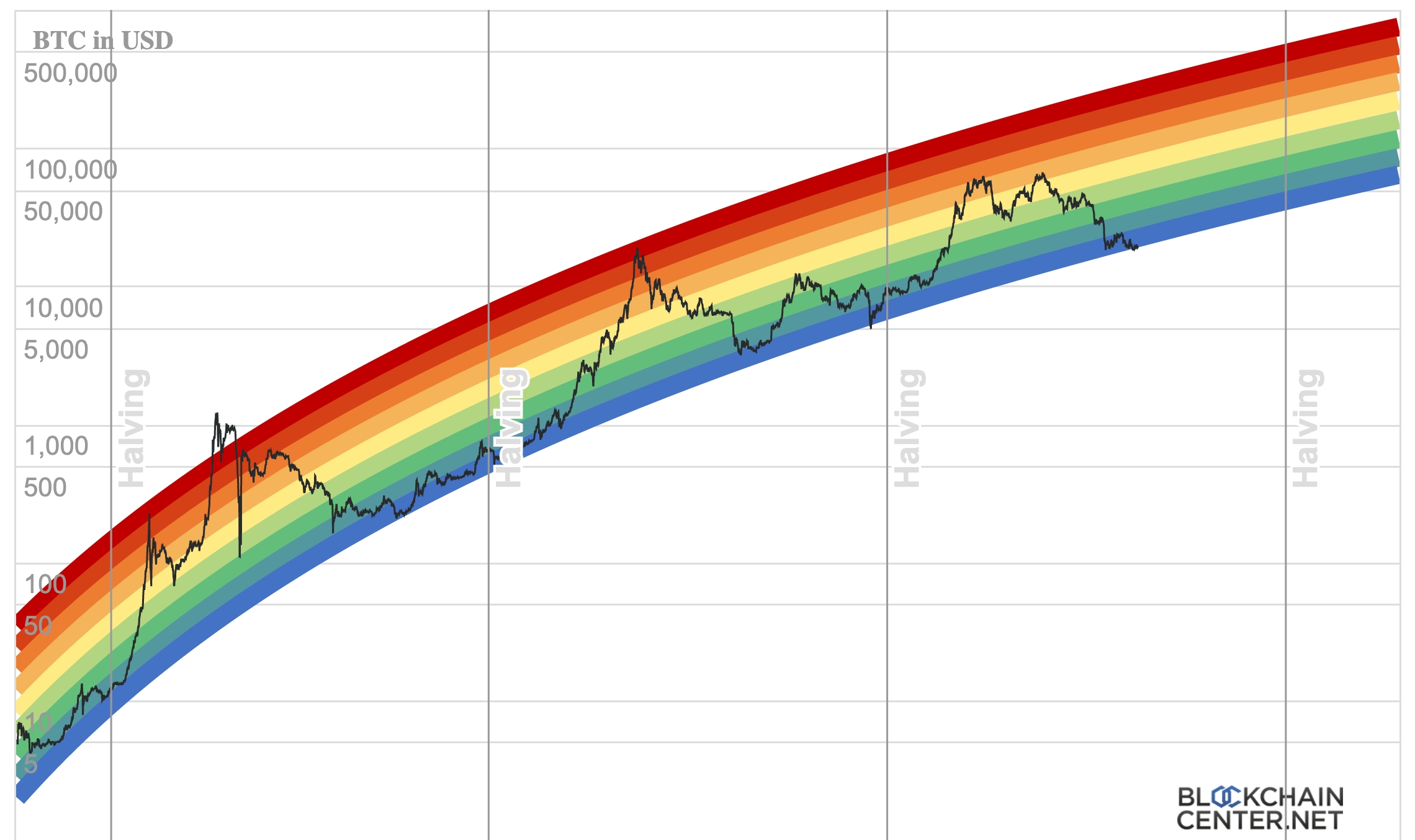

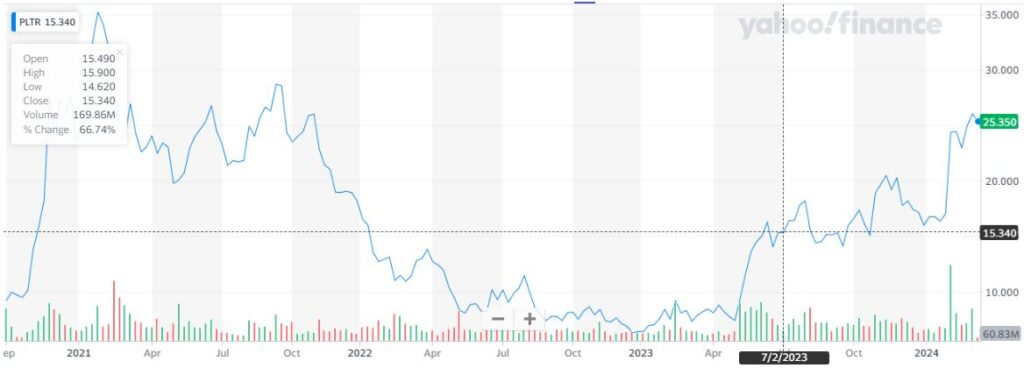

Bitcoin Price Prediction: Can Trump's Policies Push BTC Beyond $100,000?

