Buy Palantir Stock Before May 5th? Weighing The Expert Advice

Table of Contents

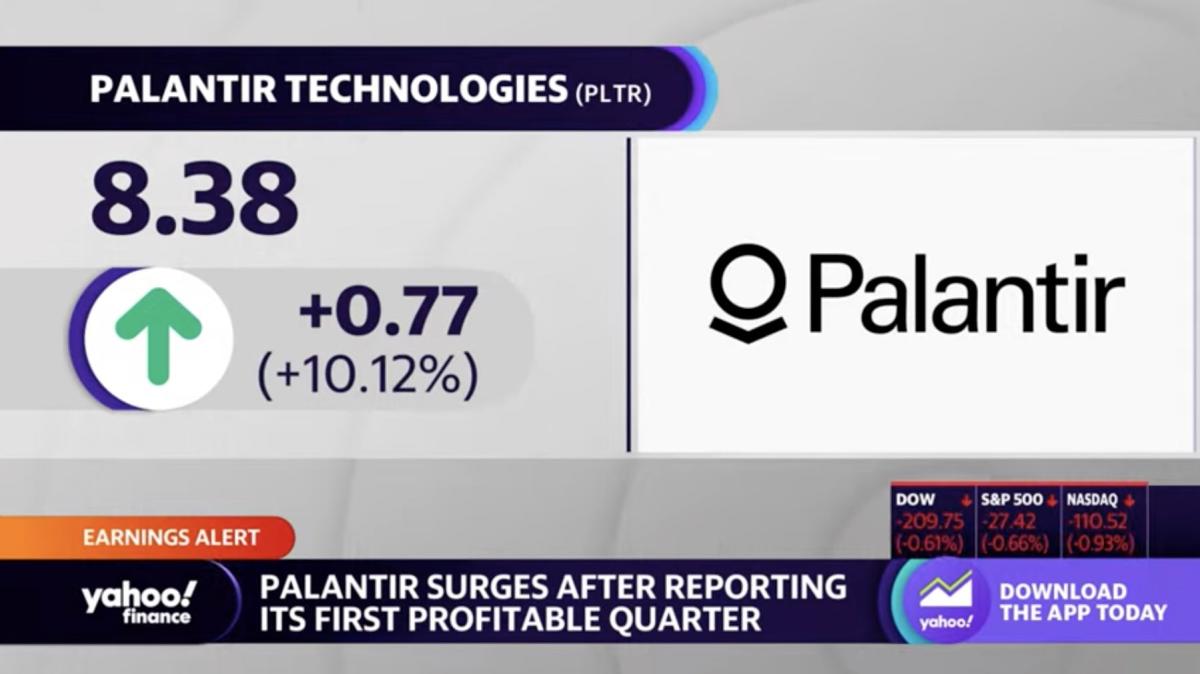

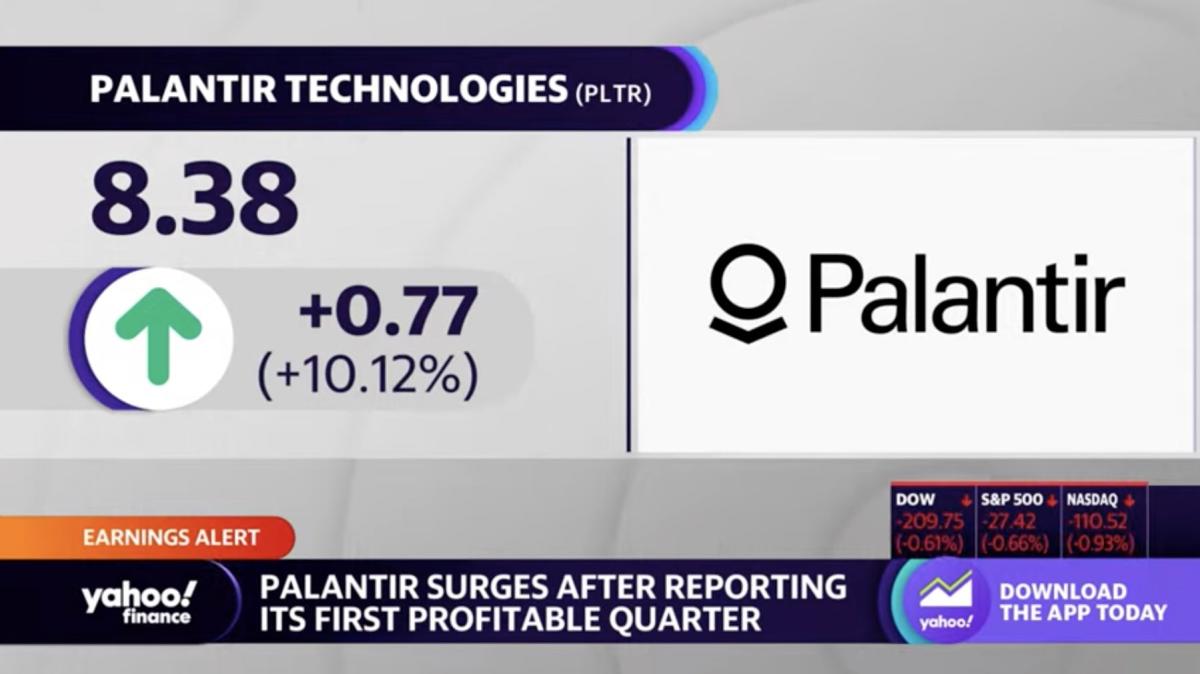

Recent Palantir Stock Performance and Trends

Palantir Technologies (PLTR) stock has experienced significant fluctuations recently. Understanding these trends is crucial before considering a "buy Palantir stock" strategy. Analyzing the Palantir stock price requires looking at both short-term and long-term trends.

