

Featured Posts

-

Zuckerbergs Strategy In The Age Of Trump

Apr 24, 2025

Zuckerbergs Strategy In The Age Of Trump

Apr 24, 2025 -

The Business Of Deportation A Startup Airlines Unconventional Approach

Apr 24, 2025

The Business Of Deportation A Startup Airlines Unconventional Approach

Apr 24, 2025 -

John Travoltas Daughter Ella Bleu Unveils A Breathtaking New Look

Apr 24, 2025

John Travoltas Daughter Ella Bleu Unveils A Breathtaking New Look

Apr 24, 2025 -

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025

Chinese Stocks In Hong Kong Surge Trade Tension Easing Fuels Rally

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Success

Apr 24, 2025