Bitcoin Rebound: Understanding The Factors Driving The Recovery

Table of Contents

Institutional Investment and Adoption

The increasing involvement of institutional investors is a significant driver of the Bitcoin rebound. Hedge funds, corporations, and other large financial players are increasingly allocating assets to Bitcoin, viewing it as a potential diversification tool and a hedge against inflation. This institutional adoption signifies a shift towards mainstream acceptance of Bitcoin as a legitimate asset class.

- Increased participation from major players: Companies like MicroStrategy and Tesla have made significant Bitcoin acquisitions, demonstrating confidence in the long-term value proposition of the cryptocurrency. Grayscale Investments, a major player in the digital asset space, also continues to accumulate Bitcoin.

- Growing acceptance as a store of value: Many investors are viewing Bitcoin as a store of value, similar to gold, offering protection against currency devaluation and economic uncertainty. This perception is further strengthened by Bitcoin's fixed supply of 21 million coins.

- Impact of ETF approvals (or potential approvals): The potential approval of Bitcoin exchange-traded funds (ETFs) could significantly boost institutional investment and liquidity, potentially fueling further price increases. Regulatory clarity regarding Bitcoin is paramount for continued institutional interest.

Macroeconomic Factors and Inflation

Global macroeconomic conditions play a pivotal role in the Bitcoin rebound. Soaring inflation rates and concerns about fiat currency devaluation are pushing investors towards alternative assets, with Bitcoin emerging as a compelling option. The perceived safe-haven characteristics of Bitcoin, coupled with its decentralized nature, are attracting investors seeking to preserve their purchasing power.

- Rising inflation rates globally: High inflation erodes the value of traditional currencies, making alternative assets like Bitcoin increasingly attractive.

- Decreased trust in traditional financial systems: Concerns about the stability and future of traditional financial systems are driving investors towards decentralized and less regulated assets like Bitcoin.

- Safe-haven asset characteristics of Bitcoin: Bitcoin's limited supply and decentralized nature make it an appealing safe haven asset during times of economic uncertainty. The correlation between Bitcoin's price and traditional markets is complex and often debated, but currently, this decoupling is supporting the Bitcoin price.

Technological Advancements and Network Growth

Technological advancements within the Bitcoin ecosystem contribute to its increasing utility and attractiveness. Improvements in scaling solutions, like the Lightning Network, are addressing scalability concerns and enhancing the efficiency of transactions. This improved infrastructure fosters broader adoption and increased network activity, indirectly supporting the Bitcoin rebound.

- Layer-2 scaling solutions: Solutions like the Lightning Network enable faster and cheaper Bitcoin transactions, making it more practical for everyday use.

- Increased transaction throughput: As the network scales, it can handle a larger volume of transactions, further solidifying its position as a viable payment system.

- Growing adoption in emerging markets: Bitcoin is gaining traction in developing countries where traditional financial systems may be less accessible or reliable.

Market Sentiment and Speculation

Market sentiment and speculation play a significant role in Bitcoin's price volatility. Positive news coverage, social media trends, and the actions of influential figures can all contribute to price surges or declines. The "Fear of Missing Out" (FOMO) effect can amplify price movements, leading to periods of rapid appreciation.

- Positive media coverage and social media trends: Positive news and social media sentiment can drive increased demand and push the price upwards.

- Impact of whale activity and large transactions: Large transactions by significant Bitcoin holders ("whales") can influence market sentiment and trigger price fluctuations.

- Role of technical analysis and price predictions: Technical analysis and price predictions, while not always accurate, significantly influence trading decisions and market sentiment.

Conclusion

The Bitcoin rebound is a complex phenomenon driven by a confluence of factors. Institutional adoption, macroeconomic pressures, technological advancements, and market sentiment all contribute to the recent price surge. Understanding these interconnected elements is crucial for navigating the volatile cryptocurrency market and making informed decisions. The increasing integration of Bitcoin into the global financial system, coupled with its underlying technological strengths, suggests a promising future for the cryptocurrency, though volatility is expected to remain a feature of the market. Understanding the drivers behind this Bitcoin rebound is crucial for informed investment decisions. Continue learning about the factors influencing Bitcoin price and stay ahead in the dynamic world of cryptocurrency. Further research into Bitcoin's price action and the underlying market dynamics will allow for a more comprehensive understanding of future Bitcoin rebounds.