- Key Price Changes and Causes: Recent price movements have been influenced by factors such as quarterly earnings reports, announcements of new contracts, and overall market sentiment towards technology stocks. Periods of increased investor confidence have led to price surges, while concerns about profitability or competition have resulted in dips. A visual representation (chart or graph, if available) would clearly illustrate these fluctuations.

- Significant News and Events: Major news events impacting Palantir's stock price include the announcement of large government contracts, partnerships with major corporations, and any updates on the company's financial performance. Positive news generally leads to a rise in the Palantir stock price, while negative news can cause a decline.

- Financial Performance: Examining Palantir's recent earnings reports, revenue growth, and profitability is essential. Investors should analyze key metrics like revenue growth rate, operating margins, and net income to gauge the company's financial health. A consistent track record of strong financial performance typically supports a higher Palantir stock price.

Expert Opinions on Palantir's Future

The opinions of financial analysts regarding Palantir's future are varied. Some analysts hold a bullish outlook on the Palantir stock forecast, predicting significant growth, while others maintain a more cautious, bearish stance.

- Bullish Predictions: Several analysts believe Palantir's unique data analytics platform and strong government contracts position the company for substantial long-term growth. They highlight Palantir's potential to expand its market share and capitalize on the growing demand for data analytics solutions. [Insert link to supporting news article or analyst report here].

- Bearish Predictions: Conversely, some analysts express concerns about Palantir's profitability and its ability to compete effectively in a crowded market. They point to potential challenges related to customer acquisition, intense competition, and the overall economic climate. [Insert link to supporting news article or analyst report here].

- Analyst Consensus: It's vital to consider the overall consensus among analysts, weighing the positive and negative predictions to form a balanced view. Look for reputable sources and consider the analysts' track records.

Analyzing Palantir's Business Model and Growth Potential

Palantir's business model centers around providing data analytics platforms to government and commercial clients. Understanding this model is key to evaluating the "buy Palantir stock" decision.

- Revenue Streams: Palantir's revenue primarily comes from software licenses and services related to its two main platforms: Gotham (for government clients) and Foundry (for commercial clients). Analyzing the relative contributions of each segment to overall revenue provides valuable insight.

- Growth Potential: Palantir's growth potential lies in both its existing markets and potential expansion into new sectors. The company has shown strong growth in government contracts and is actively pursuing opportunities in the commercial sector. The expanding adoption of data analytics across various industries points towards strong future growth potential.

- Risks and Challenges: Palantir faces challenges such as competition from established players, concerns about data privacy and security, and the need for continuous innovation to stay ahead of the curve.

Weighing the Risks and Rewards of Investing in Palantir Before May 5th

Before deciding whether to buy Palantir stock, a thorough assessment of the risks and rewards is crucial.

- Potential Downsides: Investing in Palantir before May 5th carries risks, including stock price volatility, potential for lower-than-expected financial performance, and the impact of macroeconomic factors on the company's growth. The competitive landscape also poses a risk.

- Potential Upsides: The potential rewards include significant capital appreciation if Palantir's stock price rises, driven by strong financial performance, successful market expansion, and positive investor sentiment. The potential for long-term growth in the data analytics sector is also attractive.

- Macroeconomic Factors: Broad economic trends, such as interest rate changes, inflation, and geopolitical events, can significantly influence the performance of Palantir's stock. Considering these external factors is essential for a comprehensive investment assessment.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on our analysis of Palantir's stock performance, expert opinions, and business model, investing in Palantir before May 5th presents both significant risks and potential rewards. The company shows promise, but its future performance is subject to various factors. Thorough research and consideration of your individual risk tolerance are crucial before making any investment decisions. Don't rely solely on this article; conduct your own thorough due diligence before considering buying Palantir stock. Remember that all investments carry risk, and you could lose money.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025

Elizabeth City Weekend Shooting Arrest Announced

May 09, 2025 -

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025

Snls Impression Of Harry Styles His Reaction And Why It Matters

May 09, 2025 -

Regulatory Scrutiny Indian Insurers Plea For Bond Forward Flexibility

May 09, 2025

Regulatory Scrutiny Indian Insurers Plea For Bond Forward Flexibility

May 09, 2025 -

Sensex Today Live Stock Market Updates Nifty Gains

May 09, 2025

Sensex Today Live Stock Market Updates Nifty Gains

May 09, 2025 -

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 09, 2025

Palantir And Nato How Ai Is Transforming Public Sector Operations

May 09, 2025