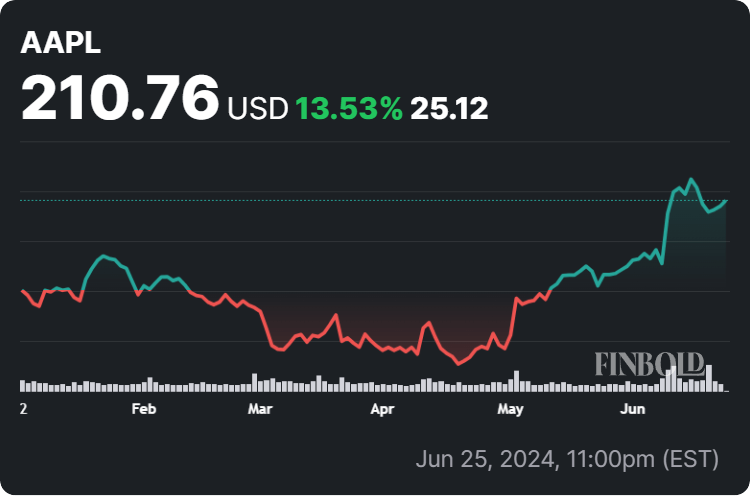

Apple Stock Price Target: One Analyst Sees $254 – Investment Analysis

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Price Target

The analyst's optimistic $254 Apple stock price target rests on several key pillars: robust iPhone sales, expansion into lucrative new technologies, and Apple's consistently strong financial performance.

Strong iPhone Sales and Services Growth

The iPhone remains the backbone of Apple's revenue, and the analyst's prediction hinges on continued strong sales. The expected launch of the iPhone 15 series is a crucial factor. Projected sales figures indicate strong demand, especially in emerging markets. This consistent growth in iPhone sales, combined with the ever-expanding and highly profitable Apple services ecosystem (Apple Music, iCloud, Apple TV+, etc.), forms a significant portion of the bullish outlook.

- Expected iPhone 15 sales figures: Analysts predict a significant increase in iPhone 15 sales compared to previous generations.

- Market share projections: Apple is projected to maintain or even increase its market share in the premium smartphone segment.

- Growth in emerging markets: Significant growth is anticipated in emerging markets like India and Southeast Asia, where Apple's brand recognition and market penetration are increasing.

Expansion into New Technologies and Markets

Apple's strategic investments in new technologies beyond the iPhone are another key driver of the $254 Apple stock price target. The much-anticipated (though still unconfirmed) Apple Car, along with advancements in augmented reality/virtual reality (AR/VR) and other services, present substantial potential revenue streams.

- Potential revenue streams from new products/services: The Apple Car, if launched successfully, could generate billions in revenue. AR/VR headsets are also poised to capture significant market share.

- Market penetration strategy for new technologies: Apple's brand reputation and established ecosystem provide a strong foundation for success in new markets.

- Competitive advantages in these new markets: Apple’s focus on user experience, seamless integration, and premium pricing positions them favorably against competitors.

Financial Strength and Future Earnings Projections

Apple's current financial health significantly bolsters the $254 Apple stock price prediction. The company boasts substantial cash reserves, high profitability margins, and manageable debt levels. Future earnings projections are positive, anticipating sustained growth driven by the factors discussed above.

- Projected EPS growth: Analysts predict consistent earnings per share (EPS) growth for the foreseeable future.

- Revenue projections for the next fiscal year: Significant revenue growth is projected for the next fiscal year, fueled by iPhone sales and new product launches.

- Analysis of Apple's balance sheet: Apple's strong balance sheet, including substantial cash reserves and minimal debt, provides a safety net against economic downturns.

Potential Risks and Challenges Affecting the Apple Stock Price Target

While the $254 Apple stock price target is ambitious, it's crucial to acknowledge potential headwinds that could significantly impact Apple's performance.

Global Economic Uncertainty and Supply Chain Issues

Global economic uncertainty, including inflation and recessionary fears, poses a significant risk. These factors can directly impact consumer spending, potentially reducing demand for Apple products. Furthermore, ongoing supply chain disruptions could affect production and delivery timelines.

- Impact of inflation on consumer spending: High inflation rates could discourage consumers from purchasing high-priced electronics.

- Risks associated with geopolitical instability: Geopolitical events can disrupt supply chains and negatively impact Apple's operations.

- Potential for supply chain bottlenecks: Continued supply chain constraints could lead to production delays and impact revenue.

Competition from Android and Other Tech Giants

Apple faces stiff competition from Android manufacturers like Samsung and Google, as well as other tech giants pushing innovative products and services. The competitive landscape is constantly evolving, and new disruptive technologies could pose a threat to Apple's dominance.

- Market share analysis of competing products: Android continues to hold a larger market share globally, putting pressure on Apple to innovate and maintain its premium positioning.

- Competitive advantages and disadvantages of Apple products: While Apple boasts a loyal customer base and strong brand reputation, competitors offer similar functionality at lower price points.

