Bitcoin Mining Boom: Exploring The Factors Behind This Week's Growth

Table of Contents

Increased Bitcoin Price and Profitability

A higher Bitcoin price is intrinsically linked to increased profitability for miners. This is a fundamental driver of the current Bitcoin mining boom.

Direct Correlation Between Price and Mining Revenue:

- Increased revenue per block mined: The reward for successfully mining a block of Bitcoin transactions is fixed (currently 6.25 BTC), but its value in fiat currency directly reflects the Bitcoin price. A higher Bitcoin price means a significantly larger reward in USD, EUR, or other national currencies.

- Higher profitability incentivizes new miners: The increased profitability makes Bitcoin mining more attractive to new entrants, leading to a surge in mining operations. This influx of new miners adds to the network's overall hash rate.

- Existing miners increase their hash rate: Established miners are incentivized to expand their operations, increasing their computing power (hash rate) to capitalize on higher profits. This also contributes to the growing network hash rate.

Impact of Difficulty Adjustment:

Bitcoin's difficulty adjustment mechanism is crucial for maintaining the network's security and stability. It automatically adjusts the computational difficulty of mining new blocks roughly every two weeks, targeting a consistent block generation time of approximately 10 minutes.

- Difficulty adjustment explanation: If the network's hash rate increases significantly, the difficulty adjusts upwards, making it harder to mine blocks. This prevents an excessive increase in block creation speed. Conversely, if the hash rate decreases, the difficulty adjusts downwards.

- How it impacts miner revenue: Difficulty adjustments directly impact miner profitability. A higher difficulty reduces the likelihood of mining a block in a given time frame.

- The effect on the market: The difficulty adjustment acts as a self-regulating mechanism. It ensures the network remains secure even during periods of significant hash rate fluctuations, ultimately affecting the overall stability of the Bitcoin market.

Technological Advancements and Energy Efficiency

Technological innovation has played a critical role in the ongoing Bitcoin mining boom. Improvements in hardware and the adoption of more sustainable energy sources are key factors.

Advancements in Mining Hardware:

- New ASIC releases: The development and release of new, more powerful Application-Specific Integrated Circuits (ASICs) constantly push the boundaries of mining efficiency. These specialized chips are designed specifically for Bitcoin mining and offer significantly higher hash rates compared to their predecessors.

- Increased hash rate per unit of power: New ASICs generally offer a higher hash rate per watt of energy consumed, making mining more energy-efficient and cost-effective.

- Lower operational costs: Improved energy efficiency translates into lower operational costs for miners, enhancing their profitability even during periods of lower Bitcoin prices.

Renewable Energy Sources for Mining:

- Reduced environmental concerns: The increasing use of renewable energy sources, such as solar and hydro power, is mitigating concerns about Bitcoin mining's environmental impact.

- Lower electricity costs: In many regions, renewable energy sources offer lower electricity prices compared to traditional fossil fuels, making Bitcoin mining more economically viable.

- Growing adoption of solar and hydro power: More mining operations are transitioning to renewable energy, driven by both cost savings and environmental responsibility.

Regulatory Landscape and Institutional Adoption

The regulatory environment and the growing interest from institutional investors also significantly influence the Bitcoin mining boom.

Favorable Regulatory Environments:

- Specific examples of countries with supportive regulations: Some jurisdictions have created more favorable regulatory frameworks for cryptocurrency mining, attracting substantial investments and operations. These include countries with abundant and inexpensive renewable energy sources.

- The effects on investment and mining operations: Clearer regulations reduce uncertainty, encouraging both domestic and foreign investment in the Bitcoin mining sector.

Growing Institutional Interest:

- Increased investment in mining companies: Large institutional investors are increasingly allocating capital to Bitcoin mining companies, providing them with the resources to expand their operations.

- Impact on the price of Bitcoin: This increased institutional investment has a positive knock-on effect, pushing the price of Bitcoin higher, which in turn further boosts mining profitability.

- Implications for future growth: The involvement of institutional investors signifies a growing level of trust and legitimacy in the Bitcoin ecosystem, paving the way for future growth in the mining sector.

Network Security and Decentralization

A healthy and thriving Bitcoin mining sector is vital for the security and decentralization of the entire Bitcoin network.

The Importance of a Secure Network:

- Relationship between hash rate and network security: A high hash rate makes it computationally infeasible for any single entity or group to control the network and manipulate transactions (51% attack). The Bitcoin mining boom increases the overall hash rate, improving network security.

