Bitcoin Price Prediction: Trump's 100-Day Speech And The $100,000 BTC Target

Table of Contents

Trump's Economic Policies and Their Potential Impact on Bitcoin

Trump's economic policies, even after leaving office, continue to have ripple effects on global markets, influencing the Bitcoin price prediction. Let's examine key areas:

Fiscal Policy and Bitcoin

Government spending and tax policies can significantly influence inflation. Increased government spending, for instance, can lead to higher inflation, potentially driving investors towards Bitcoin as a hedge against inflation.

- Example: A large-scale infrastructure program could increase inflation, potentially boosting Bitcoin adoption.

- Correlation: Historically, periods of high inflation have shown a positive correlation with Bitcoin's price growth. However, this isn't always guaranteed. A well-managed economy could mitigate inflationary pressures.

- Negative Correlation Potential: Unexpectedly high interest rates to curb inflation could negatively impact Bitcoin's price.

Regulatory Uncertainty and Bitcoin

Regulatory clarity (or lack thereof) profoundly impacts investor confidence. Uncertain regulatory environments can create volatility, affecting the Bitcoin price prediction.

- Example: A sudden ban on cryptocurrency trading in a major economy could trigger a sharp price drop. Conversely, clear and supportive regulations could attract institutional investment.

- Impact on Investor Confidence: Clear regulatory frameworks tend to boost investor confidence, increasing market capitalization. Uncertainty breeds fear, prompting some investors to sell.

- Legal Challenges: Ongoing legal battles surrounding Bitcoin and cryptocurrency regulation directly influence market sentiment and Bitcoin's price.

Geopolitical Events and Bitcoin's Safe Haven Status

Global political instability often leads investors to seek safe haven assets. Bitcoin's decentralized nature and limited supply make it an attractive option during times of uncertainty.

- Example: Geopolitical tensions or economic crises in major economies could drive capital into Bitcoin as investors seek to protect their wealth.

- Impact on Traditional Markets: When traditional markets experience turmoil, investors often look for alternative assets; Bitcoin frequently benefits in these scenarios.

- Capital Flight: Investors might shift their capital from traditional assets to Bitcoin, increasing demand and potentially driving up the price.

Analyzing the Path to $100,000 Bitcoin

Reaching the $100,000 BTC target hinges on several key factors. Let's explore them:

Market Adoption and Growth

Widespread adoption is crucial for Bitcoin's price appreciation. This includes increased institutional investment, technological advancements, and growing user bases.

- Metrics: Key metrics include the number of active Bitcoin wallets, transaction volume, and institutional holdings.

- Projections: Analyzing these metrics allows analysts to make projections about future growth and its impact on price.

- Technological Advancements: Improvements like the Lightning Network can enhance Bitcoin's scalability and usability, driving adoption.

Technical Analysis and Price Predictions

While technical analysis can offer insights, it's vital to acknowledge its limitations. Many analysts offer predictions, but these should be viewed cautiously.

- Predictions: Several analysts predict a Bitcoin price surpassing $100,000, with varying timelines and underlying assumptions. These predictions should be seen as speculation.

- Disclaimer: Price predictions are inherently uncertain; market conditions can change rapidly. Treat all predictions with a healthy dose of skepticism.

- Indicators: Technical indicators, such as moving averages and relative strength index (RSI), are tools that assist in analysis, but not predictors.

Bitcoin's Scarcity and Long-Term Value Proposition

Bitcoin's limited supply of 21 million coins contributes significantly to its long-term value proposition.

- Comparison with Gold: Similar to gold, Bitcoin's scarcity makes it a deflationary asset, potentially driving long-term price appreciation.

- Future Demand and Supply: As demand increases and the supply remains fixed, the price is likely to rise.

- Store of Value: Many believe Bitcoin's scarcity makes it a robust store of value, similar to gold.

Risks and Challenges to Reaching the $100,000 Target

Despite its potential, Bitcoin faces significant challenges:

Regulatory Crackdowns

Stricter regulations pose a substantial risk to Bitcoin's growth and price appreciation.

- Examples: Bans on cryptocurrency trading or excessive taxation could negatively impact the market.

- Impact on Market: Overly restrictive regulations can decrease investor confidence and limit market participation.

Market Volatility and Price Corrections

Bitcoin's price is notoriously volatile, with significant corrections occurring throughout its history.

- Historical Examples: Past market crashes highlight the inherent risk associated with cryptocurrency investments.

- Risk Management: Investors should employ risk management strategies such as diversification and dollar-cost averaging to mitigate losses.

