Are Late Student Loan Payments Hurting Your Credit Score?

Table of Contents

How Student Loan Payments Affect Your Credit Score

Understanding how your student loan payments impact your credit score is the first step towards financial responsibility. This section will detail the mechanics of credit reporting and the severity of late payments.

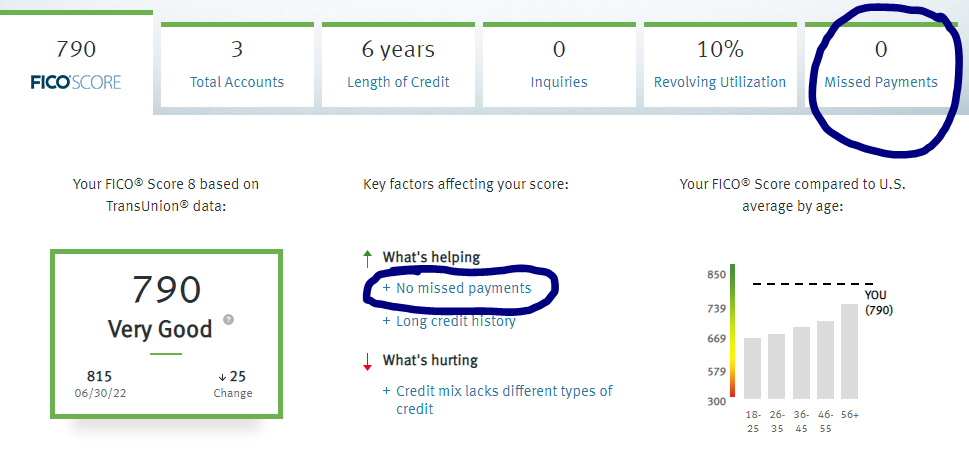

Understanding Credit Reports and FICO Scores

Credit bureaus like Equifax, Experian, and TransUnion collect information on your financial behavior, including your student loan payment history. This information is used to calculate your FICO score, a crucial metric lenders use to assess your creditworthiness.

- FICO Score: Your FICO score is a three-digit number ranging from 300 to 850, with higher scores indicating better credit.

- Payment History: Payment history is the most significant factor (35%) in your FICO score. Consistent on-time payments are crucial for maintaining a high score.

- Negative Marks: Late payments, defaults, and collections related to your student loans are considered negative marks and significantly lower your FICO score. These marks can make it harder to obtain future loans at favorable interest rates.

The Severity of Late Payments

The impact of a late student loan payment on your credit score depends on the severity of the delinquency:

- 30 Days Late: While a single 30-day late payment might not drastically affect your score, it's a warning sign. Repeated 30-day late payments will negatively impact your score.

- 60 Days Late: A 60-day late payment is a more serious issue and will cause a more significant drop in your FICO score.

- 90+ Days Late: A payment 90 days or more past due is considered severely delinquent and can severely damage your credit score. It can also lead to further negative consequences such as debt collection agencies contacting you and potential wage garnishment. This can make it extremely difficult to secure loans or credit in the future. Interest rates will also be considerably higher.

Preventing Late Student Loan Payments

Proactive measures are key to avoiding late student loan payments and protecting your credit score.

Setting Up Automatic Payments

Automating your student loan payments is one of the simplest and most effective ways to prevent late payments.

- Benefits of Auto-pay: Auto-pay ensures your payments are made on time, regardless of your schedule. Many loan servicers offer small discounts for enrolling in auto-pay.

- Setting up Auto-pay: Most loan servicers offer convenient online options to set up automatic payments from your checking or savings account.

- Confirmation: Always confirm the payment is successfully processed to avoid any unexpected late payment charges.

Budgeting and Financial Planning for Student Loan Repayment

Creating a realistic budget is essential for managing your student loan payments effectively.

- Budgeting Tools: Use budgeting apps or spreadsheets to track your income and expenses.

- Repayment Plan: Develop a comprehensive repayment plan that aligns with your financial capacity. Consider income-driven repayment plans if you're struggling.

- Prioritize Payments: Prioritize your student loan payments alongside essential expenses like rent, utilities, and food to ensure timely payments.

Communicating with Your Loan Servicer

Open communication with your loan servicer is vital, especially if you anticipate difficulties making payments.

- Contact Your Servicer: Don't hesitate to contact your loan servicer if you foresee payment issues. They may offer options such as forbearance or deferment.

- Explore Options: Understand the terms and conditions of forbearance or deferment to avoid further complications.

- Documentation: Keep records of all communications and agreements with your loan servicer.

Recovering from Late Student Loan Payments

Even with the best intentions, late payments can occur. Understanding the impact and taking steps to recover is crucial.

Understanding the Impact of Negative Marks

Negative marks from late payments typically remain on your credit report for seven years. However, their impact diminishes over time as newer, positive payment information is added.

- Length of Time: Late payments will stay on your credit report for seven years from the date of delinquency.