- Protection against 51% attacks: The more miners participate in securing the network, the less likely a 51% attack, which could compromise the integrity of the blockchain, becomes.

- Benefits of decentralization: A decentralized network is resistant to censorship and single points of failure, ensuring the long-term resilience of the Bitcoin ecosystem.

Conclusion

The current Bitcoin mining boom is fueled by a confluence of factors: the increased Bitcoin price driving profitability; significant technological advancements enhancing efficiency; a more favorable regulatory landscape in certain regions; and the growing interest from institutional investors. This synergistic effect has resulted in a surge in mining activity, strengthening the Bitcoin network’s security and decentralization. The future outlook for Bitcoin mining remains positive, with ongoing technological innovation and potential regulatory changes likely to shape the industry's trajectory. Stay informed about the exciting developments in the Bitcoin mining space and understand the factors driving this Bitcoin mining boom. Learn more about Bitcoin mining profitability and investment strategies at [link to relevant resource].

Featured Posts

-

Putin Announces Victory Day Ceasefire What To Expect

May 09, 2025

Putin Announces Victory Day Ceasefire What To Expect

May 09, 2025 -

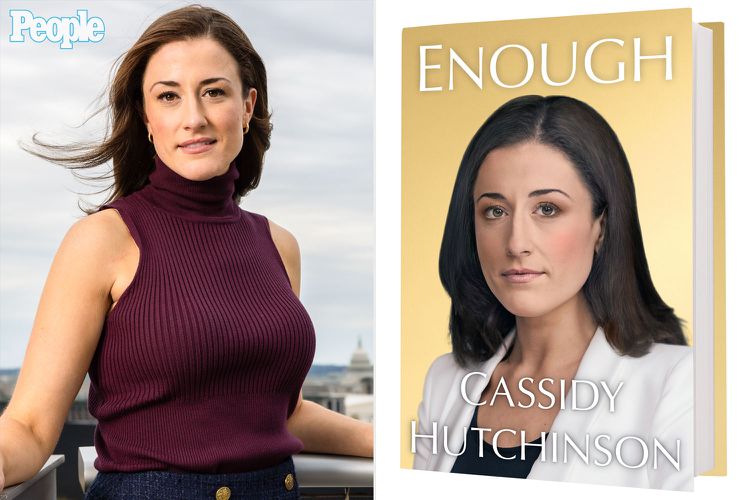

Cassidy Hutchinson Memoir What To Expect From The January 6th Hearing Witness

May 09, 2025

Cassidy Hutchinson Memoir What To Expect From The January 6th Hearing Witness

May 09, 2025 -

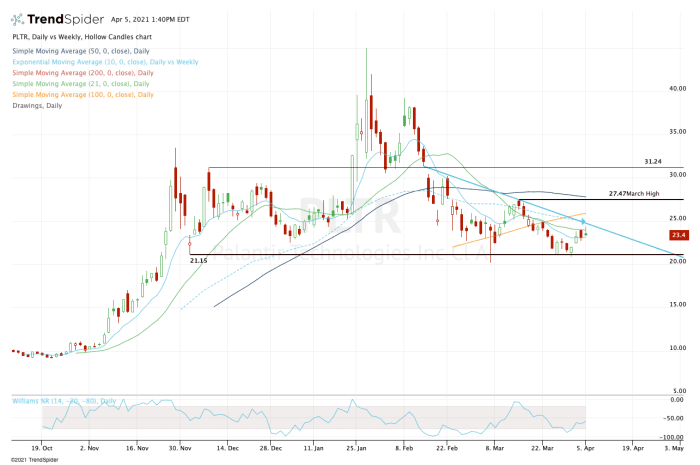

Is Palantir Stock A Good Buy Before May 5th Weighing The Risks And Rewards

May 09, 2025

Is Palantir Stock A Good Buy Before May 5th Weighing The Risks And Rewards

May 09, 2025 -

Dakota Johnson With Family At Materialist L A Screening

May 09, 2025

Dakota Johnson With Family At Materialist L A Screening

May 09, 2025 -

Germaniya Riski Novogo Naplyva Bezhentsev Iz Ukrainy Iz Za Politiki S Sh A

May 09, 2025

Germaniya Riski Novogo Naplyva Bezhentsev Iz Ukrainy Iz Za Politiki S Sh A

May 09, 2025