CAC 40: Weekly Close In Negative Territory Despite Overall Stability (March 7, 2025)

Table of Contents

Factors Contributing to the CAC 40's Negative Weekly Close

Several interconnected factors contributed to the CAC 40's negative weekly close. While global markets showed relative stability, specific anxieties and sector-specific performances played a significant role.

Impact of Global Economic Uncertainty

Lingering global economic anxieties significantly impacted investor sentiment and the CAC 40's performance. Concerns about a potential economic slowdown weighed heavily on investor confidence, leading to cautious trading and profit-taking.

- Rising Inflation Concerns: Persistent inflation in key regions, particularly in Europe, fuelled uncertainty about future interest rate hikes and their potential impact on economic growth. This uncertainty directly impacts investment decisions, often leading to a sell-off in riskier assets.

- Uncertainty Surrounding Interest Rate Hikes: The anticipated trajectory of interest rate increases by central banks remained a significant source of market volatility. The fear of aggressive rate hikes to combat inflation created a climate of risk aversion.

- Geopolitical Tensions and Their Market Impact: Ongoing geopolitical tensions in various parts of the world further exacerbated the already fragile investor sentiment. These uncertainties introduce additional risk factors that often translate into market downturns.

Sector-Specific Performance and CAC 40 Stocks

The negative performance of the CAC 40 wasn't uniform across all sectors. A sectoral analysis reveals that specific industries significantly contributed to the index's decline.

- Underperformance of Specific Sectors: The technology and energy sectors, typically volatile, experienced underperformance this week. Concerns about slowing technological innovation and fluctuating energy prices contributed to the decline in these sectors’ stock prices.

- Strong Performance in Other Sectors (Limited): While some sectors, such as luxury goods, showed resilience, their positive contributions were insufficient to offset the losses in other key sectors of the CAC 40.

- Specific Company Performance: Individual companies within the CAC 40 also experienced varying degrees of success. For example, while LVMH stock price remained relatively stable, TotalEnergies share price experienced a noticeable dip, reflecting the broader energy sector's struggles.

Influence of Key Economic Indicators

The release of key economic indicators had a measurable impact on the CAC 40's movement throughout the week.

- Economic Data and Investor Behavior: The release of weaker-than-expected employment figures in France, coupled with higher-than-anticipated inflation data, negatively affected investor confidence, prompting increased sell-offs.

- Correlation between Data Releases and CAC 40 Fluctuations: A clear correlation emerged between the release of negative economic data and subsequent fluctuations in the CAC 40, highlighting the market's sensitivity to such announcements.

- Analyst Predictions and Their Effect on the Market: Analyst predictions regarding future economic performance, often fueled by the latest data releases, further influenced market sentiment and contributed to the CAC 40's overall negative trend.

Despite the Weekly Dip: Underlying Strength of the CAC 40

Despite the negative weekly close, several factors suggest underlying strength and resilience within the CAC 40. The recent dip should not overshadow the long-term positive outlook.

Long-Term Trends and Positive Indicators

Long-term trends and positive indicators point towards a fundamentally strong market, even with the short-term setback.

- Strong Corporate Earnings Reports: Many CAC 40 companies have reported strong corporate earnings, indicating robust underlying fundamentals within the French economy.

- Positive Projections for Future Economic Growth: Economic forecasts remain cautiously optimistic, projecting moderate growth in the coming quarters, suggesting a potential recovery for the CAC 40.

- Low Unemployment Rates in France: France's relatively low unemployment rate points to a healthy labor market, providing further support for a positive long-term outlook.

Potential for Recovery and Future Outlook

While the CAC 40 experienced a dip, a cautious optimism for the future remains.

- Predictions for the Next Week or Month: While predicting short-term market movements is inherently challenging, analysts anticipate a potential recovery in the coming weeks, contingent on positive economic indicators and easing geopolitical tensions.

- Suggested Investment Strategies: For long-term investors, the current dip presents a potential buying opportunity. However, diversification within the CAC 40 and a carefully planned investment strategy remain crucial.

- Factors Influencing Future Performance: Future performance will depend on factors like global economic developments, interest rate decisions, and the resolution of geopolitical issues.

Conclusion: Navigating the CAC 40's Volatility

In summary, the CAC 40 experienced a negative weekly close on March 7, 2025, primarily due to global economic uncertainties, sector-specific performance issues, and the influence of key economic indicators. However, underlying strength remains, indicated by positive long-term trends and strong corporate earnings. The CAC 40 market presents both challenges and opportunities. To successfully navigate the CAC 40's volatility, staying informed about market trends and economic indicators is crucial. Utilizing reliable resources for continued analysis of CAC 40 market trends and developing a well-informed investment strategy in the CAC 40 index are essential for maximizing returns and mitigating risk. Stay informed and make informed decisions regarding your investing in the CAC 40.