- Credit Score Improvement: Focus on consistently making on-time payments to offset the negative impact of past late payments.

Strategies to Improve Your Credit Score

Improving your credit score after late payments requires consistent effort and responsible financial behavior.

- Credit Monitoring Services: Consider using credit monitoring services to track your credit report and identify any errors or discrepancies.

- Debt Reduction: Focus on paying down other debts to improve your credit utilization ratio.

- Low Credit Utilization: Keep your credit utilization ratio (the amount of credit you use compared to your total available credit) low. Aim for under 30%.

Conclusion

Late student loan payments significantly damage your credit score, impacting your ability to secure loans and other financial opportunities. Proactive planning, including setting up automatic payments, creating a realistic budget, and maintaining open communication with your loan servicer, is crucial for preventing late payments. If you've experienced late payments, understand that recovery is possible through consistent on-time payments and responsible credit management. Don't let late student loan payments hurt your credit score – take control of your finances today!

Featured Posts

-

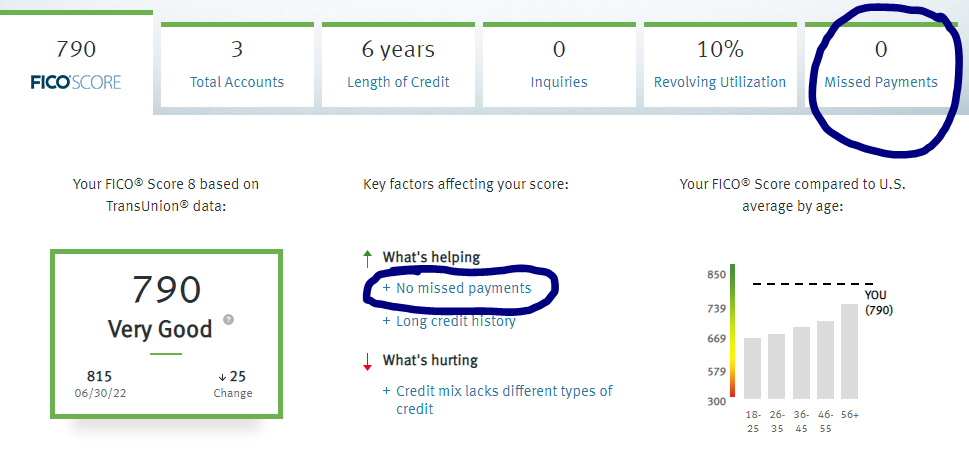

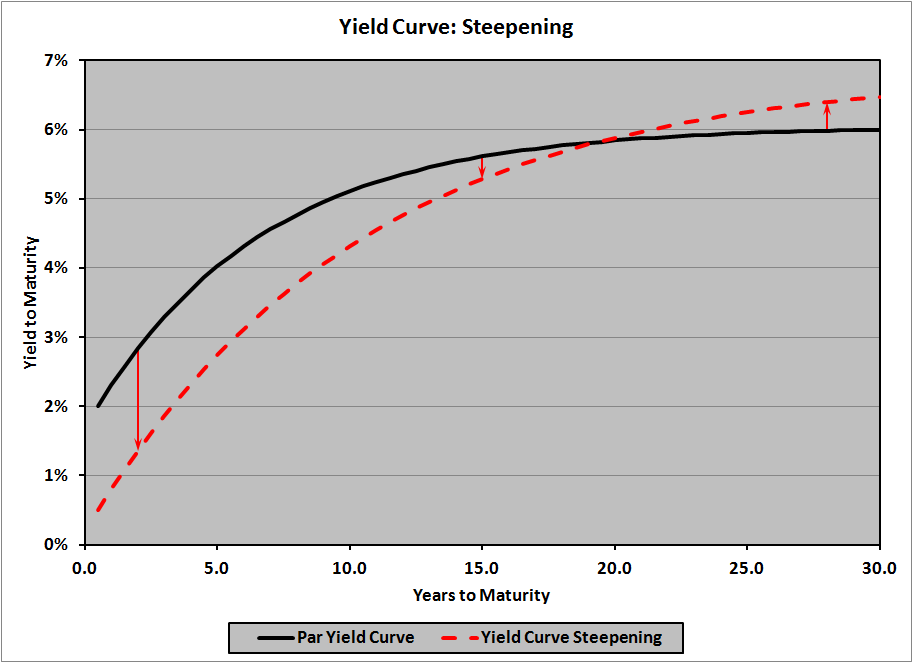

Analyzing Japans Steep Bond Curve Risks And Opportunities

May 17, 2025

