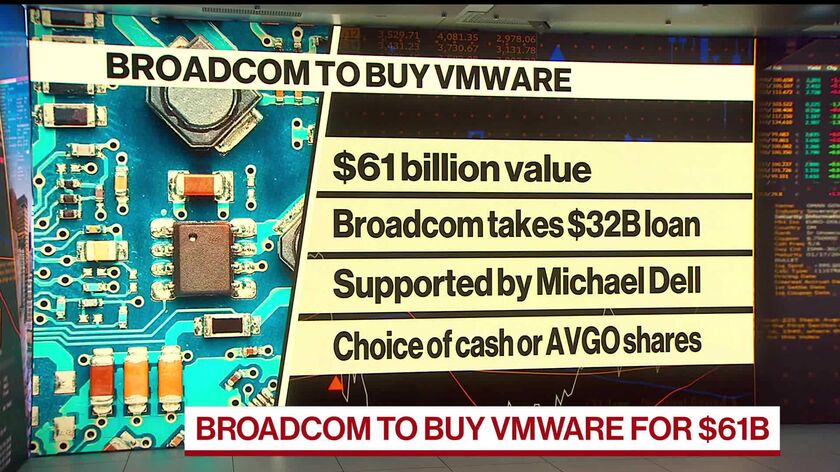

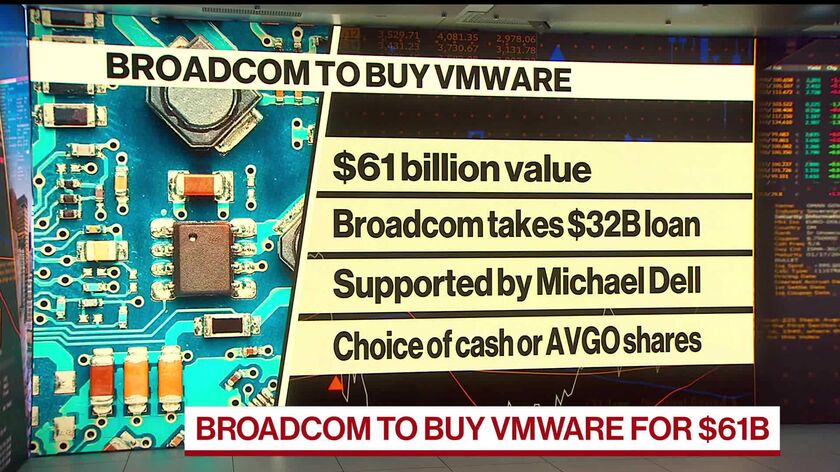

1050% Price Hike? AT&T Sounds Alarm On Broadcom's VMware Deal

Table of Contents

AT&T's Specific Concerns Regarding the Broadcom-VMware Merger

AT&T, a major telecommunications company heavily reliant on VMware's virtualization technologies, has voiced strong opposition to the merger, citing the potential for monopolistic practices and exorbitant price increases. Their argument centers on the elimination of competition and the resulting power Broadcom would wield in setting prices for essential VMware services.

- Specific examples of VMware services and projected price increases: AT&T points to crucial VMware products like vSphere, vSAN, and NSX, arguing that Broadcom's control could lead to price hikes far exceeding the initially projected increases. They highlight the potential for bundled pricing strategies that lock customers into expensive contracts, eliminating price competition.

- Analysis of how these price increases would affect AT&T's business and operating costs: These price hikes, according to AT&T, would translate to significantly higher operational costs, impacting their profitability and potentially affecting their ability to compete effectively. The increased expenses could also be passed on to consumers through higher service prices.

- Mention of potential negative consequences for consumers: Ultimately, AT&T argues that the reduced competition and inflated prices will harm consumers, who may face fewer choices and higher costs for crucial technology services. This could particularly affect smaller businesses that rely on cost-effective VMware solutions.

Antitrust Scrutiny and Regulatory Hurdles Facing the Deal

The Broadcom-VMware merger is facing intense scrutiny from global antitrust regulators. The sheer size of the deal and the dominance Broadcom would gain in several key technology sectors have raised significant concerns.