Featured Posts

-

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 25, 2025

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 25, 2025 -

Kerings Financial Report Sales Down Guccis New Era Begins

May 25, 2025

Kerings Financial Report Sales Down Guccis New Era Begins

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025 -

Kapitaalmarktrentes Toekomstperspectief Voor De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Toekomstperspectief Voor De Euro En De Markt

May 25, 2025 -

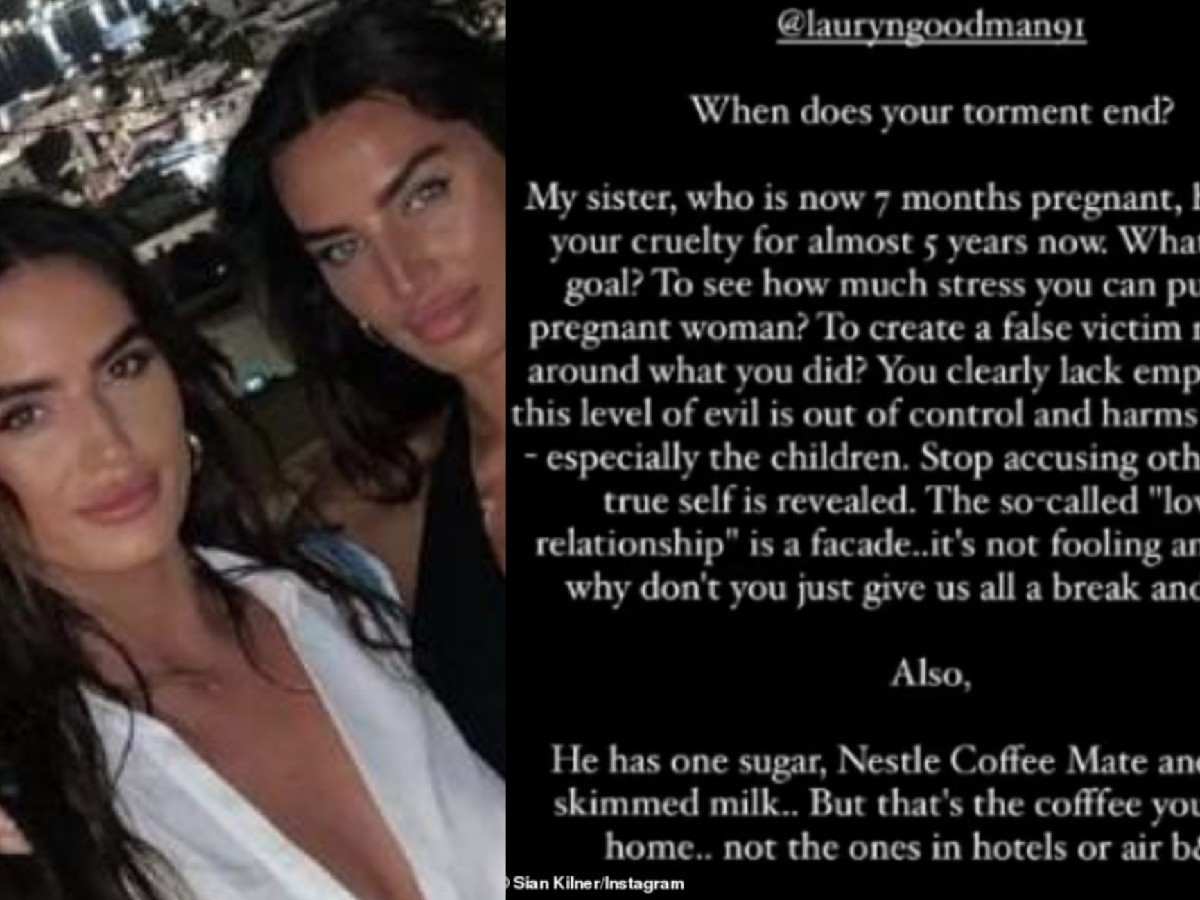

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025

Latest Posts

-

Marks And Spencers 300 Million Cyber Security Breach Lessons Learned

May 25, 2025

Marks And Spencers 300 Million Cyber Security Breach Lessons Learned

May 25, 2025 -

Hollywood Production Halts Writers And Actors Unite In Joint Strike Action

May 25, 2025

Hollywood Production Halts Writers And Actors Unite In Joint Strike Action

May 25, 2025 -

Land Your Dream Private Credit Role 5 Crucial Dos And Don Ts

May 25, 2025

Land Your Dream Private Credit Role 5 Crucial Dos And Don Ts

May 25, 2025 -

Actors And Writers Strike What It Means For Hollywood And Beyond

May 25, 2025

Actors And Writers Strike What It Means For Hollywood And Beyond

May 25, 2025 -

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 25, 2025

Open Ais Chat Gpt Faces Ftc Probe What It Means

May 25, 2025