Bitcoin Surges Past 10-Week High, Nearing US$100,000

Table of Contents

Driving Forces Behind Bitcoin's Price Surge

Several key factors are contributing to Bitcoin's impressive price rally and its potential to hit US$100,000.

Institutional Investment

The increasing adoption of Bitcoin by institutional investors is a major catalyst. Hedge funds, corporations, and even sovereign wealth funds are allocating a portion of their portfolios to Bitcoin, viewing it as a hedge against inflation and a potential store of value.

- Examples: MicroStrategy's significant Bitcoin holdings, Tesla's acceptance of Bitcoin as payment, and the growing popularity of Bitcoin-related ETFs are all indicative of this trend.

- Impact Analysis: Large institutional purchases often create significant buying pressure, pushing the Bitcoin price higher. The sheer volume of capital entering the market from these institutions is substantial.

- Grayscale Bitcoin Trust (GBTC): The ongoing success of GBTC, despite its premium to NAV, demonstrates the persistent institutional demand for Bitcoin exposure.

Regulatory Clarity & Positive Sentiment

Positive regulatory developments and growing market sentiment are further fueling the Bitcoin price surge. A more favorable regulatory environment can boost investor confidence and attract more capital into the market.

- Examples: Recent statements from regulatory bodies in certain jurisdictions signaling a more balanced approach to cryptocurrencies, coupled with the approval of Bitcoin ETFs in some markets, contribute to this positive sentiment.

- Investor Confidence: Surveys and market analyses reveal increased investor confidence in Bitcoin, especially amongst long-term holders.

- ETF Approvals: The potential for widespread Bitcoin ETF approval is a crucial factor, as it would unlock significant investment from mainstream financial institutions.

Growing Adoption and Use Cases

Beyond investment, the expansion of Bitcoin's use cases is another key driver. Bitcoin is increasingly being used for payments, remittances, and within the burgeoning decentralized finance (DeFi) ecosystem.

- Real-world Usage: The growing number of merchants accepting Bitcoin as payment, particularly in emerging markets, signifies broader adoption. The use of Bitcoin for cross-border payments is also gaining traction.

- Emerging Markets: Adoption rates in developing countries with unstable currencies are significantly higher, showcasing Bitcoin's potential as an alternative financial system.

- Lightning Network: The Lightning Network, a layer-2 scaling solution, enhances Bitcoin's transactional capabilities, facilitating faster and cheaper payments.

Technical Analysis of Bitcoin's Chart

Analyzing Bitcoin's price chart reveals crucial insights into its trajectory and potential future movements.

Key Support and Resistance Levels

Technical indicators offer clues about potential support and resistance levels. These levels represent price points where significant buying or selling pressure is expected.

- Chart Patterns: Identifying chart patterns, such as ascending triangles or pennants, can provide signals of potential future price movements.

- Support and Resistance: Analyzing historical price data can help identify key support and resistance levels that could influence future price action.

- Moving Averages and RSI: Indicators like moving averages (MA) and the Relative Strength Index (RSI) provide insights into the strength and direction of the trend.

Volume and Momentum

Examining trading volume and momentum indicators helps assess the sustainability of the current upward trend.

- Volume Data: High trading volume accompanying price increases indicates strong conviction and buying pressure, suggesting a sustainable rally.

- Momentum Indicators: Indicators like the Moving Average Convergence Divergence (MACD) can signal whether the momentum is bullish or bearish.

- Bullish/Bearish Signals: A combination of technical indicators can provide a more comprehensive view of the market sentiment and potential future price movements.

Potential Risks and Challenges

While the outlook for Bitcoin appears bullish, it's crucial to acknowledge potential risks and challenges.

Volatility and Market Corrections

Bitcoin is inherently volatile, and sharp corrections are a normal part of its price history. Investors need to be prepared for potential price swings.

- Historical Corrections: Reviewing past Bitcoin price corrections, including their magnitude and duration, is crucial for understanding potential future volatility.

- Risk Management: Employing appropriate risk management strategies, such as diversification and stop-loss orders, is essential for mitigating potential losses.

Regulatory Uncertainty and Geopolitical Risks

Regulatory uncertainty and geopolitical events could significantly impact Bitcoin's price.

- Regulatory Hurdles: The constantly evolving regulatory landscape presents uncertainty, with potential for stricter regulations in some jurisdictions.

- Geopolitical Impacts: Global events and macroeconomic factors can influence investor sentiment and the price of Bitcoin.

Conclusion: Bitcoin's Future and Investment Implications

Bitcoin's recent surge, driven by institutional adoption, positive regulatory sentiment, and growing use cases, has propelled it towards the US$100,000 mark. While the potential rewards are significant, investors must acknowledge the inherent volatility and potential risks. Thorough research and a well-defined investment strategy are crucial. Stay tuned for further updates on Bitcoin's price action and continue your research into Bitcoin investment opportunities, including exploring Bitcoin price predictions and various Bitcoin investment strategies. Remember to always conduct thorough due diligence before making any investment decisions.

