Bitcoin's 10x Multiplier: Could It Shock Wall Street?

Table of Contents

Historical Precedents for Exponential Bitcoin Growth

Analyzing past Bitcoin price cycles is crucial for understanding the potential for future growth. Examining these trends helps us identify potential catalysts and assess the likelihood of a Bitcoin 10x scenario.

The 2017 Bull Run: A Case Study

The 2017 bull run saw Bitcoin's price increase dramatically. Several factors contributed to this rapid appreciation:

- Increased Institutional Interest (Early Stages): While still nascent, early institutional interest signaled a shift towards Bitcoin's legitimacy as an asset class.

- Growing Mainstream Media Coverage: Increased media attention, both positive and negative, fueled public interest and speculation.

- Retail Investor Enthusiasm: A wave of retail investors entered the market, driving up demand and pushing prices higher.

- Limited Supply of Bitcoin: Bitcoin's fixed supply of 21 million coins acted as a deflationary pressure, driving up scarcity and value.

Learning from Past Cycles: Predicting Future Growth

Past Bitcoin price cycles offer valuable lessons for predicting future movements. Analyzing these cycles helps refine our understanding of:

- Key Market Indicators: On-chain metrics like transaction volume, network hash rate, and the number of active addresses provide valuable insights into market sentiment and adoption rates.

- Impact of Regulatory Changes: Government regulations significantly impact Bitcoin's price. Positive regulatory developments can boost confidence, while negative ones can trigger sell-offs.

- Correlation with Macroeconomic Factors: Bitcoin's price often correlates with macroeconomic trends, particularly during times of economic uncertainty or inflation. Understanding these correlations is crucial for accurate predictions.

Factors That Could Drive a 10x Bitcoin Multiplier

Several factors could potentially drive Bitcoin's price to a 10x multiplier, significantly impacting the cryptocurrency market and possibly shaking up Wall Street.

Increased Institutional Adoption: The Wall Street Factor

Institutional investors, including hedge funds and pension funds, are increasingly allocating assets to Bitcoin. This growing adoption is a key driver of potential future price increases:

- Acceptance as an Asset Class: Bitcoin is gradually gaining acceptance as a legitimate asset class, diversifying investment portfolios.

- Diversification Strategies: Institutional investors are using Bitcoin to diversify their holdings and hedge against inflation and market volatility.

- Investment Vehicles: Products like the Grayscale Bitcoin Trust provide institutional investors with regulated access to Bitcoin exposure.

Global Macroeconomic Uncertainty: Bitcoin as a Safe Haven

Global events like inflation and geopolitical instability can significantly impact Bitcoin's price. Bitcoin's characteristics make it an attractive safe-haven asset:

- Inflation Hedging: Bitcoin's limited supply acts as a hedge against inflation, preserving purchasing power.

- Decentralized Nature: Bitcoin's decentralized nature provides a shield against government control and economic turmoil.

- Comparison with Traditional Assets: During times of crisis, Bitcoin has historically outperformed many traditional assets, further strengthening its appeal as a safe haven.

Technological Advancements & Network Effects: Driving Adoption

Technological advancements, particularly Layer-2 scaling solutions, are improving Bitcoin's functionality and increasing its adoption rate:

- Lightning Network: The Lightning Network significantly increases transaction speed and reduces fees, making Bitcoin more user-friendly.

- Improved Transaction Speed and Lower Fees: These improvements make Bitcoin more practical for everyday use, beyond simple speculation.

- Growing Utility and Use Cases: Beyond being a store of value, Bitcoin is increasingly used for payments and other applications, furthering its adoption.

Potential Risks and Challenges to a 10x Scenario

While a Bitcoin 10x scenario is possible, significant risks and challenges could hinder its realization. Understanding these risks is crucial for informed investment decisions.

Regulatory Uncertainty: A Looming Threat

Government regulations significantly impact the cryptocurrency market. Regulatory uncertainty poses a considerable risk:

- Varying Regulatory Approaches: Different countries have varying regulatory approaches to Bitcoin, creating uncertainty and potential for conflict.

- Increased Scrutiny and Restrictions: Governments might increase scrutiny and implement stricter regulations, impacting Bitcoin's price.

- Bans or Heavy Regulations: In extreme cases, governments could ban or heavily regulate Bitcoin, negatively impacting its value.

