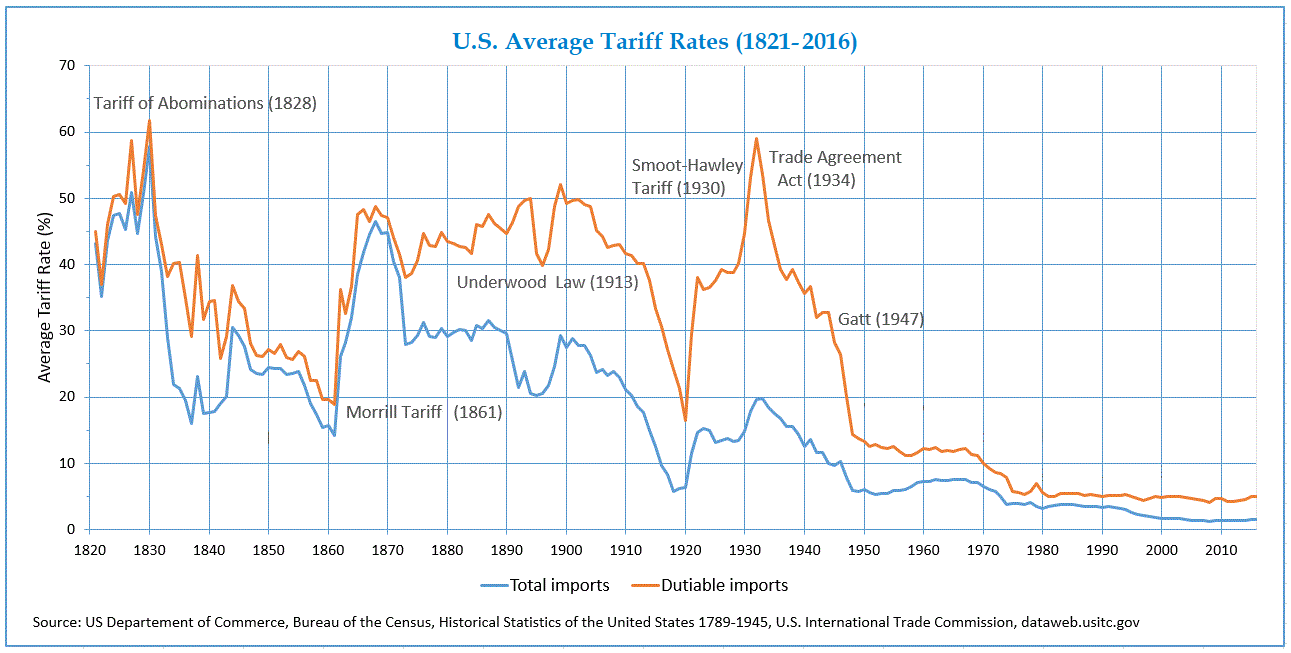

Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The Magnitude of the $900 Million Tariff Hit on Apple's Financials

The $900 million tariff hit represents a substantial blow to Apple's profitability. This figure isn't a uniform impact; it's spread across various product lines, significantly impacting profit margins. The "Tariff Impact on Apple" is clearly visible in decreased revenue streams.

- Specific product lines impacted: The tariffs primarily affect iPhones, iPads, and MacBooks imported from China. These are some of Apple's most popular and profitable products, making the impact particularly severe.

- Percentage decrease in profit margins: Analysts estimate a significant decrease in profit margins, ranging from 2% to 5%, depending on the product and the specific tariff rates applied. This translates to hundreds of millions of dollars in reduced earnings.

- Comparison to previous quarters' financial performance: This represents a sharp deviation from Apple's typically robust financial performance in previous quarters, causing concern among investors about the company's future growth trajectory.

- Analyst predictions for future quarters: Many analysts predict continued pressure on Apple's profit margins in the coming quarters unless the tariff situation improves or Apple successfully implements mitigation strategies. The "Apple Stock" price reflects this uncertainty. The "Financial Losses" are a primary concern for investors analyzing "Tariff Impact on Apple."

Investor Reaction to the Apple Stock Slump and Tariff News

The news of the tariffs and their impact on Apple's financials triggered immediate and significant market reactions, leading to a noticeable "Apple Stock Slump."

