BP Valuation Doubling Plan: CEO's Strategy And UK Listing Confirmation

Table of Contents

The CEO of BP has unveiled a bold and ambitious plan: to double the company's valuation. This daring strategy coincides with the confirmation of BP's continued listing on the UK Stock Market, signaling a significant commitment to the UK energy sector and its investors. This article delves deep into the key elements of BP's valuation doubling plan, analyzing the strategic initiatives, market factors, and potential challenges that lie ahead. We'll explore how BP aims to navigate the complexities of the energy transition while simultaneously maximizing shareholder value and securing its position as a leader in the evolving energy landscape.

Key Pillars of BP's Valuation Doubling Strategy

Keywords: BP growth strategy, BP low carbon energy, BP renewable energy, BP oil and gas, BP diversification

BP's plan to double its valuation rests on several crucial pillars, each designed to contribute significantly to its overall growth and profitability. This multi-faceted strategy acknowledges the shifting global energy landscape and aims to position BP for long-term success in a decarbonizing world.

-

Significant Investment in Renewable Energy: BP is making substantial investments in renewable energy sources, including solar, wind, and hydrogen. This includes large-scale solar farm projects, offshore wind farm developments, and investment in green hydrogen production facilities. For example, BP has committed billions to projects like the [insert example of a specific BP renewable energy project and investment amount], demonstrating a clear commitment to diversifying its energy portfolio beyond traditional fossil fuels.

-

Optimized Oil and Gas Production: While transitioning to cleaner energy sources, BP remains committed to efficient and profitable oil and gas production. The company is focusing on optimizing existing assets through technological advancements and cost-cutting measures. This includes initiatives like [insert specific example of BP's initiative to optimize oil and gas production, e.g., enhanced oil recovery techniques, digitalization of operations]. This approach aims to maximize returns from existing resources while reducing operational costs.

-

Strategic Acquisitions and Partnerships: BP is actively pursuing strategic acquisitions and partnerships to expand into new energy technologies and markets. Recent acquisitions, such as [insert examples of recent acquisitions in renewable energy or related sectors], illustrate this commitment. These partnerships allow BP to leverage external expertise and accelerate its growth in promising areas.

-

Technological Innovation and Digitalization: BP is investing heavily in technological innovation and digitalization to improve operational efficiency and reduce costs across its entire value chain. This includes the implementation of advanced analytics, artificial intelligence, and automation technologies. These advancements contribute to optimized production, reduced emissions, and improved decision-making.

-

Commitment to ESG Principles: Attracting responsible investors is crucial for BP's success. The company has made a strong commitment to Environmental, Social, and Governance (ESG) principles. This includes setting ambitious targets for emissions reduction, improving workplace safety, and promoting diversity and inclusion. These initiatives aim to enhance BP's reputation and attract investors who prioritize sustainability.

Confirmation of UK Listing and its Impact

Keywords: BP UK listing, London Stock Exchange, BP share trading, UK investment, investor confidence

BP's reaffirmed commitment to its UK listing on the London Stock Exchange is a significant factor in its valuation doubling plan. This decision conveys stability and confidence to investors.

-

Reinforced UK Market Commitment: Maintaining a UK listing underscores BP's strong ties to the UK market and its belief in the long-term potential of the British economy.

-

Enhanced Investor Confidence: The continued UK listing is expected to boost investor confidence, as it provides easier access to a large and liquid market for BP shares. This simplifies investment for UK and international investors.

-

Access to Capital: A prominent listing on the London Stock Exchange ensures BP maintains access to a large pool of capital, facilitating further investments in its strategic initiatives.

-

Regulatory Environment: The UK's regulatory framework, while demanding in terms of environmental regulations, also offers a degree of stability and predictability for BP's operations.

Addressing Challenges and Risks

Keywords: BP risk management, energy transition challenges, geopolitical risks, competition in energy sector, market volatility

BP's valuation doubling plan is not without its challenges and risks. The company recognizes these and is proactively implementing strategies to mitigate them.

-

Energy Transition Challenges: The transition to a low-carbon economy presents significant challenges, including fierce competition from established and emerging renewable energy players and the potential for technological disruption.

-

Geopolitical Risks: Geopolitical instability and uncertainty in various regions where BP operates pose significant risks to its operations and investment decisions.

-

Market Volatility: Fluctuations in energy prices and overall market volatility can significantly impact BP's valuation and profitability.

-

Risk Mitigation Strategies: BP is implementing a range of risk mitigation strategies, including diversification of its energy portfolio, robust risk management frameworks, and close monitoring of geopolitical developments.

