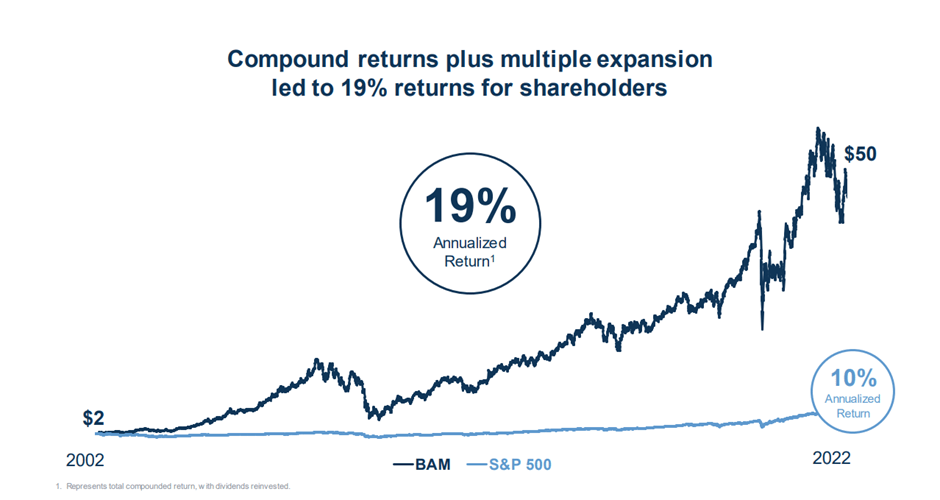

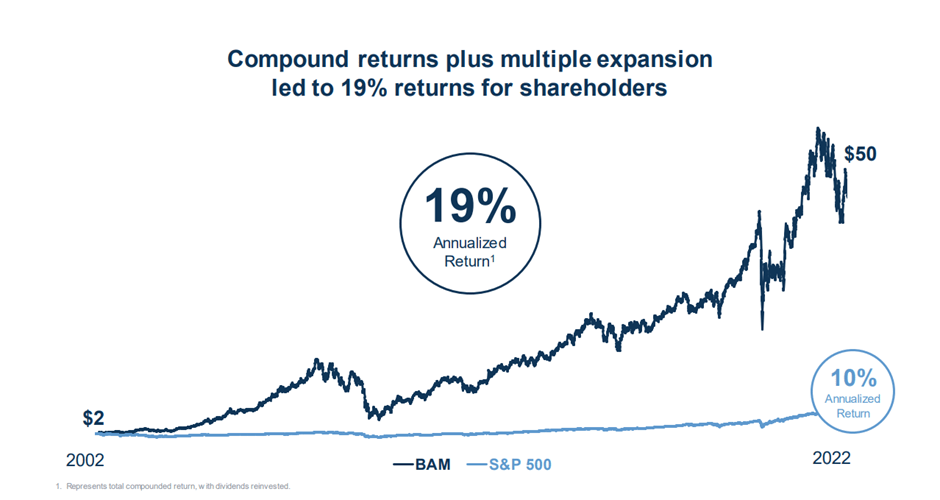

Brookfield Capitalizes On Market Dislocation With Opportunistic Investments

Table of Contents

Identifying Market Dislocations

Brookfield's success stems from a sophisticated, multi-faceted approach to identifying market dislocations. This process involves a combination of macroeconomic analysis, sector-specific research, and rigorous due diligence.

Macroeconomic Factors

Global events significantly shape investment opportunities. Brookfield's team meticulously analyzes macroeconomic trends to pinpoint sectors poised for disruption and subsequent recovery.

- Inflationary pressures: High inflation can create opportunities in sectors like energy and commodities, as prices adjust.

- Interest rate hikes: Rising interest rates can impact real estate valuations, creating opportunities for bargain purchases.

