Riot Platforms (NASDAQ: RIOT) Stock: Understanding The Current Market Situation

Table of Contents

Riot Platforms' Recent Financial Performance

Analyzing Riot Platforms' financial performance is key to understanding the current RIOT stock valuation. Examining revenue, profitability, mining operations, and Bitcoin holdings provides a holistic view of the company's health.

Revenue and Profitability

Riot Platforms' recent quarterly and annual reports reveal important trends in its revenue and profitability. While Bitcoin's price directly impacts revenue, the company's operational efficiency and cost management significantly affect its profitability.

- Revenue Growth: [Insert data on recent revenue growth, comparing it to previous periods. Use percentages and cite sources.] This growth reflects [explain the reasons for revenue growth, e.g., increased hashrate, successful expansion].

- Profitability Margins: [Insert data on profitability margins, such as gross margin and net margin. Again, cite sources and explain fluctuations.] Factors influencing margins include [explain factors, e.g., electricity costs, Bitcoin price, maintenance expenses].

- Operating Expenses: [Discuss operating expenses, including mining equipment costs, personnel costs, and other overhead. Show how these expenses impact profitability.] Effective cost management is crucial for Riot Platforms to maintain profitability even during periods of lower Bitcoin prices.

- Impact of Bitcoin Price Fluctuations on Revenue: The price of Bitcoin directly correlates with Riot Platforms' revenue. A rise in Bitcoin's value generally leads to increased revenue, while a decline has the opposite effect. [Provide examples showing this correlation using recent data].

Mining Operations and Hashrate

Riot Platforms' mining operations are central to its success. Hashrate, a measure of computing power dedicated to Bitcoin mining, is a critical indicator of the company's mining capacity and potential earnings.

- Hashrate Growth: [Present data on Riot Platforms' hashrate growth over time. Discuss factors contributing to this growth, such as the addition of new mining equipment and improvements in efficiency.] A higher hashrate generally translates to a larger share of Bitcoin mining rewards.

- Energy Consumption: The energy consumption of mining operations is a major cost factor. [Discuss Riot Platforms' energy sourcing strategies and their impact on operational costs. Mention any initiatives focusing on energy efficiency]. Sustainable and cost-effective energy solutions are crucial for long-term profitability.

- Technological Advancements: [Discuss Riot Platforms' use of advanced mining technology, such as ASICs (Application-Specific Integrated Circuits), and how this contributes to efficiency and competitiveness.] Staying ahead technologically is vital in the rapidly evolving cryptocurrency mining industry.

- Expansion Plans: [Discuss any plans for expansion, including the addition of new mining facilities or increased mining capacity. Highlight the potential impact of these expansions on future revenue and hashrate.]

Bitcoin Holdings and Treasury Management

Riot Platforms holds a significant amount of Bitcoin, which acts as a treasury asset and can influence its overall financial position.

- Size of Bitcoin Holdings: [State the current size of Riot Platforms' Bitcoin holdings. Explain the accounting treatment of these holdings and their impact on the balance sheet.]

- Potential Impact of Bitcoin Price Changes on Net Asset Value: The value of Riot Platforms' Bitcoin holdings fluctuates directly with the price of Bitcoin, impacting its net asset value. [Explain the risks and opportunities associated with this exposure].

- Treasury Management Strategy: [Describe Riot Platforms' strategy for managing its Bitcoin holdings. Discuss any plans for selling or holding onto these assets and the rationale behind those decisions.]

Market Factors Influencing RIOT Stock

Several market factors significantly influence the price of RIOT stock, including Bitcoin's price volatility, regulatory landscape, competition, and macroeconomic conditions.

Bitcoin Price Volatility

Bitcoin's price is the most significant factor affecting RIOT stock.

- Correlation between Bitcoin Price and RIOT Stock: There's a strong positive correlation between the price of Bitcoin and RIOT stock price. When Bitcoin's price rises, RIOT stock usually rises as well, and vice versa. [Provide examples demonstrating this correlation].

