Big Oil's Resistance: Impact On Global Oil Prices Before OPEC+ Decision

Table of Contents

Big Oil's Push for Increased Production

Profit Maximization vs. Market Stability

Big Oil companies face a classic dilemma: maximizing short-term profits versus contributing to market stability. While OPEC+ aims for a stable and predictable oil supply, Big Oil's primary focus is often on maximizing shareholder returns. Increased production, while potentially boosting global oil supply, could lead to lower crude oil prices, impacting profitability.

- Short-term consequences: Lower prices could reduce immediate profits for Big Oil, but increased market share might be a compensating factor.

- Long-term consequences: Sustained lower prices could discourage future investment in oil exploration and production, potentially leading to supply shortages in the long run. This could also negatively impact the long-term profitability of Big Oil companies.

Analysis of Individual Oil Majors' Stances

The actions and statements of major players like ExxonMobil, Chevron, Shell, and BP reveal a complex picture. While some publicly express support for stable markets, their actions sometimes suggest a preference for increased production. Analyzing these discrepancies is crucial to understanding Big Oil's resistance.

- ExxonMobil: Recent announcements suggest a focus on maximizing production from existing assets.

- Chevron: Has maintained a relatively neutral stance, emphasizing the need to meet global energy demand.

- Shell & BP: Both companies are increasingly focused on renewable energy, but their oil and gas production remains significant, potentially influencing their approach to the OPEC+ decision.

- Political and regulatory pressures: Governments are pressuring major oil companies to increase production to counter high energy prices, creating a difficult balancing act for these companies.

OPEC+'s Response to Big Oil's Resistance

The Balancing Act

OPEC+ faces a significant challenge: balancing the interests of its member states with the actions of independent producers like the major oil companies. Big Oil's resistance complicates the decision-making process regarding production cuts or increases.

- Potential for compromise: OPEC+ might attempt to negotiate with Big Oil to reach a mutually acceptable production level.

- Potential for conflict: If Big Oil continues its push for increased production, it could trigger retaliatory measures from OPEC+, further destabilizing the market.

Geopolitical Considerations

Geopolitical factors significantly influence both OPEC+'s decision and Big Oil's actions. The ongoing war in Ukraine, for example, has created energy security concerns and impacted global oil supply chains.

- International relations: Sanctions against Russia have disrupted global oil markets and influenced both OPEC+ and Big Oil strategies.

- Energy security: Countries are prioritizing energy independence, potentially altering their responses to Big Oil's resistance.

The Impact on Global Oil Prices

Predicting Price Fluctuations

Big Oil's resistance adds another layer of uncertainty to predicting oil prices. The outcome of the OPEC+ decision will significantly affect future prices, as will Big Oil's continued behavior.

- Scenario 1 (OPEC+ cuts production): If OPEC+ implements production cuts, it could push prices higher, despite Big Oil's attempts to increase output.

- Scenario 2 (OPEC+ maintains or increases production): This scenario might lead to more stable or lower prices, depending on the extent of Big Oil's production increases and global demand.

- Demand fluctuations: Seasonal changes in demand, as well as economic growth or recession, will also influence price movements, independently of Big Oil's resistance.

Consequences for Consumers and the Global Economy

Price volatility caused by Big Oil's resistance has significant implications for consumers and the global economy. High oil prices contribute to inflation, reduce economic growth, and impact energy affordability, particularly for vulnerable populations.

- Inflationary pressures: High oil prices contribute directly to higher transportation costs, affecting the price of goods and services.

- Economic growth: Increased energy costs can stifle economic growth, as businesses face higher operational expenses.

- Energy affordability: Rising oil prices disproportionately affect lower-income households, impacting their ability to meet basic needs.

Conclusion

Big Oil's resistance to production cuts represents a significant challenge to the stability of the global oil market. The upcoming OPEC+ decision will be crucial in determining the future trajectory of crude oil prices. The interplay between OPEC+'s actions and Big Oil's continued behavior creates uncertainty, potentially leading to price volatility with significant consequences for consumers and the global economy. Understanding the dynamics of Big Oil's resistance is crucial to navigating the complexities of the energy market. Stay informed about the evolving dynamics of Big Oil's resistance and its influence on global oil prices by subscribing to our newsletter for the latest updates.

