5 Key Dos And Don'ts: Succeeding In The Private Credit Market

Table of Contents

Do Your Due Diligence: Thoroughly Investigate Potential Investments

Thorough due diligence is paramount in the private credit market. Before committing capital to any private debt investment, you must meticulously investigate the potential investment. This involves a comprehensive assessment of several key areas.

Understanding the Borrower

Effective borrower assessment is the cornerstone of successful private credit investing. This requires a deep dive into the borrower's financial health and operational capabilities.

- Analyze the borrower's financial statements: Scrutinize balance sheets, income statements, and cash flow statements to understand their financial position, profitability, and liquidity. Look for trends and red flags.

- Credit history review: Investigate the borrower's credit history, including payment patterns, defaults, and outstanding debts. A strong credit history significantly reduces risk in private debt.

- Assess the management team: Evaluate the experience, expertise, and track record of the borrower's management team. A competent management team is essential for successful business operations and debt repayment.

- Industry and competitive landscape analysis: Understand the borrower's industry, its competitive dynamics, and the borrower's position within the market. This helps assess the borrower's long-term prospects and resilience to economic downturns.

- Independent verification: Verify the information provided by the borrower through independent sources, such as industry reports, credit agencies, and legal professionals. This crucial step in your credit analysis helps mitigate information asymmetry.

Structuring the Deal

The structure of the loan agreement significantly impacts the risk and return profile of your private debt investment.

- Loan terms understanding: Carefully review the loan terms, including interest rates, fees, repayment schedules, and any prepayment penalties.

- Covenant negotiation: Negotiate protective covenants to mitigate risks and safeguard your investment. These covenants should address key aspects of the borrower's operations and financial health.

- Seeking expert advice: Seek legal and financial advice from experienced professionals to ensure the deal structure aligns with your investment goals and risk tolerance and complies with all relevant regulations in alternative lending.

Don't Neglect Risk Management: Identify and Mitigate Potential Risks

Risk management is crucial in the private credit market. Failing to adequately assess and mitigate risks can lead to significant losses.

Assessing Credit Risk

Credit risk is inherent in any lending activity. Develop robust strategies to minimize this risk in your private credit portfolio.

- Credit scoring model development: Develop a sophisticated credit scoring model to evaluate the creditworthiness of potential borrowers. This model should incorporate both quantitative and qualitative factors.

- Stress testing implementation: Utilize stress testing techniques to assess the resilience of your investments under various economic scenarios, such as interest rate hikes or recessions.

- Portfolio diversification: Diversify your portfolio across different borrowers, industries, and loan structures to reduce the impact of any single default. This is a key principle of risk management in alternative investment strategies.

Liquidity Risk Management

Liquidity risk refers to the risk of not being able to sell your private credit investments quickly without incurring significant losses.

- Sufficient liquidity: Ensure you have access to sufficient liquidity to meet unexpected obligations or to capitalize on opportunistic investments.

- Marketability assessment: Assess the marketability of your investments in the secondary market for private credit. This impacts your ability to exit your positions if needed.

- Exit strategy development: Develop a clear exit strategy for each investment, including potential scenarios for repayment, refinancing, or sale.

Do Build Strong Relationships: Networking and Partnerships are Key

Building strong relationships is essential for success in the private credit market. Networking and strategic partnerships can unlock access to deal flow, expertise, and capital.

Networking in the Private Credit Industry

Active networking is crucial for identifying promising investment opportunities and staying abreast of market trends in private credit.

- Industry event attendance: Attend industry conferences, seminars, and workshops to meet potential partners and learn from experts.

- Relationship cultivation: Develop and maintain relationships with other investors, fund managers, and lenders. These connections can lead to valuable insights and opportunities.

- Online platform utilization: Utilize online networking platforms like LinkedIn to connect with professionals in the private credit industry.

Partnering for Success

Strategic partnerships can enhance your investment capabilities and reduce risk.

- Experienced partner collaboration: Consider collaborating with experienced partners who possess complementary skills and expertise.

- Expertise leverage: Leverage the expertise of partners in areas where you lack experience, such as legal, regulatory, or operational matters.

- Resource sharing: Share knowledge, resources, and deal flow to enhance your collective investment performance.

Don't Underestimate the Importance of Legal and Regulatory Compliance

Compliance with all applicable laws and regulations is paramount in the private credit market. Non-compliance can lead to significant penalties and reputational damage.

Navigating Regulatory Landscapes

The regulatory environment for private credit is constantly evolving. Stay informed about relevant regulations and ensure your activities comply.

- Regulatory updates monitoring: Stay informed about changes in regulations and laws affecting private credit.

- Legal counsel seeking: Seek legal counsel to ensure your investment activities comply with all applicable laws and regulations. This is vital for navigating the complex legal aspects of alternative lending.

- Regulatory impact analysis: Understand the implications of various regulatory changes on your investment strategy and operations.

Documentation and Transparency

Maintaining detailed records and ensuring transparent communication are essential for compliance and building trust.

- Transaction record keeping: Maintain detailed records of all transactions, including loan agreements, payment schedules, and communication with borrowers.

- Transparent communication: Ensure transparent communication with borrowers, partners, and other stakeholders.

- Best practices adherence: Adhere to best practices in documentation and record-keeping to minimize the risk of non-compliance.

Do Focus on Long-Term Value Creation: Patient Capital is Essential

Private credit investments often require a long-term perspective. Focusing on long-term value creation is essential for maximizing returns in this space.

Long-Term Investment Strategy

Develop a long-term investment strategy aligned with your risk tolerance and investment objectives.

- Long-term strategy development: Develop a well-defined, long-term investment strategy that considers your risk appetite and desired returns.

- Short-term pressure avoidance: Avoid short-term pressures and focus on building value over time.

