Bank Of Canada Interest Rate Debate: April's Market Volatility And Trump's Tariffs

Table of Contents

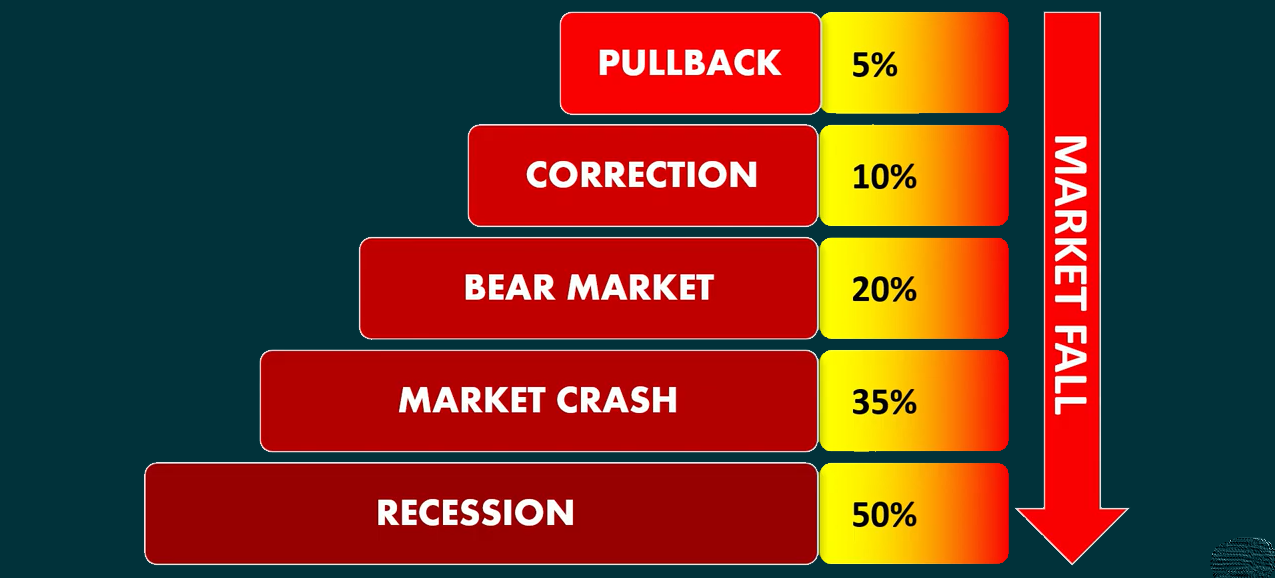

April's Market Volatility: A Deep Dive

April witnessed considerable turbulence in Canadian markets. The TSX Composite Index experienced significant daily fluctuations, reflecting broader global anxieties. The Canadian dollar also showed volatility against major currencies like the US dollar, largely influenced by external factors and the ongoing Bank of Canada interest rate debate.

Beyond interest rate expectations, several factors contributed to this volatility:

- Global Economic Uncertainty: Concerns about global recession, inflation, and geopolitical instability created a climate of investor apprehension.

- Geopolitical Events: International conflicts and political instability further fueled market uncertainty, impacting investor sentiment and capital flows.

- Commodity Price Fluctuations: Changes in the prices of key Canadian exports, such as oil and lumber, directly impacted market performance and investor confidence.

Specific examples of this volatility include:

- A 5% drop in the TSX on April 12th (example data – replace with actual data).

- A significant weakening of the Canadian dollar against the US dollar, reaching its lowest point in X months (replace X with actual data).

- Increased volatility in the Canadian bond market, reflecting investor uncertainty about future interest rate movements.

This volatility significantly impacted investor confidence, leading to cautious investment strategies and increased risk aversion. Sectors particularly vulnerable to these fluctuations included technology and real estate.

