Aussie Dollar Vs. Kiwi Dollar: Traders Bet On AUD Strength

Table of Contents

Economic Fundamentals: AUD's Relative Strength

The Australian economy has demonstrated relative strength compared to its New Zealand counterpart, significantly influencing the AUD/NZD exchange rate.

Australian Economy Outperforming New Zealand

Australia's robust economic performance is a key driver of the AUD's strength against the NZD. Several key economic indicators point to this outperformance.

- Higher Mining Exports: Australia's significant mining sector, particularly its iron ore exports, contributes substantially to its GDP and boosts the AUD.

- Robust Consumer Spending: Strong consumer spending indicates a healthy domestic economy, further supporting the AUD's value.

- Resilience to Global Headwinds: The Australian economy has shown resilience in the face of recent global economic uncertainties, strengthening investor confidence.

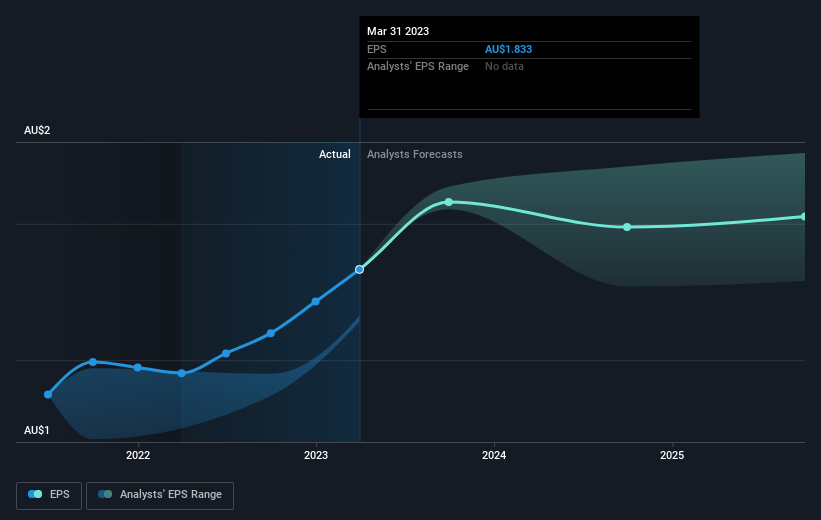

Comparing GDP growth rates, inflation, and employment data reveals a clear picture. For instance, Australia's Q2 2023 GDP growth (source needed - replace with actual data and source) outpaced New Zealand's (source needed - replace with actual data and source). Similarly, Australia's inflation rate (source needed - replace with actual data and source), while still elevated, might be showing signs of moderating faster than New Zealand's (source needed - replace with actual data and source). This difference in economic performance directly impacts the AUD/NZD exchange rate.

Reserve Bank of Australia (RBA) Policy

The Reserve Bank of Australia (RBA)'s monetary policy plays a crucial role in influencing the AUD's value.

- Interest Rate Differentials: Higher interest rates in Australia compared to New Zealand attract foreign investment, increasing demand for the AUD.

- Potential for Future Rate Hikes: The market's expectation of future RBA interest rate hikes further strengthens the AUD's appeal to investors seeking higher returns.

- Forward Guidance from the RBA: The RBA's communication regarding its future monetary policy actions influences market sentiment and impacts the AUD's trajectory.

The RBA's commitment to controlling inflation, even if it means maintaining higher interest rates for longer, is a key factor supporting the AUD's strength against the NZD. This proactive approach instills confidence in investors, making the AUD a more attractive investment.

Commodity Prices and their Influence

Commodity prices, especially iron ore, significantly impact the AUD/NZD exchange rate.

Impact of Iron Ore and Other Commodities

Australia's heavy reliance on commodity exports, particularly iron ore, makes the AUD highly sensitive to global commodity price fluctuations.

- Correlation between Iron Ore Prices and AUD Strength: A rise in iron ore prices generally strengthens the AUD, while a decline weakens it.

- Impact of Global Demand on Commodity Prices: Global economic growth and demand for raw materials significantly influence commodity prices and subsequently impact the AUD.

[Insert chart or graph here showing the correlation between iron ore prices and the AUD/NZD exchange rate. Source the data clearly.]

