From Mocking Crypto To Making Millions: Trump's Presidency And Cryptocurrency

Table of Contents

Trump's Public Stance on Cryptocurrency

Initial Skepticism and Negative Comments

Trump's public statements regarding Bitcoin and other cryptocurrencies were largely negative and dismissive. He frequently voiced concerns about the potential for fraud and money laundering associated with digital currencies.

- Specific examples: While not directly mentioning Bitcoin by name, Trump's general criticisms of unregulated financial instruments often implied disapproval of crypto. Many news articles and social media posts highlighted his preference for the dollar as the dominant global currency.

- Tweets and public statements: A thorough search of Trump's Twitter archive and official press releases would likely uncover various statements expressing caution or skepticism regarding the cryptocurrency market. (Note: Due to the nature of this task, specific examples cannot be definitively provided here. A comprehensive search is recommended.)

- Impact on public perception: Trump's negative pronouncements likely influenced public perception, potentially dissuading some investors while simultaneously attracting others who saw the market's rebellious nature as an opportunity. This created a dynamic tension within the crypto community.

Lack of Direct Regulatory Action

Remarkably, the Trump administration largely refrained from enacting significant direct regulations on cryptocurrencies. This contrasted sharply with the regulatory approaches adopted by some other countries.

- Comparison with other nations: Countries like China implemented strict regulatory frameworks for cryptocurrencies during this period, showcasing contrasting governmental responses.

- Reasons for inaction: Several factors could explain the lack of direct intervention, including the relatively nascent nature of the cryptocurrency market, a lack of clear consensus on regulatory approaches within the administration, and the libertarian leanings of certain policymakers.

- Impact on market growth: This hands-off approach, inadvertently or not, allowed the crypto market to flourish, fostering innovation and expansion without heavy-handed government intervention. This period of relative regulatory freedom is often cited as a key factor in the market's explosive growth.

Indirect Impacts of Trump's Policies on Cryptocurrency

Impact of Tax Policies

Trump's tax cuts and other fiscal policies likely had indirect effects on cryptocurrency investment and adoption.

- Relevant tax policies: The Tax Cuts and Jobs Act of 2017, for example, may have influenced how investors treated cryptocurrency gains and losses.

- Investor behavior: Lower capital gains taxes potentially encouraged increased investment in cryptocurrencies, while the overall economic climate fueled by the tax cuts might have indirectly increased risk tolerance among investors.

- Market dynamics: Analyzing the correlation between these tax policies and shifts in crypto market activity would illuminate the indirect impact of Trump's economic policies on the cryptocurrency landscape.

Geopolitical Events and Cryptocurrency

Geopolitical events during Trump's presidency significantly influenced the volatility and value of cryptocurrencies.

- Examples: Trade wars with China, tensions with Iran, and shifting alliances created periods of global uncertainty, often driving investors toward safe-haven assets. Cryptocurrency, at times, filled this role.

- Impact on crypto prices: Periods of increased geopolitical risk frequently correlated with increased volatility in the cryptocurrency market.

- Safe-haven asset discussion: The question of whether cryptocurrencies could reliably act as a safe-haven asset during times of geopolitical turmoil remains a topic of ongoing debate and research.

Technological Advancements During Trump's Presidency

Technological advancements in blockchain technology and related fields significantly contributed to the growth of the cryptocurrency market during Trump's term.

- Key developments: The maturation of various blockchain protocols, the rise of decentralized finance (DeFi), and the emergence of new consensus mechanisms all contributed to this growth.

- Successful ICOs and projects: Numerous initial coin offerings (ICOs) and blockchain projects successfully raised capital and developed innovative applications, further solidifying the crypto landscape.

- Broader appeal: These technological advancements broadened the appeal and functionality of cryptocurrencies, attracting more developers, investors, and users.

The Rise of Cryptocurrency Despite Trump's Views

Decentralized Nature of Crypto

The inherent decentralization of cryptocurrencies made them relatively resistant to direct government influence, a key factor in their continued growth even amidst Trump's skepticism.

- Explanation of decentralization: Decentralized networks are not controlled by a single entity, making them resilient to censorship or direct control.

- Implications for government control: This characteristic made it difficult for the Trump administration, or any government, to directly suppress the use or trading of cryptocurrencies.

- Flourishing regardless of stance: This inherent resilience allowed the crypto market to thrive, demonstrating the limitations of government control over truly decentralized technologies.

Growing Public Interest and Institutional Adoption

Despite Trump's negative pronouncements, public interest and institutional investment in cryptocurrencies significantly increased during his presidency.