The Bank of Canada's Response: Interest Rate Decisions and Their Rationale

In response to the prevailing economic conditions, the Bank of Canada [insert actual interest rate decision, e.g., maintained its key interest rate at 4.5% in April]. This decision was justified in their official statement by [insert quote from Bank of Canada press release, summarizing the rationale]. The Bank cited [mention specific economic indicators cited in the statement, e.g., concerns about inflation, slowing economic growth, etc.] as key factors influencing their decision.

The implications of this decision are far-reaching:

- Housing Market: The maintained rate could potentially further cool the housing market, already experiencing a slowdown.

- Consumer Spending: Higher interest rates could dampen consumer spending, potentially impacting economic growth.

- Business Investment: The higher cost of borrowing may discourage business investment, potentially hindering economic expansion.

Specific interest rate changes: [Insert details on rate changes in April].

Quotes from Bank of Canada officials: [Insert relevant quotes explaining the rationale].

Potential short-term and long-term effects: [Elaborate on the effects].

Inflationary Pressures and Monetary Policy

The Bank of Canada's mandate is to maintain price stability and full employment. In April, [explain the inflation rate and whether it was above or below the target]. The Bank's decision-making process carefully considered these inflationary pressures. The Bank uses various tools to manage inflation, including adjusting the overnight rate, communicating its intentions clearly, and influencing money supply through open market operations. The interplay between inflation and interest rates is a constant balancing act.

Trump's Tariffs: An External Shock to the Canadian Economy

Trump-era tariffs continue to exert a lingering influence on the Canadian economy. Specific sectors, such as [mention specific sectors affected, e.g., lumber, agriculture], experienced significant challenges due to these tariffs. These trade barriers contributed to the market volatility observed in April, adding another layer of complexity to the Bank of Canada interest rate debate.

The Bank of Canada acknowledged the impact of these external factors in its April statement, highlighting the ongoing uncertainty surrounding trade relations.

- Examples of specific tariffs and their effects: [provide examples and quantify the impact].

- Ripple effect on other sectors: [explain how tariffs affected other sectors].

- Potential mitigation strategies: [discuss government policies to counter the negative impacts].

Predicting Future Interest Rate Movements: Expert Opinions and Forecasts

Leading economists and financial analysts offer varying perspectives on future Bank of Canada interest rate adjustments. Some predict [mention specific predictions, e.g., further rate hikes], citing ongoing inflationary pressures. Others anticipate [mention other predictions, e.g., a pause or even rate cuts], highlighting concerns about economic growth. These predictions are influenced by factors such as inflation data, employment figures, and global economic conditions. Disagreements exist regarding the relative importance of these factors.

Conclusion: Understanding the Bank of Canada Interest Rate Debate

The Bank of Canada interest rate debate in April highlighted the complex interplay between market volatility, domestic economic conditions, and external factors like lingering trade tensions. The Bank's decision-making process is a delicate balancing act, aiming to maintain price stability while fostering sustainable economic growth. The impact of these factors on the Canadian economy is significant, influencing everything from consumer spending to business investment. The ongoing uncertainty underscores the need for continued monitoring and analysis. To stay informed about the ongoing Bank of Canada interest rate debate and its implications for the Canadian economy, subscribe to reputable financial news sources and follow the Bank of Canada's official communications. Further research into the dynamics of Canadian interest rates is highly recommended.