Diversification of New Zealand's Economy

While New Zealand's economy is strong, its lesser reliance on a single commodity like iron ore makes the NZD less susceptible to dramatic swings in commodity prices compared to the AUD.

- Tourism Sector's Influence on the NZD: New Zealand's tourism sector significantly contributes to its economy, offering some insulation against commodity price shocks.

- Vulnerability to Global Economic Shocks: While diversification helps, New Zealand's economy remains vulnerable to broader global economic downturns.

- Diversification Strategies: New Zealand's efforts to diversify its economy further can help mitigate its vulnerability to global commodity price volatility in the long term.

This relative diversification partially explains why the NZD hasn't experienced the same level of volatility as the AUD in response to recent commodity price fluctuations.

Geopolitical Factors and Market Sentiment

Geopolitical events and overall market sentiment also play a critical role in influencing the AUD/NZD exchange rate.

Global Risk Appetite and Safe-Haven Currencies

The AUD is often considered a riskier asset compared to the NZD.

- Impact of Global Uncertainty on Investor Sentiment: During periods of global uncertainty, investors often move towards safer haven assets, potentially weakening the AUD.

- Flight to Safety Phenomenon: This "flight to safety" typically leads to increased demand for currencies perceived as less risky, like the NZD or the US dollar.

- AUD's Sensitivity to Risk-Off Trades: The AUD's sensitivity to risk-off trades makes it more volatile during times of geopolitical instability or economic uncertainty.

Market sentiment plays a crucial role here. Shifts in global risk appetite directly affect investor decisions regarding AUD/NZD trading.

Political Stability and its Influence

Political stability (or instability) in both Australia and New Zealand can influence investor confidence and subsequently impact their respective currencies.

- Impact of Government Policies: Changes in government policies, particularly those impacting economic growth or foreign investment, can affect the attractiveness of both currencies.

- Political Uncertainty: Periods of political uncertainty or instability can negatively impact investor confidence, potentially leading to currency depreciation.

- Investor Confidence: Strong and stable political leadership generally fosters investor confidence, supporting currency values.

For example, [Insert example of a political event influencing the AUD/NZD exchange rate].

Conclusion

The current preference for the AUD over the NZD stems from a confluence of factors. Australia's stronger economic fundamentals, its significant reliance on commodities (particularly the impact of iron ore prices), and the AUD's sensitivity to global risk appetite all contribute to its relative strength against the NZD. Understanding these dynamics is crucial for navigating the AUD/NZD exchange rate.

Understanding the dynamics of the Aussie dollar vs. Kiwi dollar is crucial for anyone involved in currency trading or international finance. Stay informed about the latest economic indicators, commodity prices, and geopolitical developments to make informed decisions regarding AUD/NZD trading. Continue learning about the Aussie Dollar and Kiwi Dollar exchange rate and its potential for future movements.

Featured Posts

-

Romanias Presidential Runoff What To Expect

May 06, 2025

Romanias Presidential Runoff What To Expect

May 06, 2025 -

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025

The Impact Of Margin Compression On Westpac Wbc Profitability

May 06, 2025 -

Cassidy Hutchinson Key Jan 6 Witness To Publish Memoir This Fall

May 06, 2025

Cassidy Hutchinson Key Jan 6 Witness To Publish Memoir This Fall

May 06, 2025 -

Google Faces U S Demand To Divest Its Online Advertising Empire

May 06, 2025

Google Faces U S Demand To Divest Its Online Advertising Empire

May 06, 2025 -

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Chris Pratt Discusses Patrick Schwarzeneggers White Lotus Nudity

