BigBear.ai (BBAI) Faces Headwinds: Analyst Downgrade And Future Outlook

Table of Contents

Analyst Downgrade and its Rationale

The recent downgrade of BigBear.ai (BBAI) stock sent ripples through the investment community. Specifically, [Insert Analyst Firm Name], a respected research firm, issued a sell rating, lowering their price target from [Previous Price Target] to [New Price Target]. Their rationale centered on several key concerns regarding BBAI's financial performance and future prospects.

- Concerns about Revenue Growth: The analyst firm expressed concerns about the sustainability of BigBear.ai's revenue growth, citing slower-than-expected growth in [Specific Sector/Segment]. They pointed to [Specific Data Point, e.g., lower-than-projected Q3 earnings] as a key indicator of this trend.

- Profitability Challenges: BigBear.ai's operating margins have been under pressure due to [Specific Factors, e.g., increased R&D spending, intense competition]. This has raised concerns about the company's ability to achieve profitability in the near term.

- Increased Competition: The analyst report highlighted the increasing competition within the AI sector, particularly from larger, more established players. This heightened competitive landscape poses a significant threat to BigBear.ai's market share and future revenue streams.

- Impact on Investor Sentiment: The downgrade, coupled with the revised price target, immediately impacted investor sentiment, leading to a significant drop in BBAI stock price. [Include a chart here visually depicting the stock price performance around the downgrade date]. The credibility of [Analyst Firm Name] – known for its [Describe their track record, e.g., accurate predictions in the tech sector] – further amplified the negative impact.

BigBear.ai's Current Financial Performance and Challenges

BigBear.ai's recent financial results paint a mixed picture. While the company has demonstrated growth in certain areas, several challenges persist.

- Revenue and Earnings: BBAI's revenue for [Specific Period, e.g., the last quarter] was [Revenue Figure], representing a [Percentage] increase/decrease compared to the same period last year. Earnings per share (EPS) were [EPS Figure].

- Research and Development (R&D) Spending: BigBear.ai's significant investment in R&D, while essential for long-term growth and innovation, has impacted its short-term profitability. [Provide specific data on R&D expenditure and its percentage of revenue].

- Operating Expenses: High operating expenses, including [Specify areas like sales and marketing, administrative costs], are also contributing to profitability concerns. [Provide data illustrating this].

- Debt and Cash Flow: BigBear.ai's debt levels and cash flow situation need to be carefully analyzed to assess its financial stability. [Include data on debt-to-equity ratio, cash flow from operations]. The company's ability to manage its debt and ensure sufficient cash flow for future growth is crucial.

- Competitive Landscape: BigBear.ai operates in a highly competitive market, facing pressure from established industry giants and emerging AI startups. This competitive landscape impacts pricing strategies and necessitates continuous innovation to maintain a competitive edge.

Opportunities and Potential for Future Growth

Despite the current headwinds, BigBear.ai possesses several opportunities for future growth.

- AI Market Growth: The overall AI market is experiencing rapid expansion, presenting significant opportunities for companies like BigBear.ai to capitalize on increased demand for AI-powered solutions.

- Government Contracts: BigBear.ai has a strong focus on securing government contracts, which can provide a stable revenue stream and contribute to long-term growth. [Mention specific contracts or potential opportunities].

- Technological Innovation: The company's ongoing investments in R&D and technological innovation are crucial for developing cutting-edge AI solutions and maintaining a competitive advantage. [Highlight any innovative products or technologies].

- Strategic Partnerships: Strategic partnerships with other technology companies can help BigBear.ai expand its reach and access new markets. [Mention any current partnerships or potential collaborations].

- Industry Events and Regulatory Changes: Upcoming industry events and regulatory changes in the AI sector could create both opportunities and challenges for BigBear.ai. [Mention any relevant events or regulations].

