BigBear.ai (BBAI) Stock Plummets: Missed Revenue, Leadership Shakeup

Table of Contents

Missed Revenue Projections Fuel Investor Concerns

BigBear.ai's recent earnings report revealed a considerable revenue shortfall, significantly impacting investor confidence. The company missed its projected revenue targets for Q[Insert Quarter], falling short by [Insert Percentage or Specific Dollar Amount] compared to analyst expectations and its previous guidance. This underperformance raises serious concerns about the company's financial health and its ability to execute its business strategy.

Several potential causes contribute to this BBAI revenue miss:

- Slower-than-anticipated contract wins: The competitive landscape in the AI sector is intense, and securing government and commercial contracts can be challenging. BigBear.ai may have faced stiffer competition than anticipated, resulting in fewer contract wins than projected.

- Delays in project implementation: Complex AI projects often encounter unforeseen delays. Potential issues with data integration, algorithm development, or client approvals could have contributed to the revenue shortfall.

- Unexpected expenses: Unforeseen operational costs or increased R&D spending could have negatively impacted profitability and overall revenue figures.

The company's explanation for the missed projections [Insert Company's Explanation Here] failed to fully reassure investors, further eroding confidence in its short-term outlook. The impact of this missed revenue on investor confidence is undeniable, leading to a significant sell-off and a drop in BBAI stock price.

Leadership Shakeup Adds to Market Volatility

Adding to the already turbulent situation, BigBear.ai announced a significant leadership shakeup. [Insert Name] stepped down as [Position], and [Insert Name] assumed the role. [Optional: Briefly explain reasons if publicly available, e.g., "The company cited strategic differences as the reason for the departure."] This unexpected change at the top raises questions about the company's future strategic direction and operational stability.

The leadership transition's potential impacts are significant:

- Shift in corporate strategy: A change in leadership can signal a shift in the company's strategic priorities and long-term vision, potentially impacting future growth prospects.

- Operational disruptions: Any leadership change inherently creates a period of transition and potential operational disruption, potentially slowing down progress on key projects and contract fulfillment.

- Investor uncertainty: The market often reacts negatively to unexpected leadership changes, especially when details are scarce, leading to increased volatility and uncertainty among investors. This uncertainty contributed significantly to the BBAI stock price decline.

The market reaction to this leadership announcement amplified the negative sentiment already brewing due to the missed revenue projections.

Impact on BBAI Stock Price and Investor Sentiment

The combined impact of missed revenue and the leadership shakeup resulted in a dramatic decline in BBAI stock price. Since the announcements, the stock price has fallen by [Insert Percentage] %. Trading volume surged, indicating heightened investor activity and concern. This sell-off directly impacted BigBear.ai's market capitalization, reducing its overall valuation considerably.

- Percentage change in stock price: [Insert Precise Percentage]

- Analysis of trading volume and volatility: [Describe the increase in trading volume and volatility – use data if available]

- Impact on market capitalization: [Show the change in market cap based on the stock price drop]

Analyzing the Future of BigBear.ai (BBAI)

Despite the current challenges, assessing the future of BigBear.ai requires a balanced perspective. While the recent events are undeniably negative, several factors could influence a potential recovery.

- Strong technology: BigBear.ai possesses strong technology in the AI sector, potentially enabling the company to win future contracts and compete effectively.

- Government contracts: The company's focus on government contracts provides a relatively stable revenue stream, which could help cushion the impact of short-term setbacks.

- Potential for strategic partnerships: Collaborations with other tech companies could expand BigBear.ai's market reach and accelerate its growth.

However, significant challenges remain:

- Increased competition: The AI market is highly competitive, and BigBear.ai faces intense pressure from established players and emerging startups.

- Execution challenges: The missed revenue projections highlight potential challenges in the company's ability to execute its strategic plans effectively.

- Investor skepticism: Rebuilding investor confidence after such significant setbacks will require concrete evidence of improved performance and a clear path to sustainable growth.

Potential catalysts for a BBAI stock price recovery include strong Q[Next Quarter] earnings, securing major new contracts, or announcing successful strategic partnerships.

Conclusion

The significant drop in BigBear.ai (BBAI) stock price is directly linked to the missed revenue projections and the unexpected leadership changes. The combination of these events has created considerable uncertainty about the company's future prospects. While the company's core technology and government contracts offer some potential for long-term growth, investors need to closely monitor upcoming financial reports and strategic announcements to better gauge the unfolding situation. Stay informed about the unfolding situation with BigBear.ai (BBAI) stock and continue to monitor financial news and company announcements for updates on the company’s performance and strategic direction. Consider diversifying your portfolio to mitigate risk associated with highly volatile AI stocks like BBAI.

Featured Posts

-

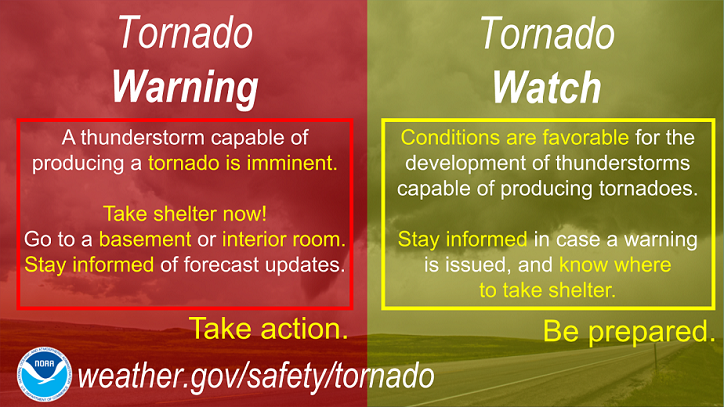

Severe Weather Safety When To Watch For Damaging Winds

May 20, 2025

Severe Weather Safety When To Watch For Damaging Winds

May 20, 2025 -

Rusenje Daytonskog Sporazuma Tadi Ceva Analiza I Posljedice Za Sarajevo

May 20, 2025

Rusenje Daytonskog Sporazuma Tadi Ceva Analiza I Posljedice Za Sarajevo

May 20, 2025 -

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025

Investing In Ai 12 Top Stocks Based On Reddit Sentiment

May 20, 2025 -

Cin Grand Prix Sinde Ferrari Icin Sok Diskalifiye Karari Hamilton Ve Leclerc

May 20, 2025

Cin Grand Prix Sinde Ferrari Icin Sok Diskalifiye Karari Hamilton Ve Leclerc

May 20, 2025 -

Logitech Forever Mouse Expectations Vs Reality

May 20, 2025

Logitech Forever Mouse Expectations Vs Reality

May 20, 2025

Latest Posts

-

Self Image And Skin Bleaching Insights From Vybz Kartels Experience

May 21, 2025

Self Image And Skin Bleaching Insights From Vybz Kartels Experience

May 21, 2025 -

Significant Reduction In Bp Chief Executives Pay 31

May 21, 2025

Significant Reduction In Bp Chief Executives Pay 31

May 21, 2025 -

The Goldbergs Exploring The Shows Humor Characters And Lasting Impact

May 21, 2025

The Goldbergs Exploring The Shows Humor Characters And Lasting Impact

May 21, 2025 -

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Acceptance

May 21, 2025

Vybz Kartel Opens Up Skin Bleaching And The Search For Self Acceptance

May 21, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025