Conclusion

BP's ambitious plan to double its valuation hinges on a comprehensive and multifaceted strategy. Significant investments in renewable energy, optimized oil and gas production, strategic acquisitions, technological advancements, and a steadfast commitment to ESG principles form the cornerstone of this plan. The confirmation of its continued UK listing adds further stability and reinforces investor confidence. While significant challenges and risks remain, BP's proactive approach to risk management and its focus on innovation position the company for potential long-term success.

Call to Action: Learn more about BP's valuation doubling plan and the company's future prospects. Stay informed about the latest developments in BP's strategy and how this impacts BP share price and BP investment opportunities. Invest wisely in the future of energy.

Featured Posts

-

Lazio Earns Hard Fought Draw Against Reduced Juventus

May 22, 2025

Lazio Earns Hard Fought Draw Against Reduced Juventus

May 22, 2025 -

Barclay Center Concert Vybz Kartel Coming To Nyc In April

May 22, 2025

Barclay Center Concert Vybz Kartel Coming To Nyc In April

May 22, 2025 -

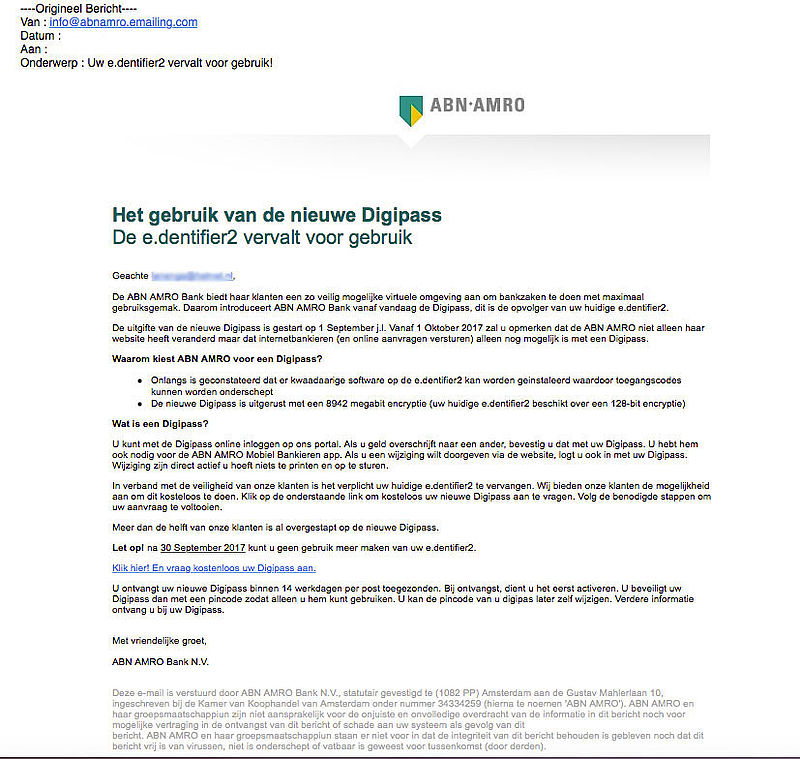

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025

Alles Over Het Verkoopprogramma Voor Abn Amro Kamerbrief Certificaten

May 22, 2025 -

Liverpool Dan Persaingan Juara Liga Inggris Analisis 10 Tahun Terakhir

May 22, 2025

Liverpool Dan Persaingan Juara Liga Inggris Analisis 10 Tahun Terakhir

May 22, 2025 -

Loto Du Patrimoine 2025 Visite Photographique Du Theatre Tivoli A Clisson

May 22, 2025

Loto Du Patrimoine 2025 Visite Photographique Du Theatre Tivoli A Clisson

May 22, 2025

Latest Posts

-

Australian Trans Influencers Record Breaking Success Why The Doubt

May 22, 2025

Australian Trans Influencers Record Breaking Success Why The Doubt

May 22, 2025 -

William Goodge A New Standard For Fastest Trans Australia Foot Journey

May 22, 2025

William Goodge A New Standard For Fastest Trans Australia Foot Journey

May 22, 2025 -

Australian Foot Crossing William Goodge Sets New Speed Record

May 22, 2025

Australian Foot Crossing William Goodge Sets New Speed Record

May 22, 2025 -

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025

A Britons Grueling Australian Run Overcoming Pain Insects And Accusations

May 22, 2025 -

Australian Cross Country Run Briton Faces Adversity Controversy And Physical Challenges

May 22, 2025

Australian Cross Country Run Briton Faces Adversity Controversy And Physical Challenges

May 22, 2025