- Potential disruptive technologies from competitors: Emerging technologies from competitors could disrupt Apple's existing markets and require significant adaptation.

Regulatory Scrutiny and Antitrust Concerns

Apple faces increasing regulatory scrutiny and antitrust investigations globally, which could impact its business model and profitability. These investigations could lead to fines or changes to Apple’s practices.

- Ongoing antitrust lawsuits and investigations: Several antitrust lawsuits are ongoing, focusing on Apple’s App Store policies and other business practices.

- Potential impact of regulatory changes on Apple’s business model: Regulatory changes could force Apple to alter its business model, potentially reducing profitability.

- Risks associated with data privacy regulations: Stricter data privacy regulations could impact Apple’s ability to collect and utilize user data for personalized services.

Alternative Viewpoints and Divergent Apple Stock Price Predictions

It's essential to acknowledge that the $254 Apple stock price target isn't universally accepted. Other analysts offer varying predictions, reflecting different perspectives and methodologies. Some analysts hold a more conservative view, citing the risks mentioned above, and predicting lower price targets. A diverse range of price targets underscores the uncertainty inherent in stock market predictions.

- Summary of other analysts’ price targets and rationale: A spectrum of price targets exists, reflecting different assessments of Apple's future performance and associated risks.

- Comparison of different investment strategies: Different investment strategies will have different tolerances for risk and might favor diverse approaches to Apple stock investment.

- Importance of diversified investment portfolios: Diversification is key to mitigating risk. Investing solely in Apple stock, regardless of the price prediction, isn't recommended.

Conclusion: Apple Stock Price Target: Making Informed Investment Decisions

The $254 Apple stock price target presented by the analyst is a bold prediction, supported by strong iPhone sales, anticipated expansion into new technologies, and Apple's solid financial health. However, it's crucial to consider the potential risks, including global economic uncertainty, competition, and regulatory scrutiny. Alternative viewpoints and a range of price predictions highlight the inherent uncertainty in the stock market.

Before making any investment decisions regarding Apple stock, it is imperative to conduct thorough due diligence, consult with a financial advisor, and consider diversifying your portfolio. Stay informed on the Apple stock price target and market trends, and analyze the Apple stock price prediction critically to make smart decisions about your Apple stock investments. Remember, responsible investing involves a comprehensive understanding of both the potential rewards and the inherent risks.

Featured Posts

-

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025

Apple Stock Prediction 254 Is Aapl A Buy Near 200

May 25, 2025 -

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 25, 2025

Cac 40 Weekly Close In Negative Territory Despite Overall Stability March 7 2025

May 25, 2025 -

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025

Auto Legendas F1 Es Motorral Szerelt Porsche Koezuti Verzioja

May 25, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 25, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 25, 2025 -

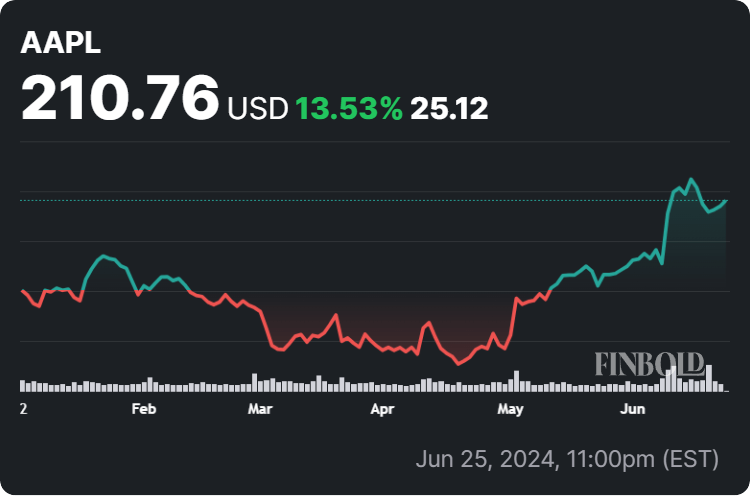

M56 Traffic Delays Cheshire And Deeside Border Collision

May 25, 2025

M56 Traffic Delays Cheshire And Deeside Border Collision

May 25, 2025

Latest Posts

-

Addressing Safety Concerns A Southern Vacation Hotspots Response To Negative Publicity

May 25, 2025

Addressing Safety Concerns A Southern Vacation Hotspots Response To Negative Publicity

