Bitcoin Price Forecast: Trump's Influence And The Road To $100,000

Table of Contents

Trump's Economic Policies and Bitcoin's Price

Donald Trump's economic policies could significantly impact Bitcoin's price trajectory. His potential return to power presents both opportunities and risks for the cryptocurrency market.

Deregulation and Crypto Adoption

A Trump administration might favor deregulation, potentially creating a more favorable environment for cryptocurrency adoption.

- Easing of crypto regulations: Reduced regulatory burdens could encourage institutional investment and broader public participation in the Bitcoin market.

- Increased institutional investment: A clearer regulatory landscape would likely attract more institutional investors, driving up demand and price.

- Impact on Bitcoin's price: Increased accessibility and market confidence, resulting from deregulation, could lead to substantial price appreciation.

- Examples: Trump's past attempts to reduce financial regulations, though not specifically targeting crypto, could foreshadow his future approach. The potential for a less restrictive environment could mirror past periods of rapid Bitcoin growth.

Fiscal Policy and Inflation

Trump's fiscal policies, often characterized by increased government spending, could fuel inflation. This, in turn, could affect Bitcoin's value.

- Impact of increased government spending: Expansionary fiscal policies can lead to higher inflation, potentially eroding the purchasing power of fiat currencies.

- Bitcoin as an inflation hedge: Many investors view Bitcoin as a hedge against inflation, leading to increased demand during inflationary periods.

- Historical correlation: Historical data suggests a positive correlation between inflation and Bitcoin's price in some instances, although the relationship is complex and not always consistent.

- Expert opinions: Financial analysts hold varying views on the extent to which fiscal policy influences Bitcoin valuation, with some believing the correlation is strong and others emphasizing other factors.

Geopolitical Uncertainty and Safe-Haven Assets

Geopolitical instability often drives investors toward safe-haven assets. Trump's presidency, marked by unpredictable foreign policy decisions, could significantly impact Bitcoin's appeal as a safe haven.

Bitcoin as a Safe Haven

Bitcoin's decentralized nature and limited supply make it an attractive alternative to traditional assets during times of uncertainty.

- Bitcoin during geopolitical instability: Historically, Bitcoin has shown periods of increased demand during times of political and economic turmoil.

- Comparison to gold: Bitcoin is often compared to gold as a safe-haven asset, though its volatility differentiates it significantly.

- Trump's foreign policy influence: Trump's unpredictable foreign policy decisions could increase global uncertainty, boosting Bitcoin's appeal as a store of value.

- Examples: Past geopolitical events, such as the 2020 US election or the ongoing war in Ukraine, have demonstrated Bitcoin's ability to act as a safe haven.

Global Economic Instability and Bitcoin

Global economic uncertainty, possibly exacerbated by Trump's policies, could further drive investors towards Bitcoin.

- Uncertainty driving Bitcoin demand: Investors often seek alternative assets during economic downturns or periods of uncertainty.

- Trump's contribution to uncertainty: Trump's trade policies and international relations could contribute to global economic volatility.

- Historical correlations: Analyzing past global economic events and their impact on Bitcoin's price reveals a complex relationship. Stronger correlations might emerge in the context of future economic uncertainty.

- Expert opinions: Experts have varying views on how much geopolitical factors directly affect Bitcoin's price, with some emphasizing other drivers of price movement.

Technological Advancements and Bitcoin's Future

Technological advancements are crucial for Bitcoin's long-term growth and price appreciation.

Layer-2 Scaling Solutions

Improvements in scalability are key to wider adoption and reduced transaction fees.

- Impact on transaction speed and scalability: Layer-2 solutions like the Lightning Network aim to improve Bitcoin's transaction speed and reduce congestion.

- Attracting mainstream adoption: Increased efficiency makes Bitcoin more attractive to businesses and everyday users.

- Emerging technologies: Technological innovations continuously improve Bitcoin's functionality and efficiency.

Institutional Adoption and Bitcoin's Growth

The increased involvement of institutional investors is a major driver of Bitcoin's price.

