Apple Stock: Long-Term Investment Despite Reduced Price Target - Wedbush's View

Table of Contents

Wedbush's Price Target Reduction: Understanding the Rationale

Wedbush's decision to lower its price target for Apple stock wasn't a sudden, impulsive move. Their rationale stems from a confluence of factors, primarily centered around concerns regarding near-term iPhone sales and the broader macroeconomic environment. While acknowledging Apple's overall strength, they expressed cautiousness about the potential impact of these challenges.

-

Specific Concerns Cited by Wedbush: Wedbush's analysts likely pointed to potential softening demand for iPhones, potentially due to factors like economic uncertainty and lengthening replacement cycles among consumers. Concerns about supply chain disruptions, although less prominent than in previous years, might also have played a role.

-

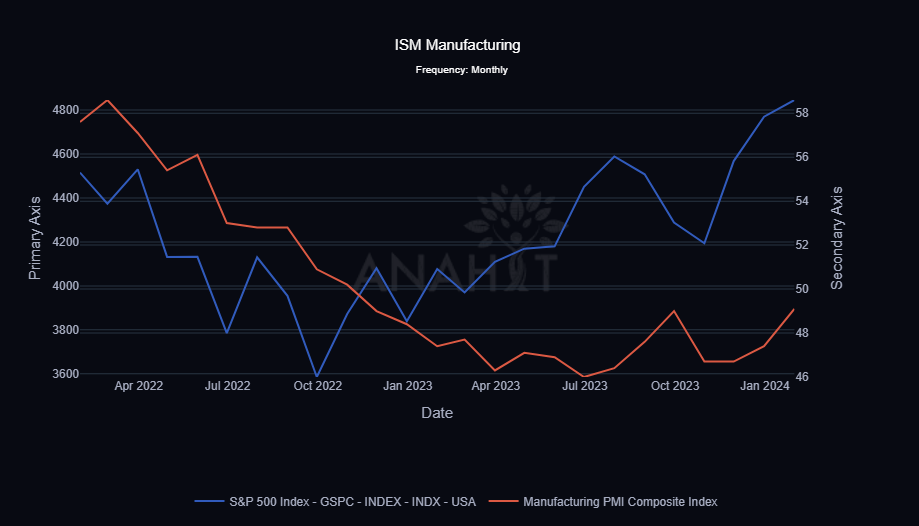

External Factors Influencing the Decision: The global economic slowdown, persistent inflation, and rising interest rates are all macroeconomic headwinds impacting consumer spending and impacting the tech sector as a whole. These factors contribute to the cautious outlook on near-term iPhone sales.

-

Significance of the Reduction: While the exact percentage reduction in the price target is crucial information (and would be included here if available from the source), it's important to consider this reduction in the context of Apple's overall stock performance. A small percentage reduction in a high-valued stock doesn't necessarily signal a catastrophic downturn. It's essential to consider the larger picture and not react solely based on short-term price fluctuations.

Apple's Continued Strengths: Why it Remains a Long-Term Investment

Despite the lowered price target, Apple's intrinsic value and future growth potential remain robust. The company's diverse revenue streams and strong brand loyalty provide a solid foundation for long-term growth, mitigating the impact of short-term market fluctuations.

-

Robust iPhone Sales and Market Share: While near-term sales might face headwinds, Apple consistently maintains a dominant market share in the premium smartphone segment. This market dominance, coupled with the strong brand loyalty amongst its customers, ensures a relatively stable revenue stream.

-

Growth in Services Revenue: Apple's services segment (including the App Store, iCloud, Apple Music, Apple TV+, and more) continues to demonstrate impressive growth. This recurring revenue stream provides a significant buffer against fluctuations in hardware sales.

-

Expansion into New Markets and Product Categories: Apple's consistent innovation and expansion into new markets (like wearables, AR/VR, and potential future ventures) fuel long-term growth opportunities. These diversifications mitigate risk and provide avenues for future revenue streams.

-

Strong Brand Loyalty and Customer Ecosystem: Apple's strong brand loyalty and the robust ecosystem surrounding its products create a sticky user base. This fosters a high retention rate and continuous revenue streams from existing users.

-

Potential for Future Innovations: Potential groundbreaking innovations, such as the highly anticipated Apple Car and advancements in artificial intelligence (AI) and augmented reality (AR), promise to further drive growth and reshape Apple’s future trajectory.

Analyzing the Risk and Reward of Investing in Apple Stock

Investing in any stock involves inherent risk, and Apple stock is no exception. While the long-term outlook remains positive, potential risks should be acknowledged.

-

Potential Risks: Competition in the tech sector is fierce. Companies like Samsung, Google, and other emerging players constantly challenge Apple's market position. Supply chain disruptions and macroeconomic volatility (e.g., inflation, recession) also present ongoing challenges.

