Is Palantir Stock A Good Buy Before May 5th? Weighing The Risks And Rewards

Table of Contents

Palantir's Recent Performance and Financial Health

Understanding Palantir's recent financial health is crucial before considering a purchase. Analyzing recent quarterly and annual reports reveals key insights into the company's performance and potential for future growth. We need to look beyond simple headline numbers and dig deeper into the specifics.

-

Revenue Growth Rate: Comparing Palantir's revenue growth rate to previous years and industry benchmarks provides a clear picture of its performance trajectory. A consistent upward trend suggests strong market demand and effective business strategies. However, a slowdown or decline warrants closer scrutiny.

-

Profitability Analysis: Examining key profitability metrics like gross margin, operating margin, and net income provides crucial information about Palantir's ability to translate revenue into profit. Improving margins indicate increased efficiency and pricing power, while declining margins may signal challenges in the marketplace.

-

Cash Flow: A strong cash flow is essential for any company's sustainability and growth. Analyzing Palantir's cash flow statements reveals its ability to fund operations, invest in research and development, and manage debt. Healthy cash flow is a positive indicator of future investment potential.

-

Significant Partnerships and Contract Wins: Palantir's success is heavily influenced by its ability to secure large contracts, particularly within the government sector. Tracking significant partnerships and contract wins offers a valuable insight into the company's future revenue streams and growth prospects. Recent wins in the commercial sector also represent significant milestones in its diversification strategy. These factors heavily impact Palantir financials and subsequent PLTR stock performance.

Analyzing Palantir's Growth Potential and Future Outlook

Palantir's long-term growth hinges on its ability to capitalize on several key market opportunities. Its success in the government contracting landscape and its expansion into the commercial sector will significantly shape its future.

-

Government Contracting Landscape: The government contracting landscape is often complex and subject to change. Analyzing the potential for future awards, considering factors such as budget allocations and evolving government priorities, is crucial to assessing Palantir's prospects in this sector.

-

Commercial Sector Expansion: Palantir's ability to successfully penetrate and expand within the commercial sector represents a significant growth opportunity. Analyzing its success in attracting and retaining commercial clients, its ability to adapt its products to diverse commercial needs, and its competitive positioning are key factors to consider. This segment will play a larger role in the Palantir future.

-

Emerging Technologies: Palantir's focus on emerging technologies like AI and data analytics positions it well for future growth. However, competition in these rapidly evolving fields is fierce. Understanding Palantir's technological edge and its ability to innovate and adapt to market trends is vital. Palantir AI initiatives, in particular, warrant close attention.

-

Disruptive Technologies and Competitors: The technology sector is highly dynamic, with constant innovation and the emergence of new competitors. Assessing the potential impact of disruptive technologies and the competitive landscape is essential for evaluating Palantir's long-term growth prospects and Palantir market share. A thorough understanding of Palantir growth in the face of competitive pressures is critical.

Assessing the Risks Associated with Investing in Palantir Stock

Despite its potential, investing in Palantir stock carries significant risks. Understanding these risks is crucial before making any investment decisions.

-

Market Volatility: The technology sector is inherently volatile, and Palantir stock price is particularly susceptible to market fluctuations. Understanding this volatility and its potential impact on your investment is essential. Palantir risks are amplified by the general market volatility.

-

Competition: Palantir faces stiff competition from established players and emerging startups in the data analytics and AI sectors. Understanding the competitive landscape and Palantir's ability to maintain a competitive edge is crucial. Palantir competition is a key factor influencing PLTR stock volatility.

-

Dependence on Government Contracts: Palantir's substantial reliance on government contracts exposes it to the risks associated with government budget cuts, policy changes, and potential delays in contract awards. This dependence introduces significant Palantir investment risks.

-

Legal and Regulatory Risks: Operating in a heavily regulated industry, Palantir faces potential legal and regulatory risks. Understanding these risks and their potential impact is essential for a comprehensive assessment.

Valuation and Stock Price Analysis

Analyzing Palantir's valuation compared to its peers and historical performance helps determine if the current stock price reflects its true worth.