- Role of institutional investors: Large-scale investments by institutional players inject significant capital into the market.

- Stable regulatory environment: A more predictable regulatory environment makes institutional participation more appealing.

- Recent trends: Observe the increasing trends of institutional investment in Bitcoin in recent years.

Factors Against a $100,000 Bitcoin Price

While a $100,000 Bitcoin price is theoretically possible, several factors could hinder its ascent.

Regulatory Risks

Government regulations pose significant challenges to Bitcoin's growth.

- Increased regulation hindering growth: Stricter regulations could limit Bitcoin's accessibility and stifle innovation.

- Government crackdowns: The potential for government crackdowns on cryptocurrencies remains a considerable risk.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile, making significant price corrections likely.

- Inherent volatility: Bitcoin's price is known for its dramatic swings.

- Likelihood of price corrections: Expect periods of significant price drops along the way to $100,000.

Competition from other Cryptocurrencies

Competition from other cryptocurrencies could affect Bitcoin's market dominance.

- Impact of competing cryptocurrencies: The emergence of new cryptocurrencies with innovative features could dilute Bitcoin's market share.

Conclusion

This Bitcoin price forecast has examined the potential influence of Donald Trump's policies, geopolitical events, and technological advancements on Bitcoin's price, exploring both the possibilities and challenges on the road to $100,000. While Trump's actions could potentially create a bullish environment, several factors could also hinder Bitcoin's ascent. Careful consideration of these factors is crucial for any Bitcoin price prediction.

Call to Action: Stay informed about the latest developments influencing the Bitcoin price forecast. Continue to research and understand the factors affecting this volatile market, and make informed decisions regarding your Bitcoin investments. Monitor the ongoing impact of political factors and technological advancements on the future of Bitcoin. A thorough understanding of the Bitcoin price forecast is essential for navigating this dynamic market.

Featured Posts

-

Ben Affleck On Matt Damons Calculated Career Path

May 08, 2025

Ben Affleck On Matt Damons Calculated Career Path

May 08, 2025 -

Ps Plus Premium And Extra March 2024 Game Additions

May 08, 2025

Ps Plus Premium And Extra March 2024 Game Additions

May 08, 2025 -

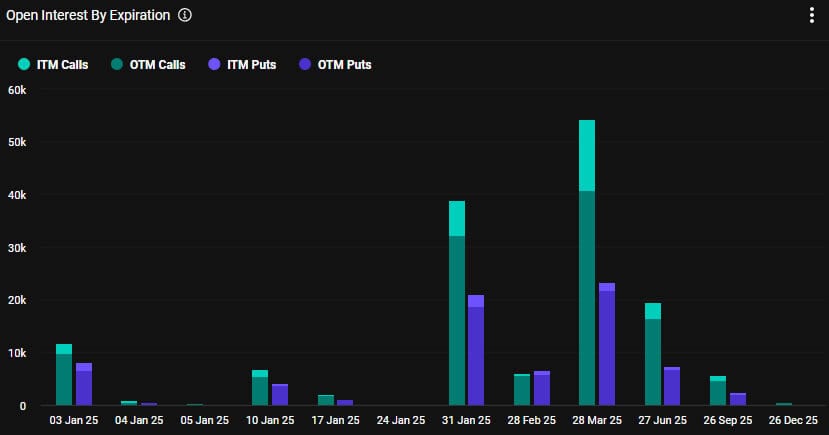

Billions In Crypto Options Expiring What To Expect For Bitcoin And Ethereum

May 08, 2025

Billions In Crypto Options Expiring What To Expect For Bitcoin And Ethereum

May 08, 2025 -

Why Reliability And Trust In Crypto News Are Crucial In 2024

May 08, 2025

Why Reliability And Trust In Crypto News Are Crucial In 2024

May 08, 2025 -

Hot New Spac Stock A Potential Micro Strategy Challenger

May 08, 2025

Hot New Spac Stock A Potential Micro Strategy Challenger

May 08, 2025