Table of Contents

Trump's Economic Policies and Their Potential Impact on Bitcoin

Trump's economic philosophy, characterized by a blend of fiscal expansion and deregulation, could significantly influence Bitcoin's price trajectory. Let's analyze key aspects:

Fiscal Policy and Inflation

Increased government spending, a hallmark of Trump's approach, could potentially fuel inflation. Bitcoin, often touted as a hedge against inflation, might benefit from such a scenario.

- Inflation and Bitcoin Price: Historically, periods of high inflation have often seen increased demand for Bitcoin, as investors seek to protect their purchasing power.

- Potential Scenarios: Under a Trump administration prioritizing significant fiscal stimulus, we might see increased inflation, potentially driving Bitcoin's price upwards as investors flock to it as a safe haven. Conversely, if inflation remains under control, the impact on Bitcoin might be less pronounced.

- Historical Examples: The correlation between inflation and Bitcoin price is not always straightforward, and historical examples offer mixed results, highlighting the complexity of this relationship. Further research is needed to establish a definitive link.

Regulatory Uncertainty and its Effect on Bitcoin

Trump's stance on cryptocurrency regulation remains a significant wildcard. A pro-crypto approach could boost investor confidence, while an anti-crypto stance could dampen enthusiasm.

- Stricter Regulation: Increased regulatory scrutiny could lead to decreased investor confidence and potentially lower Bitcoin's price.

- Lax Regulation: A more lenient regulatory environment could foster innovation and wider adoption, potentially driving Bitcoin's price higher. This is because clarity and a predictable regulatory framework are crucial for institutional investors to enter the market.

- Regulatory Clarity: The key factor is regulatory clarity. Predictability and transparent rules are vital for encouraging institutional investment and mainstream adoption, which are essential for sustainable growth in Bitcoin's price.

Geopolitical Instability and Bitcoin's Safe Haven Status

Trump's foreign policy, marked by its unpredictability, could contribute to global uncertainty. In such an environment, Bitcoin's role as a safe-haven asset could become more prominent.

- Geopolitical Unrest and Bitcoin: Historically, periods of geopolitical instability have often seen a surge in demand for Bitcoin, as investors seek alternative assets perceived as less vulnerable to political risks.

- Correlation Analysis: Examining the historical correlation between periods of heightened geopolitical tension and Bitcoin's price performance reveals a complex relationship, with spikes in price often observed during such periods.

- Safe Haven Demand: If global uncertainties persist, we could see investors seek refuge in Bitcoin, further driving its price up. However, this depends on market sentiment and the prevailing economic conditions.

Factors Beyond Trump's Influence Affecting Bitcoin's Price

While Trump's policies might play a role, other factors independently influence Bitcoin's price:

Bitcoin's Adoption Rate and Technological Advancements

Increased adoption (both institutional and retail) and technological advancements are key drivers of Bitcoin's price regardless of Trump's influence.

- Adoption Milestones: Significant milestones like institutional investment, wider merchant acceptance, and increased retail usage contribute to price appreciation.

- Technological Advancements: Layer-2 scaling solutions, improved transaction speeds, and reduced fees all contribute to a more efficient and user-friendly Bitcoin ecosystem.

Macroeconomic Factors (Beyond Trump's Policies)

Global economic conditions, such as interest rates, recessionary fears, and inflation levels outside of any Trump-specific policies, exert a significant influence on Bitcoin's price.

- Interest Rate Hikes: Increased interest rates can negatively impact Bitcoin's price as investors may shift funds towards higher-yield assets.

- Recessionary Fears: Economic uncertainty often leads investors to seek safer havens, which can positively influence Bitcoin’s price.

Market Sentiment and Speculation

Investor sentiment, speculation, and media coverage play a crucial role in Bitcoin's price volatility.

- FOMO (Fear of Missing Out): Rapid price increases often fuel FOMO, driving further price appreciation in a self-reinforcing cycle.

- Media Influence: Positive news coverage can fuel bullish sentiment, while negative news can trigger sell-offs.

Conclusion

Predicting Bitcoin's price is notoriously difficult. While Trump's policies could significantly influence Bitcoin's price, through their impact on inflation, regulation, and geopolitical stability, other macroeconomic factors and market sentiment play equally crucial roles. Whether Trump's policies will push Bitcoin beyond $100,000 is uncertain, depending on the interplay of these various elements. The potential for such a surge exists, but it's far from guaranteed. To stay updated on the Bitcoin price and further your Bitcoin price prediction knowledge, continue researching and stay informed about relevant economic and political developments. Learn more about the impact of Trump's policies on Bitcoin and the cryptocurrency market by following reputable financial news sources.