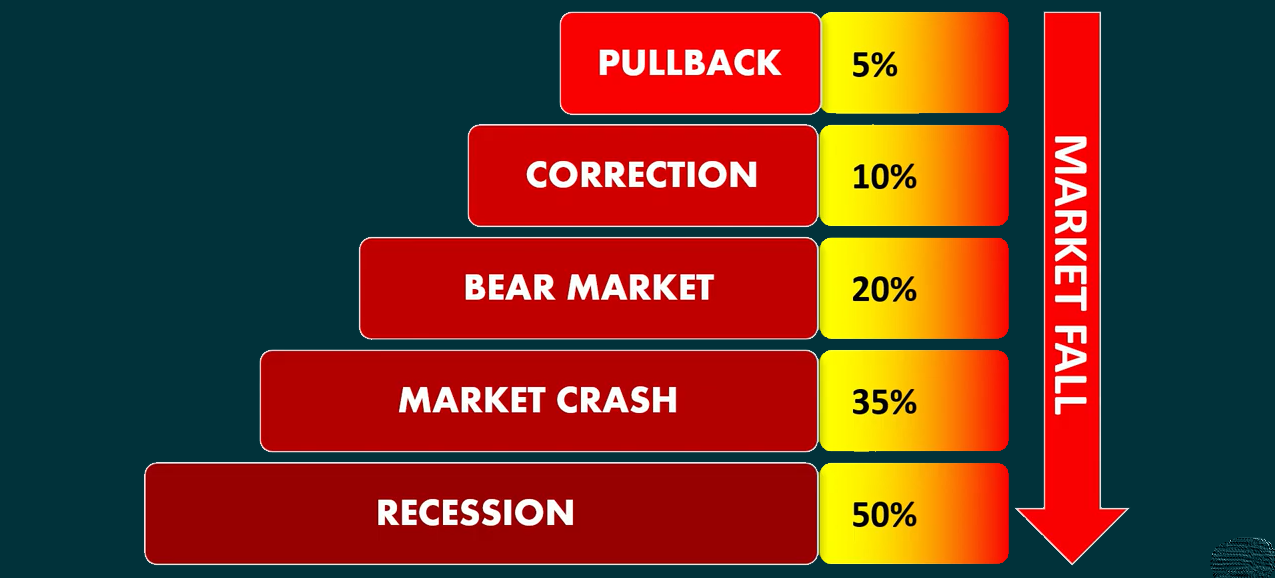

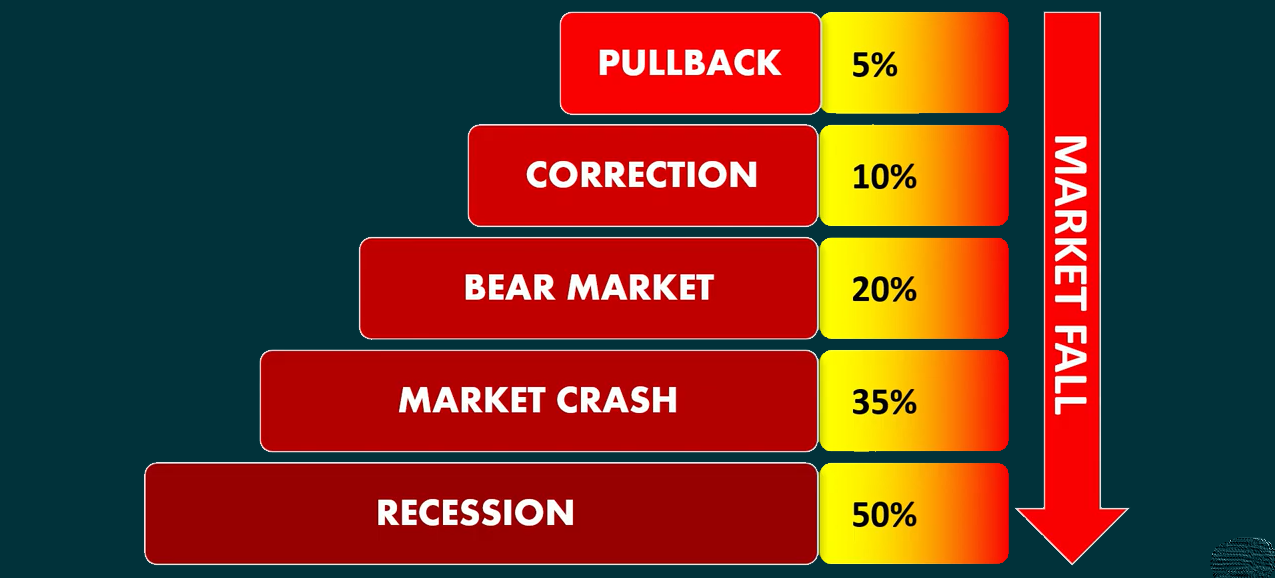

- Impact of Bullish and Bearish Markets: Bullish markets for Bitcoin are generally positive for RIOT stock, while bearish markets tend to negatively impact the stock price.

Regulatory Landscape

Regulatory changes concerning cryptocurrencies significantly influence Riot Platforms' operations.

