BigBear.ai Stock: Investment Analysis And Buying Guide

Table of Contents

Company Overview and Business Model

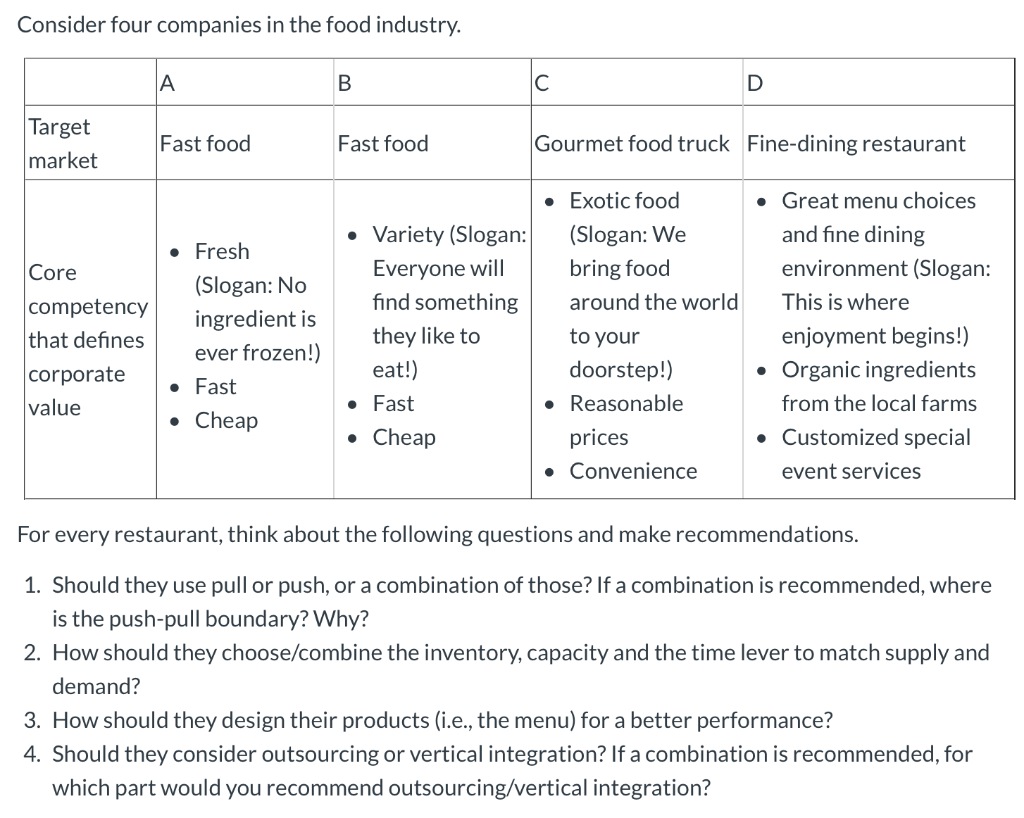

BigBear.ai is a leading provider of artificial intelligence (AI) and data analytics solutions for both the government and commercial sectors. Their core business focuses on delivering mission-critical insights through advanced analytics and AI-powered platforms. They offer a range of products and services designed to solve complex problems across various industries.

BigBear.ai's target market is broad, encompassing government agencies (defense, intelligence, and civilian) and commercial enterprises seeking to leverage AI for improved decision-making and operational efficiency. The company faces competition from other established players in the AI and data analytics space, including both large multinational corporations and smaller, specialized firms. However, BigBear.ai distinguishes itself through its focus on highly specialized, mission-critical applications.

- Focus on AI-powered solutions for mission-critical applications: BigBear.ai's solutions are tailored to address specific, high-stakes challenges, offering a competitive edge.

- Strong government contracts and partnerships: A significant portion of their revenue stream comes from government contracts, providing a degree of stability.

- Expansion into commercial markets: BigBear.ai is actively diversifying its revenue streams by expanding its reach into the commercial sector, reducing reliance on government contracts.

- Competition from other AI and data analytics companies: The competitive landscape is dynamic, requiring BigBear.ai to continuously innovate and adapt.

Financial Performance and Valuation

Analyzing BigBear.ai's financial performance requires a thorough review of their financial statements. Key metrics include revenue growth, profitability margins, debt levels, and cash flow generation. Investors should carefully examine the company's revenue trajectory, looking for consistent growth and identifying the sources of that growth. Profitability, as measured by net income and operating margins, indicates the efficiency of the company's operations.

Furthermore, a comparison of BigBear.ai's valuation to its competitors is essential. Metrics such as the Price-to-Earnings (P/E) ratio and the debt-to-equity ratio provide valuable insights into the company's relative valuation and financial health. A detailed analysis of these ratios compared to industry averages can help determine if BigBear.ai stock is overvalued or undervalued.

- Revenue growth trajectory: Consistent and sustainable revenue growth is a positive indicator of long-term financial health.

- Profitability and margins: Strong profit margins suggest efficient operations and pricing strategies.

- Cash flow generation: Positive and consistent cash flow demonstrates financial stability and the ability to fund future growth.

- Valuation metrics compared to industry peers: Benchmarking BigBear.ai's valuation against its competitors is crucial for assessing its investment attractiveness.