Featured Posts

-

From Wolves Outcast To European Football Star

May 09, 2025

From Wolves Outcast To European Football Star

May 09, 2025 -

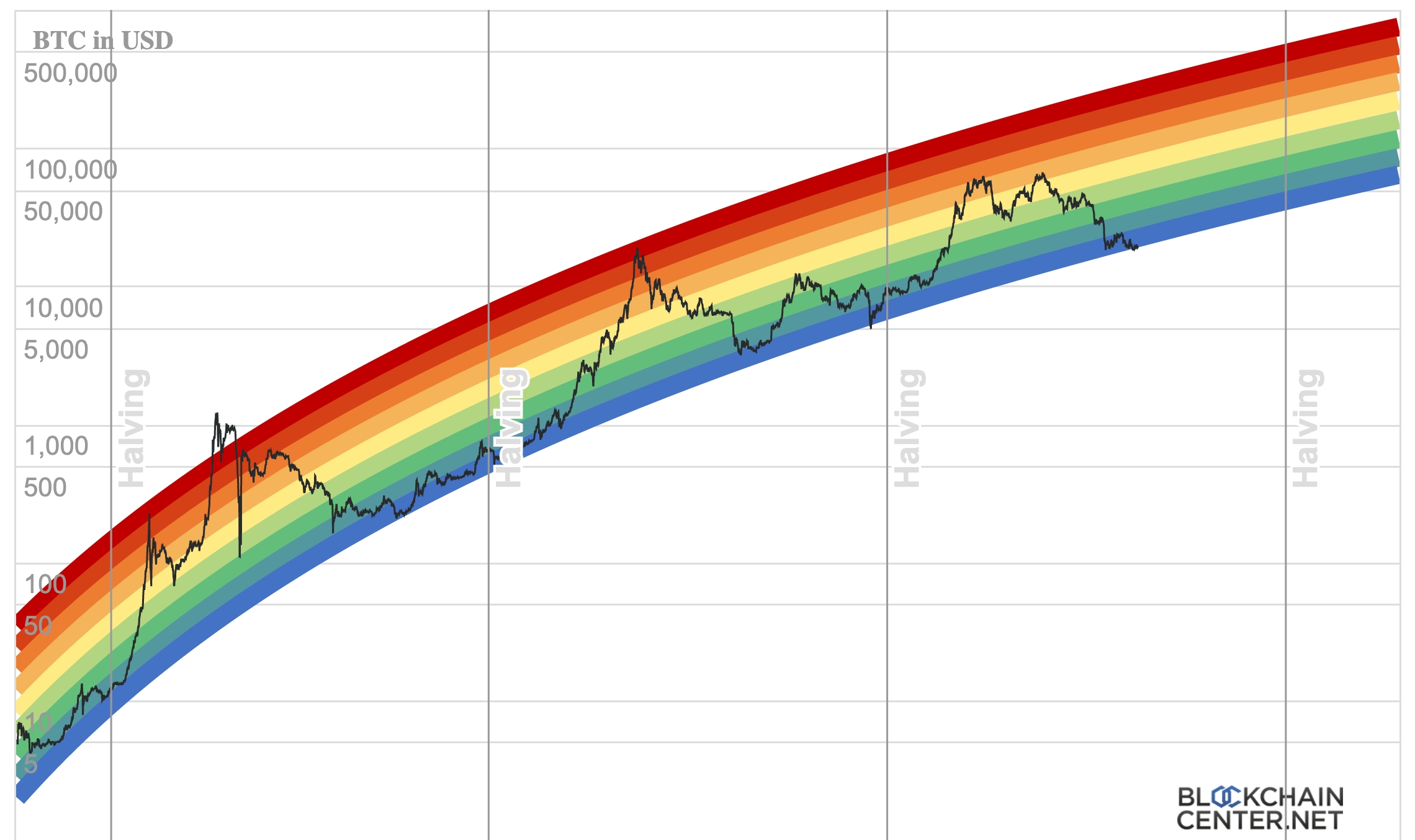

Palantir Stock Prediction Identifying Two Superior Alternatives For 2026

May 09, 2025

Palantir Stock Prediction Identifying Two Superior Alternatives For 2026

May 09, 2025 -

Cassidy Hutchinsons Memoir Key Witness To The January 6th Hearings Reveals All

May 09, 2025

Cassidy Hutchinsons Memoir Key Witness To The January 6th Hearings Reveals All

May 09, 2025 -

3 000 Babysitting Bill Vs 3 600 Daycare A Cost Comparison

May 09, 2025

3 000 Babysitting Bill Vs 3 600 Daycare A Cost Comparison

May 09, 2025 -

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025

Aeroport Permi Zakryt Podrobnosti O Snegopade I Zaderzhkakh Reysov

May 09, 2025