- Potential Changes in Regulations: Regulatory uncertainty remains a key risk. Changes in regulations in the US or other jurisdictions could impact Riot Platforms' operations and profitability. [Discuss potential regulatory changes and their potential effects].

- Impact on Mining Operations: New regulations could affect mining operations, either through increased compliance costs or restrictions on mining activities.

- Compliance Costs: Meeting regulatory requirements adds to Riot Platforms' operating expenses.

Competition in the Cryptocurrency Mining Industry

Riot Platforms competes with other large-scale Bitcoin mining companies globally.

- Key Competitors: [List Riot Platforms' main competitors, including their market share and strategies].

- Market Share: [Discuss Riot Platforms' market share within the cryptocurrency mining industry. Analyze its competitive position].

- Competitive Advantages: [Discuss Riot Platforms’ competitive advantages, such as its energy costs, technological advancements, strategic partnerships, and geographic location of its mining facilities].

Macroeconomic Factors

Broader economic trends also influence the cryptocurrency market and RIOT stock.

- Inflation: High inflation can affect investor sentiment toward risky assets like Bitcoin and RIOT stock.

- Interest Rates: Rising interest rates can reduce investment in riskier assets, impacting RIOT stock.

- Investor Sentiment: Overall investor sentiment towards cryptocurrencies influences the demand for RIOT stock.

- Geopolitical Events: Global events can significantly impact the cryptocurrency market and RIOT stock.

Analyst Ratings and Future Outlook for RIOT Stock

Analyzing analyst ratings and the future outlook for the Bitcoin mining industry provides valuable insight into RIOT stock's potential.

Analyst Price Targets and Recommendations

Financial analysts offer varying price targets and recommendations for RIOT stock.

- Average Price Target: [State the average price target from reputable analysts and cite sources].

- Range of Price Targets: [State the range of price targets from different analysts, reflecting varying opinions on the stock's future performance].

- Buy/Sell/Hold Ratings: [Summarize the consensus buy/sell/hold ratings from major analysts].

- Reasons Behind Different Opinions: [Explain the rationale behind different analyst opinions, including their assumptions about Bitcoin's price, regulatory changes, and Riot Platforms' operational performance].

Growth Potential and Long-Term Prospects

The long-term prospects for RIOT stock depend heavily on the growth of the Bitcoin mining industry and Riot Platforms' ability to adapt and innovate.

- Future Expansion Plans: [Discuss Riot Platforms' future expansion plans, including new mining facilities and technological upgrades].

- Technological Innovation: The company's ability to adopt and implement new mining technologies is crucial for maintaining its competitive edge.

- Regulatory Changes: Adapting to and navigating regulatory changes will be essential for Riot Platforms' continued success.

- Market Adoption of Bitcoin: Wider adoption of Bitcoin as a payment method and store of value positively impacts the demand for Bitcoin mining and, consequently, RIOT stock.

Conclusion

Understanding the current market situation for Riot Platforms (NASDAQ: RIOT) stock requires analyzing its recent financial performance, considering the various market factors that influence its price, and assessing its future outlook. The company's financial health is closely tied to Bitcoin's price, making it a volatile investment. Regulatory changes, competition, and macroeconomic conditions all play a significant role. While analysts offer varying price targets, the long-term potential of RIOT stock hinges on the growth of the Bitcoin mining industry and Riot Platforms' ability to adapt to a constantly evolving environment. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions related to Riot Platforms (RIOT) stock or other cryptocurrency investments. Understanding the risks involved and performing thorough due diligence are crucial for making informed investment decisions and monitoring RIOT stock performance over time.

Featured Posts

-

The Impact Of Nigel Farage On Reform Uks Growth

May 03, 2025

The Impact Of Nigel Farage On Reform Uks Growth

May 03, 2025 -

Lotto Plus Results Get The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025

Lotto Plus Results Get The Latest Numbers For Lotto Lotto Plus 1 And Lotto Plus 2

May 03, 2025 -

Fortnites In Game Store Practices Under Fire In New Lawsuit Against Epic Games

May 03, 2025

Fortnites In Game Store Practices Under Fire In New Lawsuit Against Epic Games

May 03, 2025 -

Fortnite Tmnt Skins How To Unlock Every Turtle

May 03, 2025

Fortnite Tmnt Skins How To Unlock Every Turtle

May 03, 2025 -

Fortnite Servers Down Update 34 40 Causes Offline Time

May 03, 2025

Fortnite Servers Down Update 34 40 Causes Offline Time

May 03, 2025