Significant Reduction In BP Chief Executive's Pay: 31%

Table of Contents

The energy world is buzzing. BP's CEO has experienced a dramatic 31% reduction in their pay package, sending shockwaves through the oil and gas industry and sparking intense debate around executive compensation. This article delves into the specifics of this significant salary reduction, exploring the underlying reasons and analyzing its potential ramifications for BP and the broader sector. We will examine the magnitude of the cut, potential contributing factors, and the future implications for BP CEO pay and executive compensation within the oil and gas industry.

The Magnitude of the Pay Cut and its Context

The BP CEO's pay cut represents a substantial 31% decrease in their overall compensation. While the exact figures haven't been publicly released in full detail (pending official company statements), reports suggest a significant drop from the previous year's compensation package. To illustrate, let's assume (for illustrative purposes only) that the previous year's total compensation, including salary, bonuses, and stock options, was $15 million. A 31% reduction would equate to a $4.65 million decrease, resulting in a current total compensation of approximately $10.35 million. This is a substantial reduction in BP CEO pay, significantly impacting the overall package.

- Previous Year's Compensation (Illustrative): $15 million (Salary: $X million, Bonus: $Y million, Stock Options: $Z million)

- Pay Cut Calculation (Illustrative): $15 million x 0.31 = $4.65 million

- Current Year's Compensation (Illustrative): Approximately $10.35 million

- Comparison to Competitors: Further analysis is needed to compare this reduction to CEO pay at other major oil and gas companies like Shell, ExxonMobil, and Chevron. A comparison would offer valuable insight into industry trends and norms regarding executive compensation.

Potential Reasons Behind the Pay Reduction

Several factors likely contributed to BP's decision to significantly reduce its CEO's pay. No single cause can fully explain this drastic move; rather, it is likely a confluence of pressures.

-

Company Performance: BP's financial performance in recent years might have played a significant role. Lower-than-expected profits, fluctuating stock prices, and increased operational costs could have influenced the board's decision to curtail executive compensation. Scrutiny of the company’s financial reports will be crucial in understanding the relationship between financial performance and this pay cut.

-

Shareholder Activism and Pressure: Increased pressure from shareholders concerned about executive pay levels is a common catalyst for such reductions. Activist investors often push for more equitable compensation structures and greater alignment between executive pay and company performance. Any shareholder resolutions or public statements regarding executive compensation should be analyzed for further clarity.

-

Public Scrutiny of Executive Compensation in the Energy Sector: The oil and gas industry faces intense public scrutiny regarding its environmental and social impact. High executive salaries during periods of environmental concern or questionable business practices can draw negative media attention and public backlash. Negative publicity and the associated reputational risk may have been considered when adjusting the CEO's pay.

-

Environmental, Social, and Governance (ESG) Concerns: Growing awareness of ESG factors is increasingly influencing corporate decision-making. Companies are under pressure to demonstrate a commitment to sustainable practices and responsible corporate governance, and reducing executive compensation might be seen as a step towards improving their ESG profile.

Implications of the Pay Cut for BP and the Wider Industry

The implications of this significant pay cut extend beyond BP's internal operations. The decision will likely have ripple effects throughout the company and the wider energy sector.

-

Impact on Employee Morale: The reduction in the CEO's pay could influence employee morale and perceptions of fairness within BP. If employees view the cut as a necessary step given the company's financial situation, it could foster a sense of shared sacrifice. However, if viewed as disproportionate to other pay cuts within the organization, it could negatively impact employee morale.

-

Signal to Other Companies: The decision could signal a shift in executive compensation practices within the oil and gas industry. Other companies might reconsider their own compensation structures, potentially leading to similar reductions or greater scrutiny of executive pay.

-

Changes in Investor Sentiment: Investor perception of BP might be influenced by this decision. Some investors may view it positively as a sign of responsible corporate governance and alignment with shareholder interests. Others might interpret it differently, depending on their investment strategies and views on executive compensation. Stock market reactions in the period following the announcement will be telling.

-

Future Executive Compensation Negotiations: This event will significantly influence future negotiations surrounding executive compensation within BP and potentially the wider industry. The precedent set by this 31% reduction may result in more stringent criteria for future compensation packages, emphasizing performance metrics and aligning them more closely with overall company success.

Conclusion

The 31% reduction in BP's CEO's pay is a significant development, sparking important conversations about executive compensation in the oil and gas industry. The reasons behind this drastic cut are likely multifaceted, encompassing company performance, shareholder pressure, public scrutiny, and growing ESG concerns. The long-term consequences for BP and the industry remain to be seen, but this decision undoubtedly sets a precedent and will influence future discussions regarding executive pay levels and corporate governance practices. Stay informed about changes in BP CEO pay and executive compensation trends by following our updates on significant changes in the oil and gas industry. Learn more about the impact of shareholder activism on executive pay and the evolution of compensation structures within the energy sector.