Competition from Other Cryptocurrencies

The cryptocurrency market is competitive; other cryptocurrencies may challenge Bitcoin's dominance.

- Examples: Altcoins, offering different functionalities or scalability solutions, might attract investors away from Bitcoin.

- Impact on Dominance: Competition can affect Bitcoin's market share and potentially influence its price.

Conclusion: Bitcoin Price Prediction: Trump's 100-Day Speech and the $100,000 BTC Target

Trump's economic policies and other global events, along with market adoption, technological advancements, and Bitcoin's inherent scarcity, all contribute to the complex Bitcoin price prediction. While the $100,000 BTC target is ambitious, it's not impossible. However, significant risks like regulatory crackdowns, market volatility, and competition remain. Before investing, thorough research is essential. Conduct your own Bitcoin price prediction analysis and consult reputable financial advisors. Continue your research on Bitcoin and cryptocurrency investments by exploring reliable resources to make informed decisions. Consider further refining your Bitcoin price prediction analysis by examining other macroeconomic factors and technological developments within the crypto space.

Featured Posts

-

Dakota Johnson With Family At Materialist Premiere Photos

May 09, 2025

Dakota Johnson With Family At Materialist Premiere Photos

May 09, 2025 -

Is Colapinto The Next Red Bull Driver Lawsons Position Under Scrutiny

May 09, 2025

Is Colapinto The Next Red Bull Driver Lawsons Position Under Scrutiny

May 09, 2025 -

2024 Nl Federal Election Candidate Comparison

May 09, 2025

2024 Nl Federal Election Candidate Comparison

May 09, 2025 -

10 Essential Film Noir Movies A Binge Worthy List

May 09, 2025

10 Essential Film Noir Movies A Binge Worthy List

May 09, 2025 -

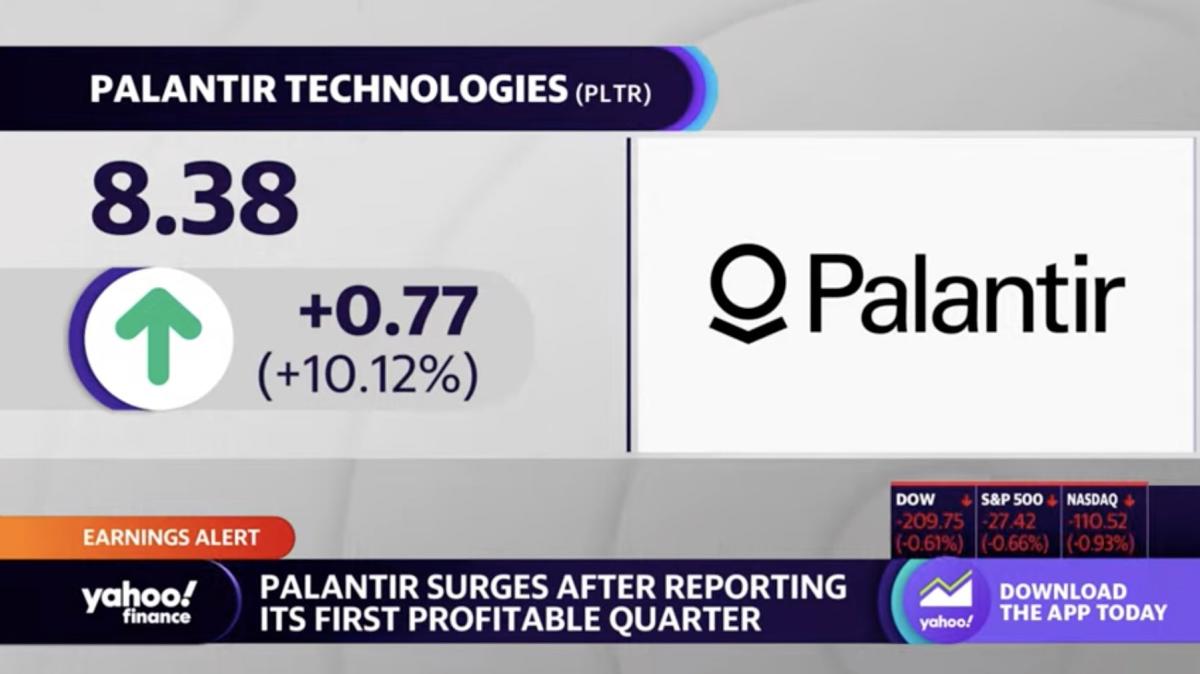

Buy Palantir Stock Before May 5th Weighing The Expert Advice

May 09, 2025

Buy Palantir Stock Before May 5th Weighing The Expert Advice

May 09, 2025