-

Potential Rewards: Apple offers a compelling combination of potential rewards, including consistent dividend payouts and the potential for significant capital appreciation over the long term. The company's strong financial performance and growth trajectory make it an attractive investment for long-term growth.

-

Diversification Strategies: To mitigate risk, diversification is crucial. Don't put all your eggs in one basket. Spreading your investments across different asset classes and sectors can significantly reduce your overall portfolio's risk.

Comparing Apple Stock to Competitors

Apple maintains a significant competitive advantage against rivals like Samsung, Google, and Microsoft. Its strong brand loyalty, seamless ecosystem integration, and consistent innovation provide a durable competitive edge, setting it apart in the crowded tech landscape.

-

Key Competitors: Samsung competes fiercely in the smartphone market, while Google dominates the Android ecosystem and Microsoft holds a strong position in software and cloud computing.

-

Apple's Competitive Edge: Apple's advantage lies in its premium brand image, user-friendly interface, and the cohesive nature of its ecosystem. This creates a strong lock-in effect, making it difficult for users to switch to competing platforms. Furthermore, Apple consistently delivers innovative products, maintaining its cutting-edge position in technology.

Conclusion

While Wedbush's lowered price target for Apple stock necessitates careful consideration, the company's robust fundamentals and considerable long-term growth potential remain compelling reasons for investors to remain optimistic. Apple's diverse revenue streams, fervent brand loyalty, and consistent innovation make it a resilient player in a dynamic market. Despite the adjusted price target, Apple stock continues to be a promising long-term investment opportunity. However, remember to conduct thorough due diligence, understand your risk tolerance, and consult with a financial advisor before making any investment decisions regarding Apple stock or any other investment. Investing in Apple stock, like any investment, carries risk, so a comprehensive understanding of your risk tolerance is paramount.

Featured Posts

-

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025

Aex In De Plus Ondanks Onrust Op Wall Street Wat Betekenen De Bewegingen Voor Beleggers

May 25, 2025 -

The Ultimate Guide To An Escape To The Country

May 25, 2025

The Ultimate Guide To An Escape To The Country

May 25, 2025 -

Pmi Surpasses Expectations Driving Dow Jones Higher

May 25, 2025

Pmi Surpasses Expectations Driving Dow Jones Higher

May 25, 2025 -

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 25, 2025

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 25, 2025 -

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025

Aktien Frankfurt Eroeffnung Dax Rueckgang Am 21 Maerz 2025 Faelligkeitstermin An Den Terminmaerkten

May 25, 2025

Latest Posts

-

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025 -

Myrtle Beach Newspapers Sweep 59 Sc Press Association Awards For Local News And Photography

May 25, 2025

Myrtle Beach Newspapers Sweep 59 Sc Press Association Awards For Local News And Photography

May 25, 2025 -

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured Sled Investigating

May 25, 2025

Myrtle Beach Officer Involved Shooting 1 Dead 11 Injured Sled Investigating

May 25, 2025 -

Volunteer For The Myrtle Beach Annual Cleanup

May 25, 2025

Volunteer For The Myrtle Beach Annual Cleanup

May 25, 2025 -

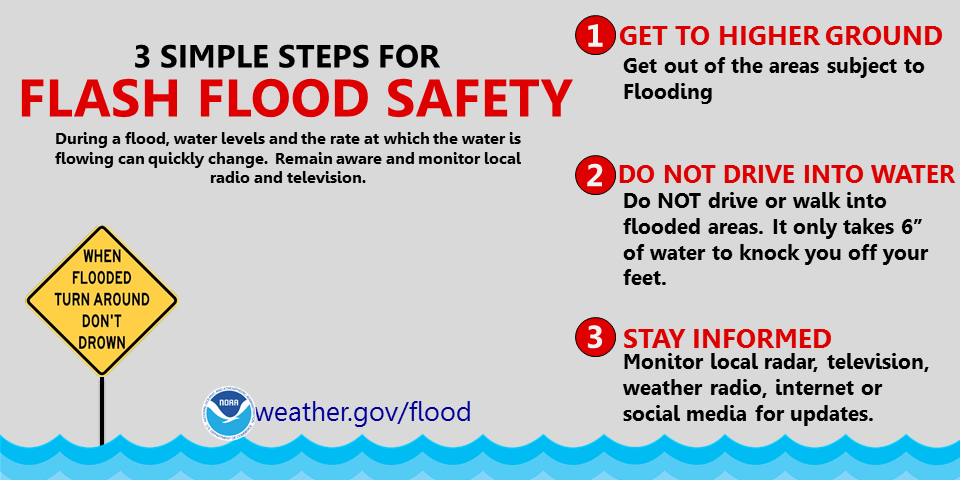

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025

Flash Flood Emergency Prevention Response And Recovery

May 25, 2025