Growth Prospects and Future Outlook

The future market potential for BigBear.ai's services is substantial, driven by the increasing adoption of AI and data analytics across various sectors. Government spending on AI and related technologies is expected to grow significantly in the coming years, creating favorable conditions for BigBear.ai's continued expansion. Furthermore, their strategic initiatives aimed at expanding into new markets and developing innovative solutions will play a vital role in their future growth.

However, potential risks and challenges exist. Intense competition, technological disruption, and geopolitical factors can all impact BigBear.ai's performance. Careful consideration of these factors is crucial for making informed investment decisions.

- Market size and growth projections for AI and data analytics: The overall market for AI and data analytics is experiencing exponential growth, creating significant opportunities.

- BigBear.ai's strategic initiatives and innovation pipeline: Their commitment to innovation and strategic expansion will be key to future success.

- Potential impact of geopolitical events and regulatory changes: Geopolitical instability and evolving regulations can create uncertainties.

- Key risks and mitigation strategies: Identifying and mitigating potential risks is critical for responsible investing.

BigBear.ai Stock: Investment Risks

Investing in BigBear.ai stock, like any stock, carries inherent risks. Market volatility can significantly impact the stock price, leading to potential losses. BigBear.ai's dependence on government contracts presents another risk, as contract wins and renewals are not guaranteed. Technological obsolescence and competition from other AI companies also pose challenges.

Diversification is essential to mitigate risk. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce the impact of any single investment's underperformance. Thorough due diligence, including researching the company's financials, competitive landscape, and future outlook, is crucial before investing.

- Stock market volatility and its impact on BigBear.ai's stock price: The stock market is inherently volatile, and BigBear.ai's stock price will fluctuate.

- Dependence on government contracts: Reliance on government contracts introduces a level of uncertainty.

- Competition and technological obsolescence: The rapid pace of technological advancement creates competitive pressures.

- Financial risks and potential for losses: Investing in stocks always carries the risk of losing money.

How to Buy BigBear.ai Stock

Buying BigBear.ai stock involves opening a brokerage account with a reputable financial institution. Many online brokers offer easy-to-use platforms for buying and selling stocks. Once your account is set up and funded, you can search for BigBear.ai stock (usually using the stock ticker symbol) and place an order to buy shares.

Different investment strategies exist, ranging from long-term buy-and-hold strategies to more active day trading approaches. Your chosen strategy should align with your investment goals, risk tolerance, and time horizon. Remember, seeking advice from a qualified financial advisor is crucial before making any significant investment decisions.

- Choosing a reputable brokerage account: Select a brokerage with a strong track record and competitive fees.

- Understanding trading fees and commissions: Be aware of all associated costs involved in buying and selling stocks.

- Setting investment goals and risk tolerance: Determine your investment objectives and how much risk you are willing to accept.

- Importance of long-term investing vs. short-term trading: Consider your time horizon and choose a strategy that matches your goals.

Conclusion

This investment analysis of BigBear.ai stock provides a comprehensive overview of the company, its financial performance, growth prospects, and associated risks. While BigBear.ai presents exciting opportunities in the rapidly growing AI and data analytics sectors, potential investors should carefully assess their risk tolerance and conduct thorough due diligence before investing. Remember, this is not financial advice, and you should consult a financial advisor before making any investment decisions regarding BigBear.ai stock or any other security. Start your research today and determine if BigBear.ai fits within your investment strategy. Consider exploring other AI stock options to diversify your portfolio.

Featured Posts

-

Official Partnership Aims Group And World Trading Tournament

May 21, 2025

Official Partnership Aims Group And World Trading Tournament

May 21, 2025 -

Pukki Ja Kamara Vaihtopenkillae Jacob Friisin Avauskokoonpano

May 21, 2025

Pukki Ja Kamara Vaihtopenkillae Jacob Friisin Avauskokoonpano

May 21, 2025 -

D Wave Quantum Inc Qbts Explaining The Recent Stock Market Volatility

May 21, 2025

D Wave Quantum Inc Qbts Explaining The Recent Stock Market Volatility

May 21, 2025 -

Mild Temperatures And Little Rain A Look At The Week Ahead

May 21, 2025

Mild Temperatures And Little Rain A Look At The Week Ahead

May 21, 2025 -

Explorer La Loire Le Vignoble Et L Estuaire A Velo 5 Circuits

May 21, 2025

Explorer La Loire Le Vignoble Et L Estuaire A Velo 5 Circuits

May 21, 2025

Latest Posts

-

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025 -

From Young Louth Chef To Business Leader A Success Story

May 22, 2025

From Young Louth Chef To Business Leader A Success Story

May 22, 2025 -

5 Podcasts Esenciales Para Fans Del Terror Suspenso Y Misterio

May 22, 2025

5 Podcasts Esenciales Para Fans Del Terror Suspenso Y Misterio

May 22, 2025 -

Louth Food Heros Entrepreneurial Journey Inspiring Others

May 22, 2025

Louth Food Heros Entrepreneurial Journey Inspiring Others

May 22, 2025 -

Sound Perimeter The Collective Power Of Music

May 22, 2025

Sound Perimeter The Collective Power Of Music

May 22, 2025