Market Volatility and Corrections: The Rollercoaster Ride

The cryptocurrency market is inherently volatile, with sharp price corrections common. Investors should be prepared for significant price swings:

- Historical Examples of Crashes: Bitcoin's history includes several significant price crashes, highlighting the market's volatility.

- Risk Management Strategies: Investors need robust risk management strategies to mitigate potential losses.

- Importance of Diversification: Diversifying cryptocurrency portfolios reduces the impact of price fluctuations.

Competition from Alternative Cryptocurrencies (Altcoins): The Threat of Disruption

The emergence of alternative cryptocurrencies (altcoins) poses a challenge to Bitcoin's dominance:

- Rise of Ethereum and Other Platforms: Ethereum and other smart contract platforms compete with Bitcoin for market share.

- Emergence of New Cryptocurrencies: New cryptocurrencies with innovative features could attract investors away from Bitcoin.

- Potential for Market Share Erosion: Competition from altcoins could erode Bitcoin's market share and limit its price appreciation.

Conclusion

The possibility of Bitcoin achieving a 10x multiplier is a captivating yet complex scenario. While historical precedents, increasing institutional interest, and macroeconomic uncertainty could fuel such a surge, significant risks and challenges remain, including regulatory uncertainty and market volatility. Careful consideration of these factors is crucial for any investor contemplating exposure to Bitcoin. Understanding the potential for a Bitcoin 10x multiplier, while acknowledging the inherent risks, is key to navigating the evolving cryptocurrency landscape. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions related to Bitcoin or other cryptocurrencies. Do your due diligence before considering a Bitcoin 10x investment strategy.

Featured Posts

-

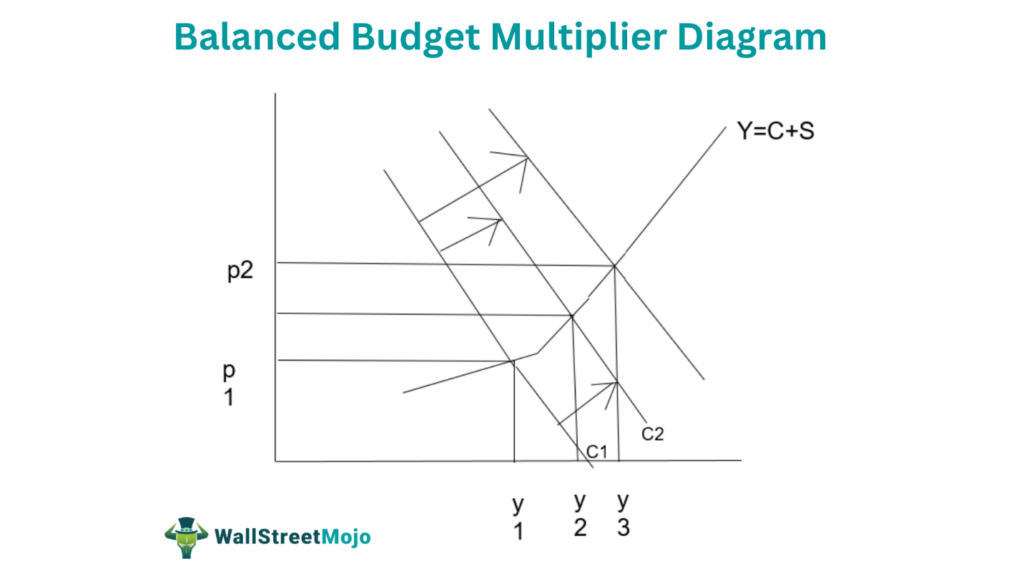

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025

Mraksh Myn Kshty Hadthh Ansany Asmglng Ke 4 Mlzman Grftar

May 08, 2025 -

Gcci Presidents Expo 2025 Work Receives Sufians Commendation

May 08, 2025

Gcci Presidents Expo 2025 Work Receives Sufians Commendation

May 08, 2025 -

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025

Arsenal Vs Psg Champions League Semi Final Preview A Tactical Breakdown

May 08, 2025 -

Next Gen Ps 5 Exclusives Ps 5 Pro Enhancements

May 08, 2025

Next Gen Ps 5 Exclusives Ps 5 Pro Enhancements

May 08, 2025