May 06, 2025

Latest Posts

-

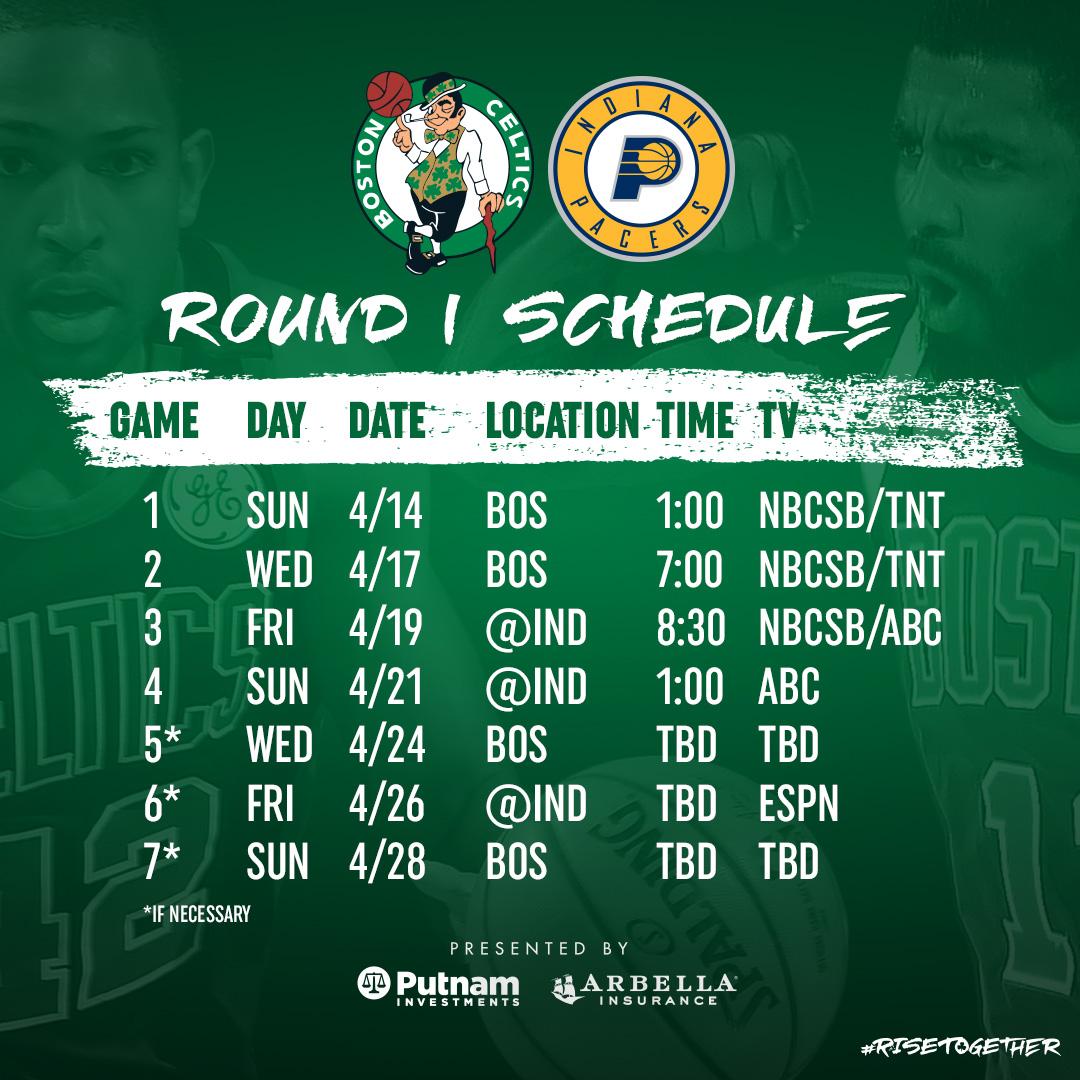

Celtics Vs Suns April 4th Game Time Tv Schedule And Online Streaming Options

May 06, 2025

Celtics Vs Suns April 4th Game Time Tv Schedule And Online Streaming Options

May 06, 2025 -

Watch Celtics Vs Heat Game Details For February 10th Time Channel Stream

May 06, 2025

Watch Celtics Vs Heat Game Details For February 10th Time Channel Stream

May 06, 2025 -

Boston Celtics Playoff Games Schedule Dates And Times Against Orlando

May 06, 2025

Boston Celtics Playoff Games Schedule Dates And Times Against Orlando

May 06, 2025 -

Celtics Vs Heat February 10 Find Game Time Tv Channel And Live Streaming

May 06, 2025

Celtics Vs Heat February 10 Find Game Time Tv Channel And Live Streaming

May 06, 2025 -

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025

Celtics Vs Suns Game Time Tv Channel And Live Stream Info April 4th

May 06, 2025