May 25, 2025 -

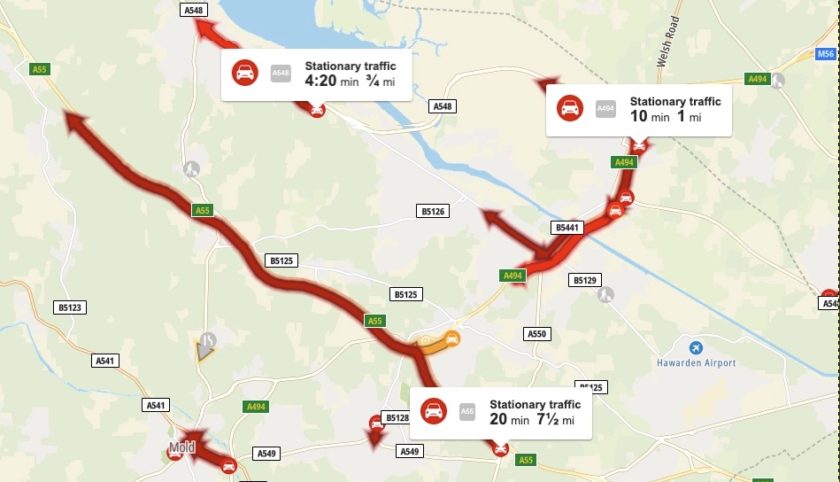

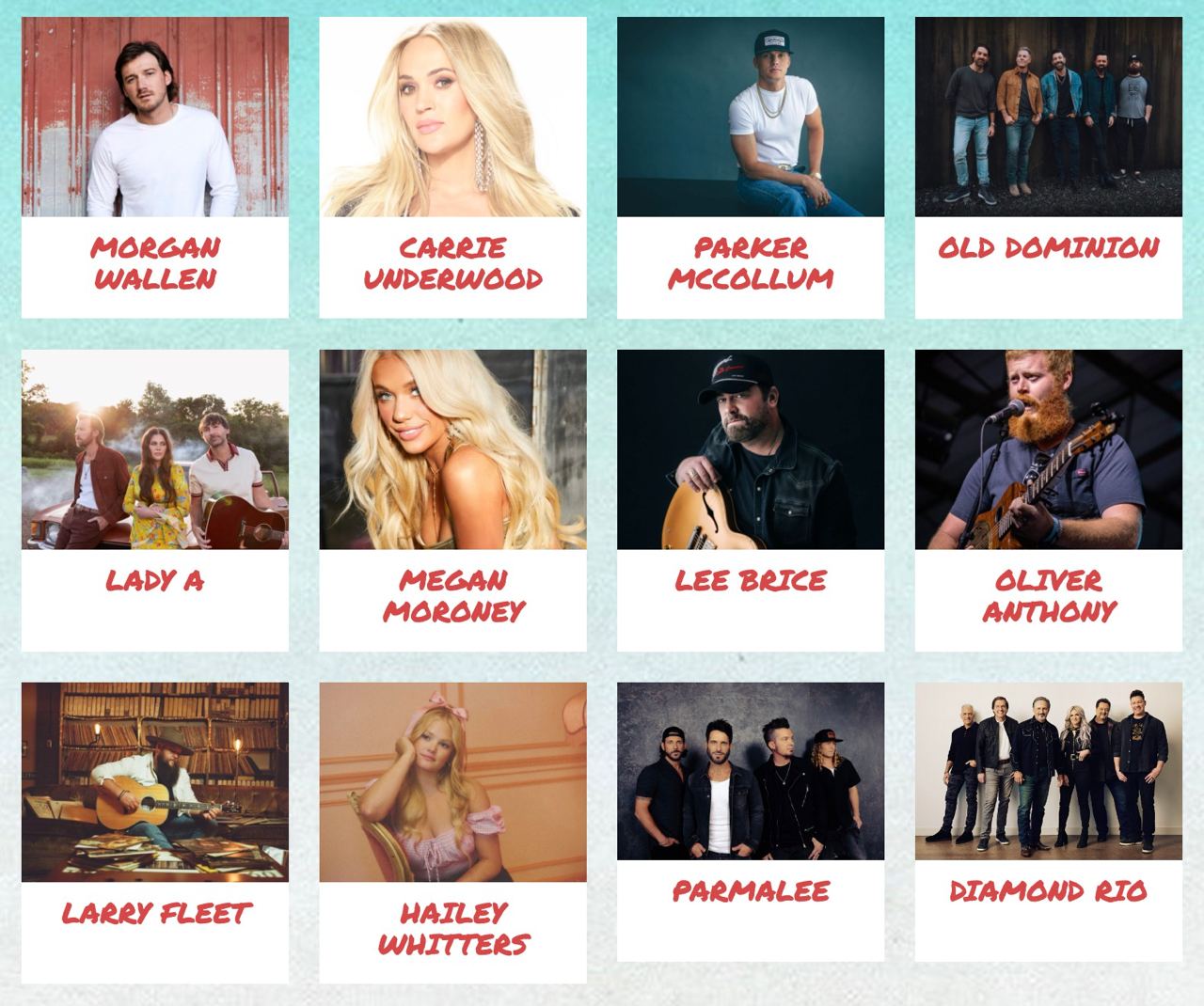

Carolina Country Music Fest 2025 A Record Breaking Sellout

May 25, 2025

Carolina Country Music Fest 2025 A Record Breaking Sellout

May 25, 2025 -

Ccmf 2025 Tickets Gone Planning For The Next Festival

May 25, 2025

Ccmf 2025 Tickets Gone Planning For The Next Festival

May 25, 2025 -

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review And Debate

May 25, 2025 -

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025

2025 Carolina Country Music Fest Tickets No Longer Available

May 25, 2025