Featured Posts

-

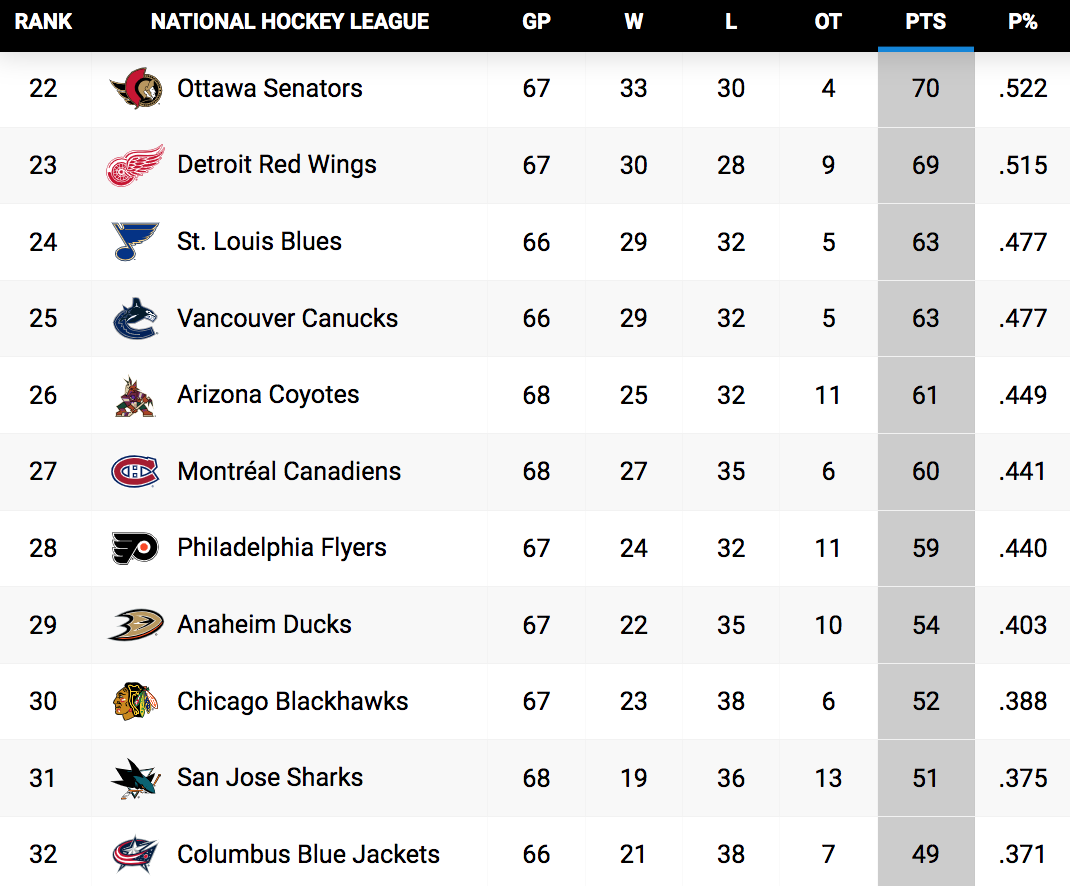

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025

Nhl Standings Update Key Games To Watch On Showdown Saturday

May 05, 2025 -

Lizzos Dramatic Weight Loss How Did She Do It

May 05, 2025

Lizzos Dramatic Weight Loss How Did She Do It

May 05, 2025 -

Understanding Googles Search Ai Training Practices Web Content And Opt Outs

May 05, 2025

Understanding Googles Search Ai Training Practices Web Content And Opt Outs

May 05, 2025 -

Kentucky Derby 2025 Online Streaming Where To Watch How Much It Costs And What To Expect

May 05, 2025

Kentucky Derby 2025 Online Streaming Where To Watch How Much It Costs And What To Expect