Featured Posts

-

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025

Southern French Alps Weather Storm Brings Unexpected Late Snow

May 21, 2025 -

Official Partnership Aims Group And World Trading Tournament

May 21, 2025

Official Partnership Aims Group And World Trading Tournament

May 21, 2025 -

Augmentation De L Activite Des Cordistes Due A La Construction De Tours A Nantes

May 21, 2025

Augmentation De L Activite Des Cordistes Due A La Construction De Tours A Nantes

May 21, 2025 -

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025

Saskatchewan Political Panel Reacts To Federal Leaders Redneck Comments

May 21, 2025 -

Discover Provence A Self Guided Walk From Mountains To Mediterranean

May 21, 2025

Discover Provence A Self Guided Walk From Mountains To Mediterranean

May 21, 2025

Latest Posts

-

Stephane La Chanteuse Romande Conquiert Paris

May 21, 2025

Stephane La Chanteuse Romande Conquiert Paris

May 21, 2025 -

Enjoy The City A List Of Manhattans Outdoor Dining Spots

May 21, 2025

Enjoy The City A List Of Manhattans Outdoor Dining Spots

May 21, 2025 -

Discussion Autour De Les Grands Fusains De Boulemane D Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025

Discussion Autour De Les Grands Fusains De Boulemane D Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025 -

Top Outdoor Restaurants In Manhattan For Summer Dining

May 21, 2025

Top Outdoor Restaurants In Manhattan For Summer Dining

May 21, 2025 -

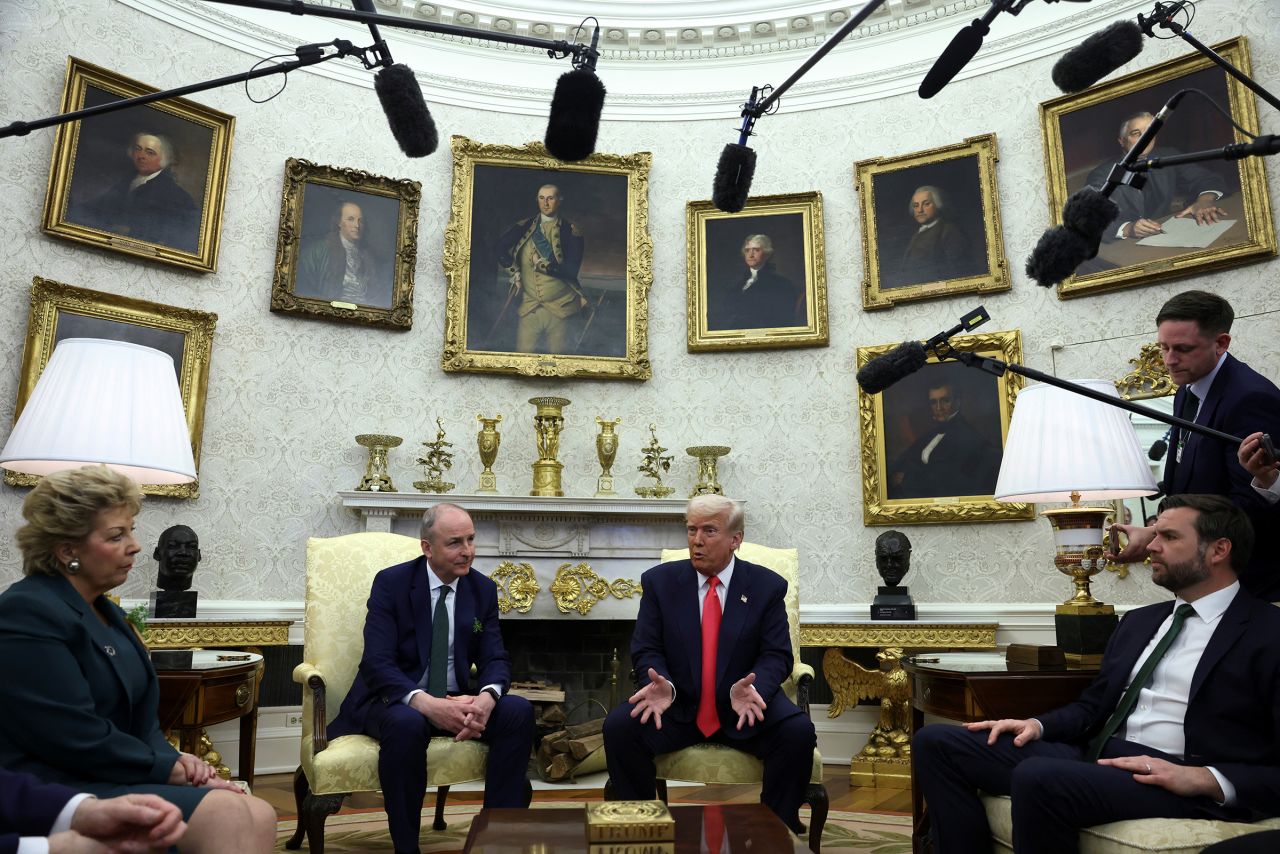

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025

White House Humor Unforgettable Moments With Trump The Irish Pm And Jd Vance

May 21, 2025