BigBear.ai (BBAI) Stock Outlook: Penny Stock Predictions And Analysis.

Table of Contents

BigBear.ai (BBAI) Company Overview and Business Model

BigBear.ai is a leading provider of artificial intelligence (AI)-powered data analytics solutions, primarily serving the government and commercial sectors. Their core offerings include advanced analytics, AI-driven decision support, and mission-critical data management solutions. BigBear.ai operates in a highly competitive landscape, facing competition from established tech giants and smaller specialized firms.

Their target market encompasses government agencies (defense, intelligence, and civilian), as well as commercial enterprises seeking sophisticated data analytics capabilities. Key strengths of their business model include their expertise in applying AI to complex data challenges and their strong relationships with government clients. Weaknesses include their relatively small size compared to larger competitors and their history of fluctuating profitability.

- AI Solutions for Government and Commercial Clients: BigBear.ai delivers bespoke AI solutions tailored to the unique needs of government agencies and commercial clients, focusing on areas such as predictive modeling, risk assessment, and cybersecurity.

- Partnerships and Acquisitions: Strategic partnerships and acquisitions play a crucial role in BigBear.ai's growth strategy, expanding their capabilities and market reach. Keep an eye on news regarding any such collaborations.

- Revenue Streams and Profitability: Revenue is generated primarily through contracts with government agencies and commercial clients. Profitability can be highly variable, influenced by the size and complexity of projects undertaken. Review their financial reports carefully for insights into their financial performance.

Recent BBAI Stock Performance and Market Sentiment

BBAI stock has exhibited considerable volatility in recent months. Daily, weekly, and monthly price fluctuations have been significant, reflecting the inherent risks associated with penny stocks. News events, market trends, and earnings reports have all significantly impacted the stock's price. For example, a positive earnings surprise could lead to a sharp price increase, while negative news could trigger a substantial decline. Overall market sentiment towards BBAI has shifted between bullish and bearish periods.

- Specific Price Movements: Track BBAI's price movements using reputable financial websites and consider comparing them to the performance of similar companies.

- News and Financial Reports: Stay informed about relevant news and announcements from BigBear.ai and analyze their financial reports to understand their performance.

- Analyst Ratings and Price Targets: Consult financial news sources for analyst ratings and price targets. Note that these are just opinions and not guarantees of future performance.

Factors Influencing Future BBAI Stock Predictions

Several key factors will influence BBAI's future stock performance. Advancements in AI technology will be crucial for the company's ability to maintain a competitive edge. Increased competition from larger tech companies poses a significant challenge. Regulatory changes in the government contracting sector could also impact their revenue streams. Finally, macroeconomic conditions (recession, inflation, etc.) can significantly influence investor sentiment and stock prices. BigBear.ai's growth potential depends heavily on its ability to secure and successfully deliver large-scale government and commercial contracts.

- Government Contract Potential: The securing of substantial government contracts is paramount to BBAI's growth trajectory.

- Competition from Larger Tech Companies: The intense competition from established tech giants with greater resources represents a major challenge.

- Penny Stock Investment Risks: Investing in penny stocks like BBAI carries significant risks, including high volatility and the potential for substantial losses.

BBAI Stock Valuation and Investment Strategies

Valuing BBAI stock presents challenges due to its relatively young age and fluctuating profitability. Methods such as Discounted Cash Flow (DCF) analysis and comparable company analysis can provide insights, but inherent uncertainties make precise valuation difficult. Potential investment strategies include long-term holding for growth, short-term trading based on technical analysis, or incorporating BBAI as a small part of a diversified portfolio.

- Inherent Risks of Penny Stocks: Penny stocks are inherently risky; their prices are highly volatile and subject to significant fluctuations.

- Investment Approach for Different Risk Tolerances: Investors with higher risk tolerances may consider a more aggressive investment strategy, while those with lower tolerances should limit their exposure.

- Portfolio Diversification: Diversifying your portfolio across different asset classes is crucial to mitigate risk.

Conclusion

This analysis of BigBear.ai (BBAI) stock reveals a company with significant potential but also substantial risks. While its innovative technology and government contracts offer opportunities for growth, the volatile nature of penny stocks necessitates a cautious approach. Investors should carefully consider the factors discussed above before making any investment decisions.

Call to Action: Before investing in BigBear.ai (BBAI) or any penny stock, conduct thorough due diligence and consult with a financial advisor. Understanding the risks and rewards associated with BBAI stock is crucial for informed investment decisions. Remember, thorough research is key to successful penny stock investing, and always consider the potential for both significant gains and substantial losses. Consider your risk tolerance and investment goals before investing in BBAI.