-

Valuation Metrics: Comparing Palantir's price-to-sales (P/S) ratio and price-to-earnings (P/E) ratio to those of its competitors provides a benchmark for assessing its relative valuation.

-

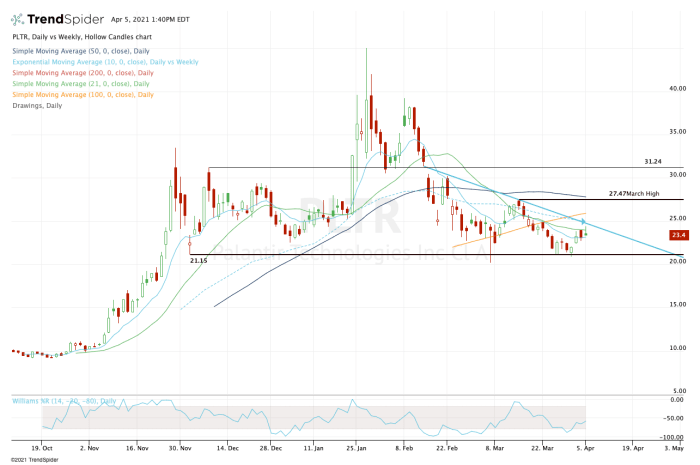

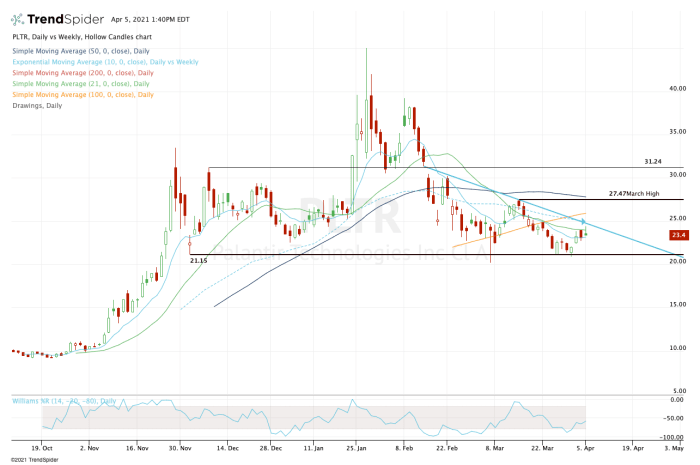

Historical Price Fluctuations: Analyzing historical price fluctuations of PLTR stock reveals its volatility and helps in understanding its price behavior patterns.

-

Analyst Ratings and Price Targets: Consulting analyst ratings and price targets provides additional perspectives on Palantir's valuation and future price movements. However, remember that these are opinions, not guarantees. Analyzing Palantir valuation is crucial for understanding Palantir stock price dynamics.

Conclusion

This article analyzed Palantir's recent performance, growth prospects, and inherent risks to help investors decide whether it's a good buy before the May 5th earnings announcement. We've weighed the potential rewards against the considerable risks involved. Remember that all investments carry risk, and this analysis is not financial advice. Before making any investment decisions regarding Palantir stock, conduct thorough due diligence and consult with a financial advisor. Do your own research and determine if a Palantir investment aligns with your risk tolerance and financial goals before May 5th. Is Palantir stock right for your portfolio?

Featured Posts

-

Katya Joness Bbc Exit A Wynne Evans Betrayal

May 09, 2025

Katya Joness Bbc Exit A Wynne Evans Betrayal

May 09, 2025 -

Proces Pour Violences Conjugales A Dijon Le Boxeur Bilel Latreche Convoque

May 09, 2025

Proces Pour Violences Conjugales A Dijon Le Boxeur Bilel Latreche Convoque

May 09, 2025 -

Elon Musk Billions Richer Tesla Rally Fuels Wealth Increase

May 09, 2025

Elon Musk Billions Richer Tesla Rally Fuels Wealth Increase

May 09, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywood Productions

May 09, 2025

Wga And Sag Aftra Strike What It Means For Hollywood Productions

May 09, 2025 -

Fox News Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025

Fox News Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025