PMI Surpasses Expectations, Driving Dow Jones Higher

Table of Contents

Strong PMI Numbers: A Deep Dive into the Data

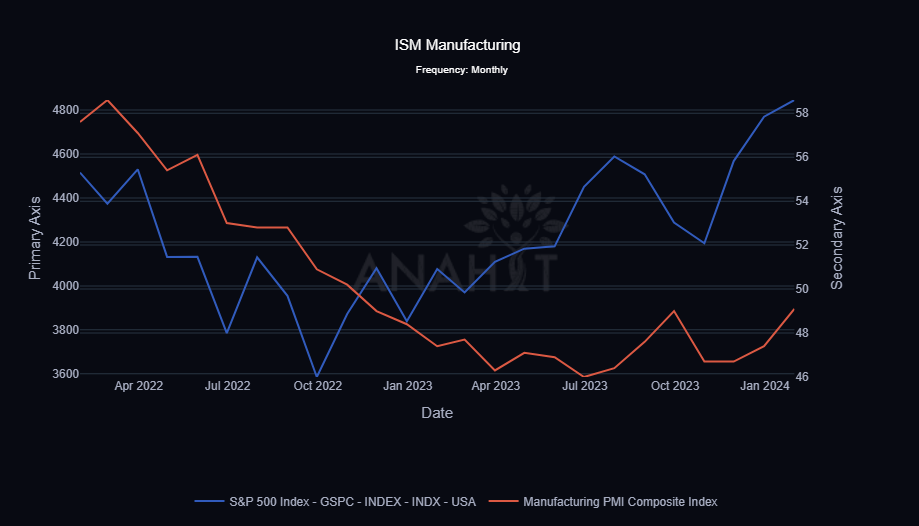

The recently released PMI data paints a picture of significant economic expansion. The key takeaway is a substantial positive surprise, exceeding even the most optimistic forecasts. Understanding the nuances of this data is crucial for interpreting its impact on the market. We'll break down the key components to give you a clearer picture.

-

Specific PMI score and percentage increase compared to previous month and expectations: The preliminary PMI for [Month, Year] came in at [Specific Score], a [Percentage]% increase from the previous month's [Previous Month's Score] and significantly higher than the anticipated [Expected Score]. This represents a robust increase in business activity.

-

Analysis of the components contributing to the strong PMI reading (e.g., new orders, production, employment): The strong PMI reading wasn't driven by a single factor, but rather a confluence of positive indicators. New orders surged, indicating strong future demand. Production levels also increased, reflecting businesses' confidence in the economic outlook. Employment figures showed continued growth, further supporting the overall picture of economic expansion.

-

Comparison to other key economic indicators: The PMI's positive performance aligns with other positive economic indicators such as rising consumer confidence and increasing retail sales. This convergence of data points towards a strong and sustained economic recovery.

-

Geographical breakdown of PMI data (if available): [Insert geographical breakdown if available. For example: The strong PMI was particularly pronounced in the manufacturing sector, with significant growth reported across multiple regions, including the Midwest and the South. This geographically diverse growth suggests a broad-based economic expansion, rather than localized pockets of strength.]

The Impact on the Dow Jones Industrial Average

The positive PMI data had an immediate and significant impact on the Dow Jones Industrial Average. The market reacted favorably to the news, triggering a notable rally.

-

Point-by-point Dow Jones performance following the PMI release: Following the PMI release, the Dow Jones experienced a [Percentage]% increase, closing at [Closing Value]. This represented a significant gain compared to the previous day's closing.

-

Analysis of investor response, including trading volumes and stock price changes: Investor sentiment shifted markedly towards optimism. Trading volumes increased substantially, reflecting heightened interest and activity in the market. Many individual stock prices saw significant gains, especially in sectors sensitive to economic growth.

-

Mention specific sectors or companies most affected: Sectors like manufacturing and consumer discretionary experienced some of the most significant gains, reflecting the direct impact of the strong PMI data. Companies with significant exposure to these sectors saw corresponding increases in their stock prices.

-

Discussion of any related news or events influencing the market: While the PMI release was the primary driver, it's important to note that other factors, such as [Mention any other relevant news or events], could have also played a role in shaping the market's reaction.