- Mention of specific regulatory bodies involved (e.g., FTC, EU Commission): Both the Federal Trade Commission (FTC) in the United States and the European Commission are meticulously examining the deal, evaluating its potential impact on competition and consumer welfare. Other national regulatory bodies may also weigh in.

- Summary of potential legal challenges and their likelihood of success: Legal challenges are anticipated, focusing on the potential for reduced competition and anti-competitive pricing practices. The likelihood of success depends on the strength of the evidence presented by regulators and the effectiveness of Broadcom's defense strategies.

- Analysis of previous examples of blocked tech mergers: Precedents exist for blocking major tech mergers on antitrust grounds. Analyzing these cases and their legal reasoning offers insights into the potential challenges facing the Broadcom-VMware acquisition.

Broadcom's Response and Defense Strategies

Broadcom has vigorously defended the acquisition, arguing that it will lead to innovation and efficiency. They contest AT&T's claims of dramatic price increases.

- Summary of Broadcom's statements regarding price increases and competition: Broadcom maintains that the merger will not lead to significant price increases and may even result in cost savings through economies of scale. They emphasize the integration of VMware's technologies into their existing portfolio, potentially leading to enhanced products and services.

- Analysis of Broadcom's proposed remedies to address antitrust concerns: To address regulatory concerns, Broadcom may offer remedies such as divesting certain assets or making commitments to maintain competition. The effectiveness of these remedies in mitigating antitrust concerns remains to be seen.

- Assessment of the credibility of Broadcom's defense: The credibility of Broadcom's defense hinges on the evidence they present to regulators and the persuasiveness of their arguments. The success of their defense will significantly influence the ultimate fate of the acquisition.

Impact on the Broader Tech Industry and Consumers

The outcome of the Broadcom-VMware merger will have far-reaching consequences for the broader tech industry and its consumers.

- Potential impact on cloud computing costs and availability: The deal could significantly impact cloud computing costs and availability, potentially leading to increased prices and reduced choice for businesses relying on cloud-based infrastructure.

- Consequences for businesses that rely heavily on VMware solutions: Businesses heavily dependent on VMware solutions could face substantial price increases and potential disruptions if the merger proceeds without appropriate safeguards.

- Potential long-term effects on innovation and competition: The merger's long-term impact on innovation and competition remains uncertain. Reduced competition could stifle innovation, ultimately harming consumers.

Alternative Scenarios and Future Outlook

Several scenarios are possible following the regulatory review process.

- Likelihood of each potential outcome: The deal could be approved outright, blocked entirely, or approved with conditions, such as asset divestments or behavioral remedies. The likelihood of each outcome depends on the strength of the evidence presented by regulators and Broadcom's response.

- Analysis of the potential consequences of each outcome for AT&T, Broadcom, VMware, and the broader industry: Each outcome will have significant ramifications for the involved companies and the wider tech industry. Approval without conditions could lead to significant market consolidation and potential price increases. A blocked merger could preserve competition but potentially disrupt market stability.

- Prediction of future trends in the enterprise software market: The outcome will profoundly shape the future of the enterprise software market, influencing pricing strategies, innovation, and competition.

Conclusion

AT&T's concerns regarding a potential 1050% price hike following the Broadcom VMware acquisition highlight the significant antitrust implications of this merger. Regulatory scrutiny is intense, with regulators weighing the potential benefits against the risks of reduced competition and increased prices. Broadcom's defense strategies will be crucial in determining the outcome. The ultimate impact on consumers and the broader tech industry remains uncertain, potentially affecting cloud computing costs, innovation, and the competitive landscape for years to come. What are your thoughts on the potential implications of the Broadcom VMware acquisition? Share your perspective on the potential for a significant price hike in the comments below!