Featured Posts

-

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 21, 2025

Groeiend Autobezit Stuwt Occasionverkoop Bij Abn Amro

May 21, 2025 -

Abn Amro Kamerbrief Certificaten Verkoopstrategie En Programma Overzicht

May 21, 2025

Abn Amro Kamerbrief Certificaten Verkoopstrategie En Programma Overzicht

May 21, 2025 -

Why Gen Z Loves Little Britain Despite Its Cancellation

May 21, 2025

Why Gen Z Loves Little Britain Despite Its Cancellation

May 21, 2025 -

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 21, 2025

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 21, 2025 -

How Aimscap Conquered The World Trading Tournament Wtt

May 21, 2025

How Aimscap Conquered The World Trading Tournament Wtt

May 21, 2025

Latest Posts

-

Arne Slot Admits Liverpool Fortune Luis Enrique Weighs In On Alisson

May 22, 2025

Arne Slot Admits Liverpool Fortune Luis Enrique Weighs In On Alisson

May 22, 2025 -

The Goldbergs A Complete Guide To The Beloved Sitcom

May 22, 2025

The Goldbergs A Complete Guide To The Beloved Sitcom

May 22, 2025 -

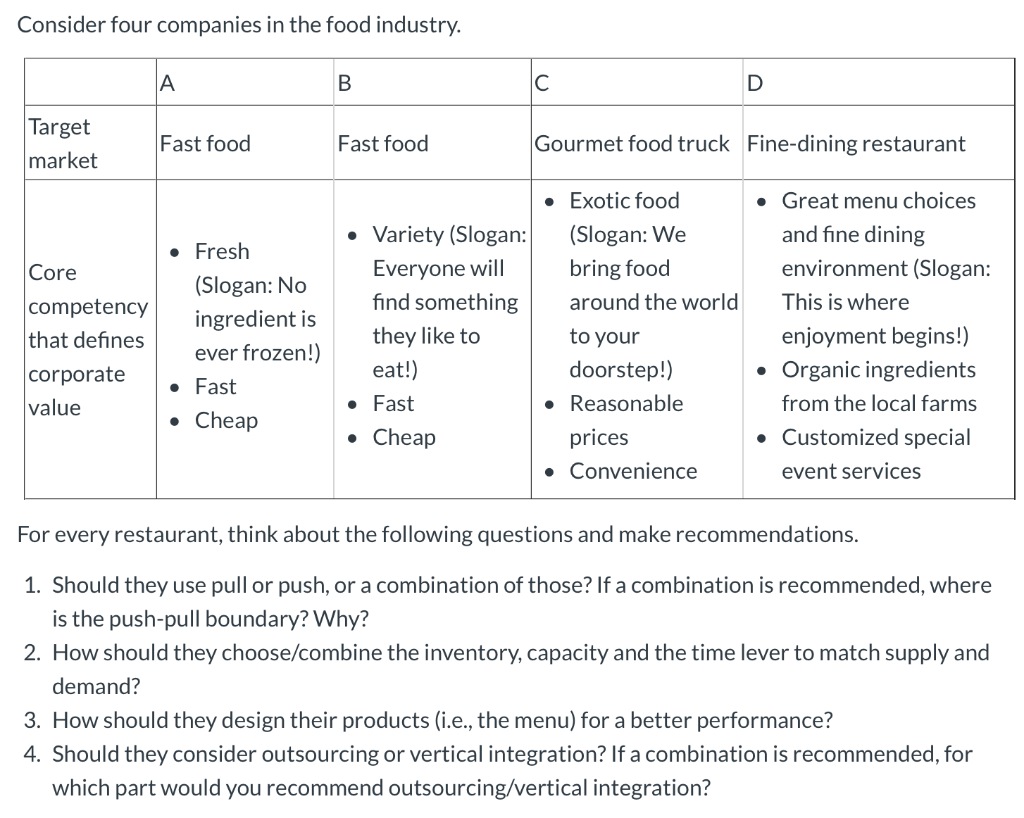

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025

Local Louth Food Business Owner Offers Expertise To Other Companies

May 22, 2025 -

From Young Louth Chef To Business Leader A Success Story

May 22, 2025

From Young Louth Chef To Business Leader A Success Story

May 22, 2025 -

5 Podcasts Esenciales Para Fans Del Terror Suspenso Y Misterio

May 22, 2025

5 Podcasts Esenciales Para Fans Del Terror Suspenso Y Misterio

May 22, 2025