Featured Posts

-

New Superman Film First Glimpse Of Kryptos Heroic Deeds

May 08, 2025

New Superman Film First Glimpse Of Kryptos Heroic Deeds

May 08, 2025 -

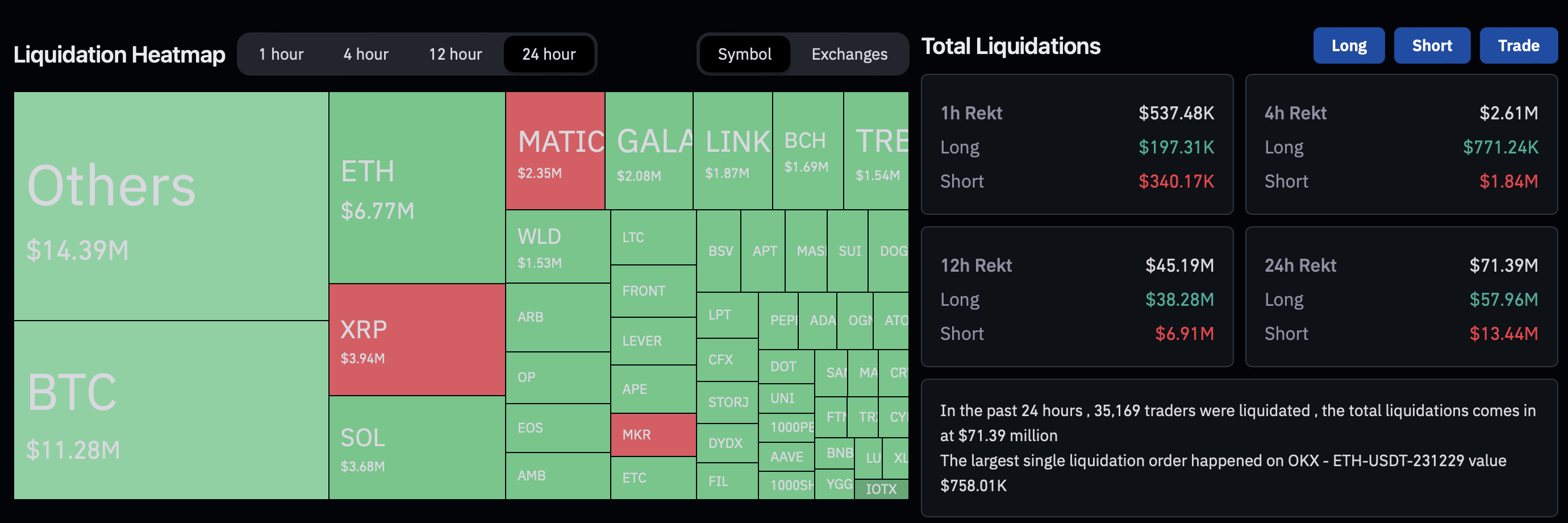

67 M In Ethereum Liquidations Is Another Market Crash Coming

May 08, 2025

67 M In Ethereum Liquidations Is Another Market Crash Coming

May 08, 2025 -

Inter Milans Sommer Thumb Injury Threatens Serie A And Champions League Hopes

May 08, 2025

Inter Milans Sommer Thumb Injury Threatens Serie A And Champions League Hopes

May 08, 2025 -

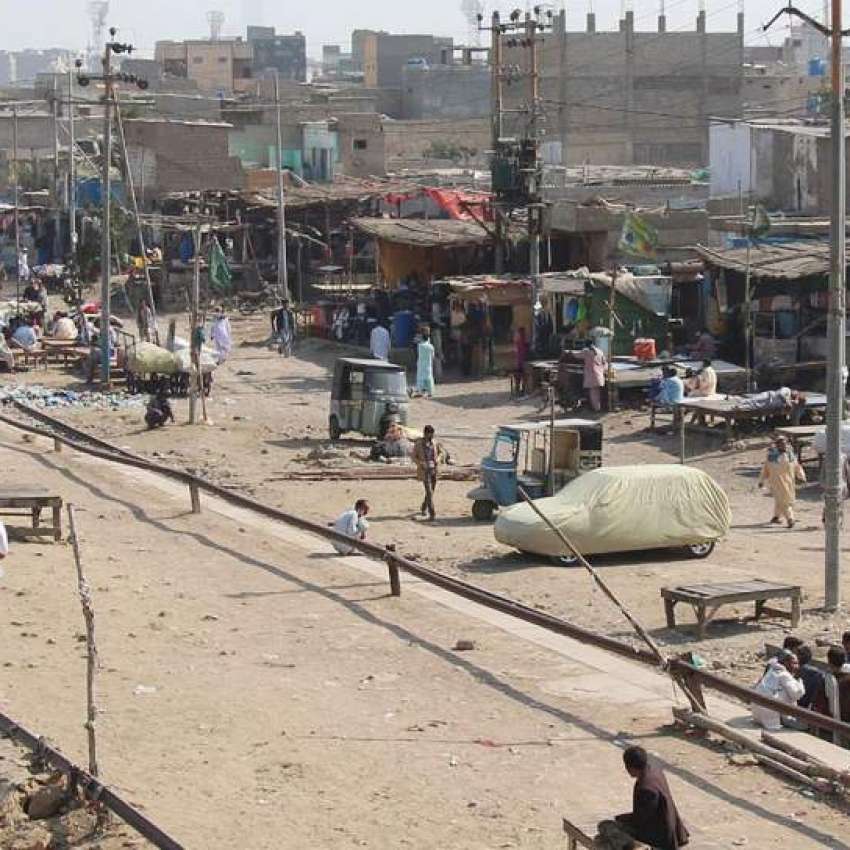

Krachy Ke Bed Lahwr Myn Bhy Py Ays Ayl Trafy Ka Dwrh

May 08, 2025

Krachy Ke Bed Lahwr Myn Bhy Py Ays Ayl Trafy Ka Dwrh

May 08, 2025 -

4 Mlzman Grftar Mraksh Myn Kshty Hadthe Awr Ansany Asmglng Ka Ankshaf

May 08, 2025

4 Mlzman Grftar Mraksh Myn Kshty Hadthe Awr Ansany Asmglng Ka Ankshaf

May 08, 2025