Auto Industry Dealerships Renew Opposition To Mandatory EV Sales

Table of Contents

Dealers' Key Concerns Regarding Mandatory EV Sales Quotas

Dealerships are voicing strong concerns about the feasibility and financial implications of mandatory EV sales quotas. These concerns span several key areas, impacting their operational capacity and profitability.

Investment Costs and Infrastructure Challenges

The transition to selling EVs presents significant upfront investment costs for dealerships. Upgrading facilities to accommodate EV charging infrastructure is a major hurdle. This includes installing charging stations, providing appropriate electrical capacity upgrades, and ensuring the stations are compatible with a range of EV models. Furthermore, there's significant uncertainty surrounding consumer demand for EVs in their specific market area, making it difficult to justify the substantial financial investment. Many dealerships, particularly those in smaller towns or rural areas, lack the resources to make these necessary upgrades.

- High upfront costs: Installing Level 2 and DC fast chargers can cost tens of thousands of dollars, depending on the number of stations and power requirements.

- Return on investment (ROI) uncertainty: The profitability of EV sales is currently uncertain, with varying profit margins compared to gasoline vehicles. This uncertainty increases the risk associated with significant investments in infrastructure.

- Uneven infrastructure development: Government support for EV infrastructure development is often unevenly distributed, leaving many areas underserved and making it challenging for dealerships in these areas to comply with mandatory quotas.

- Lack of skilled labor: Dealerships may need specialized technicians trained in EV maintenance and repair, adding to training and labor costs.

Inventory Management and Sales Training

Effectively managing inventory for both electric and gasoline vehicles presents a significant logistical challenge. Dealerships need to balance inventory levels to meet fluctuating demand for different vehicle types, while simultaneously managing the space constraints of their lots. Moreover, sales staff require specialized training to effectively sell and advise customers on EVs, including range anxiety, charging solutions and available tax credits and incentives. This adds to the overall training costs and requires additional resources to educate the sales force.

- Inventory management complexities: Balancing EV and gasoline vehicle stocks requires sophisticated inventory management systems and accurate demand forecasting.

- Specialized sales training: Dealerships need to invest in training programs to equip their staff with the knowledge and skills to effectively sell and service EVs.

- Reduced profit margins (potentially): The current lower profit margins on some EVs compared to gasoline vehicles further complicates the financial equation for dealerships.

- Increased warranty costs (potential): Although the technology is advancing, battery replacements and other EV-specific repairs may initially lead to higher warranty costs than traditional vehicles.

Consumer Readiness and Market Acceptance

Consumer readiness and market acceptance are critical factors influencing the success of mandatory EV sales quotas. Many consumers remain hesitant about adopting EVs due to range anxiety (fear of running out of battery charge), charging infrastructure limitations, and a lack of understanding about the technology. Addressing these concerns through public awareness campaigns and investment in charging infrastructure is vital for driving broader adoption.

- Range anxiety: Concerns about limited driving range and the availability of charging stations remain a significant barrier for many potential EV buyers.

- Charging infrastructure gaps: The lack of sufficient public charging infrastructure, particularly in rural areas, hinders EV adoption.

- Lack of consumer knowledge: Many consumers lack a thorough understanding of EV technology, charging processes, and maintenance requirements.

- High initial purchase price: EVs typically have a higher upfront purchase price compared to gasoline vehicles.

Arguments Against Mandatory EV Sales Quotas

Critics of mandatory EV sales quotas argue that a market-driven approach is more effective than government mandates. They suggest allowing consumer demand to dictate the pace of EV adoption, fostering innovation and competition within the market.

Market-Driven Approach vs. Government Mandates

Proponents of a market-driven approach contend that government mandates stifle innovation and distort market forces. They argue that consumer demand, alongside technological advancements and decreasing battery costs, will naturally drive EV adoption without the need for regulatory intervention. Allowing the market to decide prevents potential negative impacts on consumer choice and competition.

- Market signals: A market-driven approach allows for natural market adjustments based on supply, demand, and consumer preferences.

- Innovation: Competition among manufacturers drives innovation in EV technology and affordability.

- Consumer choice: Mandates can limit consumer choice by potentially reducing the availability of gasoline vehicles.

- Economic efficiency: Market forces allocate resources more efficiently than government mandates.

Impact on Smaller Dealerships and Rural Communities

Mandatory EV sales quotas disproportionately impact smaller dealerships and those in rural communities. These dealerships often lack the financial resources to invest in the necessary EV infrastructure and training programs. This could lead to economic hardship, job losses, and a potential reduction in the availability of vehicle choices in underserved areas.