Featured Posts

-

Innovative Tariff System Dutch Utilities Explore Solar Driven Price Reductions

May 03, 2025

Innovative Tariff System Dutch Utilities Explore Solar Driven Price Reductions

May 03, 2025 -

This Country Your Practical Travel Guide

May 03, 2025

This Country Your Practical Travel Guide

May 03, 2025 -

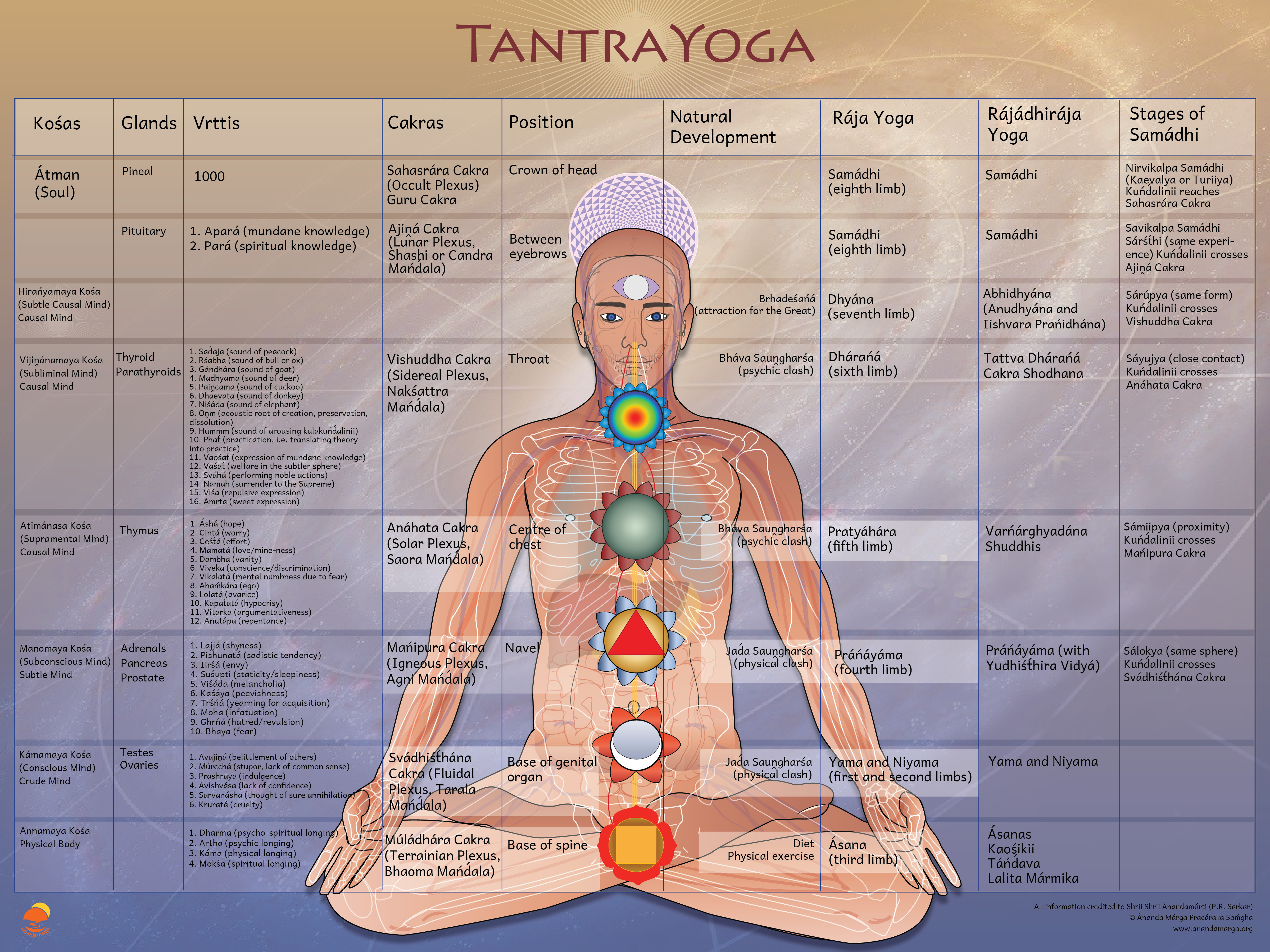

Fotos Laura Keller Em Retiro De Tantra Yoga De Biquini

May 03, 2025

Fotos Laura Keller Em Retiro De Tantra Yoga De Biquini

May 03, 2025 -

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 03, 2025

Why Arent Nick Robinson And Emma Barnett Hosting Together On Radio 4

May 03, 2025 -

The Revised Energy Policy Guido Fawkes Take

May 03, 2025

The Revised Energy Policy Guido Fawkes Take

May 03, 2025