May 05, 2025 -

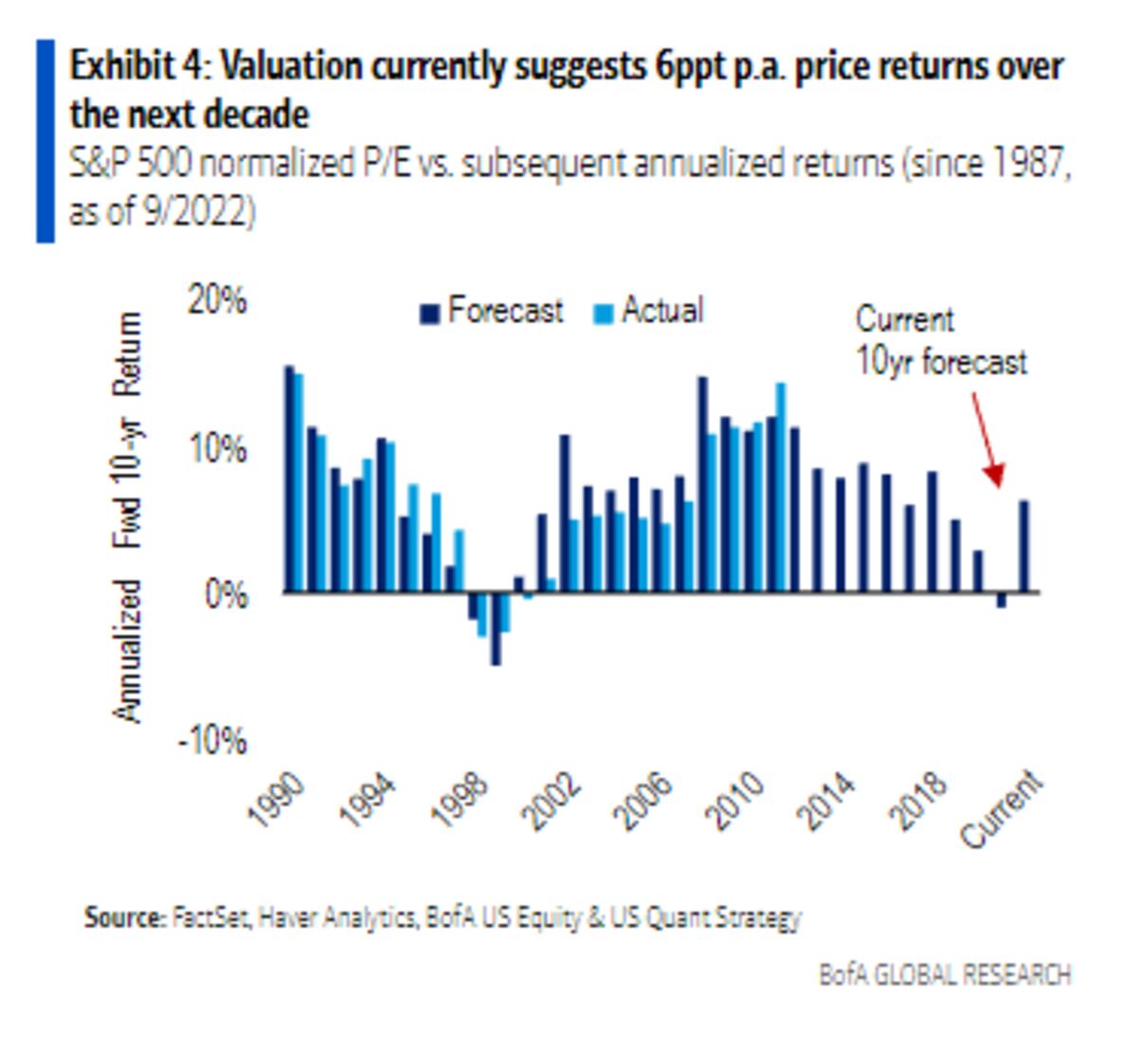

Are High Stock Valuations A Concern Bof A Weighs In

May 05, 2025

Are High Stock Valuations A Concern Bof A Weighs In

May 05, 2025

Latest Posts

-

Ufc 314 Neal Vs Prates Cancellation A Major Setback

May 05, 2025

Ufc 314 Neal Vs Prates Cancellation A Major Setback

May 05, 2025 -

Poiriers Retirement Paddy Pimbletts Perspective And The Mma Debate

May 05, 2025

Poiriers Retirement Paddy Pimbletts Perspective And The Mma Debate

May 05, 2025 -

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025

Did Dustin Poirier Make A Mistake Retiring Paddy Pimbletts Take

May 05, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 05, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Predictions And Betting Odds

May 05, 2025 -

Ufc 314 Did Jean Silva Curse At Bryce Mitchell During The Press Conference

May 05, 2025

Ufc 314 Did Jean Silva Curse At Bryce Mitchell During The Press Conference

May 05, 2025