Analyzing Japans Steep Bond Curve Risks And Opportunities

May 17, 2025 -

Mikal Bridges Plea Less Court Time For Knicks Key Players

May 17, 2025

Mikal Bridges Plea Less Court Time For Knicks Key Players

May 17, 2025 -

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025

Thibodeau Blasts Refs After Knicks Game 2 Defeat

May 17, 2025 -

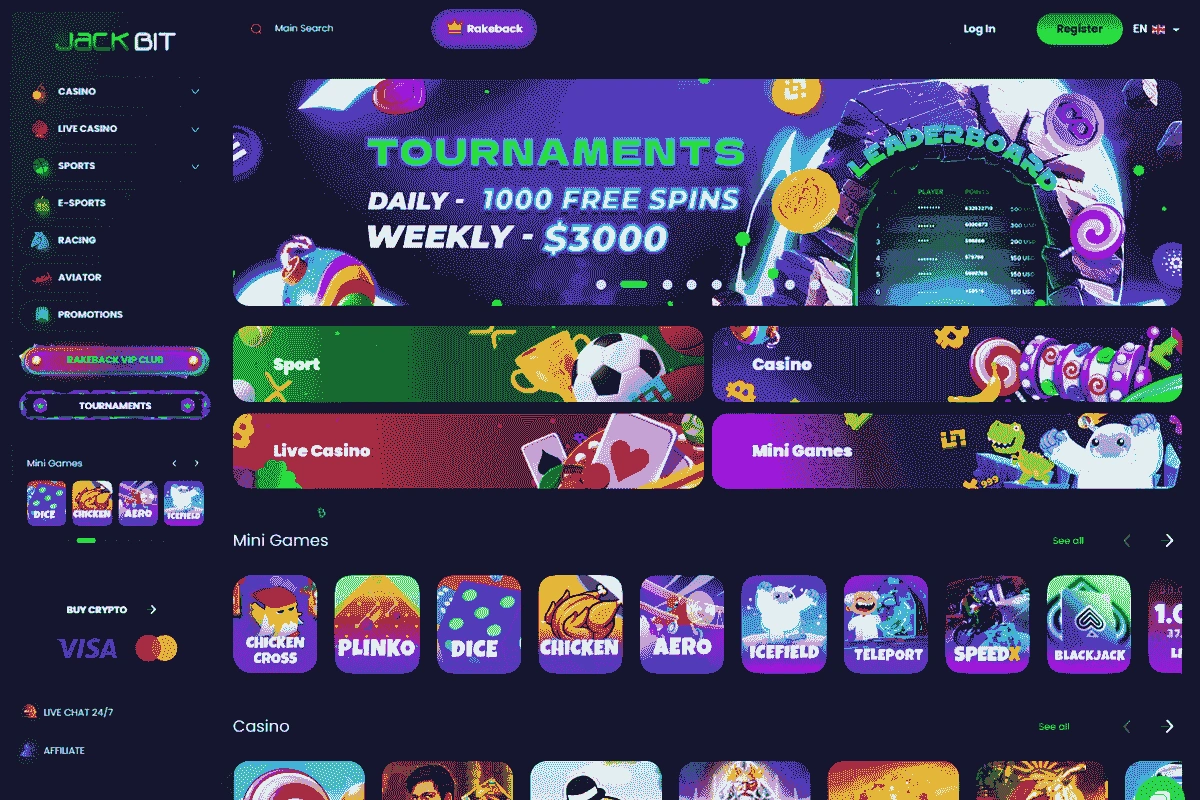

Choosing The Best Crypto Casino In 2025 Jackbits Advantages

May 17, 2025

Choosing The Best Crypto Casino In 2025 Jackbits Advantages

May 17, 2025 -

Dominacija Ige Svjontek Pobednicki Niz I Predstojeci Mecevi

May 17, 2025

Dominacija Ige Svjontek Pobednicki Niz I Predstojeci Mecevi

May 17, 2025

Latest Posts

-

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025

Krah Alkarasa U Barseloni Rune Proslavlja Pobednicku Titulu

May 17, 2025 -

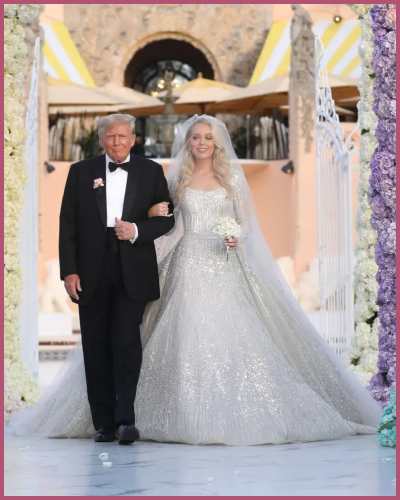

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025

Alexander Boulos Arrives Expanding The Trump Family Lineage

May 17, 2025 -

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025

Barselona 2024 Rune Nadmasuje Povredenog Alkarasa

May 17, 2025 -

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025

Tiffany Trump And Michael Boulos Welcome First Child A Look At The Trump Family Tree

May 17, 2025 -

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025

Runeov Trijumf Neocekivani Ishod Finala U Barseloni

May 17, 2025