- Stock price fluctuations since the tariff announcement: Following the tariff announcement, Apple's stock price experienced a noticeable dip, reflecting investor anxieties about the company's ability to absorb the financial losses.

- Investor sentiment and analyst ratings: Investor sentiment turned negative, with many analysts downgrading their ratings on Apple stock due to the uncertainty surrounding the long-term implications of the tariffs. Negative "Investor Sentiment" contributed to the "Apple Stock Price" decline.

- Trading volume changes: Trading volume for Apple stock significantly increased in the days following the tariff announcement, indicating heightened investor activity and concern.

- Impact on Apple's market capitalization: The "Apple Stock Slumps" resulted in a considerable decrease in Apple's market capitalization, a clear reflection of the negative impact of the tariffs on investor confidence. The "Market Reaction" was swift and negative.

Potential Long-Term Implications of Tariffs on Apple's Business Strategy

The tariffs force Apple to reassess its business strategy and explore ways to mitigate the negative impact. The "Tariff Impact on Apple" necessitates a long-term strategy shift.

- Potential for price increases for consumers: To offset the increased costs associated with the tariffs, Apple may be forced to increase prices for its products, potentially impacting consumer demand.

- Shifting production locations to mitigate tariffs: Relocating some of its manufacturing operations to countries outside of the tariff's reach is a serious consideration for Apple to reduce its reliance on Chinese manufacturing. "Production Relocation" is a key element of "Tariff Mitigation."

- Long-term impact on Apple's global supply chain: The tariffs have highlighted the vulnerabilities of Apple's global supply chain, prompting a review and diversification of its manufacturing partners. This "Supply Chain Disruption" is a long-term concern.

- Exploration of alternative manufacturing strategies: Apple may explore alternative manufacturing strategies, such as automation or increased reliance on suppliers in other regions, to reduce its dependence on a single manufacturing base. The "Apple Business Strategy" needs adaptation to face the ongoing "Tariff Impact on Apple."

Comparing Apple's Response to Other Tech Companies Facing Similar Tariffs

Other tech companies facing similar tariffs have adopted various strategies, including absorbing some of the costs, increasing prices, and diversifying their supply chains. While Apple's response is still evolving, it will be interesting to compare its effectiveness against competitors' approaches.

Conclusion: Understanding the Apple Stock Slump and Future Tariff Implications

The $900 million tariff impact has significantly contributed to the recent Apple stock slump, creating uncertainty for both investors and the broader tech industry. The "Apple Stock Slumps" illustrate the profound influence of global trade policies. This analysis has highlighted the significant financial losses, the negative investor sentiment, and the potential long-term implications for Apple's business strategy. Understanding the "Tariff Impact on Apple" is crucial for navigating the current economic climate. To stay informed, stay updated on Apple stock slumps, monitor the impact of tariffs on Apple, and follow Apple's response to the $900 million tariff. The ongoing uncertainty surrounding tariffs emphasizes the importance of continued observation of this situation and its evolving impact on Apple and the global tech market.

Featured Posts

-

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 24, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stocks