- Financial burden: Smaller dealerships may struggle to meet the financial requirements of upgrading facilities and training staff.

- Infrastructure limitations: Rural areas often lack the charging infrastructure necessary to support a significant increase in EV sales.

- Economic impact: Closure of smaller dealerships could result in job losses and a negative impact on local economies.

- Reduced access to vehicles: Consumers in rural areas may face reduced access to vehicles if dealerships close due to the inability to meet quotas.

Potential Solutions and Compromises

Addressing the concerns of dealerships while promoting EV adoption requires a balanced approach. Phased implementation and public-private partnerships can help mitigate the challenges and facilitate a smoother transition.

Phased Implementation and Incentives

A phased implementation of EV sales quotas would allow dealerships time to adapt to the changing market conditions. This would involve gradually increasing the quota over several years, giving dealerships the opportunity to invest in necessary infrastructure and training without facing immediate financial strain. Government incentives and financial assistance specifically targeted at smaller dealerships and those in underserved areas can aid in this transition.

- Gradual increase in quotas: A phased rollout gives dealerships sufficient time to adjust their operations and invest in necessary infrastructure.

- Financial incentives: Government subsidies and tax breaks can help offset the costs of EV infrastructure upgrades and training programs.

- Targeted support for smaller dealerships: Specific programs should aid smaller dealerships in adapting to the increased adoption of EVs.

- Tax credits for EV purchases: Incentivizing consumers to purchase EVs would increase market demand and help justify investments by dealerships.

Public-Private Partnerships for Infrastructure Development

Public-private partnerships can accelerate the development of EV charging infrastructure. By sharing the investment costs and risks, governments and private companies can ensure a more equitable distribution of charging stations across different regions. These partnerships can leverage the expertise and resources of both the public and private sectors to achieve a faster and more efficient rollout of charging infrastructure.

- Shared investment: Governments and private companies can share the financial burden of developing EV charging infrastructure.

- Risk mitigation: Public-private partnerships can help mitigate the risks associated with infrastructure investments.

- Equitable distribution: Partnerships can help ensure that charging stations are distributed across all areas, including rural and underserved communities.

- Innovative solutions: Collaboration can lead to innovative solutions for charging infrastructure deployment and management.

Conclusion

The renewed opposition from auto industry dealerships to mandatory EV sales highlights the complex challenges involved in transitioning to a cleaner transportation future. While the need for increased EV adoption is undeniable, a balanced approach that addresses the legitimate concerns of dealerships is crucial. A phased implementation, coupled with substantial government support for infrastructure development and dealer training, could facilitate a smoother transition and foster a more sustainable automotive industry. Ignoring the concerns around mandatory EV sales could severely hinder the progress toward a more sustainable automotive landscape. Open dialogue and collaborative efforts are necessary to navigate this crucial juncture in the automotive industry and ensure a successful transition to electric vehicles. Finding common ground and implementing effective solutions will be vital to achieving widespread adoption of electric vehicles and ultimately, a cleaner future. Let's work together to find solutions that support both the transition to electric vehicles and the viability of auto dealerships.