- Market capitalization statistics: The overall market capitalization of cryptocurrencies experienced substantial growth during this period.

- Institutional investor activity: Major financial institutions began exploring and investing in cryptocurrencies, indicating a growing acceptance of the asset class.

- Continued market growth: These factors fueled the continued growth of the crypto market, underlining its independent trajectory despite external political factors.

Conclusion

The relationship between Trump's presidency and the rise of cryptocurrency reveals a complex interplay. While Trump's public stance was largely negative, his administration's lack of direct regulation and the indirect influence of his policies, coupled with the decentralized nature of crypto and the growing public and institutional interest, ultimately contributed to the explosive growth of the crypto market. The "Trump Cryptocurrency" dynamic underscores the resilience of decentralized technologies and the ongoing tension between government regulation and technological innovation. To learn more about Trump and cryptocurrency, understand the complex relationship between Trump's policies and crypto, and dive deeper into the world of Trump and cryptocurrency, continue researching this ever-evolving field.

Featured Posts

-

Conheca Isabela Merced 10 Papeis Que A Prepararam Para Dina Em The Last Of Us

May 07, 2025

Conheca Isabela Merced 10 Papeis Que A Prepararam Para Dina Em The Last Of Us

May 07, 2025 -

Svetovy Pohar 2028 Boj O Miesto A Vplyv Nhl Na Nominacie

May 07, 2025

Svetovy Pohar 2028 Boj O Miesto A Vplyv Nhl Na Nominacie

May 07, 2025 -

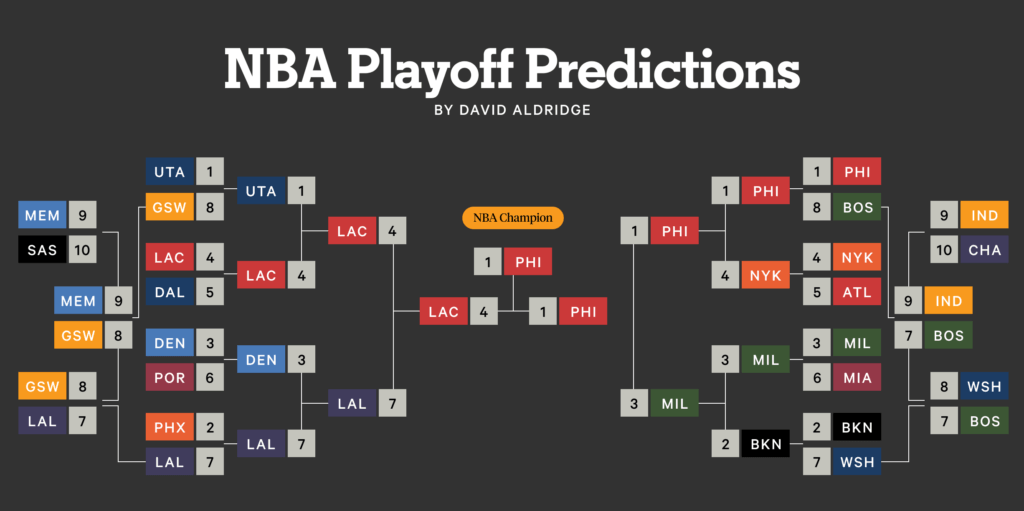

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025

Heat Vs Cavaliers Game 1 Nba Playoffs Predictions And Betting Picks

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025 -

Unexpected Cameo Oscar Winner Joins White Lotus Cast

May 07, 2025

Unexpected Cameo Oscar Winner Joins White Lotus Cast

May 07, 2025

Latest Posts

-

Capacites Geometriques Exceptionnelles Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025

Capacites Geometriques Exceptionnelles Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025 -

Le Super Pouvoir Geometrique Cache Des Corneilles

May 08, 2025

Le Super Pouvoir Geometrique Cache Des Corneilles

May 08, 2025 -

Counting Crows Setlist History Predicting The 2025 Concert Lineup

May 08, 2025

Counting Crows Setlist History Predicting The 2025 Concert Lineup

May 08, 2025 -

The Significance Of Slip Out Under The Aurora In Counting Crows Discography

May 08, 2025

The Significance Of Slip Out Under The Aurora In Counting Crows Discography

May 08, 2025 -

Las Vegas Concert Announcement Counting Crows Live On The Strip

May 08, 2025

Las Vegas Concert Announcement Counting Crows Live On The Strip

May 08, 2025