Featured Posts

-

Fortnite 34 30 Release Date Maintenance Sabrina Carpenter Update And Patch Notes

May 03, 2025

Fortnite 34 30 Release Date Maintenance Sabrina Carpenter Update And Patch Notes

May 03, 2025 -

Riot Platforms Nasdaq Riot Stock Understanding The Current Market Situation

May 03, 2025

Riot Platforms Nasdaq Riot Stock Understanding The Current Market Situation

May 03, 2025 -

The Conservatives Desperate Gamble A Boris Johnson Comeback

May 03, 2025

The Conservatives Desperate Gamble A Boris Johnson Comeback

May 03, 2025 -

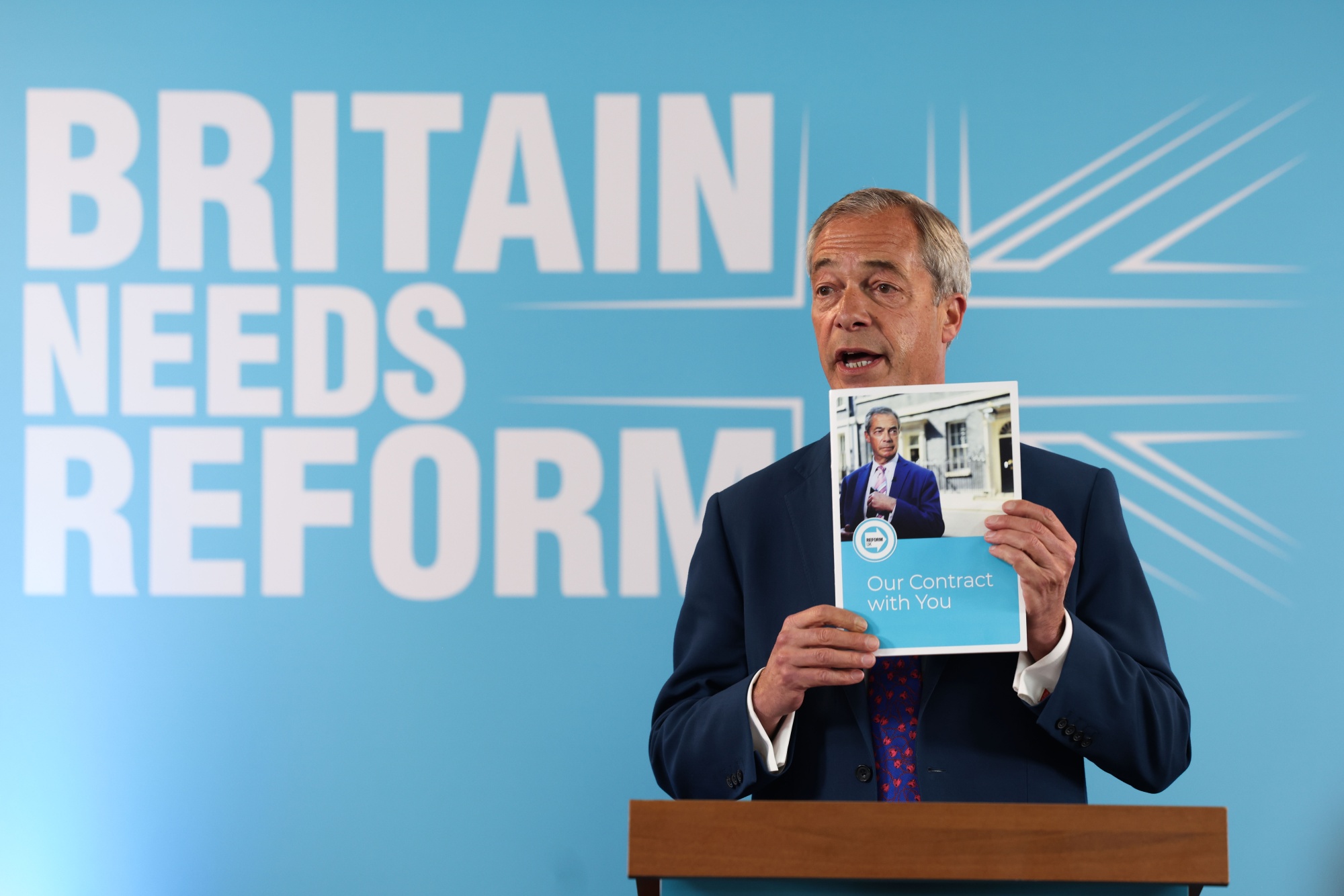

Analysis Farages Reform Uk And Their Support For The Snp

May 03, 2025

Analysis Farages Reform Uk And Their Support For The Snp

May 03, 2025 -

Euro 2025 Three Decisive Questions For Sarina Wiegman And England

May 03, 2025

Euro 2025 Three Decisive Questions For Sarina Wiegman And England

May 03, 2025