Featured Posts

-

Carcamusas Un Plato Toledano Con Alto Valor Proteico Receta Completa

May 31, 2025

Carcamusas Un Plato Toledano Con Alto Valor Proteico Receta Completa

May 31, 2025 -

Entdecken Sie Das Neue Escape Spiel Im Mueritzeum

May 31, 2025

Entdecken Sie Das Neue Escape Spiel Im Mueritzeum

May 31, 2025 -

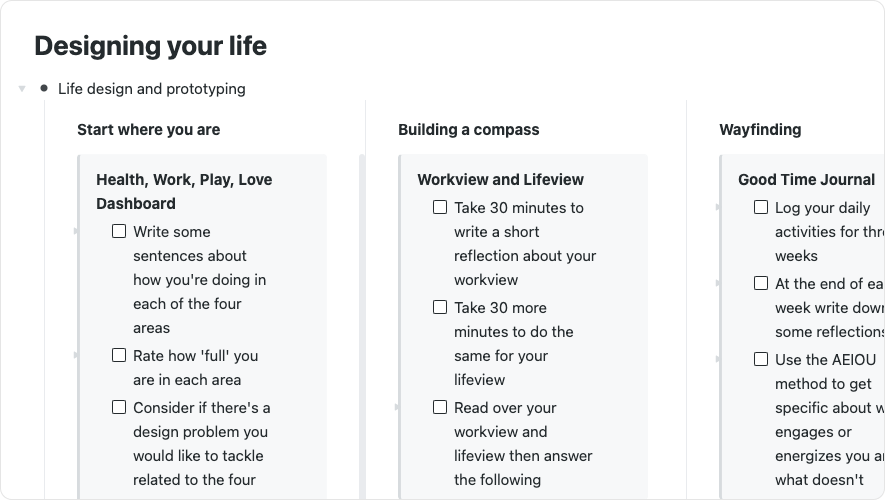

Designing Your Good Life A Practical Guide

May 31, 2025

Designing Your Good Life A Practical Guide

May 31, 2025 -

Umbrella Alert Tracking Showers And Thunderstorms In Ne Ohio

May 31, 2025

Umbrella Alert Tracking Showers And Thunderstorms In Ne Ohio

May 31, 2025 -

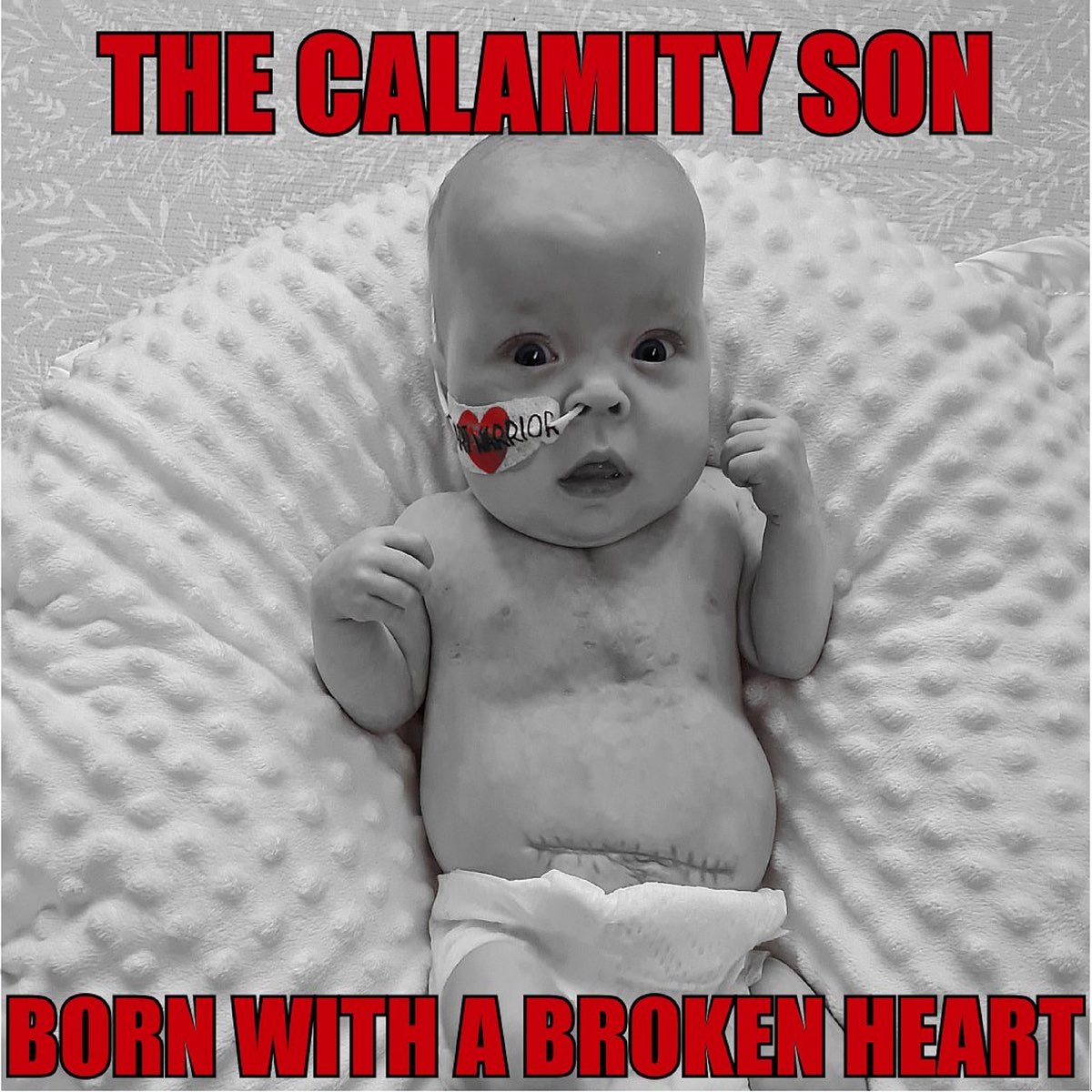

Banksys Broken Heart Mural Headed To Auction

May 31, 2025

Banksys Broken Heart Mural Headed To Auction

May 31, 2025