Underlying Factors Contributing to the Positive PMI

The unexpectedly strong PMI is not simply a random occurrence; it reflects underlying improvements in several key economic areas.

-

Specific economic factors and their influence on PMI: Increased consumer spending, driven by factors such as [mention reasons, e.g., rising wages and decreasing unemployment], played a significant role. Businesses also showed increased confidence, leading to higher levels of investment and expansion.

-

Data points supporting these claims (e.g., consumer confidence indices, retail sales figures): Data from the Consumer Confidence Index supports this analysis, showing a marked increase in consumer optimism. Retail sales figures also confirm a significant rise in consumer spending, further validating this trend.

-

Expert opinions or quotes adding weight to the analysis: "[Quote from an economist or market analyst explaining the factors behind the strong PMI]."

-

Discussion of any potential risks or challenges that could impact future PMI performance: While the current outlook is positive, several challenges could still impact future PMI performance. These include persistent inflationary pressures and the potential for rising interest rates to dampen economic growth. Supply chain disruptions could also pose risks.

Long-Term Implications for the Economy

The strong PMI suggests a positive outlook for the economy in the coming months and years. However, sustained growth depends on various factors remaining favorable.

The sustained strength in the PMI suggests a continued period of economic expansion, positive for both the overall economy and long-term investment strategies. However, it is vital to carefully consider the potential risks outlined earlier and monitor upcoming economic releases for a more nuanced understanding of the long-term implications.

Conclusion

The unexpectedly strong PMI data has significantly boosted investor confidence, leading to a substantial increase in the Dow Jones Industrial Average. This positive economic signal reflects improvements across various economic sectors and provides a strong outlook for future growth. The underlying factors driving this surge in PMI need to be continuously monitored for sustained economic performance.

Call to Action: Stay informed about key economic indicators like the PMI and their impact on the Dow Jones to make informed investment decisions. Follow our updates on future PMI releases and their effect on the market. Understanding the PMI and its implications is crucial for successful market navigation. Regularly checking the Purchasing Managers' Index will provide valuable insight into the direction of the economy and the Dow Jones.