Featured Posts

-

From Mocking Crypto To Making Millions Trumps Presidency And Cryptocurrency

May 07, 2025

From Mocking Crypto To Making Millions Trumps Presidency And Cryptocurrency

May 07, 2025 -

Simone Biles Post Gymnastics Career Whats Next

May 07, 2025

Simone Biles Post Gymnastics Career Whats Next

May 07, 2025 -

The Karate Kid A Cinematic Analysis Of Theme And Character Development

May 07, 2025

The Karate Kid A Cinematic Analysis Of Theme And Character Development

May 07, 2025 -

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 07, 2025

16 Million Penalty For T Mobile Three Year Data Breach Investigation Concludes

May 07, 2025 -

Cem Karaca Anadolu Nun Sesi Bati Nin Notalari

May 07, 2025

Cem Karaca Anadolu Nun Sesi Bati Nin Notalari

May 07, 2025

Latest Posts

-

50 Years Of Tension India Launches Major Strikes Against Pakistan

May 08, 2025

50 Years Of Tension India Launches Major Strikes Against Pakistan

May 08, 2025 -

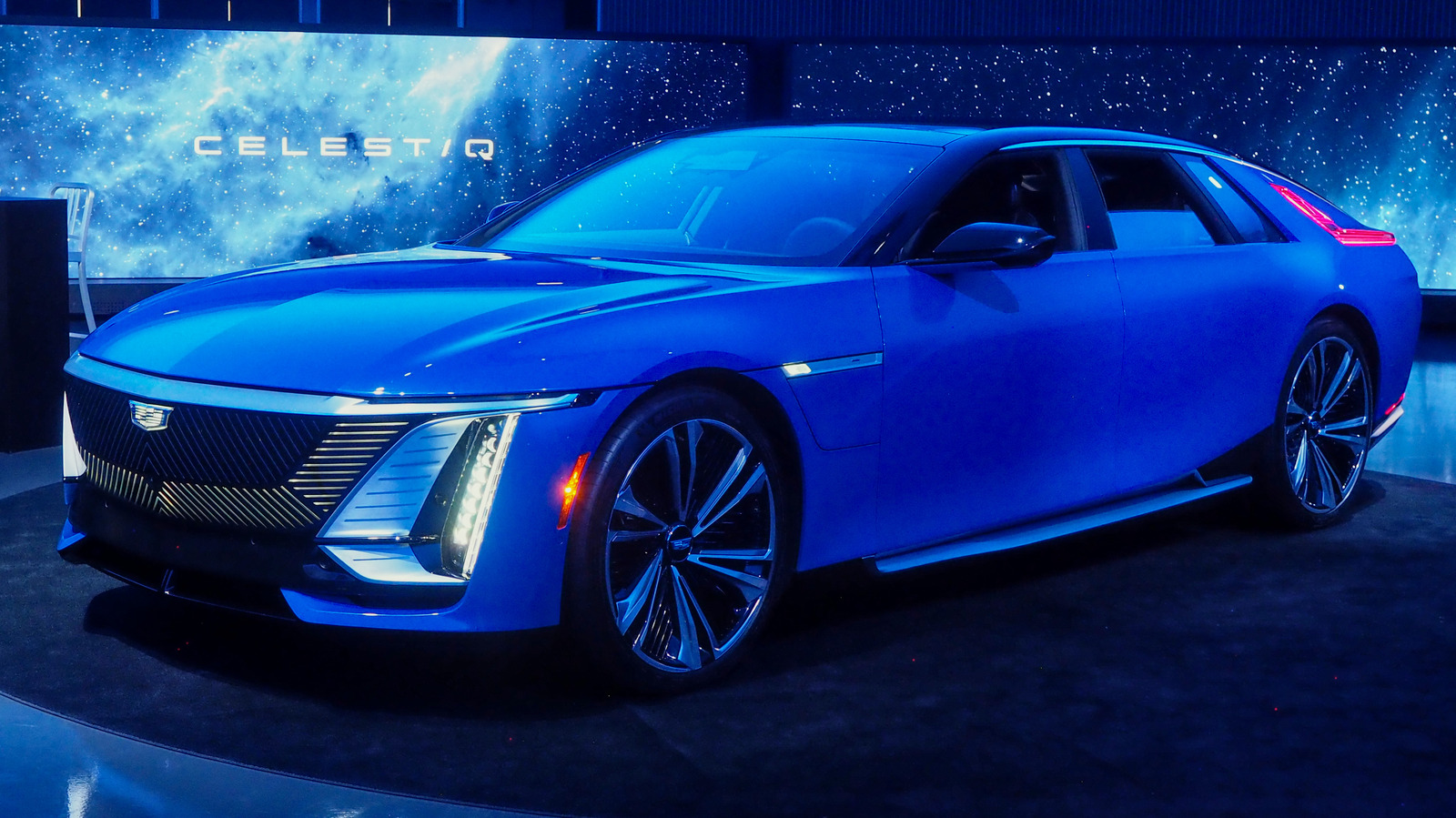

360 000 Cadillac Celestiq Ev A First Drive Review

May 08, 2025

360 000 Cadillac Celestiq Ev A First Drive Review

May 08, 2025 -

Combating The Superbug Crisis Understanding The Threat Of Deadly Fungi

May 08, 2025

Combating The Superbug Crisis Understanding The Threat Of Deadly Fungi

May 08, 2025 -

Indias Deepest Strikes Into Pakistan In Over 50 Years Cnn Report

May 08, 2025

Indias Deepest Strikes Into Pakistan In Over 50 Years Cnn Report

May 08, 2025 -

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025

Cadillac Celestiq First Drive Impressions Of The Bespoke Ev

May 08, 2025