Australia's Opposition: $9 Billion Budget Improvement Plan

Table of Contents

Key Areas Targeted for Savings

The Opposition's $9 billion budget improvement plan focuses on three key areas to achieve its ambitious goals: reducing government spending, generating revenue through tax reforms, and enhancing overall efficiency and productivity.

Reducing Government Spending

The plan proposes significant spending cuts across various government departments and programs. The Opposition argues that these cuts are necessary to address wasteful expenditure and ensure responsible fiscal management. Specific areas targeted include:

- Streamlining bureaucratic processes: Eliminating redundant roles and consolidating overlapping departments are expected to yield significant savings. The Opposition projects a saving of approximately $2 billion through this measure.

- Reducing duplication of services: By identifying and eliminating duplicate services across different government agencies, the Opposition aims to achieve further cost reductions. This initiative is projected to save an additional $1 billion.

- Targeted cuts to specific programs: While specific program details remain under wraps pending further announcements, the Opposition has hinted at targeted cuts to less effective welfare programs, aiming for an additional $1.5 billion in savings. This will undoubtedly be a controversial aspect, requiring careful consideration and public consultation to mitigate potential negative social impacts. Counterarguments might focus on the potential impact on vulnerable populations, requiring the Opposition to demonstrate how support will be provided to those affected.

Revenue Generation through Tax Reforms

The Opposition's plan also incorporates several tax reforms designed to increase government revenue. These include:

- Changes to corporate tax rates: A proposed marginal increase in the corporate tax rate for large multinational companies is anticipated to generate an estimated $2 billion in additional revenue. This will require careful balancing to avoid discouraging investment and economic growth.

- Closing tax loopholes: The Opposition plans to close several identified tax loopholes exploited by high-income earners and corporations, aiming for an additional $1 billion in revenue. This will require detailed legislation to prevent unintended consequences and ensure fairness.

- Increased tax on specific goods or services: While specifics haven't been released, the Opposition suggests potential increases in taxes on luxury goods or environmentally damaging products. This could generate further revenue while potentially encouraging more sustainable consumption patterns. The potential impact on inflation and consumer spending will need to be carefully assessed.

Improving Efficiency and Productivity

Beyond spending cuts and tax reforms, the Opposition emphasizes the importance of improving government efficiency and productivity across all sectors. This will involve:

- Investing in technology to streamline government operations: Modernizing outdated systems and leveraging technology to automate processes will reduce administrative costs and improve service delivery.

- Improving procurement processes to reduce costs: Implementing more transparent and competitive procurement processes will ensure that government purchases are made at the best possible prices.

- Implementing measures to enhance workforce productivity: Investing in employee training and development, as well as optimizing workflows, will enhance the overall productivity of the public sector.

Economic Impact of the $9 Billion Improvement Plan

The Opposition's proposed plan has significant implications for the Australian economy.

Projected Fiscal Benefits

The Opposition projects that the $9 billion budget improvement plan will significantly reduce the national debt over the next few years. They anticipate a reduction in the budget deficit, potentially leading to a budget surplus within a specific timeframe (specific figures to be released). This, they claim, will improve Australia's credit rating and attract further foreign investment.

Impact on the Australian Economy

The Opposition predicts that the plan will have a positive impact on the Australian economy, stimulating job creation and promoting economic growth. However, potential negative consequences, such as increased unemployment in specific sectors due to spending cuts or reduced consumer spending due to tax increases, must be carefully considered. Further detailed economic modelling is required to support these claims and address potential counterarguments.

Political Implications and Public Response

The Opposition's $9 billion budget improvement plan has sparked considerable debate within the Australian political landscape. Other political parties have voiced both support and criticism, with differing perspectives on the feasibility and effectiveness of the proposed measures. Public opinion polls show a mixed response, with varying levels of support and opposition depending on the specific proposals and their perceived impact on different segments of the population. The impact on the upcoming election remains uncertain, although the plan is likely to play a significant role in shaping the political discourse.

Conclusion: Analyzing Australia's Opposition's $9 Billion Budget Proposal – A Path to Fiscal Responsibility?

Australia's Opposition's $9 billion budget improvement plan represents a significant attempt to address the nation's fiscal challenges. The plan combines spending cuts, tax reforms, and efficiency improvements, aiming for a more responsible and sustainable budget. While the projected benefits are substantial, potential drawbacks necessitate careful consideration and further analysis. The success of this plan hinges on its effective implementation and ability to mitigate potential negative consequences. Learn more about the details of Australia's Opposition's $9 billion budget plan and share your thoughts in the comments below!

Featured Posts

-

Leaked Unreleased 2008 Disney Game Appears On Ps Plus Premium

May 03, 2025

Leaked Unreleased 2008 Disney Game Appears On Ps Plus Premium

May 03, 2025 -

Fans Speculate On Christina Aguileras Altered Appearance

May 03, 2025

Fans Speculate On Christina Aguileras Altered Appearance

May 03, 2025 -

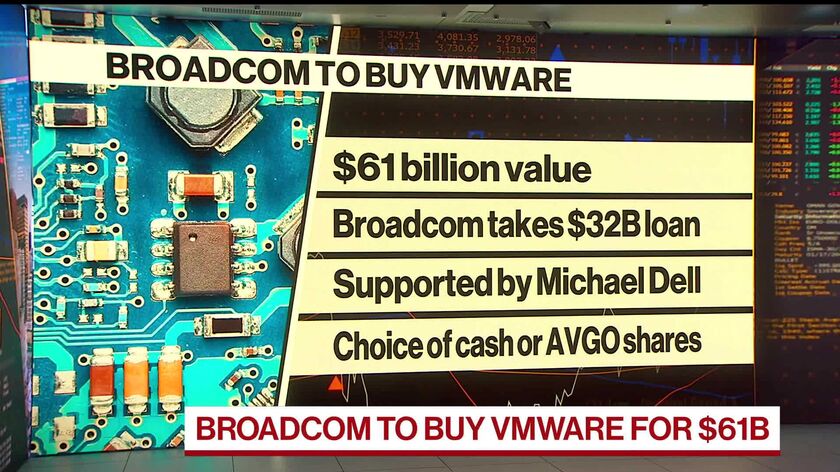

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 03, 2025

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 03, 2025 -

Arsenal Faces Stiff Champions League Competition Sounesss Warning

May 03, 2025

Arsenal Faces Stiff Champions League Competition Sounesss Warning

May 03, 2025 -

Poleodomiki Diafthora Mia Analysi Tis Systimatikis Krisis Kai I Odos Pros Tin Epanidrysi

May 03, 2025

Poleodomiki Diafthora Mia Analysi Tis Systimatikis Krisis Kai I Odos Pros Tin Epanidrysi

May 03, 2025