- Value creation prioritization: Prioritize investments that have the potential to generate long-term value, even if it requires patience.

Active Portfolio Management

Actively manage your portfolio to maximize returns and mitigate risks.

- Investment monitoring: Regularly monitor your investments to identify potential risks and opportunities.

- Strategy adaptation: Adapt your investment strategy as needed based on market conditions and changes in the performance of your investments.

- Risk and opportunity management: Proactively manage risks and identify new investment opportunities.

Conclusion: Mastering the Private Credit Market: Your Path to Success

Success in the private credit market requires a combination of thorough due diligence, robust risk management, strong relationships, unwavering commitment to legal and regulatory compliance, and a long-term investment horizon. By diligently following these dos and don'ts—from meticulous financial statement analysis and loan structuring to diligent network building and active portfolio management—you can confidently navigate the complexities of private credit investing. Remember that effective private credit investing demands patience and a strategic approach focused on long-term value creation in private debt and alternative lending opportunities. By following these key dos and don'ts, you can confidently navigate the complexities of the private credit market and achieve significant success in your private credit investments.

Featured Posts

-

Hurun Report 2025 Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025

Hurun Report 2025 Elon Musk Still Richest Despite Massive Net Worth Decline

May 10, 2025 -

Samuel Dickson Industrialist And Lumber Industry Pioneer In Canada

May 10, 2025

Samuel Dickson Industrialist And Lumber Industry Pioneer In Canada

May 10, 2025 -

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025

Potential Tariffs On Aircraft And Engines Examining Trumps Trade Policy

May 10, 2025 -

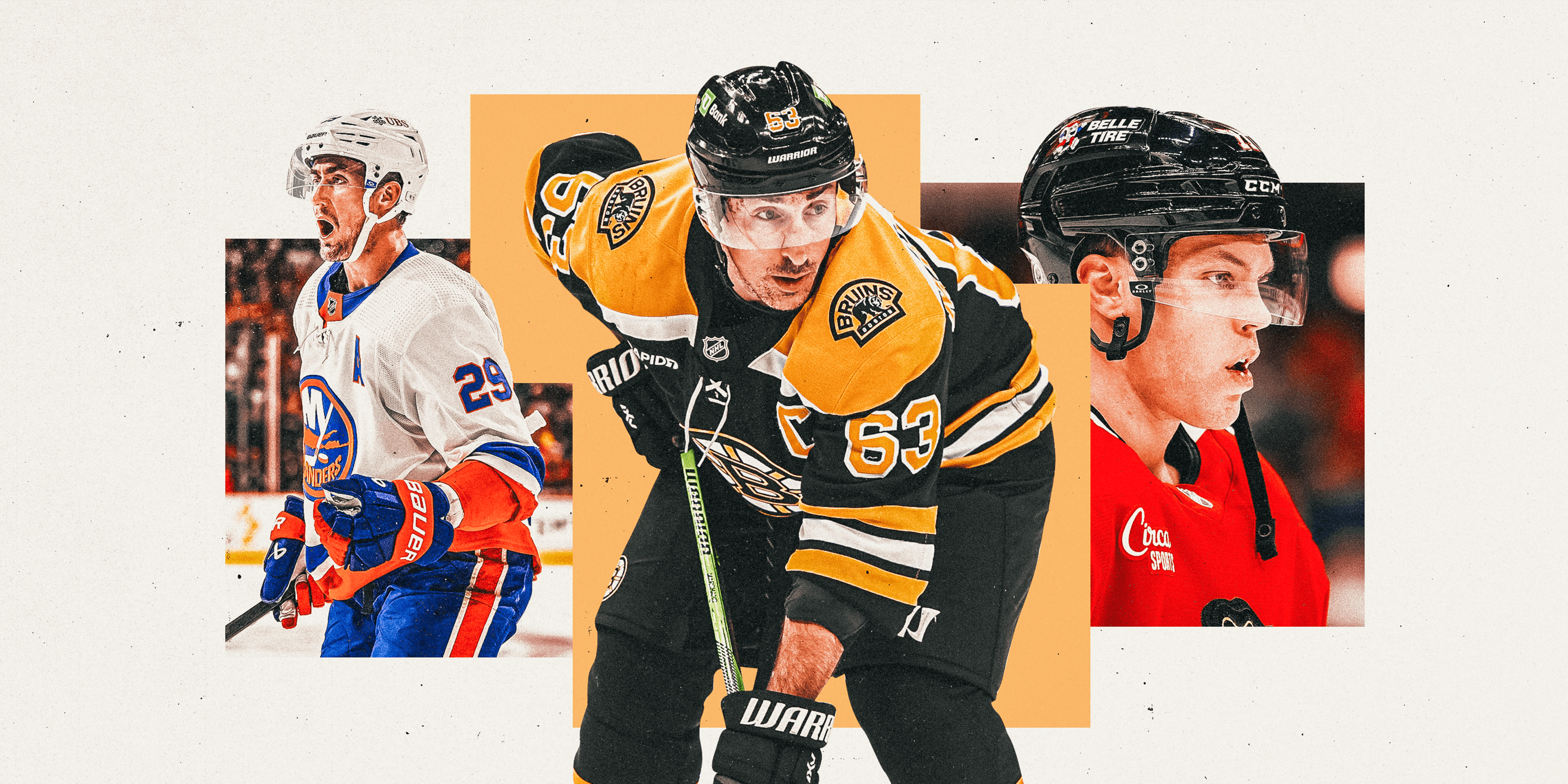

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025

Predicting The 2025 Nhl Playoffs After The Trade Deadline

May 10, 2025 -

Ihsaas Transgender Athlete Ban Following A Trump Order

May 10, 2025

Ihsaas Transgender Athlete Ban Following A Trump Order

May 10, 2025