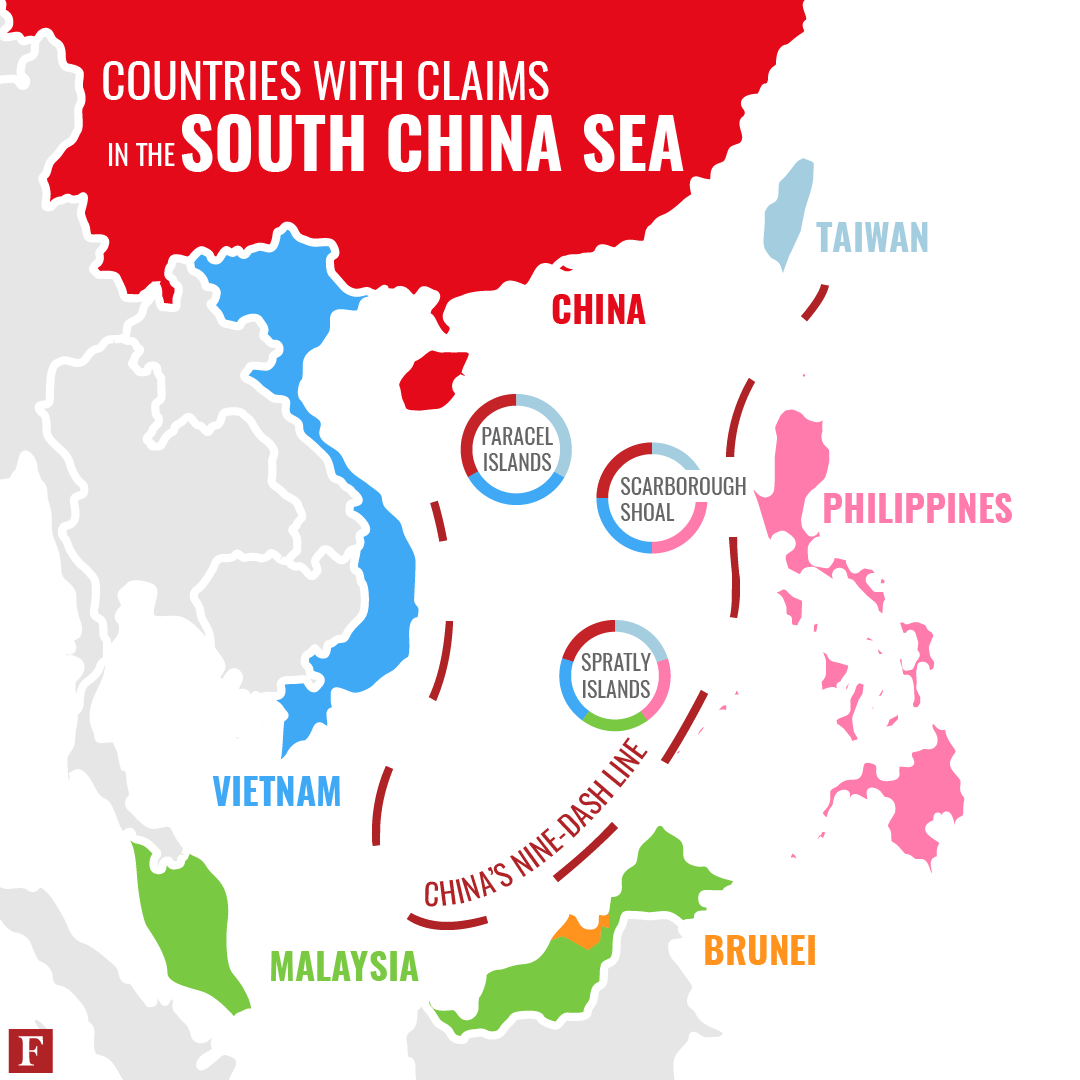

- Geopolitical instability: Global conflicts can lead to supply chain disruptions, opening doors for strategic investments in resilient sectors.

- Technological advancements: Rapid technological changes can disrupt traditional industries, creating opportunities for investment in innovative solutions.

By meticulously tracking these macroeconomic factors and their ripple effects, Brookfield identifies areas ripe for opportunistic investment. This "macroeconomic analysis" forms the foundation of their investment strategy.

Sector-Specific Analysis

Brookfield doesn't rely solely on macroeconomic trends. They conduct in-depth sector-specific analysis to uncover undervalued assets and opportunities for growth.

- Real Estate: Market downturns often create opportunities to acquire undervalued properties in prime locations.

- Infrastructure: Brookfield invests in essential infrastructure projects, capitalizing on long-term growth potential even during economic instability.

- Renewable Energy: The transition to cleaner energy sources offers lucrative investment opportunities, especially as government policies incentivize renewable energy projects.

- Private Equity: Brookfield actively seeks undervalued companies in various sectors, offering potential for significant turnaround and growth.

This targeted "sector analysis" allows Brookfield to focus resources on sectors exhibiting the greatest potential for returns during periods of market dislocation.

Due Diligence and Risk Assessment

Brookfield’s rigorous due diligence process is paramount to their success. It minimizes risk and maximizes potential returns.

- Comprehensive financial analysis: Thorough examination of target companies' financials, including historical performance, current liabilities, and future projections.

- Detailed market research: Assessing market conditions, competitive landscape, and regulatory environment.

- Management team evaluation: Evaluating the experience, competence, and integrity of the management team.