Featured Posts

-

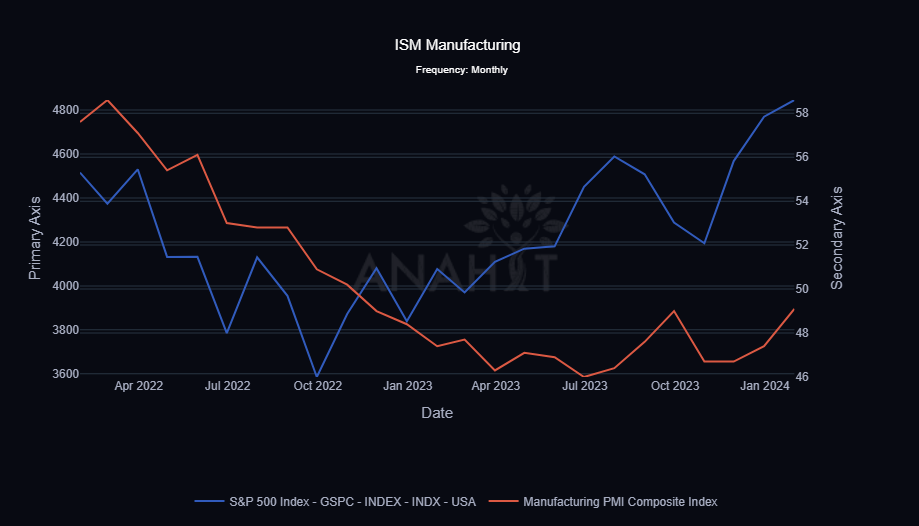

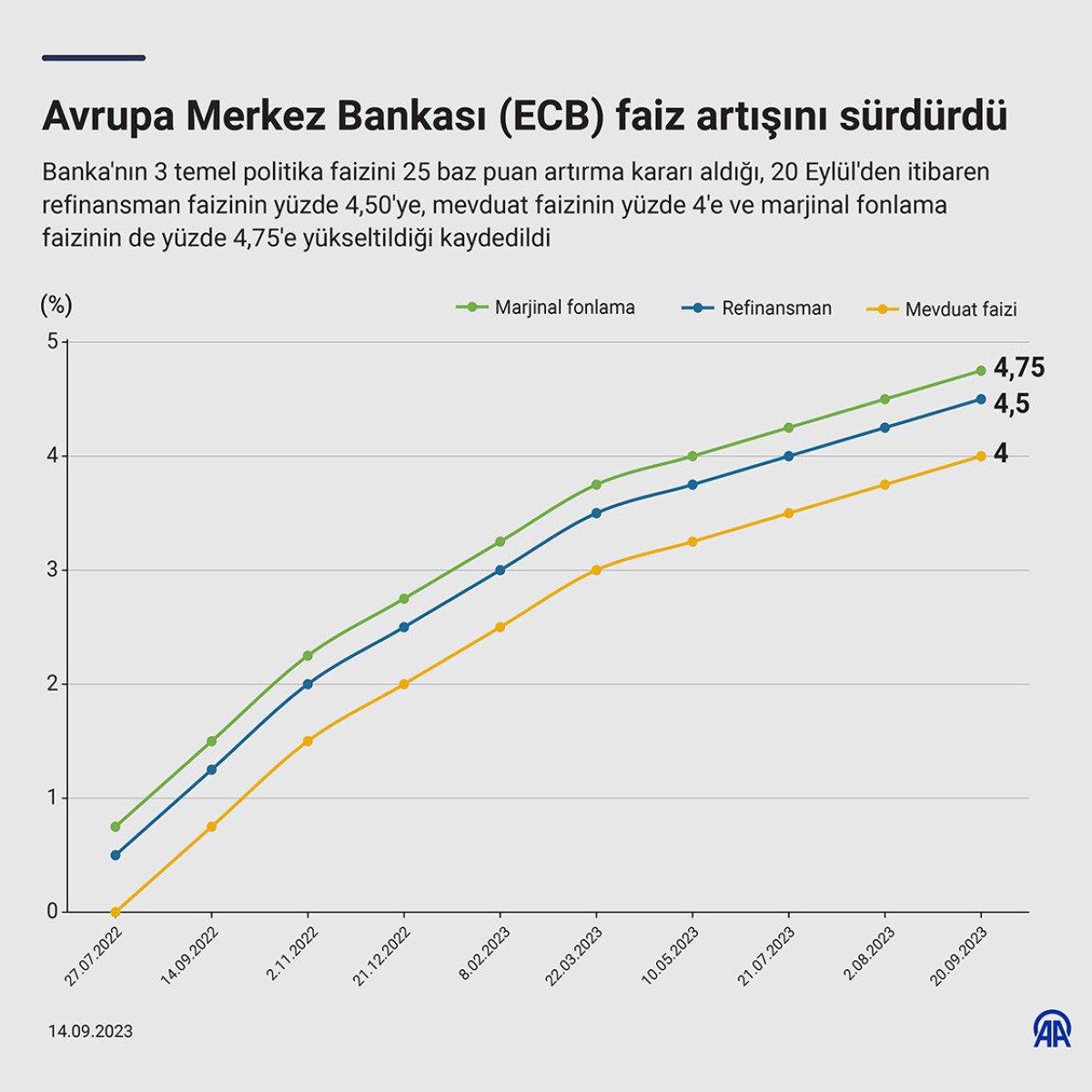

Avrupa Borsalari Ecb Faiz Politikasi Kararina Nasil Tepki Verdi

May 25, 2025

Avrupa Borsalari Ecb Faiz Politikasi Kararina Nasil Tepki Verdi

May 25, 2025 -

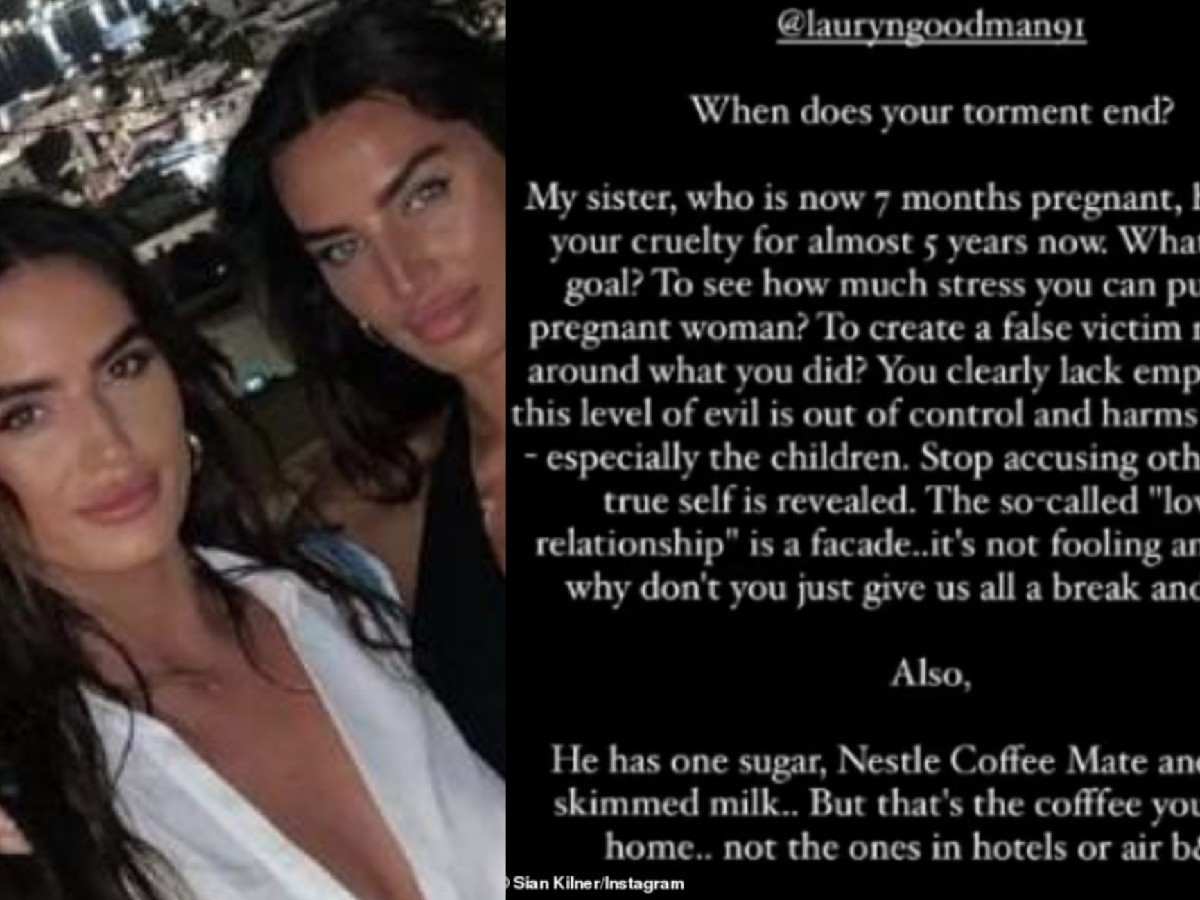

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025

Following Kyle Walkers Night Out Annie Kilners Poisoning Allegations Explained

May 25, 2025 -

Long Term Investing A Realistic Look At Buy And Hold Strategies

May 25, 2025

Long Term Investing A Realistic Look At Buy And Hold Strategies

May 25, 2025 -

Memorial Day 2025 Flight Bookings When To Fly And Save Money

May 25, 2025

Memorial Day 2025 Flight Bookings When To Fly And Save Money

May 25, 2025 -

Sharp Decline In Amsterdam Stock Market Aex Index Hits 1 Year Low

May 25, 2025

Sharp Decline In Amsterdam Stock Market Aex Index Hits 1 Year Low

May 25, 2025

Latest Posts

-

The I O And Io Battleground How Google And Open Ai Are Shaping The Future

May 25, 2025

The I O And Io Battleground How Google And Open Ai Are Shaping The Future

May 25, 2025 -

Negotiations Under Pressure Trump And The Republicans

May 25, 2025

Negotiations Under Pressure Trump And The Republicans

May 25, 2025 -

Understanding The I O Io Debate Google And Open Ais Tech Rivalry

May 25, 2025

Understanding The I O Io Debate Google And Open Ais Tech Rivalry

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025 -

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025