May 24, 2025 -

Listen To Joy Crookes Latest Single Carmen

May 24, 2025

Listen To Joy Crookes Latest Single Carmen

May 24, 2025 -

Aktienmarkt Frankfurt Dax Entwicklung Und Optionsablauf Am 21 Maerz 2025

May 24, 2025

Aktienmarkt Frankfurt Dax Entwicklung Und Optionsablauf Am 21 Maerz 2025

May 24, 2025 -

16 Nisan 2025 Avrupa Piyasa Oezeti Stoxx Europe 600 Ve Dax 40 Ta Duesues

May 24, 2025

16 Nisan 2025 Avrupa Piyasa Oezeti Stoxx Europe 600 Ve Dax 40 Ta Duesues

May 24, 2025 -

Michael Caine Remembers Filming A Sex Scene With Mia Farrow A Surprising Story

May 24, 2025

Michael Caine Remembers Filming A Sex Scene With Mia Farrow A Surprising Story

May 24, 2025

Latest Posts

-

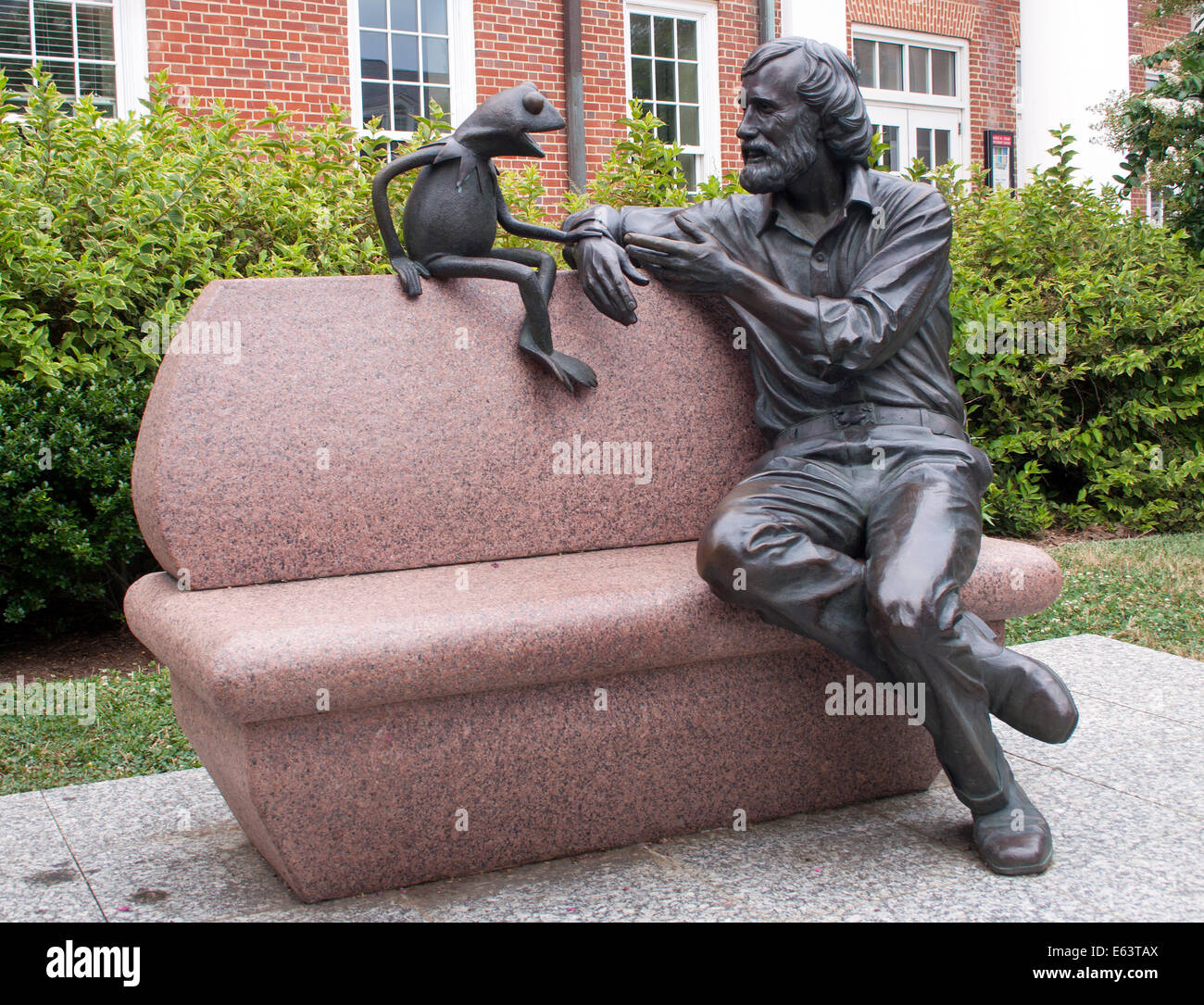

University Of Marylands 2024 Commencement Kermit The Frog To Speak

May 24, 2025

University Of Marylands 2024 Commencement Kermit The Frog To Speak

May 24, 2025 -

Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025

Kermit The Frog To Address University Of Maryland Graduates

May 24, 2025 -

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025

2025 Commencement Speaker Kermit The Frog At The University Of Maryland

May 24, 2025 -

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025

Kermit The Frogs University Of Maryland Commencement Speech 2025

May 24, 2025 -

Confirmed Kermit The Frog To Speak At University Of Maryland Graduation 2025

May 24, 2025

Confirmed Kermit The Frog To Speak At University Of Maryland Graduation 2025

May 24, 2025