- Risk mitigation strategies: Developing strategies to mitigate potential risks, such as hedging against market fluctuations or diversifying investments.

This thorough "due diligence" and robust "risk management" framework ensures Brookfield makes informed decisions, reducing the potential for losses and enhancing the likelihood of successful investments.

Brookfield's Opportunistic Investment Strategies

Brookfield's approach to opportunistic investing goes beyond simply identifying undervalued assets. It involves a dynamic, multi-pronged strategy.

Value Investing Approach

Brookfield embraces a core philosophy of "value investing," focusing on identifying assets trading below their intrinsic worth.

- Long-term perspective: Brookfield takes a long-term view, patiently waiting for market conditions to favor their investments.

- Fundamental analysis: Focusing on the underlying value of assets rather than short-term market fluctuations.

- Margin of safety: Building in a margin of safety to protect against unforeseen circumstances.

Examples of successful "value investments" include Brookfield's strategic acquisitions of distressed real estate portfolios during the 2008 financial crisis.

Active Portfolio Management

Brookfield actively manages its portfolio, constantly adapting to changing market conditions.

- Dynamic asset allocation: Adjusting investment allocations based on market trends and opportunities.

- Strategic divestments: Selling assets when market conditions are favorable to maximize returns.

- Reinvesting profits: Using profits from successful investments to fund new opportunities.

This "active investing" and adept "market timing" allows Brookfield to capitalize on short-term fluctuations while maintaining a long-term vision.

Strategic Partnerships and Joint Ventures

Brookfield frequently collaborates with other investors and industry experts through "strategic partnerships" and "joint ventures."

- Access to expertise: Leveraging the expertise of partners to enhance investment analysis and execution.

- Shared risk and resources: Distributing risk and pooling resources for larger-scale investments.

- Unique opportunities: Gaining access to exclusive investment opportunities through established networks.

These collaborations significantly expand Brookfield's reach and capabilities.

Case Studies of Successful Opportunistic Investments

Brookfield's track record speaks volumes. Here are a couple of examples:

Example 1: Real Estate Acquisition in London

During a period of economic uncertainty in the UK, Brookfield identified and acquired a portfolio of undervalued commercial properties in central London. Through strategic renovations and effective leasing strategies, they significantly increased the value of these assets, generating substantial returns.

- Sector: Real Estate

- Strategy: Value investing, active portfolio management

- Return on Investment: Significant capital appreciation and increased rental income.

Example 2: Infrastructure Investment in North America

Brookfield invested in a portfolio of toll roads and other infrastructure assets during a period of low investor confidence. The long-term nature of the infrastructure assets provided stable cash flows, even during economic downturns, generating predictable returns.

- Sector: Infrastructure

- Strategy: Value investing, long-term investment

- Return on Investment: Steady cash flow and capital appreciation.

These "case studies" demonstrate Brookfield's ability to identify and capitalize on opportunities during market dislocations.

Conclusion

Brookfield's success in capitalizing on market dislocations is a testament to their sophisticated approach. Their meticulous identification of undervalued assets, coupled with their dynamic investment strategies and rigorous risk management, has consistently generated substantial returns. The key takeaways are the importance of thorough macroeconomic analysis, targeted sector-specific research, and the active management of a diversified portfolio. By understanding and applying these principles, investors can improve their chances of capitalizing on market volatility. To learn more about Brookfield's investment strategies and explore similar "opportunistic investment strategies" for your own portfolio, conduct further research into their publicly available information and consider consulting with a financial advisor specializing in "capitalizing on market volatility."

Featured Posts

-

Lahwr Ky Ahtsab Edaltwn Ka Mstqbl 5 Edaltwn Ke Khatme Ke Bed

May 08, 2025

Lahwr Ky Ahtsab Edaltwn Ka Mstqbl 5 Edaltwn Ke Khatme Ke Bed

May 08, 2025 -

Resolving The U S China Trade Dispute The Significance Of The Upcoming Meeting

May 08, 2025

Resolving The U S China Trade Dispute The Significance Of The Upcoming Meeting

May 08, 2025 -

Ghana Health Authority Condemns Proposed Jhl Privatisation

May 08, 2025

Ghana Health Authority Condemns Proposed Jhl Privatisation

May 08, 2025 -

Ikea And Sonos Officially Part Ways Future Of Wireless Speakers

May 08, 2025

Ikea And Sonos Officially Part Ways Future Of Wireless Speakers

May 08, 2025 -

Colin Cowherd And Jayson Tatum A Continuing Disagreement

May 08, 2025

Colin Cowherd And Jayson Tatum A Continuing Disagreement

May 08, 2025