Investment Implications and Considerations for BBAI Stock

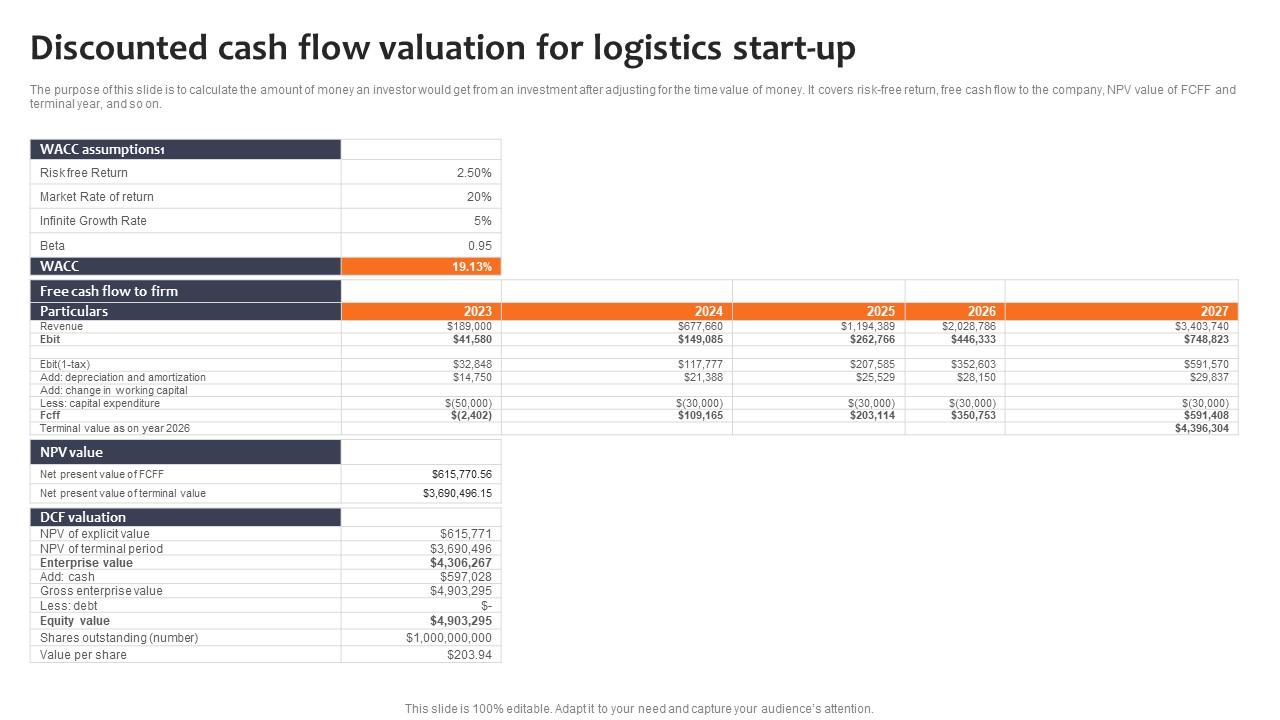

The valuation of BBAI stock and the associated risks require careful consideration.

- Stock Valuation: Currently, BBAI's stock valuation is [Mention current valuation metrics, e.g., P/E ratio, market capitalization] which, compared to its peers and considering the recent downgrade, might suggest [Overvalued/Undervalued/Fairly Valued] status.

- Risk Assessment: Investing in BBAI stock carries inherent risks. The volatility of the AI market, the company's financial performance, and the intensity of competition all contribute to the risk profile.

- Buy or Sell Recommendation: The recent analyst downgrade warrants a cautious approach. While the long-term prospects for BigBear.ai remain promising, the near-term challenges necessitate careful consideration before making investment decisions. A long-term perspective with a thorough risk assessment is crucial.

- Future Prospects: The future prospects for BBAI depend on its ability to overcome current financial challenges, successfully execute its growth strategy, and navigate the competitive landscape. A cautious but optimistic outlook seems warranted, contingent upon successful execution of its strategic initiatives.

Conclusion

This analysis of BigBear.ai (BBAI) reveals a company facing significant headwinds due to a recent analyst downgrade and concerns surrounding its financial performance. While challenges exist, opportunities remain in the rapidly expanding AI market. Investors should carefully consider the risks and potential rewards before making investment decisions. The complexities of BBAI's financial situation require diligent research and a long-term perspective.

Call to Action: Stay informed about the evolving situation with BigBear.ai (BBAI) stock and continue your research before making any investment decisions related to this dynamic AI company. Understanding the intricacies of BBAI’s financial performance and future outlook is crucial for navigating the complexities of this promising, yet volatile, sector. Thoroughly assess the BBAI investment opportunity, considering both its inherent risks and growth potential.

Featured Posts

-

Raw 5 19 2025 Positive And Negative Highlights From Wwe Monday Night Raw

May 21, 2025

Raw 5 19 2025 Positive And Negative Highlights From Wwe Monday Night Raw

May 21, 2025 -

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025

Ragbrai And Beyond Exploring Scott Savilles Cycling Life

May 21, 2025 -

Man Breaks Australian Cross Country Running Record

May 21, 2025

Man Breaks Australian Cross Country Running Record

May 21, 2025 -

Klopps Coaching Influence How Hout Bay Fc Benefited

May 21, 2025

Klopps Coaching Influence How Hout Bay Fc Benefited

May 21, 2025 -

I Los Antzeles Psaxnei Ton Giakoymaki

May 21, 2025

I Los Antzeles Psaxnei Ton Giakoymaki

May 21, 2025

Latest Posts

-

Understanding Saskatchewans Position On Western Canadian Separation

May 22, 2025

Understanding Saskatchewans Position On Western Canadian Separation

May 22, 2025 -

Is Western Separation A Viable Option For Saskatchewan A Political Panel Discussion

May 22, 2025

Is Western Separation A Viable Option For Saskatchewan A Political Panel Discussion

May 22, 2025 -

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025 -

Saskatchewan Political Panel Examining The Backlash Following Federal Leaders Remarks

May 22, 2025

Saskatchewan Political Panel Examining The Backlash Following Federal Leaders Remarks

May 22, 2025 -

Bp Valuation Doubling Plan Ceos Strategy And Uk Listing Confirmation

May 22, 2025

Bp Valuation Doubling Plan Ceos Strategy And Uk Listing Confirmation

May 22, 2025